In February 2023, Wargaming, a leading multi-platform game publisher, partnered with Noda to launch instant open banking payments for their games. This collaboration provided Wargaming's players with a variety of online payment methods, including account-to-account (A2A) transactions powered by the open banking infrastructure.

What is Open Banking & A2A?

Open banking was enforced in 2018 when the EU's PSD2 regulation required traditional banks to share customer data with authorised fintech firms like Noda. The data sharing happens via application programming interfaces (APIs), which allow different software systems to communicate securely.

Open banking fuelled account-to-account (A2A) payments, often referred to as ‘Pay-by-Bank’. With Noda's pay-by-bank option, Wargaming gamers can skip entering lengthy card details manually, as the system automatically redirects them to their trusted bank’s interface from the payment page. This improved user experience (UX), reduces cart abandonment and enables gaming merchants to access funds more quickly.

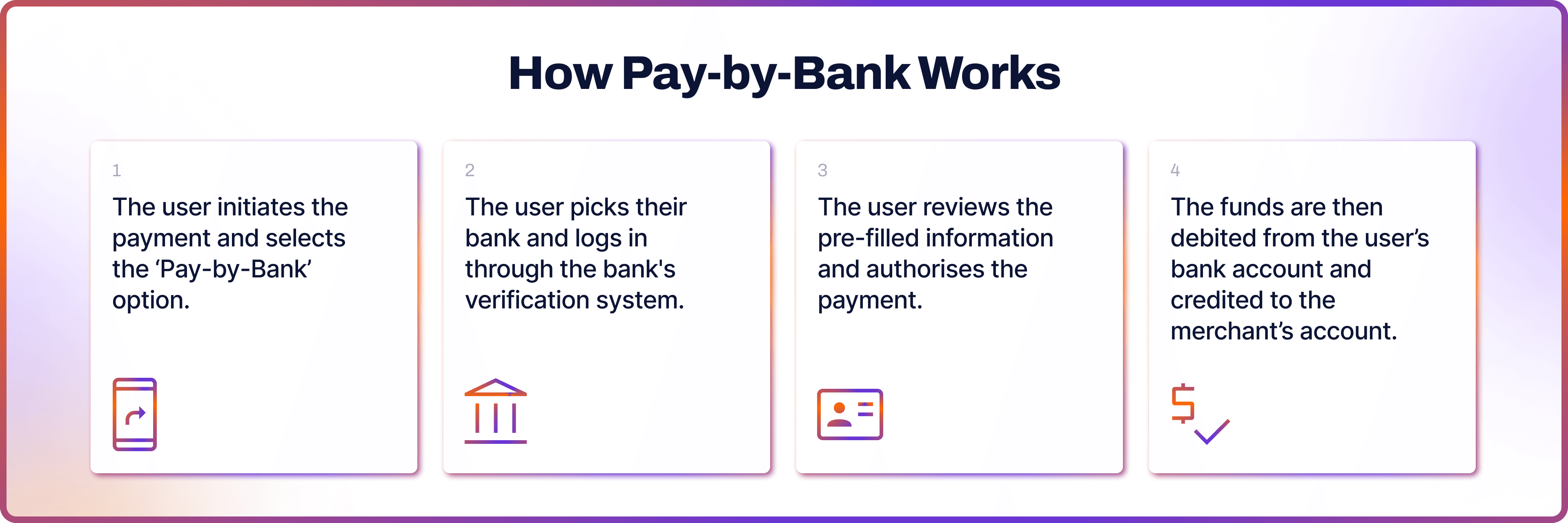

How Pay-by-Bank Works

The process for open banking A2A payments typically follows these steps:

- The user initiates the payment and selects the ‘Pay-by-Bank’ option.

- The user picks their bank and logs in through the bank's verification system.

- The user reviews the pre-filled information and authorises the payment.

- The funds are then debited from the user’s bank account and credited to the merchant’s account.

Benefits of Open Banking for Wargaming

The key benefit of open banking transactions is that they incur lower fees compared to traditional payment methods. “Noda’s unified platform connects multiple banks across the globe, simplifying payment processing,” said Sebastian Totté, Noda’s Head of Gaming. The pay-by-bank option bypasses card networks by transferring money directly between bank accounts. Fewer intermediaries mean lower fees for gaming merchants. Specifically, according to 'The Future of Payments' report by Accenture, banks leveraging Open Banking APIs have seen a reduction in payment processing costs by up to 20%.

Secondly, A2A payments eliminate slow settlements typical to traditional payment methods like cards and BACS, which can take up to three days to process. Card processors might even hold larger rolling reserves. In contrast, A2A payments are credited almost instantly, allowing gaming businesses to track their cash flow in real-time. “Noda provides a C2B bank account and daily settlements, making it easier for Wargaming to manage deposits efficiently,” added Sebastian. Notably, according to the Open Banking Implementation Entity (OBIE) 2019 report, 50% of payments via Open Banking APIs were processed in under 30 seconds, showcasing the efficiency of this system.

Another crucial benefit of open banking is smoother UX for gaming. A2A payments eliminate the need for manually entering card details. Instead, gamers are transferred to their trusted banking interface in just a few clicks. “A seamless payment process reduces cart abandonment and increases conversions,” explained Sebastian. Furthermore, studies underscore the impact of open banking on user experience: Customers using Open Banking services experienced a 30-40% increase in satisfaction due to personalised financial products, according to How Financial Institutions Can Take Advantage of Open Banking by McKinsey & Company.

Another advantage is the decrease in fraud. According to the European Central Bank's "Report on Card Fraud," the implementation of Strong Customer Authentication (SCA) under PSD2 has reduced online payment fraud by up to 75% in the EU.

Future of Open Banking Payments

Open banking payments are rapidly gaining popularity in the online gaming industry and other sectors. This trend is expected to continue, with Statista projecting A2A to account for 10% of all online transactions by 2026. Presently, they are the fourth most popular payment method globally, trailing digital wallets and bank cards.

According to Statista’s March 2023 report, Europe is leading the adoption of A2A. Yet the geography is expected to expand in the coming years. McKinsey predicts that by 2026, A2A payments in North America could handle $200bn in consumer-to-business transactions.

Elevate Payments with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

Learn More Case Studies

From Checkout to Workout: Free Multi Mineral Complex with Noda

Empowering Latvia’s Entrepreneurs with Seamless Payments

Plug into the Future: Pay with Noda and Get a Gift from Viron.lv