The growing adoption of smartphones continues to fuel the momentum for digital wallets, or e-wallets. They are the dominant payment method worldwide, accounting for 49% of all transactions in 2022.

Meanwhile, the open banking technology is revolutionising finance as we know it. Open banking enables traditional banks to share data with licensed fintech companies, provided consumer consent. This results in more innovative and personalised products.

Yet, can digital wallets and open banking go hand in hand? Here, we take a deep dive into the two industry trends and explore how they can complement each other.

What Is a Digital Wallet And How Does It Work?

A digital or electronic wallet is an online application that stores different payment cards in a single interface. Users can pay via a digital wallet without manually retrieving their payment details. Mobile wallets are a sub-category of digital wallets that are native to smartphones and tablets.

Digital wallets can also store gift cards, loyalty cards, tickets, boarding passes, identification cards, and much more. During the COVID-19 pandemic, digital wallets were used to store vaccination certificates.

Other types of digital wallets include closed wallets often used by food and restaurant chains to offer loyalty programs. With closed wallets, customers can only pay for items issued by the merchant.

Using digital wallets is more secure than entering card details manually. The built-in security functions of a digital wallet include tokenisation. It encrypts the real financial data with a unique set of numbers called a token.

The tokens cannot be reverse-engineered or decoded to access the original data. Even if the token is intercepted or stolen, the data remains safe. Tokenisation helps protect against fraud in digital transactions, as it makes it much harder for hackers to gain access to the original card details.

