Want Faster Payouts? Here’s What to Know About Instant Payout APIs

People are used to things happening instantly, and that includes getting paid. If your payouts are delayed, your users will feel it. That’s why instant payouts are on the rise across gaming, marketplaces, and digital platforms. They’re fast, reliable, and expected.

With real-time payments projected to grow 289% by 2030, now’s the time to look at how your business handles payouts.

This guide explains how instant payout APIs work, what to look for in a provider, and how Noda helps you scale with a flexible, multi-currency setup that keeps money moving fast.

An instant payout API is a type of payment technology that allows businesses to send money instantly to a recipient’s bank account or card. These APIs connect directly with banking networks and card schemes, enabling real-time transfers without manual intervention.

They’re built to be fast, secure, and easy to integrate – making them ideal for companies that need to automate outgoing payments at scale. With an instant payouts API in place, businesses can move funds in seconds rather than hours or days, improving user experience and operational efficiency.

An instant payout API connects your platform to a payment gateway that supports real-time transfers. Once integrated, it gives you direct access to banking rails and card networks so you can move money instantly, anytime.

Here’s what that means in practice:

The API handles everything in the background. It securely initiates the payout, communicates with the bank or card issuer, and confirms once the funds land – usually within minutes, sometimes even seconds, depending on the destination.

Forget batch processing or next-day transfers. Customers expect their money fast, especially in industries like gaming or lending where timing matters. Instant payouts let you move funds in real time, with no delays or cut-off windows.

In the UK, instant payments already account for nearly 10% of all transactions – and that number is expected to keep rising through 2028. Schemes like Faster Payments (FPS) in the UK and SEPA Instant in Europe have made real-time transfers the new normal.

Noda’s instant payout connects directly to these networks, with additional support for card payouts through integrated card schemes. Funds arrive in minutes – whether you're sending to a bank account or debit card.

65% of customers choose companies that offer fast, simple online transactions. That expectation extends beyond the purchase. They want the same level of ease when it’s time to get paid.

Instant payout APIs reduce the complexity of managing outbound payments. Instead of using different banks or systems, everything flows through one API – saving time and reducing errors.

Noda’s approach is designed for simplicity. It gives you a single account for both pay-ins and payouts, so you’re not stuck moving money around or managing extra accounts. One setup, full control.

Above 90% acceptance rate across markets. Build a better payout flow with Noda → |

Trust is built with every transaction. When users know they’ll get paid on time, every time, it strengthens your brand and improves retention.

An instant payout API adds that layer of dependability, reducing failed transactions, uncertainty, and support tickets. It tells your users: we’ve got you covered.

Noda’s solution is designed to support that trust at scale. Fast payouts to bank accounts and cards, clear tracking, and no unnecessary delays. Just a better experience from start to finish.

The global non-wholesale cross-border payments market is projected to grow from €36.3 trillion in 2024 to €58.7 trillion by 2032. That includes B2C payouts, SMB payments, and remittances – proof that cross-border money movement is becoming a core part of doing business.

To keep up, platforms need instant payout solutions that support multiple currencies natively, without adding manual work, delays, or unnecessary fees.

Noda supports EUR and GBP for both pay-ins and payouts, all through a single account – so you can reach more users, in more places, with the currencies they trust.

Whether you’re sending one payout a week or thousands a day, a good instant payout API should scale with you, without the growing pains.

As transaction volumes increase, so does the need for infrastructure that can keep up across regions, currencies, and payout methods.

Noda is built for scale. With direct connections to over 2,800 banks across 28 countries – including the UK, Brazil, Canada, and Europe – it gives you the reach to grow globally without switching systems or adding complexity.

Setting up an instant payout API doesn’t need to be complex. Most businesses can get up and running in three key steps, no heavy dev work or long timelines required.

The first step is picking a partner that fits your business model and geography. The best instant payouts API provider offers fast setup, strong compliance, and multi-currency support. Clear documentation and responsive support also go a long way, especially if your team isn’t fully technical.

