What Is a Payment Gateway?

If you’re just starting an online business, you might be wondering how to take payments on your website. That’s where a payment gateway comes in—it’s the system that securely handles every card transaction, making sure the money from your customer’s card gets to your bank account. Without it, you can’t accept online payments.

And with £38 billion lost to cart abandonment in the UK in 2024 alone, it’s vital to make checkout smooth, secure, and easy for your customers. In this guide, we’ll explain exactly what an online payment gateway is, how it works, and how to pick the right one to get your online business off the ground.

A payment gateway is the system that makes it possible for your business to take payments online.

While gateways were originally built just for card payments, today’s systems are much more flexible. They can handle mobile wallets, crypto, BNPL, and even newer methods that we’ll explore later in this guide.

But first, let’s look at the big picture.

The UK's e-commerce scene is booming. Online retail sales hit £177.11 billion in 2024, making online shopping nearly a third (30.4%) of all retail sales, with smartphones generating 63% of the online shopping orders.

However, businesses are losing potential sales at the final hurdle since 77% of people shopping on their phones abandon their baskets, and even on computers, 69% of shoppers stop before buying. Overall, roughly three out of four shopping journeys end in abandonment, mostly due to unexpected costs like shipping and taxes that pop up at checkout.

Then there's the fraud problem, which is getting expensive fast. Card-not-present fraud, mostly from online shopping, accounted for the majority of payment card fraud overall, reaching £570 million in just the first half of 2024.

It’s easy to see how retailers find themselves caught between a rock and a hard place. Make checkout too simple, and fraudsters have a field day. Add too many security steps, and customers get frustrated and leave. Either way, you're losing money, whether it's to abandoned carts or fraudulent transactions.

This is where online payment gateways become absolutely crucial. They're the behind-the-scenes technology that handles the online payments for your business. When a customer types in their card details and clicks "pay," the gateway takes over and does three crucial jobs: it secures the payment information, checks if the transaction is legitimate, and gets the money from the customer's bank to yours.

