For online marketplace companies, payment gateways are essential to facilitate secure transactions. Without them, the process of exchanging funds would be cumbersome and risky. Here, we take a look at the importance of this technology and how to choose the best payment gateway for your marketplace.

What Is a Payment Gateway?

A payment gateway is a crucial tool for businesses to handle transactions, whether online or face-to-face. Like a physical card reader in brick-and-mortar stores, it facilitates online payments for marketplaces by passing payment information from the customer to the merchant, payment processor, and the banks involved.

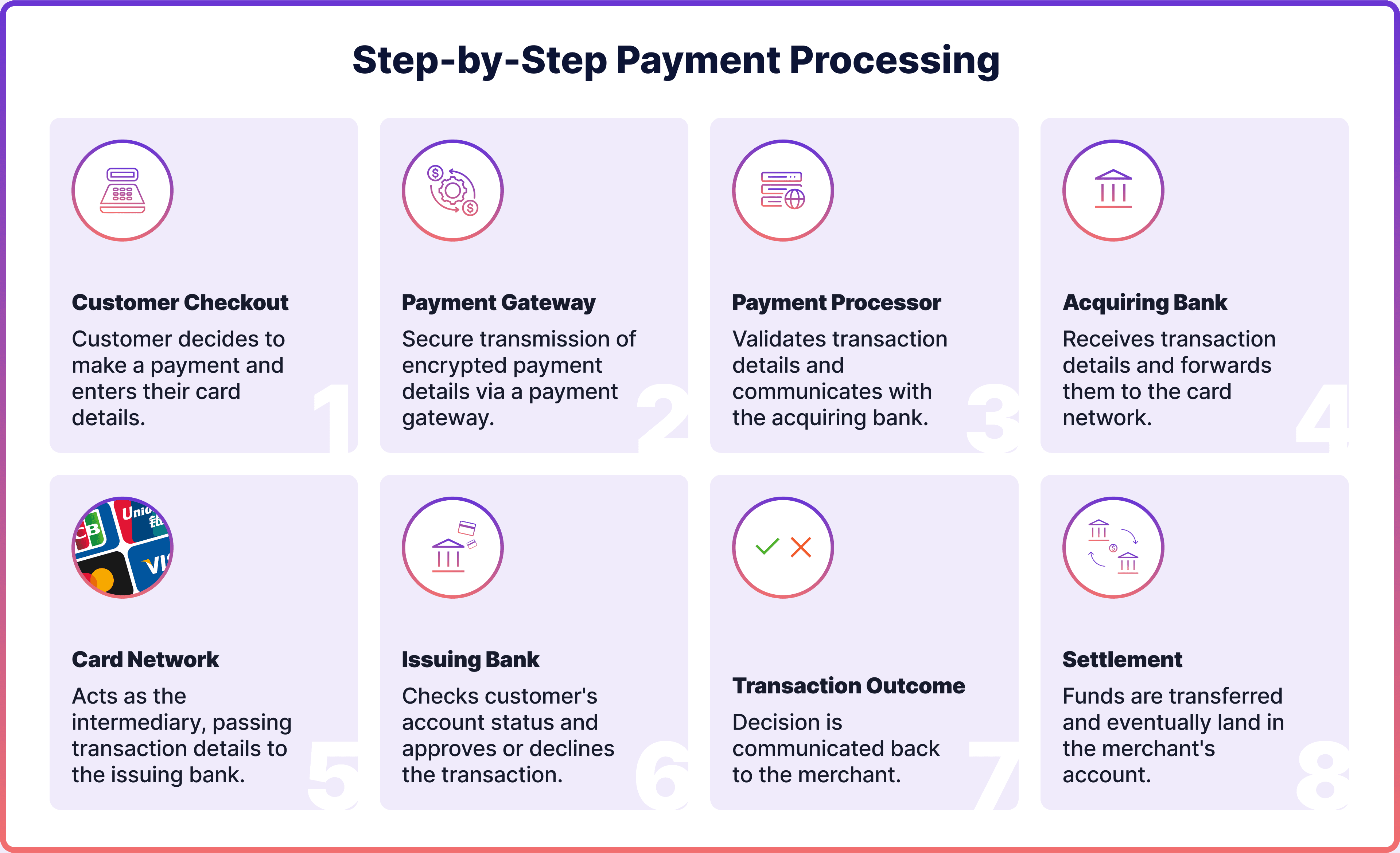

How Payment Gateway Works

When a customer makes a purchase, either online or in a store, they start the payment process. The payment gateway verifies their details and checks their account balance.

