E-gaming is a dynamic and rapidly evolving field, continually influenced by technological advancements. The industry is diverse, hosting a variety of companies, from game developers and gaming platforms to esports.

Open banking can improve the efficiency and security of financial transactions in the e-gaming world. Here, we take a look at how open banking can transform the gaming experience, exploring important use cases and real-life examples.

What is Open Banking?

Previously, traditional banks held a monopoly over customers’ data. Open banking emerged to change this. In the open banking ecosystem, licensed fintech companies are authorised to access read-only data with customer consent. In return, they create innovative, personalised products and user experiences.

Open banking was legally mandated in Europe in 2018, with the enforcement of the PSD2 regulation. The data exchange is run on application programming interfaces (APIs), which act as a software bridge, allowing banks to pass on the data securely. The use cases for open banking are versatile and span across industries, from finances and e-commerce to travel and gaming.

Open Banking for Gaming: Use Cases

There are various ways how the gaming providers can leverage open banking. From instant pay-ins and pay-outs to personalised journeys and improved compliance processes, open banking offers innovative and versatile features for the e-gaming industry.

Instant Payment Processing

Open banking can simplify payment processing in the gaming industry, offering a quick and secure way for gamers to top up their accounts and withdraw money.

A fintech can acquire a Payment Initiation Service Provider (PISP) license under PSD2 to access customer data. PISPs can perform payments for gamers without the need to enter card details. Open banking also facilitates A2A payments, which results in a simplified user experience.

Personalisation

Open banking can enhance the players’ experience, making it more personal to individual players. The data sharing allows the analysis of a gamer’s behaviour and spending habits.

This valuable information can be used to tailor experiences more closely to individual preferences. Personalisation can help gaming providers to engage and retain loyal players, as well as attract new clients.

Improved AML & KYC

Open banking makes it easier to prevent fraud and comply with anti-money laundering (AML) rules in the gaming industry. It helps in the Know Your Customer (KYC) process by ensuring individuals are not involved in illegal activities.

Open banking provides fast access to a client's full transaction history, showing details like payee names and transaction locations. This simplifies collecting user data, verifying sources of wealth, providing insights into transactions, and evaluating risks. Also, open banking reduces the need for less secure paper documents, favouring safer digital records.

Case Study: Noda & Wargaming

More and more gaming companies are using open banking to their benefit. In February 2023, Wargaming, an award-winning online game publisher, teamed up with Noda to introduce instant open banking payments in gaming. This partnership allowed Wargaming's players to access diverse online payment options, including account-to-account (A2A) transactions.

“We are more than excited to partner with Wargaming, a company that, for sure, has already left a huge legacy in the gaming industry with its iconic games – World of Tanks and World of Warships,” said Igor Loktev, Head of Noda.

“We believe that Noda’s payment solution will benefit the gamers’ time, leaving more time to actually enjoy the gaming experience rather than spending it on completing the payments,” he added.

Benefits of Open Banking for Gaming Industry

- Streamlined Payments: Open banking facilitates direct bank-to-bank transfers. This makes the payment process faster and more efficient.

- Enhanced Security: Open banking employs rigorous security protocols. These include strong customer authentication, reducing the risk of fraud and enhancing the safety of online transactions.

- Personalised Gaming Experience: By accessing players' financial data, gaming companies can offer tailored suggestions and promotions. This personalisation is based on spending patterns and preferences, enhancing player engagement and satisfaction.

- Efficient Anti-Fraud Measures: Real-time financial data monitoring through open banking helps to detect and prevent fraudulent activities quickly. This proactive approach is vital in an industry vulnerable to online fraud.

- Simplified Compliance: Open banking simplifies compliance with regulatory requirements like KYC and AML. It provides easy access to necessary financial information, streamlining verification processes.

- Reduced Costs: Open banking often involves lower transaction fees than traditional payment methods. This cost-effectiveness can be a significant advantage for both gaming companies and players, making transactions more economical.

Future of Open Banking & Gaming

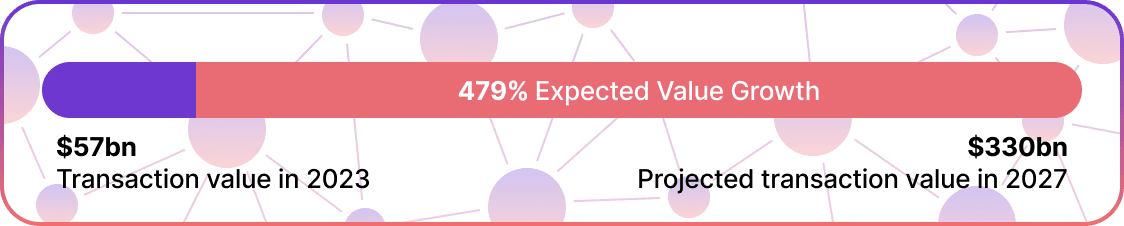

Consumer adoption of open banking is expected to surge in the next decade. According to Juniper Research, the total value of open banking transactions will increase from $57bn in 2023 to $330bn by 2027 —a staggering growth rate of 479%. The gaming market, too is posed for rapid growth.

Meanwhile, Mordor Intelligence predicted the total market value to surge from $272.86bn in 2024 to $426.02bn in 2029. Gaming operators should seek efficient payment systems to tap into this potential. Players' preferred payment methods are diverse, and it’s essential to offer a variety of payment options to accommodate players' varied preferences.

Regulation will remain key in shaping how open banking will change the gaming industry. In Europe, PSD2 was essential for the adoption of open banking. In 2024, the new regulation PSD3 will be completed, suggesting higher API quality and stronger security features.

Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

How can open banking be used in gaming?

Open banking can facilitate instant, secure payment processing, allowing gamers to easily top up their accounts without entering card details. It also enables the personalisation of gaming experiences by analysing players' financial data to understand their preferences and spending habits.

How can open banking transform the gaming industry?

Open banking can transform the gaming industry by streamlining financial transactions, enhancing payment security, and providing personalised experiences to players. It simplifies compliance processes like AML and KYC while reducing transaction costs.

What are real-life examples of open banking in the gaming industry?

A real-life example of open banking in the gaming industry is the partnership between Wargaming, an online game developer, and Noda, in February 2023. This collaboration allowed Wargaming's players to access various online payment options, including A2A transactions.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants