E-commerce has grown rapidly over the past ten years and is set to continue growing even more. Forbers Advisor reports that in 2023, 20.8% of worldwide retail sales were online, totalling $6.3 trillion. This is projected to rise to $8.1 trillion by 2026, with online sales making up 24% of retail purchases.

Yet, e-commerce payment experiences often fall short of being smooth. Integrating open banking to help process payments can simplify user experience (UX), boost conversions, and reduce costs for e-commerce merchants.

What Are Open Banking Payments?

Since 2018, the EU's PSD2 regulation has required banks to share customer data with licensed fintech firms via application programming interfaces (APIs). This secure way of sharing information has fuelled direct account-to-account (A2A) payments, also known as "Pay-by-Bank”, or open banking payments.

A2A as a payment method brings several advantages to e-commerce businesses, including quick fund transfers and a smooth UX. Customers can avoid entering payment details manually because the flow directs them from the payment site to their banking app and back through app-to-app redirection.

This enhances the shopping experience, decreases cart abandonment, and allows merchants to access funds quickly. According to Statista, in 2022, A2A accounted for 9% of global e-commerce payment transactions.

How A2A Payments Work

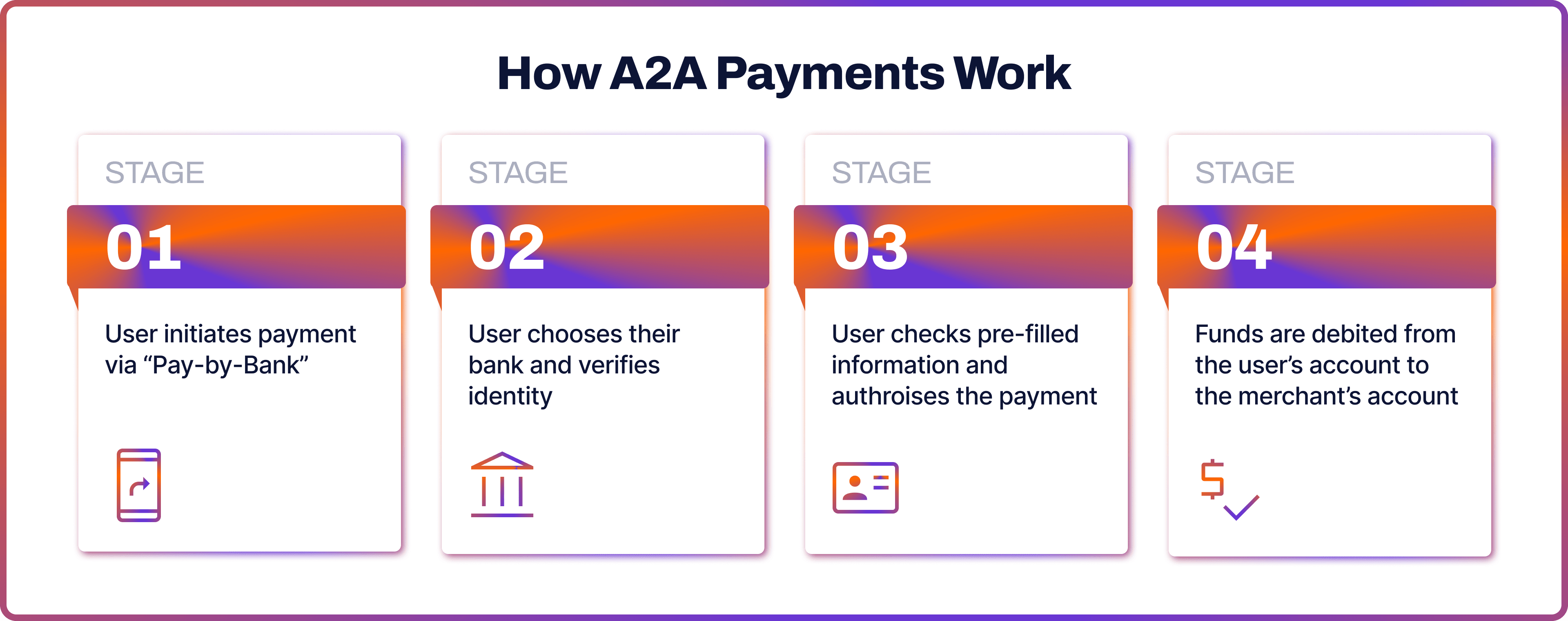

The flow for open banking A2A payments looks something like this:

- The user initiated the payment and chooses the “Pay-by-Bank” option

- The user chooses their bank and logs in using the bank’s verification

- The user checks the pre-filled information and authorises the payment

- The funds are debited from the user’s bank account and credited to the merchant’s account.

