Digital payments have become the new norm, rendering traditional cash as a relic of the past. This shift is more than just convenience; it reflects our evolving digital landscape.

With the rise of smartphones and online banking, consumers opt for speed, security, and personalisation. From mobile wallets like Apple Pay and Google Pay to A2A payments driven by open banking, the options for cashless transactions are ever-expanding.

Here, we take a look at the key trends in digital payments and how they are likely to shape the future of the digital payments industry in 2025 and beyond.

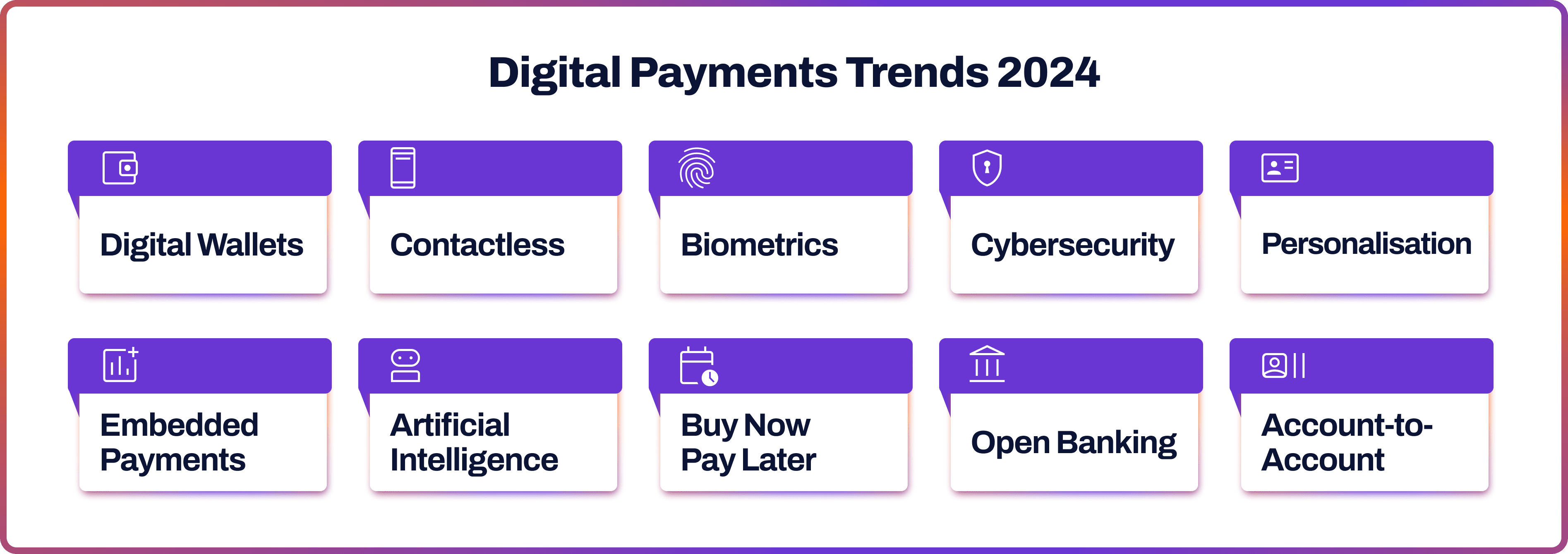

Digital Payments Trends 2025

Below are the top ten electronic payment trends businesses should be aware of entering into 2025: from digital wallets and biometrics to embedded payments and open banking.

Digital Wallets

Digital wallets are currently the most popular digital payment method in the word, accounting for 49% of all transactions in 2022. Consumers can store multiple cards in a digital wallet and make payments without entering their details. Mobile wallets like ApplePay or GooglePay can also keep gift cards, loyalty cards, tickets, IDs, and even vaccination certificates.

During the pandemic and social distancing, digital wallet adoption soared. They are especially popular in China, with Alipay and Tenpay being the major players.

Digital wallets will continue gaining momentum in 2025 and beyond. A Transparency Market Research (TMR) study predicted the mobile wallet market will reach $16.2tn by 2031. Meanwhile, Juniper Research expected digital wallet transactions to increase from $9tn in 2023 to over $16tn by 2028, marking a 77% rise.

Contactless Payments

Along with digital wallets, the shift to cashless payments accelerated with the global pandemic. This prompted more physical retailers to adopt contactless payment systems. Contactless payments use Near Field Communication (NFC) technology to enable data exchange between a device or a bank card and a payment terminal.

In 2025, this trend will likely continue due to its convenience for consumers. According to Juniper Research, the projected value of contactless transactions could reach $11tn by 2027.

Biometric Payments

Biometrics utilise unique physical and behavioural traits for identity verification. They are often used for extra security in payment authorisation.

