Open banking is an innovative framework in finance that’s gaining momentum worldwide. It is reshaping the financial landscape by enabling secure data sharing between banks and authorised third-party providers, with the customer’s clear consent. It lets fintech firms and other financial service providers initiate payments and allows them access information that was previously confined to traditional banking systems. This change has opened the door to a wave of innovation, resulting in more personalised, responsive and user-friendly products and services.

Initially driven by regulatory changes such as PSD2 in Europe, open banking has grown into a global movement. It is transforming not only the way consumers manage their finances, but also how businesses handle payments, lending, compliance and more. By widening access to financial data, open banking encourages competition, supports new market entrants and gives customers greater control over their financial lives.

Its increasing uptake across the world highlights its real value. From making online payments quicker and easier to streamlining credit checks and helping people gain a clearer picture of their finances, open banking is proving effective across many sectors. In this article, we explore some of the most practical and relevant use cases, from personal finance apps and digital wallets to income verification tools and enhanced checkout experiences.

What is Open Banking?

The idea of data sharing first appeared in Europe, which is often named the cradle of open banking. The groundbreaking PSD2 regulation mandated European banks to open their Application Programming Interfaces (APIs) to licensed fintech firms, legally named third-party providers (TPPs). The directive was enforced in 2018.

Open Banking APIs are sets of defined rules that enable entities to communicate with each other. They function as a software bridge within the open banking ecosystem, enabling banks to share data securely.

The result of open banking is a win-win. Customers grant their consent, and in turn, fintech companies create personalised products and streamline user experiences. Previously, banks held a monopoly over customer information.

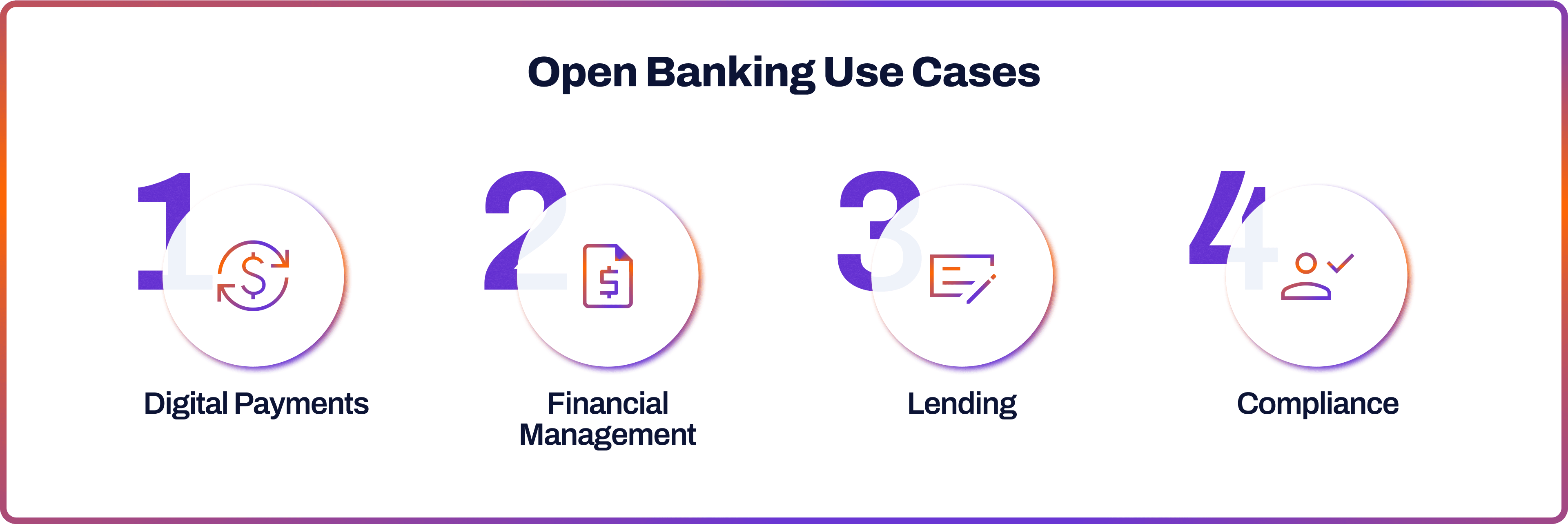

Open Banking Use Cases

The popularity of open banking is gaining momentum. In 2025, the adoption in the UK reached a record high, with 1 in 5 British consumers being active users and almost 20% of small businesses, according to the latest Open Banking Impact Report.

The open banking use cases are versatile and span across the business landscape. Both companies and consumers value its benefits, and there is a lot that can be done with open banking.

Digital Payments

One of the best open banking examples at work is digital payments. One type of license a fintech may obtain is to become a Payment Initiation Service Provider (PISP). PISPs are able to access read-only financial data and initiate payments on their behalf.

This enables simplified payments and user experience as consumers no longer need to type in their card details at e-commerce website checkouts. PISP providers, like Noda, are popular among merchants who want to streamline online payments.

A leading open banking example in practice is digital payments through Payment Initiation Service Providers (PISPs). This results in a faster, more secure and seamless checkout experience.