Next, the transaction data goes to a payment processor and then to the merchant's bank, which sends it to a card network like Visa or Mastercard. The network contacts the customer's bank to verify funds and assess the risk. If everything checks out, the bank approves the transaction, and the payment gateway finalises the sale with the marketplace.

Payment Gateway vs Payment Processor

Payment gateways and payment processors, though often provided by the same company, play distinct roles in transactions. The gateway secures and transfers customer payment data, acting as a bridge to the payment system.

A marketplace payment processor, on the other hand, manages the actual movement of funds between banks, completing the transaction. Essentially, the gateway gathers and encrypts data while the processor executes the money transfer.

How Do Marketplace Payments Work

Marketplace payments operate differently from standard e-commerce businesses. In a typical e-commerce setup, when customers pay, the money goes directly to the merchant's bank account.

This contrasts with marketplace payments, where the payment flow involves more participants. A marketplace acts as an intermediary between customers and vendors, earning by taking a fee from transactions conducted on its platform.

Single vs Multi-Vendor Marketplace

Marketplaces can be categorised into single-vendor and multi-vendor types based on the number of sellers present on the platform.

- Single-Vendor: A single-vendor marketplace is a platform where a single seller offers their products or services to customers. It has a simpler payment process as all transactions go to one merchant.

- Multi-Vendor: A multi-vendor marketplace is where multiple merchants (two or more) sell their products or services. This setup means each merchant pays a commission, complicating the website payment process.

Marketplace Payments Trends in 2024

Understanding payment trends is crucial for designing a strategy and meeting consumer preferences. Keeping up with these trends can help you choose the most suitable marketplace payment gateway for your business.

Digital Wallets

Digital wallets are the leading payment method globally, making up 49% of all transactions in 2022. They allow consumers to store various cards and make payments without entering their details manually. Adding digital wallets as a payment option on your marketplace could significantly increase revenue and, in turn, your commissions.

Buy Now, Pay Later (BNLP)

The Buy Now, Pay Later (BNLP) payment method lets customers purchase now and pay later in instalments. BNLP gained popularity for its flexibility during financial downturns. It's especially favoured by Gen Z and millennials for making payments more manageable. It may be worth considering BNLP as a payment option if that’s your target market.

Open Banking

Open banking revolutionised digital payments by ending traditional banks' control over customer data. Legally required in Europe by PSD2, it mandates banks to share their APIs with licensed third-party providers, encouraging competition and innovation. By enabling open banking payments, marketplaces can reduce transaction fees, speed up the payment process, and enhance security.

Account-to-Account (A2A) Payments

Account-to-Account (A2A) payments enable direct money transfers between bank accounts without manually entering card details. The move toward open banking led to more businesses using A2A payments. Open banking has made them cheaper, quicker, and more secure.

Marketplace Payment Solutions: Key Features

Before choosing the best payment gateway for your marketplace, it's crucial to do thorough research. With so many payment systems available, it can be overwhelming. Consider a list of key factors to help you make an informed decision.

Currencies & Regions

Limited geography can impact your marketplace's growth. Ensure your payment provider supports the required regions and currencies for global coverage. This allows your customers a broader range of marketplace payment options, which is essential for serving a worldwide clientele.

Payment Methods

Find out which payment methods your customers prefer and adjust your payment system accordingly. Ensure your payment gateway accommodates popular methods like digital wallets and bank cards. This approach helps meet customer needs and enhances their payment experience on your marketplace platform.

