Chargebacks can quietly drain your business's profits if not managed effectively. Understanding and managing chargebacks can save your business from unnecessary losses and improve customer satisfaction.

Here, we take a look at the essentials of chargebacks, why they happen, and how to dispute them effectively. We also explore practical strategies of how to prevent chargebacks, protecting your business, and enhancing overall financial security.

What Is a Chargeback?

A chargeback is when a credit or debit card issuer reverses funds to the cardholder after they dispute a charge. Chargebacks should not be confused with refunds, where the business returns the money for a refund of the good or service.

A merchant chargeback, on the other hand, involves the issuing bank withdrawing funds from the business's account. The bank holds the money during their investigation and returns it to the customer if the dispute is valid.

Why Chargebacks Happen

Chargebacks were initially introduced to protect consumers from credit card fraud. They aimed to boost confidence in credit cards by allowing consumers to recover lost funds. If a fraudulent purchase was made, the cardholder could flag the charge to their bank and get their money back.

While the system was designed for consumer protection, some people misuse it. Instead of returning an item and requesting a refund, they dispute charges to avoid the returns process or to deal with orders that never arrived.

E-commerce chargebacks requested for reasons other than legitimate fraud are known as "friendly fraud," and they make up 75% of all chargebacks, according to Visa. Other common reasons include:

- Genuine fraud: The charge was not authorised by the cardholder.

- Non-delivery: The items never arrived.

- Incorrect items: The customer received the wrong items.

- Delayed refunds: The refund took longer than expected.

- Poor quality: The customer was unhappy with the quality of the product.

- Misleading descriptions: The product was significantly different from its description.

- Clerical errors: The customer was charged more than once.

What Is Chargeback Fraud?

While many chargebacks result from misunderstandings, some are fraudulent. Friendly fraud, where chargebacks are requested for non-fraudulent reasons, accounts for 75% of all chargebacks. Another type of chargeback fraud involves stolen credit cards. Both types cost merchants significantly.

Are Chargebacks Bad for Businesses?

Chargebacks can significantly harm merchants. Refunding customers is never ideal, but the costs of chargebacks go beyond lost sales. Processing chargebacks takes time, results in lost inventory, and includes fees from payment processors, leading to financial losses.

Chargebacks also highlight issues such as poor customer satisfaction or security problems in cases of fraud. A high number of chargebacks usually indicates deeper problems within the business that need fixing.

How Many Chargebacks Are Normal for Merchants?

Card networks and acquirers would typically have different standards for acceptable chargeback levels. Usually, a chargeback-to-transaction ratio of 1% is considered the maximum acceptable limit for most merchants.

Exceeding the 1% chargeback threshold can lead to several consequences. Your payment provider may impose higher transaction fees or other penalties if your chargeback ratio is too high.

How to Dispute a Chargeback as a Merchant

Timelines for chargeback claims vary by bank and product type, but generally, customers have 120 days to file a claim. This period starts when the customer either raises the issue with the merchant or receives their goods.

To dispute a chargeback as a merchant, communicate with the bank, providing them with the evidence you have. Banks then will investigate disputed chargebacks.

Your chances of reversing the charges improve if you have all supporting evidence ready. You need to prove to the bank that you sent the item on time and that it was received. Here are some other examples of helpful evidence:

- Shipping and delivery information

- Tracking number for shipped items

- Tracking updates

- Proof of receipt or signature

- Proof of refund, if provided

- Communication records between merchant and buyer

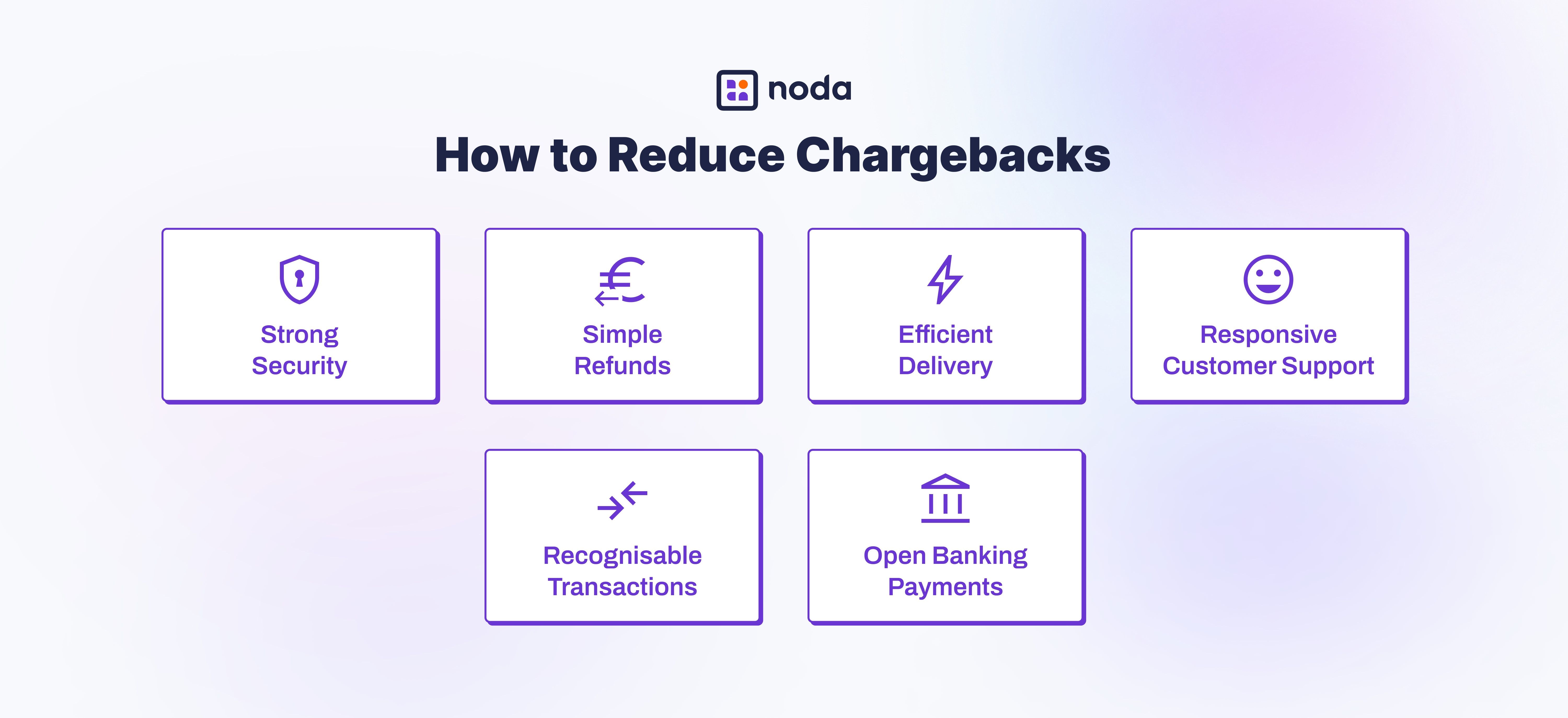

How to Reduce Chargebacks

Fortunately, there are a number of effective ways to reduce chargebacks and avoid the associated inconveniences. Let’s take a look at them in more detail.

Strengthen Security

Chargebacks are a form of fraud. That’s why strengthening security measures like verification can help with chargeback fraud prevention. Use tools like card security codes (CVV), Address Verification Service (AVS), and 3D Secure to minimise fraudulent transactions.

You can sign up for chargeback alerts triggered by suspicious behaviour, such as multiple small transactions or mismatched addresses or IPs. Your payment provider should assist with this and offer anti-fraud monitoring systems.

Simplify Refund Policy

At first glance, creating an easy returns process might seem detrimental to your bottom line, but it's actually a smart chargeback prevention strategy. Refunds are far more business-friendly than chargebacks.

Encourage customers to return unwanted products through proper channels instead of disputing charges with their bank. Create an easy, frictionless return policy and communicate it clearly to your customers. If a customer wants a refund, do everything possible to ensure it happens through a refund process rather than a chargeback.