Online retailers in particular benefit from providers such as Noda, which offers affordable and real-time payments. By avoiding traditional card networks, Noda helps reduce transaction costs and ensures quicker settlement of funds through instantly sending the money directly from the customer’s account to the merchant’s bank account, in contrast to card payments which usually take 1-3 days to process. This allows businesses to improve their cash flow, increase conversion rates and retain more of their revenue.

Financial Management

The payment initiation may also be valuable for automating investments and savings. Instead of manually paying into an account every month, a user can authorise their provider to initiate payments on their behalf, helping in financial management.

Open banking enables automation in investing and saving by allowing users to authorise providers to initiate regular payments on their behalf. A fintech may hold an Account Information Service Provider (AISP) licence, meaning it can access users’ financial data without initiating payments. This feature is ideal for budgeting tools and financial reconciliation for both individuals and businesses.

For example, the UK app Emma connects bank, credit card, investment and even crypto accounts in one place, helping users track spending, identify and cancel unwanted subscriptions, set budgets, and receive tailored insights, potentially saving up to £600 a year. Tools like that streamline financial management by offering real-time visibility and actionable recommendations that make money management easier and more effective.

Lending

Another open banking use case related to the AISP functionality is simplifying lending. In order to give a loan, lenders need to undergo a lengthy process of analysing a borrower’s credit history and income. Yet open banking is posed to change this.

As open banking providers can aggregate financial data, they can instantly provide all the necessary information to lenders in just a few minutes. Open banking can streamline credit history checks, affordability and income verification in all types of lending. This results in more efficient operations for businesses and higher approval rates for consumers.

Compliance

Open banking can streamline compliance, fraud prevention and KYC processes. Know Your Customer (KYC) is a set of measures to ensure one doesn’t work with businesses or individuals involved in illegal activity.

With just a few clicks, open banking can provide a comprehensive view of a client's transaction history, including details about their payees and locations. This can simplify retrieving user information, validating sources of wealth, providing transactional data, and evaluating risk profiles.

Plus, open banking eradicates the need for paper documents, which are more vulnerable than their digital equivalents.

Sustainable Finance and Carbon Tracking

One of the more forward-thinking financial API use cases is carbon tracking. Some fintech companies like MoneyHub now use open banking data to calculate the carbon footprint of user spending. By categorising transactions, they can estimate the environmental impact of purchases and suggest greener alternatives.

For example, a banking app might tell a user how much CO₂ was generated by a recent flight or shopping spree and offer options like carbon offsetting or eco-friendly merchants. This use of open banking supports sustainability goals and creates a new layer of personal financial insight.

Seamless Onboarding for Financial Services

Traditional onboarding processes for financial services can involve lengthy paperwork, manual ID checks and document uploads. Open banking allows companies to automatically pull verified account information during sign-up, making onboarding quicker and more secure.

For example, a fintech app offering savings accounts could use open banking to validate a user’s name, sort code and account number instantly, without requiring them to manually input their details. This lowers friction, reduces fraud risk and improves user conversion rates.

Multi-banking and Subscription Management

Open banking enables consumers and businesses to manage multiple bank accounts within a single interface, offering greater visibility and control over finances. This is particularly beneficial for subscription-based services, where timely payments and customer retention are essential.

By accessing real-time banking data, businesses can detect issues such as failed direct debits or insufficient funds before they become a problem. This allows them to notify customers in advance and offer alternatives, such as switching payment accounts or rescheduling charges, thereby reducing involuntary cancellations and lost revenue.

For instance, a video streaming platform or fitness app could use open banking to monitor subscription payments and prompt customers to update their payment method or top up their account when necessary. Businesses can also offer flexible billing aligned with a customer’s salary cycle, improving customer experience and increasing retention.

At the same time, users benefit from multi-banking tools that allow them to track recurring charges across all accounts, identify unnecessary subscriptions, and manage spending more effectively, all from one dashboard.

Income Verification for Gig Workers

One of the more interesting and practical use cases for open banking is income verification. For freelancers, gig workers and those with multiple income sources, proving income for renting a flat or applying for a loan can be a challenge. According to the UK landlord website, Vouch, open banking makes income verification faster and more accurate by aggregating transaction data across various platforms and bank accounts.

A property rental platform could integrate open banking into its onboarding process, allowing applicants to instantly verify their income with a few clicks, instead of submitting months of payslips or PDFs. This simplifies the process for tenants and increases trust for landlords or agents.

Personalised Financial Products

Financial institutions and fintechs are using open banking data to design better, more tailored products. By analysing spending patterns, income streams and savings behaviours, companies can offer personalised credit lines, insurance premiums or savings plans that adapt to a customer’s real financial behaviour.

For instance, a digital insurance provider might use open banking data to offer a flexible car insurance policy that charges customers based on actual usage and monthly affordability, rather than flat rates. Likewise, a bank might offer short-term credit facilities aligned with the user’s cash flow cycle, reducing default risk while improving customer satisfaction.

Which Industries Benefit from Open Banking?

- Financial Technology: Open banking allows fintech companies to access vast amounts of data and develop more innovative products.

