Payment security is an area of cybersecurity that businesses simply cannot ignore. As the use of digital payment methods increases globally, so does the vulnerability to various types of fraud. Online payment fraud is predicted to cost businesses a staggering $343 billion between 2023 and 2027, according to AAG.

Fortunately, cybersecurity tools are growing in variety and efficiency, too. Here, we take a look at the key payment security solutions merchants should add to their arsenal.

What is Payment Security?

Payments and security are all about keeping money and sensitive financial information safe. Payment security protects transactions from fraud, theft and misuse with tools such as encryption, tokenisation, multi-factor authentication, and more. Payment security also involves ensuring compliance with specific protocols and rules set by the industry regulators.

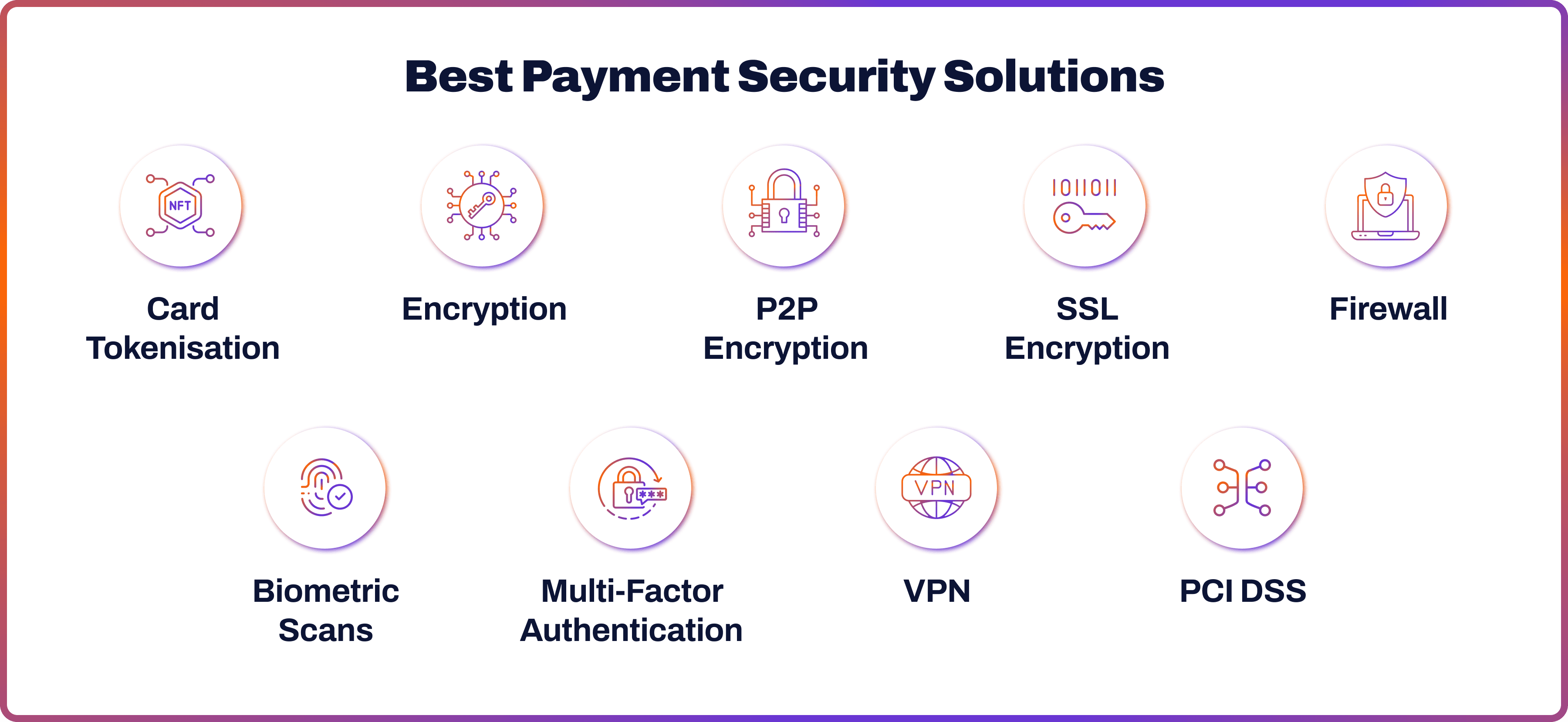

Best Payment Security Solutions

The cybersecurity solutions to protect payments vary in scope and the mechanisms behind them. Here, we take a look at some of the popular tools in online payment security.