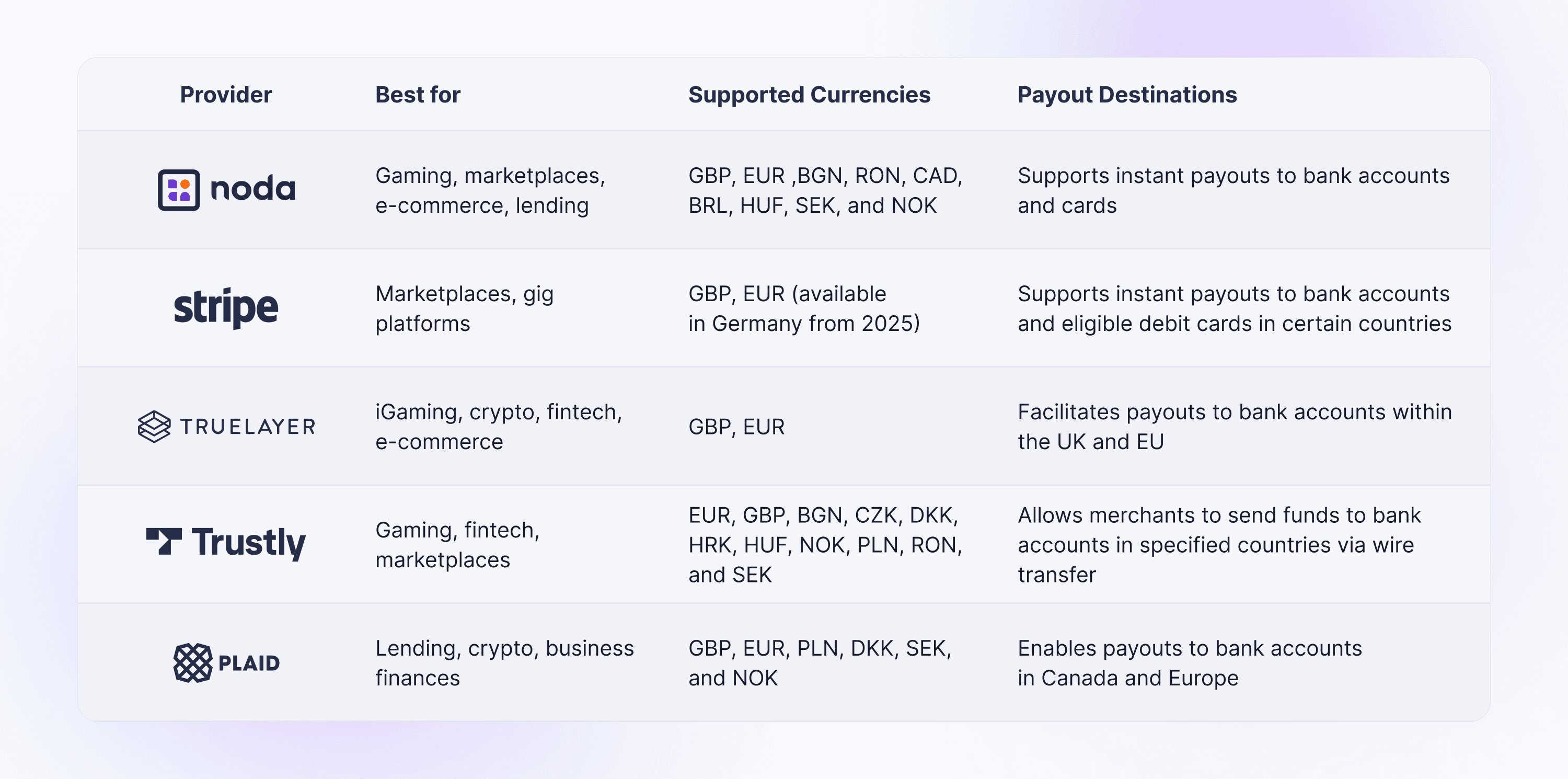

Here’s a quick look at some top instant payout APIs for businesses, based on common use cases:

Tip: When comparing providers, look beyond just fees. Think about geography, scale, user experience, and how easily it fits into your existing flow.

Once you’ve chosen a provider, you’ll get a set of API keys or credentials to connect your system securely. This is how your backend talks to the payout service: initiating, verifying, and tracking each transaction.

With most providers, you can plug into their REST APIs or SDKs using standard tools. Noda, for example, offers developer-ready documentation for payouts making it easy to integrate and move fast without unnecessary complexity.

Before going live, run test transactions in a sandbox environment. This lets you check for edge cases, validate payout logic, and make sure everything works as expected. Most instant payouts API providers offer clear docs, dashboards, and support to help your team go live quickly.

Noda gives you full flexibility with both bank and card payouts, so you can move money fast, wherever your users are.

You can send funds directly to bank accounts, backed by Open Banking standards, or push payouts to debit cards in minutes. No delays, no unnecessary steps.

This setup is ideal for platforms that handle frequent, high-volume transactions, including:

Whether your users prefer a bank transfer or card payout, Noda helps you keep the experience fast, smooth, and built for scale.

With Noda, payouts arrive when they matter most. From a long-awaited loan to hard-earned wages or a quick refund after a cancelled order, getting paid within seconds builds trust and loyalty. In moments that matter, fast payouts create real value.

Ready to make payouts better? Try Noda today.