Please note that the information about the companies in this article was sourced from their respective websites as of December 2025. This information may be subject to change.

Merchants know Plaid as a leader in open banking data, powering balance checks, identity verification, and connections to thousands of banks. But what if you also need payments? What options does Plaid really offer merchants, and where does it fall short?

This Plaid review looks at the provider’s features, pricing, coverage, and user feedback to answer that question. And for businesses that want more than data – reliable payments, transparent fees, and full coverage of cards, wallets, and open banking – we’ll introduce Noda as a stronger alternative.

Plaid Pros & Cons

| Pros | Cons |

| Connects to nearly 2,000 banks in Europe (90% coverage) and 10,000+ in North America | No card, wallet – only open banking and direct debits |

| Strong client base in fintech, SaaS, and financial apps | Offering is narrow for retail merchants |

| Core strengths in authentication, balance checks, identity verification, and transaction data | Opaque pricing – no public rate cards, “contact sales” required |

| Secure infrastructure: MFA, bank-grade encryption, PSD2 & FCA compliant | Reputation concerns: $58M lawsuit settlement over data practices |

| Poor support: no live chat/phone, long response times (24–72h) | |

| Mixed reviews: Trustpilot 1.3/5, G2 ~4/5 |

Plaid Overview

What Is Plaid?

Plaid is a payment provider founded in 2013 in San Francisco by Zach Perret and William Hockey. It began as a financial‑data aggregator for fintech companies, with early customers being the likes of Venmo, Coinbase, Robinhood. Plaid provided the rails to connect bank accounts for balance checks, identity verification, and transaction history.

Over time, Plaid expanded from the US to UK/EU markets, offering open banking data tools and payment solutions, as well added variable recurring payments (VRPs) in the UK. In 2020, Visa attempted to acquire Plaid for $5.3 billion, but the deal was blocked by US regulators.

Plaid Revenue & Valuation

Plaid still isn’t profitable, with losses at under $20 million in 2024. It’s bringing more money though – the company recently raised $575 million in funding, at Plaid’s valuation of $6.1 billion. Plaid’s revenue is expected to hit about $430 million in 2025.

Plaid Coverage: Supported Banks & Markets

Plaid’s doesn’t really reveal merchants from which countries can register with a Plaid account; but it does reveal the bank coverage by market.

North America

Plaid supports over 10,000 institutions across the US and Canada, which are their main market.

Europe

Plaid claims to have over 90% coverage, connecting to nearly 2,000 financial institutions. Here is the list of countries from its European bank explorer:

- Austria

- Belgium

- Denmark

- Estonia

- Finland

- France

- Germany

- Ireland

- Italy

- Latvia

- Lithuania

- Norway

- Poland

- Portugal

- Spain

- Sweden

- Netherlands

- United Kingdom

Plaid’s Key Industries & Clients

Plaid’s key clients are fintechs, SaaS companies, igaming and financial apps. It supports use cases like account aggregation, lending, budgeting, and wealth management. For retail merchants, Plaid’s offering is narrower, focused mainly on enabling open banking data insights (such as transaction data), and VRPs.