Card Tokenisation

Card tokenisation involves encrypting the actual financial data with a unique set of numbers called a token. The tokens represent card information but don’t reveal the real financial information.

The tokens cannot be reverse-engineered or decoded to access the original data. Even if the token is intercepted or stolen, the data remains safe. Tokenisation helps protect against fraud in digital transactions, as it makes it much harder for hackers to gain access to the original card details.

Encryption

Encryption converts data into complex code that can only be read with the right key. While it may sound similar to tokenisation, the crucial difference is that tokens do not use keys to decode information into its original form.

Encryption is widely used to protect sensitive data from criminals. It utilises algorithms to transform readable information into an unreadable format.

Point-to-Point Encryption (P2PE)

P2PE is a security protocol that protects card data during an online transaction. P2PE encrypts the financial information immediately to ensure secure transfer between the payment terminal and the gateway for processing. The data stays encrypted until the payment is processed. P2PE is an essential tool in payment security as it prevents hackers from accessing sensitive data.

SSL Encryption

A Secure Sockets Layer (SSL) is another type of encryption that ensures the security of internet payments. SSL prevents criminals from stealing any sensitive financial data between the two systems.

SSL establishes an encrypted link between a web server and a browser. When a user visits an SSL-secured website (indicated by 'https' in the URL and often a padlock icon in the browser), the SSL protocol encrypts the data exchanged between their browser and the server.

Firewall

A firewall is like a security guard for a computer or network. A firewall oversees incoming and outgoing traffic and can block specific traffic from entering the network based on a set of security rules. Firewalls are used as a barrier to prevent unauthorised access is a crucial component of cybersecurity.

Biometric Scans

Biometric scans use unique physical features, such as fingerprints, voice, iris patterns or facial features, to identify and authenticate an individual. They are the next stage of the verification technology and are considered more secure than passwords or PINs.

Multi-Factor Authentication

Multiple-factor authentication (MFA) requires two or more verification factors to grant access to an account, system or network. Instead of just asking for a password, MFA combines multiple credentials. The verification factors include:

- Knowledge: This could be something a user knows, like a password or an answer to a security question.

- Possession: This includes their devices like a laptop or a mobile phone.

- Inherence: This is something a user possesses inherently, like their fingerprint or facial features.

Virtual Private Networks (VPN)

VPN creates an encrypted connection over a less secure network, therefore providing a safe environment for online transactions.

When a VPN is used, internet traffic travels through a VPN server. This means that data is encrypted, and the user’s online identity is masked, making it more difficult for cybercriminals to steal data or gain access.

PCI DSS Compliance

PCI DSS, an industry security standard designed to secure cardholder data, was developed to ensure secure payment systems across the industry. The protocol was recently updated to PCI DSS 4.0. It involves 12 key requirements:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update anti-virus software or programs

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need to know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security for all personnel

If you are a business using an external payments processor, always ensure the company is PCI DSS compliant.

Secure Payment Gateways

A payment gateway enables businesses to accept and process transactions. It serves as a digital cashier, collecting customer payment details and securely transmitting them further to a payment processor. Think of a card machine in a retail store - an online payment gateway is exactly that for digital payments.

The payment processing security is essential, as it handles sensitive financial information. A safe payment gateway would employ the following features.

- Encryption: A secure payment services provider must encrypt data to protect sensitive information like credit card numbers during transactions.

- Authentication: It would verify the identities of both parties in a transaction to prevent fraud.

- Compliance: To ensure a payment securely stores data, verify whether it complies to the industry standards like PCI DSS.

- Fraud Detection: It’s important that a payment gateway uses advanced algorithms to detect and prevent suspicious activities.

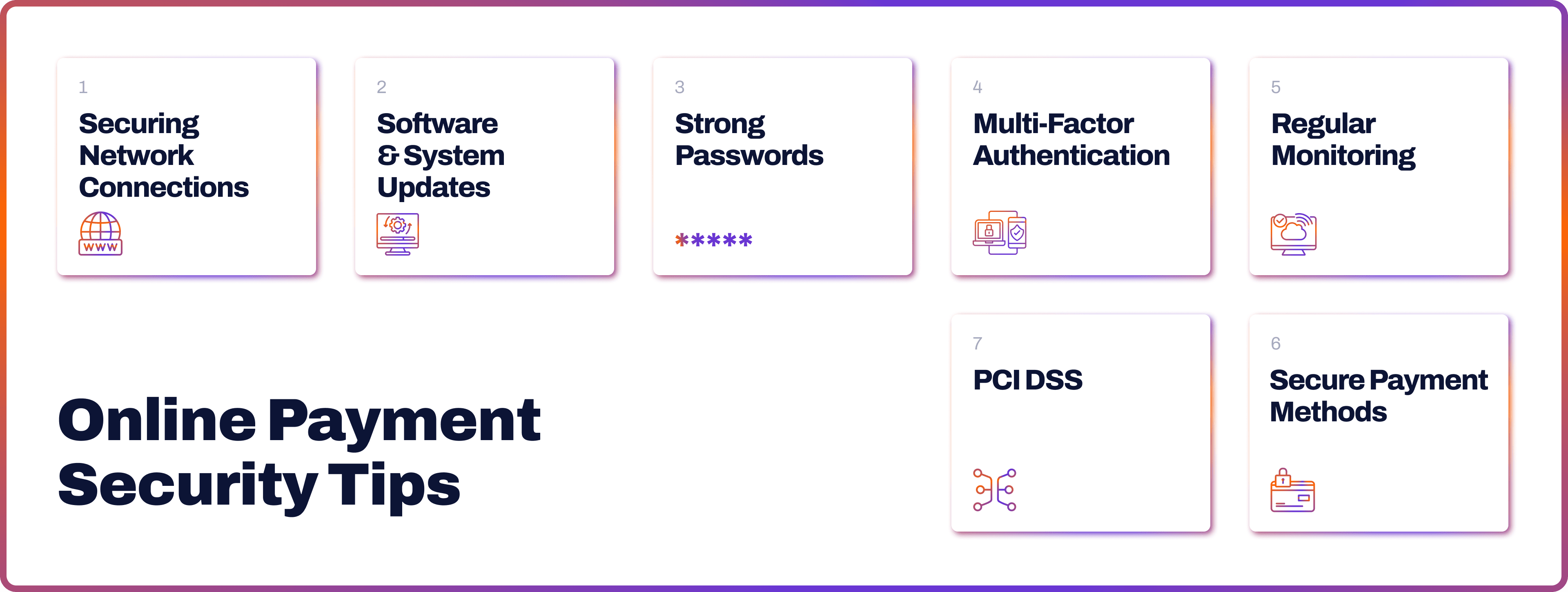

Online Payment Security Tips

There is a number of ways how businesses can enhance security and decrease the risk of cyber fraud. Below are some of the tips that businesses may want to consider.

Securing Network Connections

Utilise secure, private networks for business operations. A VPN can provide additional encryption, safeguarding data during online transactions. This helps in preventing unauthorised access to sensitive information.

Software and System Updates

Keep all systems, including security software, up-to-date to guard against new cybersecurity threats. Regular updates can decrease vulnerabilities, reducing the risk of data breaches and malware infections.

Strong Password Policies

Implement strict password policies. Encourage complex, unique passwords for each system and mandate regular changes. This practice helps prevent unauthorised access to business systems and data.

Multi-Factor Authentication

Adopt Multi-Factor Authentication (MFA) for added cybersecurity. This could include one-time passwords (OTPs), biometric verification, or security tokens, significantly enhancing the security of sensitive business accounts and systems.

Regular Monitoring

Continuously monitor transactional and system activities. Use advanced tools to detect anomalies, which could indicate potential security threats or breaches, allowing for timely intervention.

Secure Payment Methods

Opt for robust and secure payment solutions. Look for services offering advanced security features, encryption, and fraud protection to safeguard customer information.

PCI DSS

Ensure all payment processes and systems comply with Payment Card Industry Data Security Standards (PCI DSS). Compliance helps in protecting customer payment information and maintaining trust.

Secure Payments with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What are the main types of payment security?

The main types include encryption, tokenisation, SSL encryption, firewalls, multi-factor authentication, and adherence to PCI DSS standards.

What are the best payment security technology tools?

The top tools include SSL encryption, Point-to-Point Encryption (P2PE), card tokenisation, firewalls, biometric authentication, VPNs, and PCI DSS compliance software.

How do businesses secure payments?

Businesses secure payments using encryption, strict access control, regular updates of security software, firewalls, multi-factor authentication, and ensuring PCI DSS compliance.

What makes an online payment safe?

Online payment is safe when it employs encryption (like SSL), data protection through tokenisation, and multi-layered authentication processes. It should also comply with security standards like PCI DSS.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants