Open banking has transformed the financial industry forever. This innovative framework required traditional banks to share data with third-party providers, ending banks’ monopoly over customer information. Introduced in Europe by PSD2, open banking has fuelled innovation in payments, lending, budgeting, and many more areas.

Yet many questions remain about, for example, what type of data can be accessed through open banking, who can access it, and what are the use cases of open banking for businesses. In this article, we aim to give you the answers.

What Is Open Banking Data?

As the name suggests, open banking data is the customer information that banks share with licensed third-party providers. The data sharing only happens with the customer’s consent, which they can withdraw anytime.

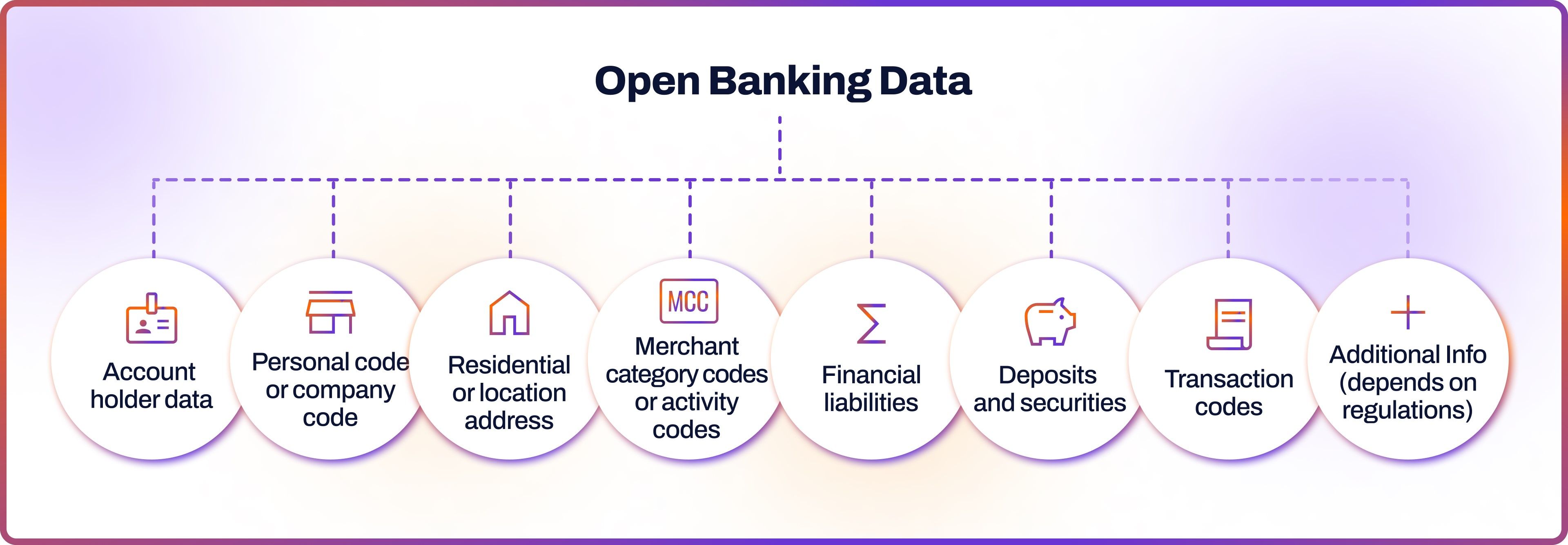

What Data Can Be Shared through Open Banking?

The types of information collected through open banking would vary depending on the jurisdiction.

For example, in Europe, it is governed by the Second Payment Services Directive (PSD2), which is soon to be updated to PSD3. Its UK equivalents are Payment Services Regulations (PSR) and Open Banking Limited.

In Australia, data sharing is regulated by the Consumer Data Right (CDR) and the New Payments Platform (NPP) initiative.

Meanwhile, in the United States, open banking is being shaped by the Consumer Financial Protection Bureau (CFPB), which is currently developing regulations to address data rights.

Regulators usually set strict open banking data standards about the types of information that can be collected. These rules aim to limit data collection so that third-party companies only access the data needed to provide their specific financial service.

The most common open banking data points include account holder data such as name and surname; personal code or company code; residential or location address; merchant category or activity codes; financial liabilities; deposits and securities; transaction data.

Sometimes additional information, like employment status or place of employment, might be collected. However, this always depends on regulations.

Open Banking Data Sharing Explained

From a technical standpoint, banks share data via application programming interfaces (API), which are sets of definitions and protocols that allow different software systems to communicate to each other.

Sharing data through APIs is considered much more secure than using screen scraping. It’s a data-sharing method used by some companies before, where a computer program extracts data from human-readable output from another program. Screen scrapping is vulnerable to data leaks and hacker attacks.

The process of sharing open banking data APIs, on the other hand, is monitored and supervised according to current government regulations, like the European PSD2 and Open Banking Limited in the UK. Regulators establish data-sharing standards, including security requirements. For example, in Europe, strong customer authentication (SCA) is a legal requirement for open banking payments.

Moreover, the regulators set up API specifications to ensure these are universal across the banks. For instance, the UK’s Open Banking Limited provides specifications for Read/Write APIs, Open Data API, Dynamic Client Registration, and more.

Who Has Access to Open Banking Data?

As mentioned above, only licensed third-party providers can access open banking data. These are usually fintech companies that want to use this data to innovate or create new tools.

To gain a license, companies must meet specific criteria and apply via local regulators such as FCA in the UK, BaFin in Germany, ACPR in France, and other relevant authorities of the country in question to make sure that providers comply with the rules and handle data correctly. Regulators can also revoke accreditations.

In European PSD2, there are two licenses providers can gain to access the data - Payment Initiation Service Provider (PISP) and Account Information Service Provider (AISP).

PISPs can access read-only open banking data and authorise payments on behalf of consumers. PISP services are often used by fintech companies to automate savings and investing transactions. Plus, merchants often use PISP providers, like Noda, to simplify payments.

Meanwhile, AISPs are permitted to view read-only open banking data, but cannot initiate payments. For example, credit agencies often use AISP services to access a customer's credit history. Another example is budgeting tools that let users view all their accounts in one app.

Open Banking Consent

Yet data sharing wouldn’t happen without customer consent. Customers can withdraw consent anytime. In this case, they would need to contact either their bank or the third-party provider.

Contrary to a common perception, managing consent isn't as straightforward as just ticking a box. The consent process must comply with regulations such as PSD2 and GDPR.

Typically, the banking consent flow starts with the third-party provider asking the client for permission to access their data. Then, if the client agrees, they complete the authentication process. From there, both parties receive data transfer confirmation.

Open Banking Data Use Cases for Businesses

Open banking data sharing enables a range of valuable tools and features. With client consent, everyone benefits. Businesses gain more data to work with, while customers enjoy more innovative and personalised products. Here are some of the applications of open banking data.

Personalisation

Open banking has the potential to improve user experience significantly. By sharing data, businesses can analyse customer behavior and spending habits. This offers applications across various industries, from gaming to e-commerce. For instance, with open banking data, a budgeting or investing app can provide tailored insights to its users.

Verification

Another use case for open banking AISP functionality is simplifying verification of income and wealth, as well as affordability checks and risk assessments for areas like renting, lending and insurance. Traditionally, their teams would analyse an individual's credit history and income through lengthy manual processes. Open banking aggregates financial data, providing them with necessary information in minutes.

Compliance

Open banking data can also streamline compliance, fraud prevention, and Know Your Customer (KYC) processes. By providing a comprehensive view of a client's transaction history it simplifies identity verification, verification of the sources of wealth sources, risk evaluation, and more. Open banking data is also fully digital, which means no paper documents are needed.

Financial Management

Managing finances, too, becomes much easier with open banking data for both individuals and companies. AISPs gather information from multiple bank accounts and institutions, putting everything in one place. This feature is perfect for budgeting and accounting tools, allowing users to view all their transactions in a single interface.

Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants