The world of finance is undergoing a remarkable transformation, and Belgium is part of this revolution. Across Europe, open banking adoption has been impressive. In fact, only in 2023, 43 million European users have embraced this new way of banking, representing an annual compound growth rate of 53%. Belgium is no exception to this trend.

In this small but digitally savvy nation, 29 banks have already joined the open banking implementation. This is a testament to the country's willingness to embrace innovative financial solutions. In fact, Belgium has emerged as an active participant of this trend, with 87% of households actively using online banking services.

For online merchants and fintech professionals, Belgium’s Open Banking ecosystem offers opportunities to streamline payments, enhance security, and unlock valuable data insights. In this article, we will explore the key elements of Open Banking in Belgium—covering regulations, payment gateways, and processors, helping you thrive in this evolving ecosystem.

What is Open Banking? A Quick Reminder for Businesses

Open Banking enables customers to securely share their financial information with trusted third-party providers (TPPs) through APIs. This allows real-time payments via instant bank transfers, a type of account-to-account (A2A) payment that eliminates the need for traditional mediators.

Unlike traditional bank transfers, which rely on banks to control the flow of financial information, Open Banking empowers customers to directly share selected data and transfer funds securely with approved TPPs.

For businesses, this protocol simplifies payment processes, enabling faster authentication, reduced transaction layers, and enhanced security. Merchants benefit from quicker transactions, lower fees, and a more streamlined customer experience.

Open Banking Regulation in Belgium

In Belgium, the acceptance of Open Banking follows the EU’s Payment Services Directive 2 (PSD2), a regulation designed to enhance the security and transparency of online payments. Under PSD2, banks are required to provide licensed third-party providers (TPPs) with secure API access to customer payment account data but only with the customer’s consent. This framework not only prioritises customer trust but also improves the user experience.

In Belgium, the implementation of PSD2 is overseen by two key regulatory bodies: the National Bank of Belgium (NBB) and the Financial Services and Markets Authority (FSMA). These organisations ensure that TPPs meet licensing requirements, maintain financial stability, and safeguard consumer interests.

What sets Open Banking in Belgium apart is its emphasis on secure data sharing via APIs. Many banks and TPPs follow the NextGenPSD2 framework developed by the Berlin Group, ensuring seamless and secure connections between banks and providers.

Belgium Open Banking Overview

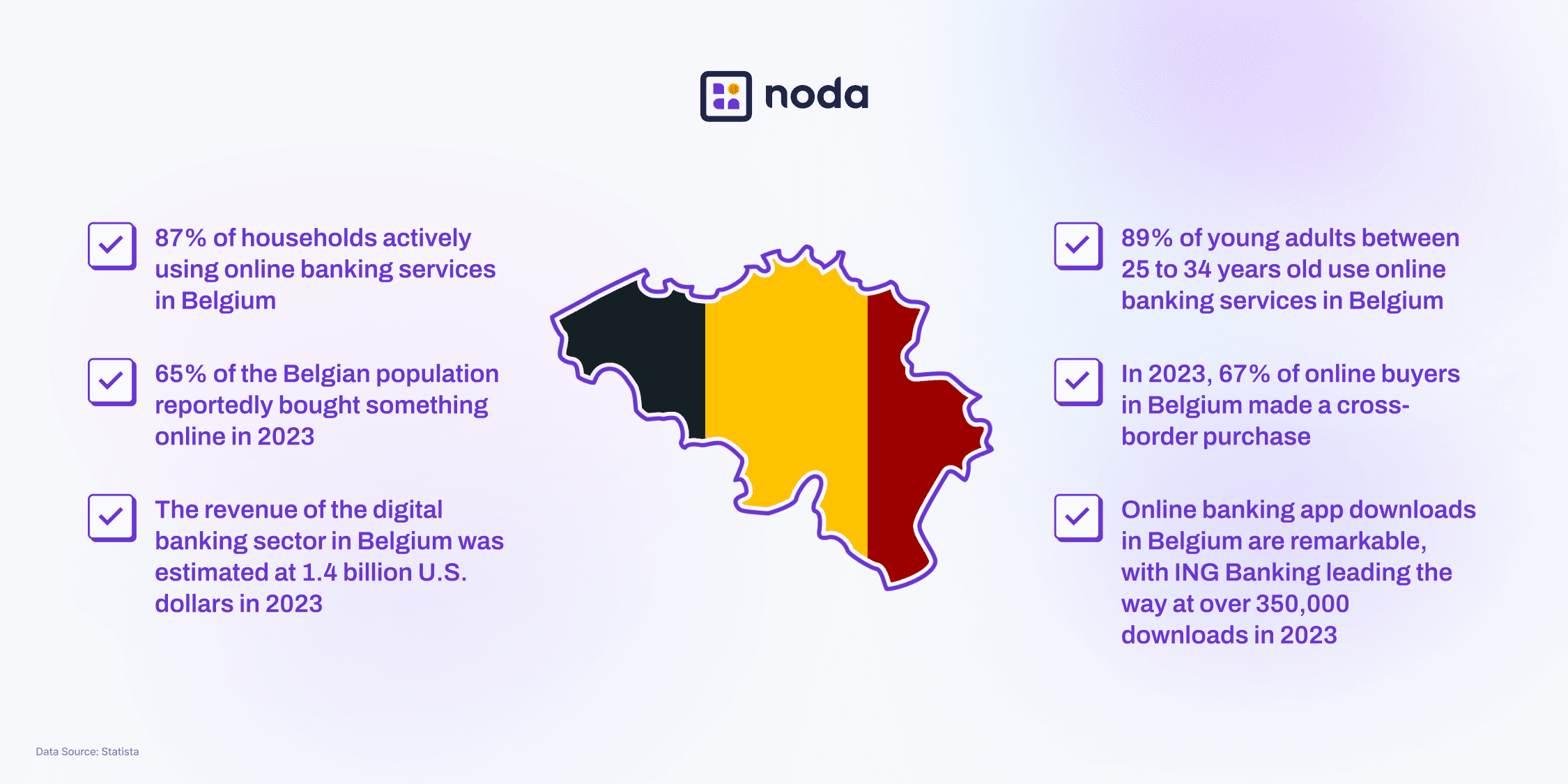

If you're considering adopting Open Banking payments in the Belgian market, it's important to understand its growing penetration. Since 2005, 23% of the Belgian population has used the internet for online banking services. By 2023, this figure has grown to 80% of adults, with young adults aged 25 to 34 leading the way at 89% adoption, according to Statista.

Additionally, e-commerce is fairly well established in Belgium. On average, 7 out of 10 households in Belgium make at least one purchase via the Internet each year. The high level of adoption presents a significant opportunity for businesses to tap into a growing digital market.

Let’s have a look at the key highlights of online banking in Belgium.

Payment Gateways and Processors in Belgium

Traditional payment gateways and processors have long dominated Belgium’s financial ecosystem, but they often come with significant drawbacks. High transaction fees, lengthy settlement times, and increased fraud risks are common challenges. Unsurprisingly, Belgian consumers are becoming more cautious.

In 2018, 42% of consumers relied on credit cards for purchases, but by 2020, this figure dropped to just 25%, according to Statista. The decline is largely attributed to the higher costs associated with credit card transactions.

Open Banking solutions have emerged as a compelling alternative, addressing these pain points with faster, safer, and more cost-effective payment options. By enabling direct bank-to-bank transfers, Open Banking eliminates intermediaries, reduces fees, and offers merchants the added benefit of no chargebacks.

The Future of Open Banking in Belgium

The endorsement of online and digital payments is on the rise in Belgium, driven by consumer demand for fast, secure, and affordable payment options. Open Banking is perfectly positioned to meet these needs, providing businesses with innovative tools to offer seamless, real-time payment experiences that align with modern expectations.

Looking ahead, the introduction of PSD3 is expected to further enhance the financial ecosystem. This new directive will promote transparency, competition, and innovation by mandating data sharing through open APIs. For businesses, this means access to more integrated and forward-thinking financial services that can drive growth and deliver better customer experiences.

Integrate Open Banking in Belgium with Noda

Adopting Open Banking with Noda goes beyond just cutting costs and eliminating chargebacks. Noda empowers merchants with tools and insights to better understand customers, refine services, and drive growth. Here’s how Noda can help your business succeed in Belgium:

- High Bank Coverage: Connects seamlessly with major Belgian banks and supports Open Banking payments across 28 countries, partnering with over 2000 banks to simplify cross-border transactions.

- Advanced Insights: Noda provides analytics tools such as Data Enrichment to help merchants analyse customer behaviour and spending patterns with unique insights.

- Effortless Integration: Noda offers simple integration with popular e-commerce platforms using payment plugins or advanced API solutions.

- Cost-Effective Payments: By eliminating intermediaries, Open Baking with Noda reduces transaction fees and accelerates payment processing speed, delivering a secure, fast, and efficient payment experience.

Whether you’re an online retailer or fintech professional, Noda’s all-in-one solution positions your business for success in Belgium’s evolving Open Banking market. Get in touch and discover how Noda can simplify payments and unlock new opportunities today.

FAQs

Is Open Banking available in Belgium?

Yes, Open Banking is available in Belgium and operates under the EU’s Payment Services Directive 2 (PSD2). This regulation requires banks to securely share financial data with authorised third-party providers when customers consent. With Open Banking, you can access services like account aggregation, budgeting apps, and direct bank payments in Belgium.

Which Belgian banks offer Open Banking?

Several Belgian banks have embraced Open Banking, including ABN AMRO, Belfius Bank, CBC Belgium, Fintro, Fortis, HelloBank BE, ING, KBC Belgium, and N26. These banks provide secure API access to enable seamless integration with third-party services.

Is open banking legal in Belgium?

Yes, Open Banking is fully legal in Belgium and regulated by the National Bank of Belgium under PSD2. To protect user data, banks and third-party providers must implement robust security measures, including Strong Customer Authentication (SCA).

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each