In the dynamic realm of finance, there is a transformative force known as the open banking APIs. This innovative concept is revolutionising traditional banking systems and delivering exceptional customer experiences.

But what exactly is the meaning of application programming interface (API)? And why should business owners and executives pay heed to its significance? Let's unravel this term together and delve into the multitude of potential benefits it holds.

What is an API in Open Banking?

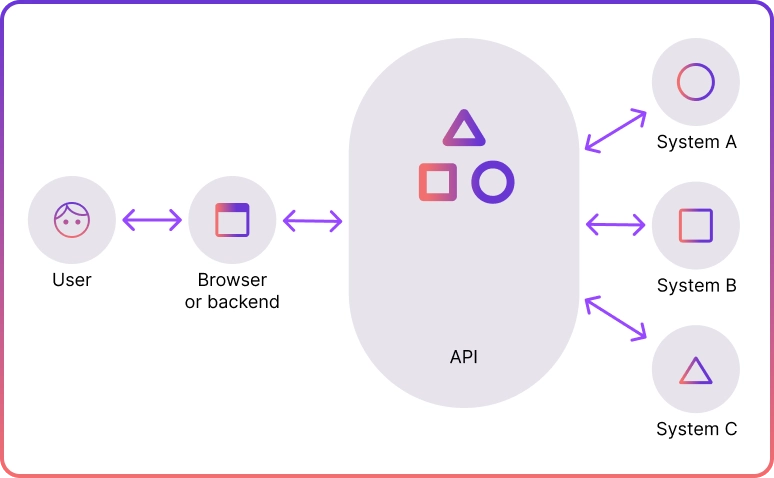

API in simple words is an acronym for Application Programming Interface and serves as a software intermediary enabling seamless communication between different applications.

In the realm of open banking, APIs play a crucial role in securely sharing financial data among banks and authorised third-party service providers. This exchange of data promotes the development of innovative financial products and services that can effortlessly integrate with existing banking systems.

How do APIs Work?

An API can be likened to a software bridge that facilitates the seamless transfer of data between two parties. Within the open banking industry, APIs serve as the connecting link between licensed third-party providers and banks, promoting standardisation and efficiency while ensuring utmost security. This streamlined flow of financial information, including transaction-related data, is what paves the way for open banking initiatives.

Types of API in Open Banking

There are three main types of APIs used in open banking:

- Private APIs refer to the internal systems utilised by each individual bank or financial institution for seamless information exchange within their own network.

- Partner APIs are designed for the bank's business partners.

- Open APIs are accessible to third parties, even without being affiliated with the bank. They play a pivotal role in open banking by empowering external providers to offer innovative payment structures and services.

Who Can Use Open Banking APIs?

Only authorised organisations are permitted to utilise open banking APIs. These include Payment Initiation Service Providers (PISPs) and Account Information Service Providers (AISPs).

PISPs act as intermediaries between merchants and banks, facilitating payment initiation, while AISPs have access to individuals' financial data for services like budgeting and financial management tools.

Benefits of using APIs explained

- Innovative opportunities: Businesses engaged in open banking can gain access to new services and financial data. This access fosters innovation and leads to enhanced customer services.

- Efficient data sharing: APIs enable seamless, secure, and efficient sharing of bank transaction data with businesses, which can significantly enhance operations.

- Data control: APIs grant customers greater control over their personal financial data, which empowers informed decision-making.

- Expanded value chain: APIs provide banks with access to a larger network, allowing for the development of innovative services and products.

- Customer insights: APIs offer banks and financial institutions valuable insights about customers, which enables data-driven decision-making and facilitates personalised services.

Final thoughts

To conclude, the impact of open banking APIs is undeniably transformative. This technology not only reshapes the financial sector but also ignite a wave of innovation across various industries.

For business executives and owners, leveraging these APIs can unlock unprecedented growth and enhance customer satisfaction. The future of finance embraces openness, connectivity, and data-driven approaches. By embracing open banking APIs, you stay ahead of the curve while paving the way for a more transparent, efficient, and customer-centric business environment.