Ensure Efficient Delivery

Customers might initiate a chargeback if they believe a product is lost or unlikely to arrive. Mitigate this risk by giving clear delivery details, including the carrier, confirmation and tracking numbers, delivery time expectations, and contact information for issues. This transparent approach to delivery will provide extra chargeback protection.

Customer Support

This brings us to our next point: building a strong customer support function is crucial for effective chargeback management. That’s because chargeback requests often happen when customers can't resolve issues with the business directly.

Problems like unexpected subscription charges, duplicate charges, or incorrect items can lead to chargebacks if customers can't easily contact your company. Ensuring accessible and responsive customer service as well as order confirmation can help prevent this.

Make Transactions Recognisable

One common reason customers dispute charges is that they don't recognise the business name on their bank statement. Each charge includes a brief description, which should show the business name. However, if the name is unrecognisable or missing, customers may dispute the charge thinking it's fraudulent.

To prevent chargebacks, ensure that your business name is clearly visible on customers' statements. This clarity reduces the likelihood of disputes.

Obtain Evidence

In the unfortunate scenario when you do experience a chargeback - make sure that you have strong evidence that the customer participated in the transaction and received the goods or services.

Keep signed delivery receipts, courier tracking information, or the customer's IP address, description, date, and time of download if you sell digital services. This will help you defend yourself during the bank investigation.

Get Chargeback Insurance

Chargeback insurance for merchants, also known as a chargeback guarantee or reimbursement, covers the cost of chargebacks arising from fraudulent transactions. In return for this protection, merchants pay a monthly premium or a percentage of each transaction to the insurer. Chargeback insurance is typically offered as an add-on to fraud detection services.

Open Banking Payments to Minimise Chargebacks

Open banking payments are an excellent way to reduce chargebacks. Introduced in Europe by PSD2 in 2018, these transactions occur directly from account to account (A2A), bypassing card networks. With no intermediaries involved, open banking payments don't have built-in chargeback rights, saving costs, time, and administrative effort in processing disputes.

As a pay-by-bank payment method, open banking offers several advantages, including fast fund transfers and a smooth user experience. Customers avoid manual entry of payment details as the process redirects them from the payment site to their trusted banking interface and back.

This improves the shopping experience, reduces cart abandonment and chargebacks, and allows merchants to access funds quickly. According to Statista, A2A payments accounted for 9% of global e-commerce transactions in 2022.

Reduce Chargebacks with Noda

You can reduce chargebacks with Noda, a global open banking and payments provider. We also assist online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation.

Noda partners with 2,000 banks across 28 countries, spanning over 30,000 bank branches. We support a wide range of currencies for globally-minded clients, and offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine user experience, Noda is your partner in growth.

FAQs

How long does a merchant have to dispute chargeback?

Merchants generally have 120 days to dispute a chargeback. This timeline can vary by bank and product type.

What are chargeback fees?

Chargeback fees are penalties charged to merchants by payment processors when a chargeback occurs. These fees cover the administrative costs of processing the dispute and can add up quickly.

Can a merchant dispute a chargeback?

Yes, a merchant can dispute a chargeback by providing evidence that the transaction was legitimate. This includes documentation such as delivery receipts, tracking numbers, and communication records with the customer.

How do chargebacks affect a business?

Chargebacks can significantly harm a business by causing lost revenue, increased fees, and higher operational costs. They also indicate potential issues with customer satisfaction or security.

When is a chargeback appropriate?

A chargeback is appropriate when a customer encounters fraudulent charges, non-delivery of goods, or receives incorrect or poor-quality items. It acts as a consumer protection mechanism for resolving such disputes.

What is chargeback protection?

Chargeback protection is a service that reimburses merchants for the costs associated with chargebacks due to fraudulent transactions. Merchants typically pay a monthly premium or a percentage of each transaction for this coverage.

What is a friendly fraud chargeback?

Friendly fraud chargeback occurs when a customer disputes a legitimate transaction, often to avoid the friction of returning an item or to get a refund for goods they want to keep. It accounts for a significant portion of all chargebacks.

How do I stop chargebacks?

To avoid chargebacks, ensure clear communication with customers, provide detailed delivery information, and implement strong security measures. Offering easy return policies and maintaining responsive customer service also help reduce chargeback occurrences.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know