Benefits of Open Banking Integration for E-commerce

- Security: The authentication occurs directly with the bank, meaning merchants don't deal with sensitive data at checkout, reducing their concern about fraud liability at the payment stage.

- Speed: In the UK and EU, open banking payments are processed instantly, allowing merchants to access funds right away, which can help their cash flow management.

- Cost-efficient: A2A transaction fees are usually lower than in traditional banking, which saves funds for merchants to invest in other areas.

- Higher Conversions: A2A payments lead to more revenue as shoppers authorise payments easily and smoothly without manually entering card details.

How to Integrate Open Banking Payments into E-Commerce

There are several ways to implement an open banking payments integration into an e-commerce business. Let’s examine them closely.

Integration with an Open Banking Provider

The most common method of integrating open banking services is through application programming interfaces (API). This could be direct or through a payment service provider (PSP) such as Noda, which might already support your current payment methods. There are several types of A2A integration:

- Direct Open Banking API integration offers a customisable payment journey but demands more time and technical knowledge for implementation.

- Integration tools such as hosted payment pages (HPPs) or software development kits (SDKs) provide a smoother, easier integration experience for developers, though they offer slightly less customisation.

The integration type you need would depend on the desired payment flow on your e-commerce website and the developer resources you have at your disposal. Integrating may appear challenging at first, but a reliable provider will help you navigate this process and advise on the best integration type to achieve your goals.

A provider usually assigns an integration specialist to assist with your setup. An established provider will have carried out hundreds of integrations, learning what works well and what doesn’t for different use cases, industries and business models.

Make sure to discuss the following questions with your provider:

- Integration Template & Timeline: A reliable provider would guide you through the integration process and help create and follow an implementation timeline.

- Objectives: A key goal for any new payment process is to increase conversion rates, which is the ratio of customers who finish a payment journey they begin. Your integration team should provide guidance on designing a payment flow that boosts conversion.

- UX/UI Recommendations: Your provider, having collaborated with a variety of e-commerce companies, can offer advice on UX and UI tailored to your specific use case and goals.

The integration process requires efforts from both your e-commerce payment system provider and your business. Delays on your end, such as limited developer resources or other priorities, will extend the timeline. However, with a well-managed direct integration where both parties are committed and have clear agreements on deliverables, it should take about six weeks to move from start to launch.

Integrating Yourself

Self-serve options are available, too, where businesses are granted access to raw open banking data. Yet for many e-commerce companies, without expert guidance, navigating this data and integrating it into existing systems can become a complex and daunting task.

The problem that can arise is when banks don't use a standard API, making integration tough. Partnering with an e-commerce payment solution that combines multiple open banking services can solve this. They can take charge of ensuring a smooth integration and tackle any issues that arise.

Future of Open Banking Payments

The rapid adoption of open banking payments in e-commerce is expected to accelerate further. Statista predicts A2A payments to reach 10% of all e-commerce transactions by 2026. They are already the fourth most popular payment method globally after digital wallets, credit cards and debit cards, respectively.

Currently, Europe is the leader in A2A payments adoption, according to Statista’s March 2023 assessment. Yet, its geography may expand in the future. McKinsey predicts that in North America, A2A payments could handle about $200 billion in consumer-to-business transactions by 2026 and potentially much more in other types of payments.

Open Banking Payments with Noda

Elevate your e-commerce business with Noda’s payment and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide open banking and payment gateway provider for seamless business transactions. From A2A payment facilitation to financial analytics, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What are the main advantages of open banking for e-commerce businesses?

They include instant fund transfers, simplified UX with app-to-app redirection, avoiding manual entry of payment details, lower transaction costs, and higher conversion rates as payments are authorised quickly and easily.

How do I start e-commerce integration with Noda’s open banking payments?

First, you should be onboarded with Noda. Simply fill out the form, and our sales team will contact you shortly. We offer easy onboarding with the personalised guidance of a dedicated manager. Our processor smoothly integrates with API and front-end components, ensuring seamless merging into your e-commerce platform.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each