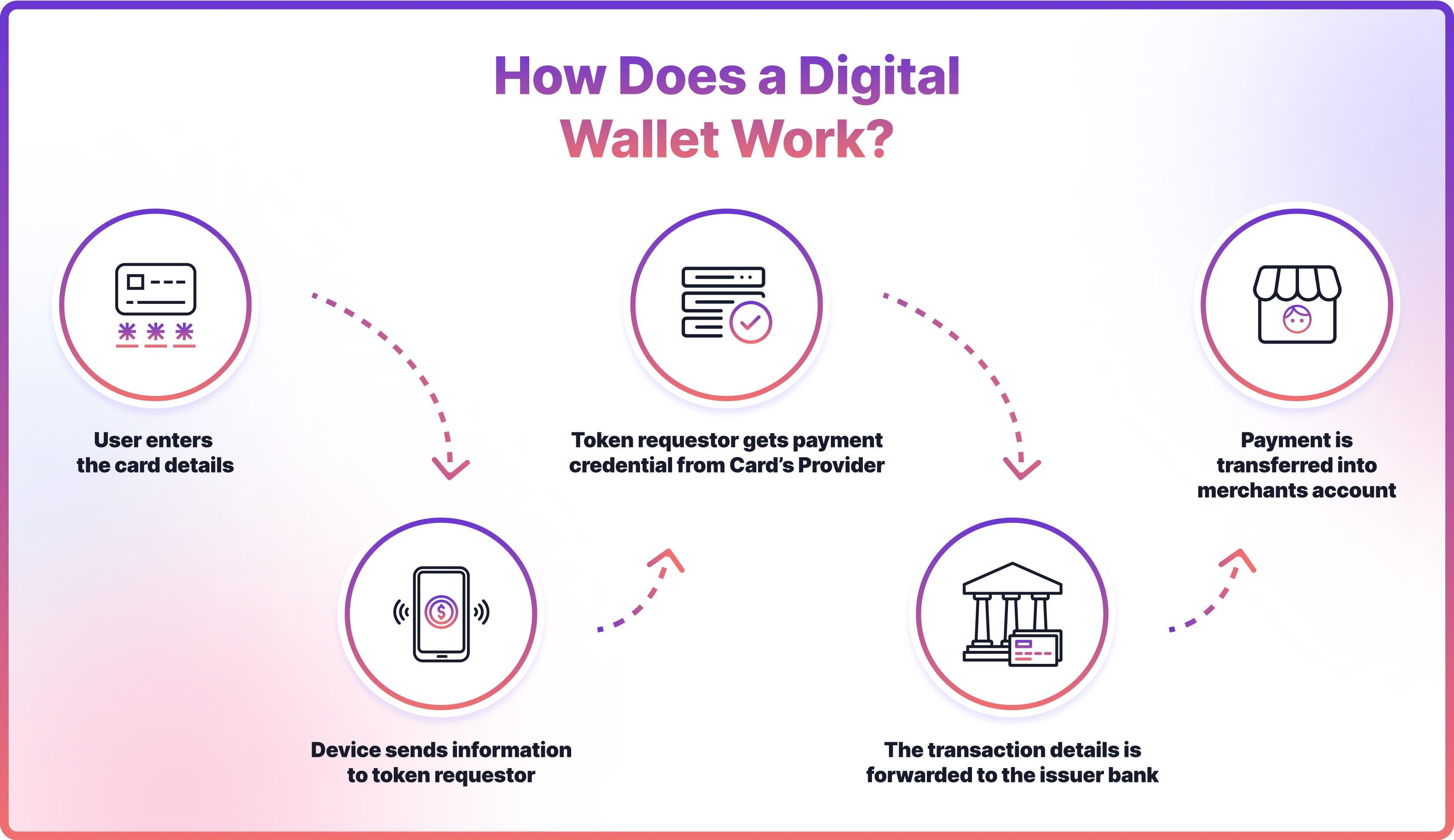

How to Pay with a Digital Wallet

There are multiple ways customers can pay using digital wallet technology, from contactless payments to in-app purchases. Let’s have a look at these scenarios in more detail.

Contactless Payments

Virtual wallets allow contactless payments - think of mobile wallets such as Apple Pay and Google Pay. They utilise Near Field Communication (NFC) technology, which allows two devices - a smartphone and a payment terminal - to communicate when brought nearby.

Magnetic Secure Transmission (MST) is an alternative tech for contactless payments. MST enables mobile devices to transmit tokenised card information to a payment terminal’s magnetic stripe card reader, just like a regular physical bank card. MST is used by Samsung phones.

QR Codes

Users can pay via quick response (QR) codes using their digital wallets. They would need to scan the merchant’s QR code displayed at the checkout, directing them to the payment page. From there, users must authorise the payment via a digital wallet.

Online Payments

Digital wallets are often used as a payment method on e-commerce websites. This applies to both mobile and web browsing and is a convenient option for users.

In-app Payments

Consumers can often buy goods or services directly inside a mobile application. Usually, apps offer the mobile wallet payment method to simplify user experience.

Benefits of Digital Wallets

- Intuitive UX: Digital wallet solutions provide a seamless user experience, enabling customers to pay with just a few taps.

- Convenience: Mobile wallets allow users to store multiple cards in one app, removing the need for physical cards.

- Security: Digital wallets use tokenisation, which means card details are encrypted.

Future of Digital Wallets

Digital wallet adoption accelerated in the aftermath of the global pandemic. Between 2015 and 2020, the usage increased almost five-fold, from 0.4 to 2.3 billion, according to Merchant Machine. Customers found mobile wallets more convenient in a social-distancing environment and health threats.

Digital wallets are especially popular in Asia, with China at the forefront.The most popular digital wallets there include Alipay and Tenpay established long before Apple Pay and Google Pay.

In future, the growth is likely to continue. A study by TMR expected the mobile wallet market to be valued at $16.2tn by 2031. A separate study by Juniper Research predicted digital wallet transactions to rise from $9tn in 2023 to over $16tn in 2028, a surge of 77%.

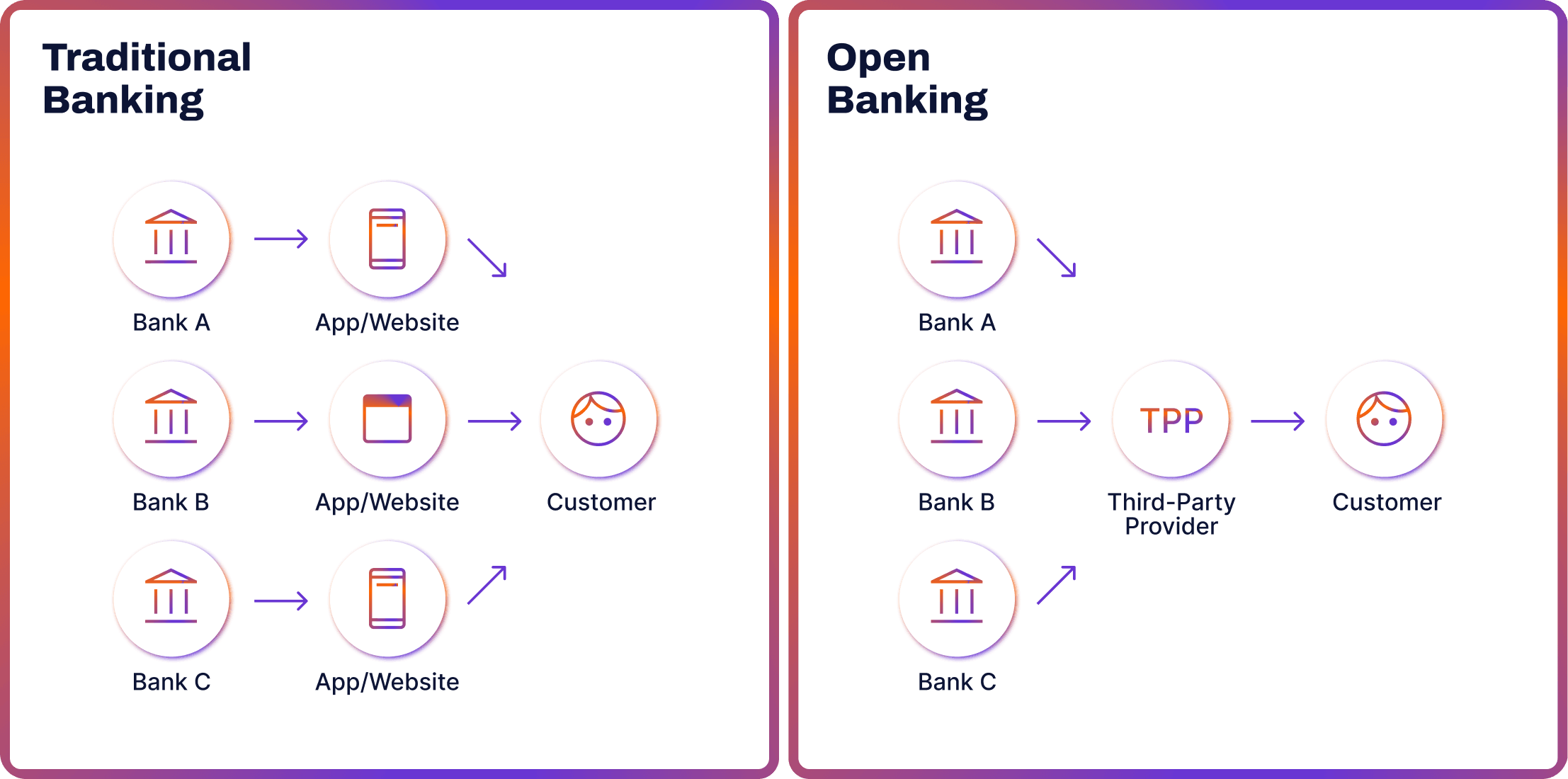

What is Open Banking?

Open banking allows data sharing between traditional banks and authorised fintech companies. Europe is often referred to as the cradle of open banking, as it was among the first regions to make it mandatory. The groundbreaking PSD2 regulation enforced in 2018 mandated European banks to start sharing data with licensed third-party providers (TPPs)

Open banking is powered by Application Programming Interfaces (APIs). They are sets of defined rules that enable entities to communicate with each other. They function as a software bridge within the open banking ecosystem, enabling banks to share data securely.

Banks open their APIs to licensed fintech (or TPPs), which results in a win for all. Customers grant their consent, and in turn, companies create personalised products and streamline payments and user experiences. Previously, banks held a monopoly over customer information.

Some of the key use cases of open banking include instant payments, financial management apps, credit checks and compliance.

Digital Wallets for Open Banking

Open banking can provide important features for digital wallets. For example, it can enable a seamless way of moving money or up-to-date account information.

Digital wallets need to be topped up regularly. Open banking offers a quick and secure way of transferring funds. Previously, these processes could involve delays and hidden fees. When the open banking functionality is integrated, users can top up their digital wallets in just a few clicks without extra costs.

The second example of open banking paired with the digital wallet services is the account information feature. Let’s take a look at the case study of Apple. In November 2023, the iPhone maker launched open banking API integration for Apple Pay in the UK.

Users can now access the latest account and transaction information on Apple’s mobile wallet without exiting the app. Previously, they could only do so via official banking apps. This feature can empower customers to stay up-to-date on their account balance, and therefore make more informed financial decisions.

Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

Are digital wallets safe?

Digital wallets are a secure payment method. Using them is safer than entering card details manually. Digital wallets utilise tokenisation, which encrypts the actual financial data into a unique set of numbers called a token. The tokens cannot be reverse-engineered or decoded to access the original data.

What else can a digital wallet be used for?

Digital wallets can also store gift cards, loyalty cards, tickets, boarding passes, identification cards, and much more. During the COVID-19 pandemic, digital wallets were used to store vaccination certificates. There are also closed digital wallets often used by food and restaurant chains to offer loyalty programs. With closed wallets, customers can only pay for items issued by the merchant.

How do I get a digital wallet?

To choose a digital wallet, first conduct thorough research. Determine which wallets are compatible with your devices. Then, follow the steps on the wallet’s official website.

Latest from Noda

Payment Methods in Spain 2026: A Guide for Online Merchants

6 Fintech Trends to Watch in 2026

Open Banking Benefits for UK E-commerce Merchants