Chargeback Processing

Chargeback fraud can significantly impact vendors and marketplaces. It cost merchants over $20bn in 2021, with an expected rise to $117.47bn in 2023. A good payment gateway should offer robust chargeback support, minimising financial losses and protecting the marketplace and its vendors.

Security & Compliance

In digital commerce, transactions security is crucial. Here are some common features payment gateways use to protect both marketplaces and vendors:

- PCI DSS: The industry’s security standard for all companies that process, store, or transmit credit card information.

- Tokenisation: Replaces sensitive data with unique tokens that retain all the essential information without compromising security.

- Multi-Factor Authentication (MFA): Requires two or more factors of authentication (knowledge, possession, inherence) to verify a user's identity and authorise payments.

- SSL/TLS: Protocols that provide secure communications over a computer network by encrypting data.

- Anti-Fraud: Systems and techniques used to monitor, detect and prevent fraudulent activities.

Integration

It's vital for a payment gateway to fit with your current setup. For example, it should allow for easy product listings and customer purchases on your marketplace platform. This ensures a smooth operation and a better shopping experience.

How to Choose a Payment Gateway for Marketplace

Selecting the right payment gateway can greatly enhance how your marketplace operates transactions. Follow these steps:

- Identify

Before selecting a payment gateway provider, consider what you need. Think about key security features, your budget, required payment methods, UX simplicity and how it will integrate with your system. This will help you find a provider that matches your unique marketplace needs.

- Review

Evaluate various payment gateway providers. Look at their ratings on review sites, especially feedback from other marketplaces. Organise a table to compare essential features and how each provider stacks up against your needs.

- Trial

After narrowing your list, contact the providers for a demo. Many offer trial periods, allowing you to test their services. This step is critical to ensure their solution fits your marketplace well.

Payment Gateway for Marketplace with Noda

Elevate your business with Noda’s payment gateway and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. Operating in the EU and Canada, Noda supports a wide range of currencies for globally-minded clients with scalable plans to fuel your business growth.

Benefits of Choosing Noda for Payment Gateway

- Open Banking: Enhance user experience (UX) and simplify transaction flow with the power and security of open banking payments

- Marketplace Payment Processing: Streamline marketplace pay-outs and pay-ins, leverage intuitive UX, smart routing and offer a variety of popular payment methods

- Global Currencies: Noda works with multiple currencies to support your marketplace clients around the world

- AI-Powered Analytics: Leverage our data-driven insights. Noda’s tools offer ready-to-use analytics of client behaviour, including segmentation and forecasting algorithms

- Security: Noda is a secure provider, ensuring PCI DSS compliance, encryption and fraud prevention

- Scalable Plans: We offer solutions for marketplaces of all sizes, with scalable plans available to support your growth

FAQs

How do marketplace payments work?

Marketplace payments involve additional steps and participants compared to standard e-commerce transactions. The marketplace is an intermediary between customers and merchants, earning revenue through transaction fees.

How do I set up marketplace payments?

To set up marketplace payments, you need to choose a payment gateway provider that fits your business needs. Then, integrate the selected payment gateway into your marketplace platform.

Do I need a payment gateway?

Yes, you need a payment gateway to process transactions on your marketplace platform. The payment gateway securely transmits payment information between customers, merchants, payment processors, and banks.

Is a payment gateway safe?

Payment gateways typically employ various security measures such as PCI DSS compliance, tokenisation, multi-factor authentication, SSL/TLS encryption, and anti-fraud systems. However, it's essential to choose a reputable provider to minimise security risks.

What is the best payment method for selling online?

The best payment method for selling online depends on factors such as customer preferences, geographic location, and the type of product. Popular payment methods include digital wallets, credit and debit cards, and alternative payment solutions like BNLP.

How do I start using Noda’s payment gateway for my marketplace?

Noda offers easy onboarding with the personalised guidance of a dedicated manager. Our marketplace payment platform smoothly integrates with APIs and front-end components, ensuring seamless merging into your interface. To start using Noda, fill out this form, and our sales representatives will contact you shortly.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each