One in four bankruptcies in Europe is tied to late payments—a clear sign of how damaging slow cash flow can be. Businesses deserve better, and instant settlement gateways provide the speed and control they need to stay ahead.

This guide explores how instant settlements work, their advantages, and how Noda provides merchants with a seamless, cost-effective solution.

What is an Instant Settlement Payment Gateway?

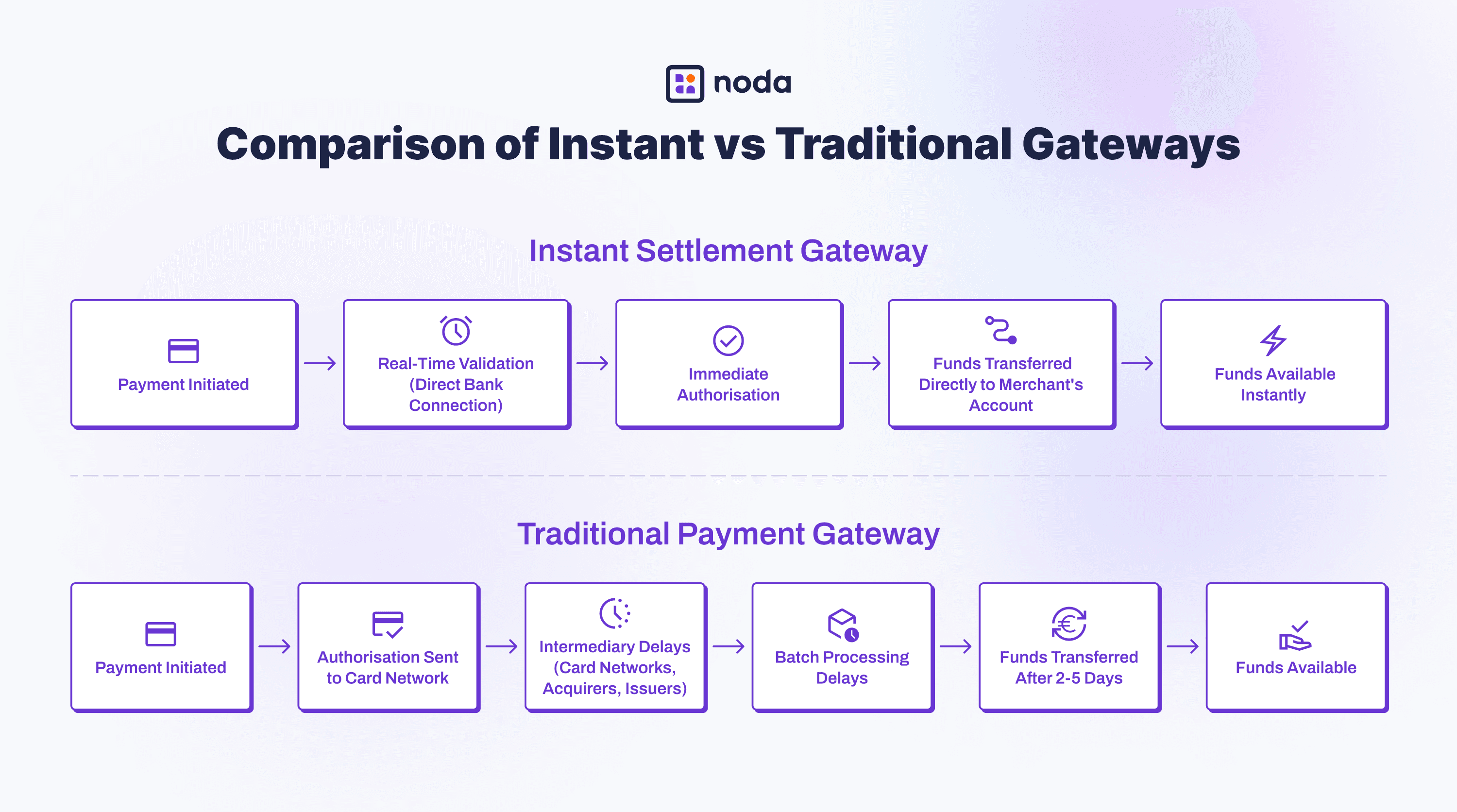

An instant settlement payment gateway processes payments in real-time or near real-time, ensuring funds are available to the merchant almost immediately after a transaction. Unlike traditional gateways, which often involve intermediary delays of several days, these systems streamline the payment process for faster access to funds.

Solutions like Noda's Open Banking Payments provide flexibility, enabling funds to be sent directly to a merchant’s account or deposited into tailored accounts designed for specific business needs.

The Advantages of Instant Settlement

Switching to an instant settlement payment gateway brings more than convenience—it provides practical solutions to common business challenges. Here’s how:

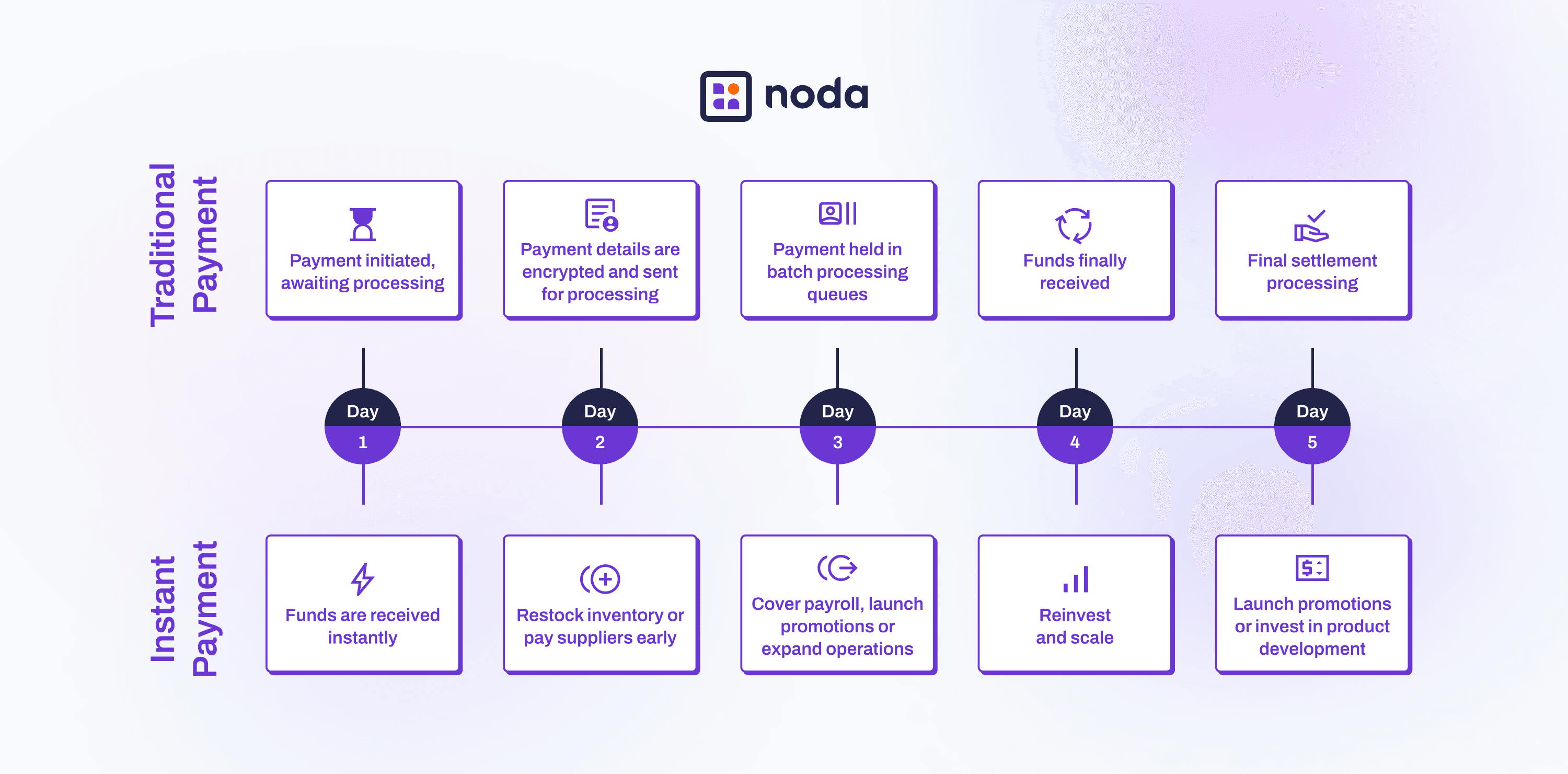

Stronger Cash Flow

Access to funds in real-time means businesses can cover expenses like payroll, supplier payments, and inventory restocks without delays. For example, a café can use same-day funds to stay stocked during busy weekends, avoiding lost sales.

Improved Customer Experience

Instant payments make for smoother checkouts, building trust and loyalty. With 93% of customers likely to make repeat purchases after a great experience, businesses that offer fast, reliable payments gain a competitive edge.

Reduced Credit Dependency

Cash flow disruptions often force businesses to rely on loans—54% of businesses have faced this challenge due to delayed payments. Instant settlement provides immediate access to funds, helping businesses restock inventory or pay suppliers without turning to high-interest credit. This not only reduces costs but also boosts financial stability, allowing room for growth.

Cost Efficiency

Bank payments bypass high card network fees like interchange and cross-border charges. By leveraging direct bank-to-bank transactions, businesses can significantly reduce costs compared to traditional card payment systems.

Choosing the Best Instant Settlement Payment Gateway

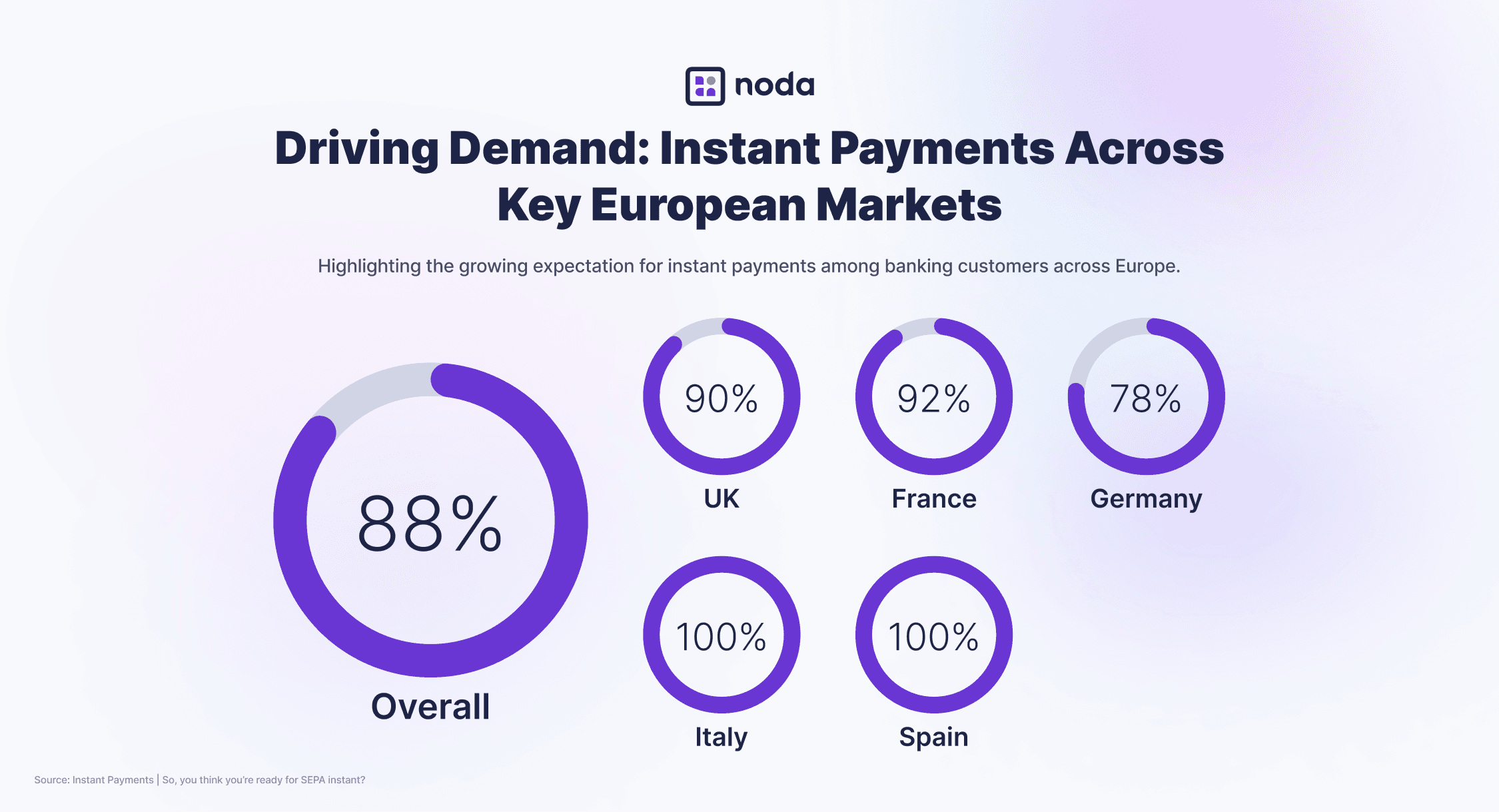

Finding the best instant settlement payment gateway means focusing on features that truly matter for your business. The SEPA Instant Credit Transfer (SCT Instant) scheme, with its 10-second processing time and 24/7/365 availability, sets the benchmark for reliability and speed. When selecting a gateway, look for these key features:

Fast and Reliable Transfers

A strong gateway ensures funds land in your account instantly, keeping cash flow steady and enabling quick financial decisions. This means no delays in covering operational costs or reinvesting in growth.

Transparent and Predictable Costs

Hidden fees can drain profits, especially for high-volume businesses. The best gateways provide clear, upfront pricing models, ensuring businesses can maintain profitability while scaling operations.

Security

A reliable gateway safeguards your transactions and customer data with advanced security protocols. Features like bank-level security protect sensitive information without compromising speed or efficiency.

Global Reach

For businesses expanding internationally, a gateway with multi-currency support and integration with global banking networks is essential. Tools like APIs and e-commerce plugins make scaling operations and managing cross-border payments effortless.

Industries That Benefit Most from Instant Payment Gateways

Instant payments are revolutionising cash flow and efficiency in business operations, with some industries seeing significant advantages. Here's how four key sectors are using instant payments to solve critical business challenges:

E-commerce

Online retailers depend on fast cash flow to optimise operations and scale efficiently. Same-day settlement gateways allow merchants to reinvest in inventory immediately after sales, maintain stock levels during peak seasons, and respond quickly to changing market demands. With instant payment processing and split payment features, these gateways streamline operations while delivering a seamless checkout experience for customers.

Travel and Hospitality

The travel industry often faces cash flow challenges with advanced bookings, last-minute cancellations, and cross-border transactions. Instant settlement gateways provide immediate access to booking revenues and deposit payments, enable efficient refund processing, and offer multi-currency support to help businesses cater to international customers with ease.

Automotive

Automotive transactions, from deposits to after-sales payments – often involve significant capital. Instant settlement gateways address this by providing immediate access to deposits, full payments, and after-service charges. This allows dealerships and service centres to maintain operations efficiently while building customer trust through transparent, immediate payment processing.

Social Commerce and Campaigns

Content creators and social sellers depend on quick access to earnings from tips, donations and campaigns. Instant settlement payment gateways provide flexible solutions through features like No-Code Payment Page or Instant Payment Links, allowing creators to focus on engaging their audience rather than managing payment delays. This fast access to funds ensures smoother campaign management, supports consistent content creation and real-time audience engagement.

Why Choose Noda?

Noda aims to help businesses like yours thrive by simplifying transaction flow and ensuring instant access to funds. Here’s how we combine powerful payment capabilities with straightforward implementation:

Get Paid Faster

No more waiting for funds to settle. With Noda, your revenue is available immediately after every transaction—so you can cover expenses, reinvest in growth, and keep your business running smoothly.

Expand Globally Without Hassle

Tap into opportunities worldwide with Noda’s connections to over 2,000 banks across 28 countries. Multi-currency support ensures your customers can pay in their local currency while you enjoy same-day settlements.

Keep More of Your Earnings

Reduce costs with direct bank-to-bank payments that cut out unnecessary intermediaries. Our products like Instant Payment Links help you streamline operations and protect your margins.

Seamless Integration

Noda’s seamless integration adapts to your business needs, offering simple payment pages or custom API solutions that embed directly into your systems. Our team supports you at every step, ensuring a smooth setup with minimal impact on your operations.

Take Control of Your Payments with Noda

Noda is redefining instant settlement with faster access to funds, reduced fees, and seamless global capabilities. Designed for businesses that value efficiency and agility, it’s the smart choice for managing payments in real-time.

Take the first step toward faster, smarter payments. Choose Noda and see the difference instantly.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each