Plaid Payments & Data Features

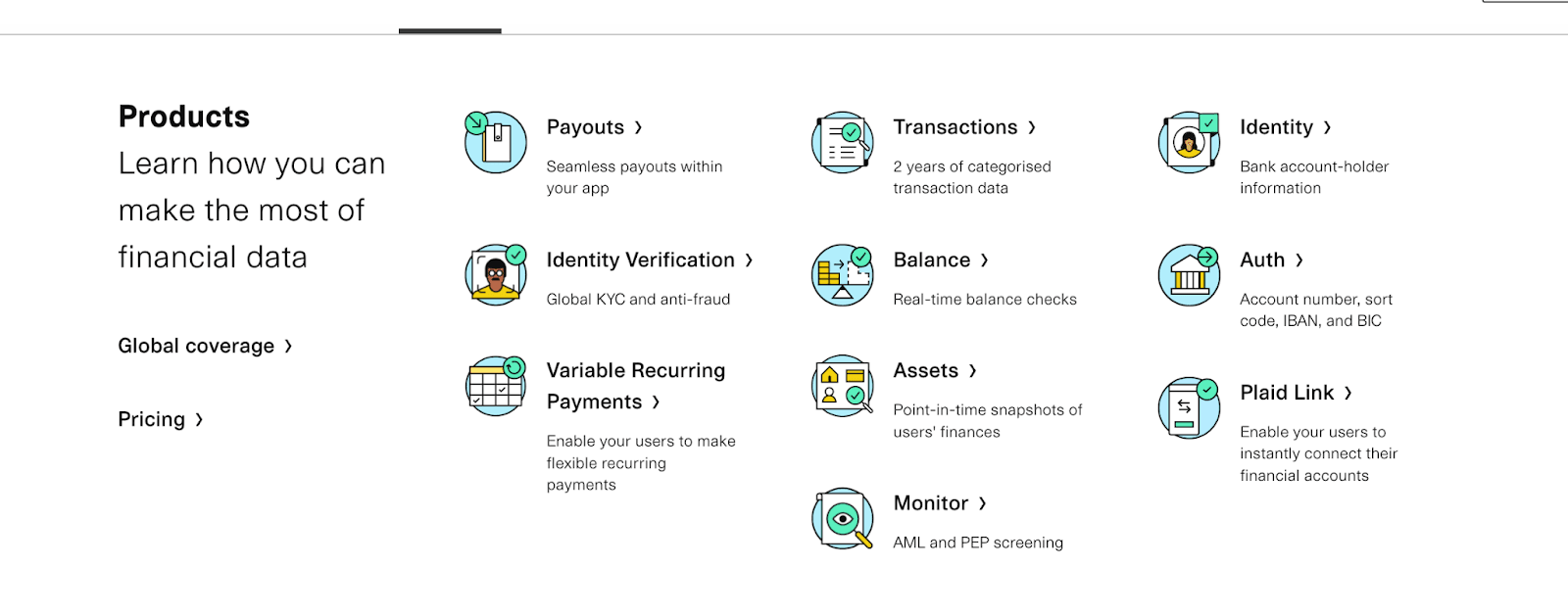

Plaid offers a wide range of products, and as you can see below, their core offering focuses on open banking data, rather than payments. However, payments and VRPs are supported too.

| Authentication | Verified accounts and routing numbers, including direct debit payments and payouts |

| Balance | Real-time balance checks |

| Payments | Open banking payments |

| Variable recurring payments (VRPs) | Recurring payments based on open banking (only in the UK) |

| Identity verification | Global KYC and anti-fraud |

| Identity authentication | Bank-account holder authentication |

| Transaction data | Up to 24 months of categorised open banking transaction data |

| Assets | Point-in-time snapshot of user’s finances |

| Link (onboarding) | Bank connections to enable users connect their financial accounts |

| Plaid integration | Flexible options: API, Plaid link |

| Payouts | Running on UK Faster Payments rails

|

Plaid Payment Methods

- Direct debits and payouts (US only): Plaid enables US businesses to pull funds straight from a customer’s bank account or send money back outhandy for subscriptions, bills, or issuing refunds.

- One-off open banking payments (UK, EU): These are single bank-to-bank payments initiated by the customer. Merchants usually receive them instantly or within one business day.

- Variable recurring payments (UK only): Think of these as direct debits with more flexibility. Merchants can collect different amounts at different times, as long as the customer has given consent. VRPs are built on open banking.

What Plaid Doesn’t Offer

Plaid won’t integrate card payments (credit or debit), digital wallets like Apple Pay or Google Pay. Its strength lies in verifying bank details, authenticating accounts, and initiating payments.

