Did you know that merchants can be ghosted, too, like in dating? It's called cart abandonment and is quite common in e-commerce. According to the research on cart abandonment statistics from the Baymard Institute, 70.19% of online shopping baskets are typically left uncompleted.

Put simply, for every 10 customers who put an item in their shopping cart, seven leave the platform without buying it. Cart abandonment causes e-commerce stores in the US and EU to lose out on the potential of $260 billion worth of lost orders, according to the research.

Here, we take a look at this unpleasant trend and suggest some shopping cart abandonment solutions.

What Is Shopping Cart Abandonment?

E-commerce shopping cart abandonment happens when a customer puts items in their online basket and doesn't complete the purchase. This may be due to several reasons, including the lack of preferred payment methods, high shipping costs, or the customer deciding against the purchase for any other reason.

Why Is Shopping Cart Abandonment a Problem for Retailers?

Cart abandonment significantly impacts online businesses. Consider this scenario: if you're earning $25,000 per month from online sales and could convert just 25% of those abandoned orders into completed sales, you would gain an additional $75,000 annually.

What Is the Average Shopping Cart Abandonment Rate?

Research from Barilliance indicates that e-commerce cart abandonment rates vary by device. Shoppers on mobile devices and tablets are more likely to abandon their carts on the checkout page than shoppers on desktops:

- Desktop: 73.07%

- Mobile: 85.65%

- Tablets: 80.74%

Customer location also affects cart abandonment rates. For instance, Barillance showed that 86.15% of shopping carts in Spain are abandoned before completion. Conversely, the Netherlands has the lowest abandonment rate, with 65.49% of shoppers not finishing their purchases.

Top Five Reasons for Shopping Cart Abandonment

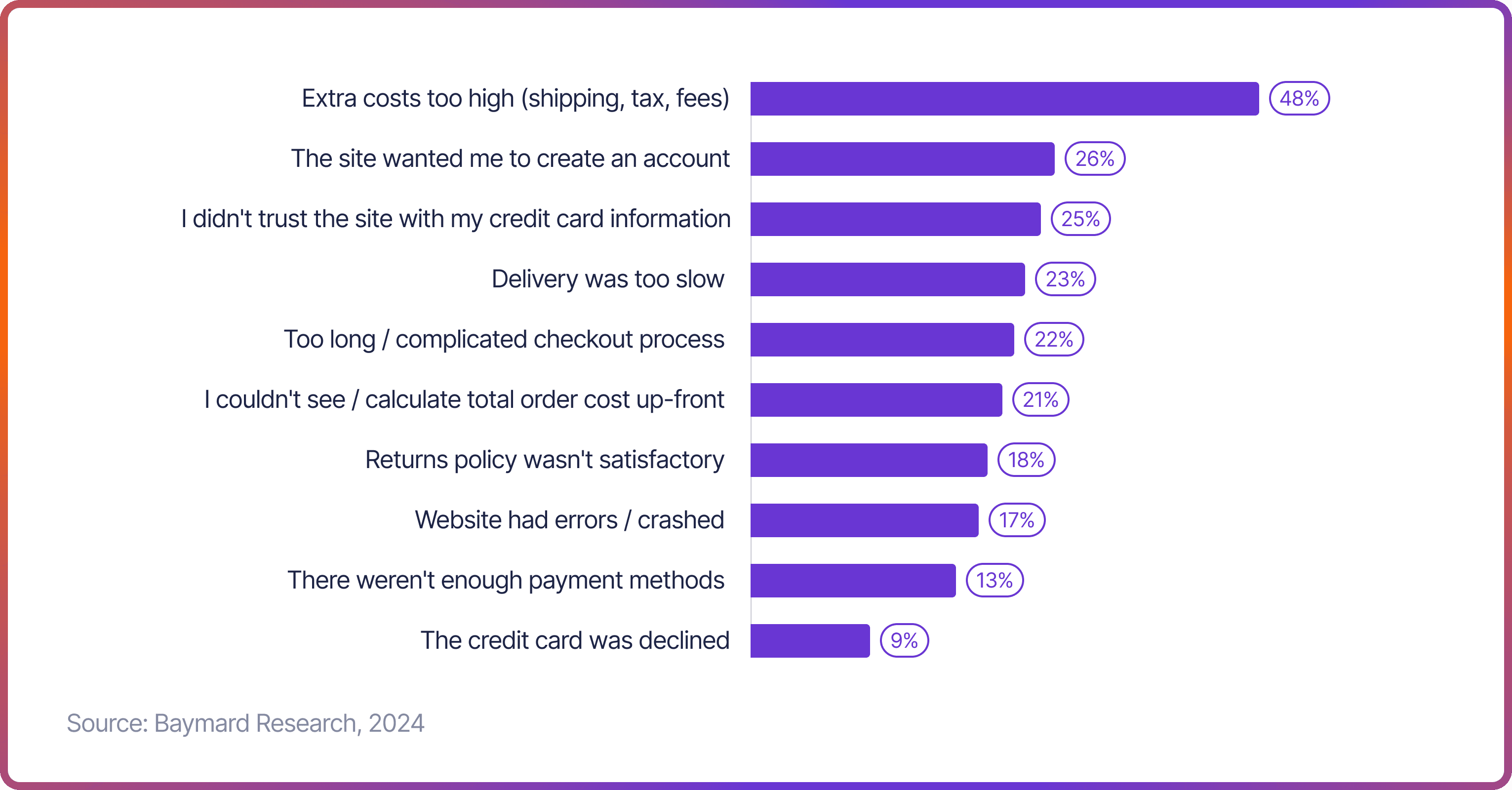

Extra Costs

Cost is a major factor for today's online shoppers, so it's no surprise that additional fees at checkout are leading the way of the top cart abandonment reasons. Unexpected charges such as shipping, taxes, and duties often aren't clear to the customer upfront. In fact, these added costs lead 48% of shoppers to abandon their carts and leave the website.