Read: E-Commerce Payment Security: Ensuring Safe Transactions

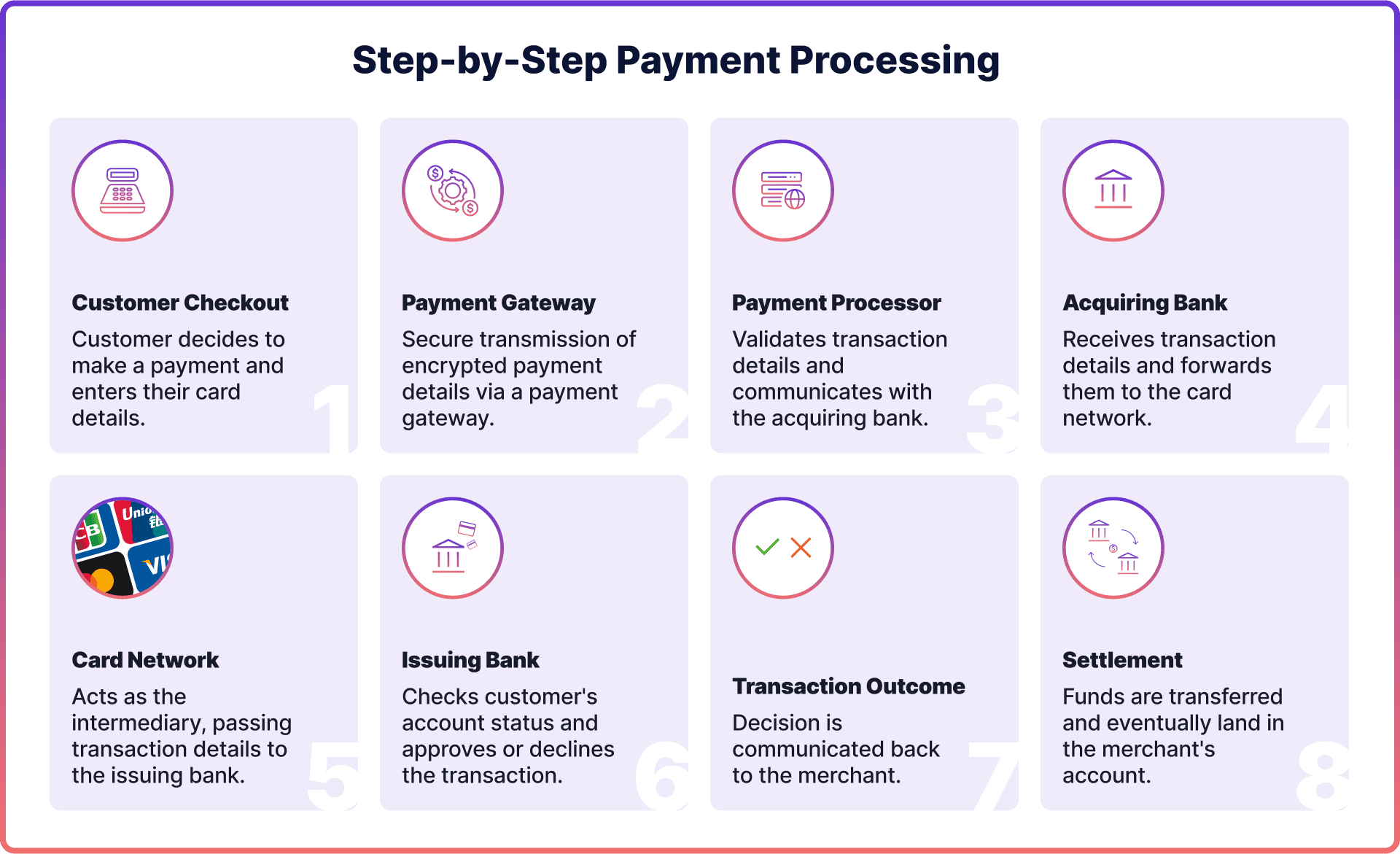

Let’s say a customer’s ready to buy something from your website. They enter their card details and click “Pay.” From there, the payment gateway steps in and kicks off a process that’s surprisingly quick (usually just a few seconds) but involves several important steps behind the scenes.

Here’s how it all plays out:

In most cases, you’ll get a confirmation instantly, but the actual settlement of funds can vary.

Later in the article, we’ll look at different payout speeds, cost structures, and what you should look for depending on your business size.

These two terms often get thrown around together—and sometimes even used interchangeably—but they’re not the same thing. A payment gateway and a payment processor work together to complete a transaction, but they handle different parts of the job.

Here’s a simple way to think about it:

Noda offers both payment gateway and payment processing services, integrating them into a unified platform designed for online businesses, simplifying payment operations and reducing the need for multiple service providers.

Firstly, Noda functions as a payment gateway by securely collecting and transmitting customer payment details. It supports various payment methods, including:

Noda also acts as the payment processor, handling the transfer of funds from your customer’s bank to your business account, taking care of refunds, and ensuring everything runs smoothly in the background.

This ultimately allows businesses to handle transactions seamlessly from initiation to settlement.

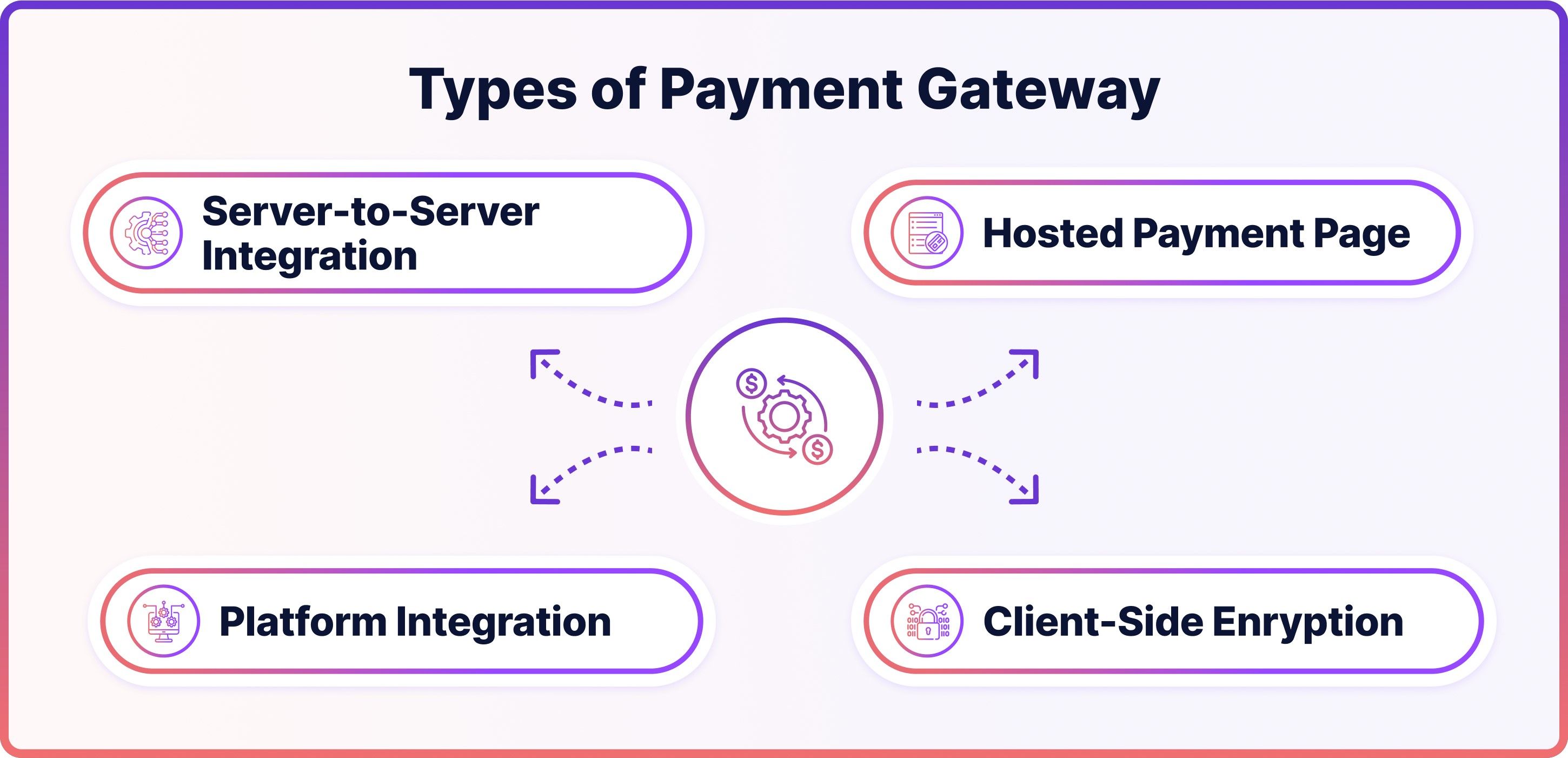

Not all payment gateways work the same way. Depending on your business size, how your website is built, and what kind of checkout experience you want to offer, you’ve got a few options.

Let’s take a look:

With this option, your customer is sent to the payment provider’s secure page to enter their payment details. Once the payment is complete, they’re redirected back to your website.

It’s a simple and secure option because the payment provider handles the sensitive card data, and you don’t have to worry about PCI compliance. This setup is great if you want a quick and easy way to start accepting payments.

This setup keeps your customer on your site the whole time. The payment details go straight from your checkout form to the gateway’s system via a secure API connection. It creates a smooth experience for your customer, but it also means you’re handling more sensitive data, so you’ll need to make sure your system meets strict security standards.

With this method, the customer’s payment information is encrypted right in their browser before it’s sent anywhere. That way, even if someone intercepts the data in transit, it’s protected. It’s a smart balance: you still get control over the checkout process, but the encryption adds an extra layer of security, helping you stay compliant without needing to build everything from scratch.

Many e-commerce platforms come with a payment gateway built in. You don’t have to worry about connecting to a separate payment provider; everything’s already there, ready to go. It’s an easy, all-in-one solution that saves time on setup and often comes with competitive processing rates. Ideal if you want to focus on your products and leave the payment side to the platform.

How do Payment Gateways Ensure Payments Are Secure?

A good payment gateway uses multiple layers of security to make sure everything stays locked down and protected from fraud or data breaches, including:

This is the gold standard for payment security. All gateways must comply with the Payment Card Industry Data Security Standard (PCI DSS). It’s a set of rules that control how card data is stored, processed, and transmitted. If your gateway is PCI compliant, that’s a solid first sign you’re in safe hands.

As soon as your customer enters their card details, the gateway encrypts the data, scrambling it into unreadable code so no one else can see it. This encryption happens both in transit (while the data moves through the internet) and at rest (if it’s stored).

Instead of storing actual card numbers, many gateways use tokenisation. This means they replace sensitive card details with a random string of characters (a "token"). Even if a hacker got hold of the token, it’s useless without the rest of the system.

In the UK and across Europe, Strong Customer Authentication (SCA) is now required for most online payments. This usually involves 3D Secure, where the customer gets a text, push notification, or fingerprint prompt from their bank to confirm the transaction.

Modern gateways also come with built-in fraud prevention systems. These use machine learning to flag suspicious activity, like unusual locations, large orders out of the blue, or mismatched billing and shipping details.

Most payment gateways rely on cards, which sounds fine at first, but it quickly adds up. Fees eat into your profits, settlements take days, and there are always extra middlemen like Visa, Mastercard and issuing/acquiring banks taking their cut.

Instead of routing payments through card networks, Noda uses direct bank payments powered by Open Banking. That means payments go straight from your customer’s bank account to yours, so you don’t have to deal with cards, long wait times, or extra fees.

You get:

And with dedicated support from a real account manager, you’re never left figuring it out on your own.

Want to see how Noda works?

Book a quick demo, and we’ll show you how it can save you time and money while keeping your payments secure and seamless.

In e-commerce, a payment gateway is the tool that makes it possible for your business to accept payments online. It securely moves payment information from your customer to the banks and processors involved, making sure transactions are safe, authorised, and completed correctly.

A payment gateway is the system that captures and sends your customer’s payment details for approval, while a payment processor moves the money between the customer’s bank and your business account. You need both to accept gateway payments securely.

The best payment gateway depends on your business needs. If you want fast payouts and low fees, Noda is a great choice.

An API in a payment gateway is a tool that lets developers connect your website directly to the gateway’s system, creating a smooth checkout where payment details flow straight to the processor.

For many businesses, the cheapest option is Noda, which uses Open Banking to process account-to-account payments with fees starting at just 0.1%. Other payment gateways like Stripe or PayPal also have competitive rates, depending on your transaction volume.

Payment gateway fees usually include setup fees, per-transaction fees, monthly service charges, and sometimes chargeback fees. It’s important to compare these costs across different payment gateway services.

There are hosted payment gateways that send customers to a secure page, self-hosted gateways that keep customers on your site, and API-based payment gateways that offer a seamless integration with your checkout.

The payment gateway process starts when a customer enters payment details on your site. The gateway encrypts the data and sends it to the payment processor, which contacts the bank for approval. If the payment is approved, the gateway confirms the transaction on your website.

Banks hold money and move it between accounts. Payment gateways are the technology that processes transactions by capturing card details, checking for fraud, and sending payment requests to banks. When someone buys from your website, the gateway handles the technical work while banks handle the actual money movement.

Yes, PayPal functions as both a payment gateway and a payment processor. When customers choose PayPal at checkout, PayPal handles the entire transaction process.

No, Google Pay is a digital wallet, not a payment gateway. Google Pay stores customers' payment methods securely and lets them pay with a tap or click instead of entering card details manually. However, the actual payment processing still goes through a payment gateway.