Why Merchants Switch to Noda

Plaid built its name on bank connectivity. But for e-commerce merchants, its gaps are hard to ignore: opaque pricing, limited payment options, patchy support, and a past that raises trust concerns.

Noda is built to solve those problems.

We bring all the main payment methods together in one place: open banking, cards with AI-powered smart routing, and digital wallets like Apple Pay and Google Pay. No need for multiple providers. Open banking payments in particular are far more cost-efficient, starting from just 0.1% per transaction with no card-processing fees.

Our coverage is wide too: more than 2,000 banks across 28 countries in the EU and UK. Integration is flexible: use a full API, ecommerce plugins like WooCommerce, Magento, OpenCart, PrestaShop, or no-code tools like pay-by-link, checkout pages, or QR codes.

What merchants value most about Noda:

- Cost-efficient payments: starting from 0.1% for open banking transactions

- 2,000 banks across 28 countries in the EU and UK. Explore bank coverage.

- Flexible integration options: plugins, payment links, API

- Instant payouts to keep cash flow healthy

- Dedicated account manager for onboarding, integration, and ongoing support

- 90-day free trial for SMBs

- Multilingual checkout (English, German, Dutch, Spanish, French, Bulgarian, Portuguese, Romanian)

- Smart extras like data enrichment and bank-based sign-in

With Noda, you’re getting a complete, transparent, and merchant-first solution.

Plaid Security & Compliance

Security is at the heart of Plaid’s pitch. The platform leans on multi-factor authentication, bank-grade encryption, and secure APIs to protect data. In Europe, it’s fully PSD2-compliant and authorised by the UK’s FCA.

But Plaid’s track record isn’t spotless. In 2021, the provider paid $58 million to settle a US class-action lawsuit over claims it collected more data than necessary and mimicked bank login screens without clear disclosure. As part of the deal, Plaid committed to greater transparency, tighter data limits, and a consumer data portal.

For merchants, the lawsuit doesn’t change payment flows directly, but it does add a reputational wrinkle. With customers increasingly alert to privacy issues, Plaid’s past may colour how much they trust the brand.

Plaid’s Pricing & Fees

Plaid keeps its pricing close to the chest. There are no public rate cards, everything is negotiated case by case. Plaid fees would typically hinge on factors like:

- How many API calls you make

- Which products you use (payments, identity, data services)

- Transaction volumes

- Where you’re operating

Fintech forums on Reddit say that API calls can run anywhere from $0.25 to $1 each, depending on usage. Payments pricing is even less clear, with most merchants told to “contact sales.”

For businesses, Plaid’s closed-door pricing can be a headache. Without clear benchmarks, it’s tough to budget confidently or weigh Plaid against competitors.

Plaid Customer Reviews & Feedback

Plaid’s reputation is a mixed bag. On Trustpilot, it scores 1.3 out of 5, with mostly negative reviews. Over on G2, it does much better, averaging about 4 out of 5, though there are still some complaints.

- What users like: Plaid makes it easy to connect with thousands of banks, integrates quickly, and is generally seen as secure and reliable.

- What frustrates users: Connectivity hiccups and failed transactions are common gripes. Many struggle with slow or unhelpful support, often finding it hard to reach a real person. Error messages, failed transfers, and ongoing concerns about data privacy also come up a lot.

- Plaid support experience: Plaid doesn’t offer public live chat or phone lines. Most support requests go through email or an online form, with responses typically taking 24 to 72 hours.

FAQs

Is Plaid safe?

Yes. Plaid uses bank-grade encryption, multi-factor authentication, and is FCA compliant in the UK, in Europe they’re regulated by Nederlandsche Bank (DNB). But note, it has faced past scrutiny over data practices.

How does Plaid work?

Plaid connects apps and merchants to customer bank accounts. It verifies identity, checks balances, and can initiate payments (like variable recurring payments) through secure APIs.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each