Create an Account

First-time customers at your online shop seek a quick checkout experience, which may be hindered by the requirement to create an account. Requesting non-essential information like birthdays and phone numbers can frustrate customers, leading to cart abandonment. Indeed, 26% of these abandonments happen because of registration demands. Additionally, even repeat customers may struggle to recall login details.

Lack of Trust

Given that online checkouts involve submitting sensitive information such as credit card details and home addresses, it's understandable that modern shoppers are concerned about their privacy. In fact, 25% of people abandon their online shopping carts because they do not trust the site with their card information.

Slow Delivery

Delivery is a significant pain point for today's consumers. Shoppers prefer online shopping with free delivery, and nearly a quarter (23%) will abandon their cart if there's a lengthy delay between order placement and delivery.

Complicated Checkout

A typical checkout process can contain around 12 elements, with common fields like your name, address, and birthday to help online retailers get to know their customers better. However, this quest for information might be driving customers away. A lengthy and complex checkout process accounts for 22% of shopping cart abandonments.

How to Reduce Shopping Cart Abandonment

Partner with a Reputable Payment Provider

Choosing the right payment provider is key to decreasing cart abandonment. A good provider will deliver a smooth, user-friendly payment interface that works flawlessly across all devices, including mobiles and tablets, where cart abandonment is typically higher. Ensure the payment process is simple and straightforward, avoiding complex navigation or lengthy data entry. Additionally, providing a range of payment options can meet various customer preferences, reducing shopping cart abandonment and improving satisfaction.

Accept a Wide Range of Payment Methods

The days of customers having to type lengthy card numbers into their browsers are a thing of the past. In fact, 13% of people have abandoned shopping carts because a retailer did not provide a wide range of payment options. Today, digital wallets, bank cards, account-to-account (A2A) and Buy Now Pay Later (BNLP) are some of the most popular payment methods worldwide.

Offer Free Delivery

Amazon has changed how we shop with its free and sometimes one-day delivery options. As a small business, competing with such offerings can be challenging. Slow delivery options lead to 24% of abandoned carts because Amazon's speedy shipping is a major draw for many shoppers. To stay competitive, consider offering free delivery prominently for better cart abandonment strategy. You could provide free shipping for orders exceeding a certain value or incorporate the average shipping cost into your product prices.

Highlight Returns Policy

Return policies are crucial not only after purchase but also during the checkout process. In fact, 18% of cart abandonments are due to unsatisfactory return policies. While online retailers often struggle with returns, hiding return options until after purchase isn't always wise. Shoppers appreciate knowing they can return items for a full refund if they don’t meet expectations. To reduce cart abandonment, highlight your return policy during checkout.

Reduce Cart Abandonment in E-Commerce via Emails

Cart recovery email campaigns are an effective method for reclaiming lost revenue. These campaigns track product details such as the items a customer added to their cart, along with specifics like size and color, and use this data to send email reminders encouraging customers to complete their purchases. Effective cart recovery emails often include a reminder of the abandoned items and additional incentives like free shipping to entice the customer to finalise their purchase.

How to Improve Cart Abandonment Rate with Open Banking

Prior to open banking, traditional banks held exclusive control over customer data. However, in 2018, the European PSD2 regulation required banks to share customer information with licensed third-party providers through application programming interfaces (APIs). The open banking framework is tightly regulated, ensuring data sharing occurs only with customer consent.

A key aspect of open banking is account-to-account payments, or “pay-by-bank.” Customers can authorise a transaction directly through their bank without manually inserting their payment details. This seamless user experience can help reduce cart abandonment.

The system directs users from the merchant’s platform to their trusted bank’s interface. Strong customer authentication (SCA) is a legal requirement under PSD2 and is part of the open banking payments flow.

Reduce Cart Abandonment with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine user experience, Noda is your partner in growth.

FAQs

How do I avoid shopping cart abandonment?

To avoid shopping cart abandonment, ensure your website provides a smooth and user-friendly payment interface across all devices. Offer a variety of payment options, including digital wallets and BNLP. Additionally, make sure delivery options are competitive, and return policies are clearly communicated during the checkout process.

What is a good abandoned cart recovery rate?

A good abandoned cart recovery rate is typically around 10% to 30%. This means that for every ten abandoned carts, one to three sales are recovered through targeted recovery strategies such as email campaigns and incentives.

What is the formula for the shopping cart abandonment rate?

The formula for the shopping cart abandonment rate is (Number of completed purchases / Number of shopping carts created) x 100. This abandoned cart percentage reflects the number of baskets left compared to those created.

How can an e-commerce business reduce the number of abandoned carts on its website?

An e-commerce business can reduce the number of abandoned carts by improving site speed, simplifying the checkout process, and removing unexpected costs like high shipping fees. Offering a range of payment options and highlighting a flexible returns policy during the checkout can also help.

What can cause a high cart abandonment rate for e-commerce businesses?

High cart abandonment rates can be caused by unexpected costs such as shipping, taxes, and duties, a complicated checkout process, the requirement to create an account, slow delivery, and a lack of trust in the website to handle payment information securely.

Why are people abandoning checkout?

People often abandon checkout because of unexpected costs, the requirement to create an account, concerns about payment security, slow delivery, and a complicated checkout process. Providing clear information and streamlining the payment process can help mitigate these issues.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each