Biometric payments can employ fingerprints, facial features, or retinal scanning to ensure the person attempting a payment is who they claim to be. The biometric data is encrypted and stored either within the device or on a remote server.

In 2022, the global biometric digital payments market was valued at $7.4bn by Maximize Market Research. They predicted the market to exceed $19bn by 2029. Meanwhile, Grand View Research expected biometric payments to grow at a rate of 62% CAGR between 2022 and 2030.

Rise of Cybersecurity

Digital payments provide a fruitful ground for cybercriminals. With e-commerce sales surging, hackers develop new techniques to outsmart defence systems. In 2021, 71% of surveyed businesses reported being victims of payment fraud, according to JPMorgan Research.

Some of the common types of fraud in the digital payments landscape include phishing, identity theft, account takeover, spoofing and authorised push payment (APP) fraud. Like never before, an efficient and up-to-date cybersecurity stack is crucial for businesses, and this trend will continue into 2025 and beyond.

Personalisation

Personalisation can increase engagement, elevate customer experience and boost revenues. In recent years, technology innovators such as Apple and Netflix have significantly elevated standards in terms of personalisation.

Modern consumers expect a high degree of personalised experience. In 2021, McKinsey research revealed that 71% of consumers “expect companies to deliver personalised interactions”, and 76% “get frustrated when this doesn’t happen”.

This applies to payment processing solutions, too, and therefore is the next modern digital payment trend. Providers, like Noda, who offer strong data and analytics capabilities, will enable merchants to deliver more personalised product offerings.

Embedded Payments

Embedded payments integrate payment services directly into a non-financial business's software or app. They allow customers to pay without leaving the platform.

Embedded payments become a new norm in our lives, with a wide range of use cases. For example, the Starbucks mobile application allows customers to pay for their coffee and food while gathering loyalty rewards. Ride-hailing services such as Uber and Lyft also allow customers to link their cards and automatically pay for rides through the app.

A report from IDC predicted that by 2030, 74% of digital consumer payments will be conducted via nonfinancial institutions with embedded payments. Banks will no longer dominate payments as they have done before.

Artificial Intelligence (AI)

In 2023, artificial intelligence took the central stage, particularly through the swift adoption of ChatGPT. This technology may significantly impact the digital payments sector as well.

According to McKinsey, artificial technology could add $2.6tn to $4.4tn in value to the global economy annually across the 63 different business use cases they analysed.

In the world of digital payment technology, AI can drive biometric payments, increase accuracy of fraud detection, support integrations, enhance financial analytics. At its core, generative AI acts as a force multiplier, boosting productivity and efficiency of the current technology.

Buy Now Pay Later (BNLP)

Buy Now Pay Later (BNLP) services boomed several years ago due to their flexibility during the financial recession. BNLP is a payment method that enables customers to buy goods and pay for them in installments over a period of time. It’s a popular payment choice among GenZ and millennials.

As of 2023, the BNLP market size was valued at $309.2bn by Global Data. The firm forecast BNLP to reach $565.8bn by 2026. “Online payments are rapidly growing as more consumers are taking advantage of online shopping thereby favoring BNPL market growth,” OpenData said. “BNPL over the last couple of years has gained popularity as an alternative credit option, a trend expected to continue during the forecast period.”

Open Banking

Open banking is a groundbreaking framework in the digital payments space. Previously, traiditonal banks held a monopoly over customer data. With open banking, they are required to share application programming interfaces (APIs) with licensed third-party providers.

In Europe, open banking is legally mandated through the PSD2 regulation enforced in 2018. Banks open their APIs to authorised providers, which results in a win for all. Customers grant their consent, and in turn, companies create personalised products and streamline payments and user experiences.

Account-to-Account (A2A) Payments

While Account-to-Account (A2A) payments have been around for a while, the shift towards open banking encouraged an increase in adoption. Open banking made A2A payments more cost-effective, faster, and safer by minimising intermediaries.

FIS 2023 Global Payments Report revealed that A2A payments accounted for $525bn in global e-commerce transaction value in 2022, a 13% increase from 2021. The report predicted that A2A will account for 11% of e-commerce transactions by 2026.

Open Banking & Payments with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

Future of Digital Payments

Digital and cashless payments are accelerating in adoption, and the trend will keep the momentum. Research and Markets predicted digital payments to grow at a CAGR of 16% between 2023 and 2026. This means that by 2026, the volume of non-cash transactions worldwide is projected to nearly double.

With the rise of e-commerce, digital payment innovation is essential for companies more than ever. Businesses can no longer ignore the power of online payments. Choosing a reliable provider is key to leveraging the latest digital payment solutions.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each