- Financial Services: The industry, especially financial management tools, benefits from data sharing and improved customer insights. With open banking, they can provide more tailored advice.

- E-commerce: Digital merchants can enjoy simplified payment processes powered by open banking. They can offer their clients a better user experience.

- Mortgage Lending: Lenders can have immediate access to a borrower’s financial information, increasing the speed of mortgage approval, and reducing paperwork and labour needed.

- Business Lending: With open banking, lenders can access a company’s creditworthiness with less time and effort.

- Consumer Lending: Again, in consumer lending, open banking provides a more accurate and rapid assessment of loan applications.

- Accounting and Bookkeeping: Open banking enables automatic reconciliation and invoice matching by connecting directly to bank accounts. This saves time, reduces errors and enhances cash-flow management for SMEs and accountants..

- Travel and Hospitality: Travel platforms can use open banking to offer direct bank payments at checkout, lowering transaction fees and reducing payment failures for high-value bookings.

- Identity Verification and Fraud Prevention: Providers can confirm customer identities and detect fraudulent behaviour in real time by accessing bank account data. This speeds up onboarding and reduces risk in sectors such as fintech, e‑commerce and regulated markets.

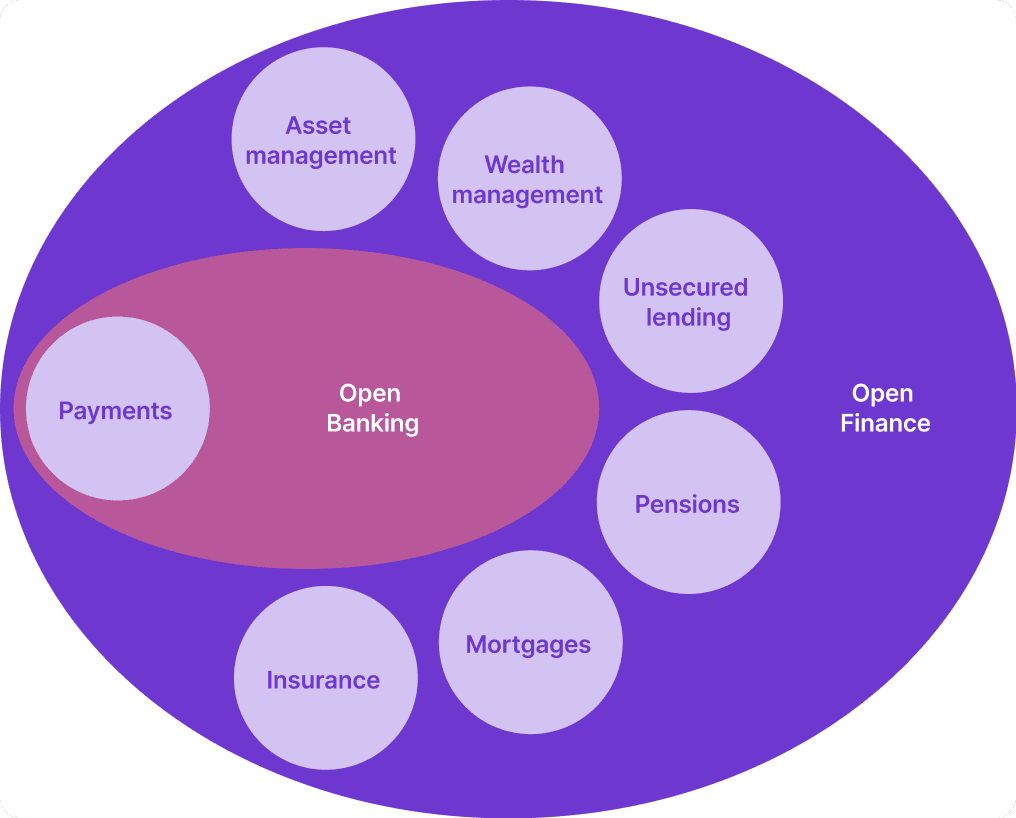

Open Finance: Use Cases

Open finance is an expansion of open banking into other sectors of finance: investments, pensions, insurance, and more. It is governed by the same principles of secure sharing of data and mandatory customer consent.

Open Finance: Use Cases

Open finance is an expansion of open banking into other sectors of finance: investments, pensions, insurance, and more. It is governed by the same principles of secure sharing of data and mandatory customer consent.

Open finance has not yet been fully adopted on a global scale, but Brazil stands out as a leading example of successful implementation. Spearheaded by its central bank, Brazil introduced open banking regulations in 2021 and has since evolved into one of the most advanced open finance ecosystems in the world. By 2025, the framework includes banking, insurance, pensions, investments and foreign exchange, with broad participation from banks, credit unions, fintechs, insurers and brokerages.

As of April 2025, more than 70 million active data sharing consents have been granted by consumers, and financial institutions now process billions of API calls each week. Nubank alone handles nearly 9 billion API calls per month. This level of integration has enabled a wide range of personalised financial services and contributed to the growth of Brazil’s digital economy.

Despite this progress, adoption is still developing. Many banks report that only a small percentage of their customers currently engage with open finance services. Additionally, around 16 percent of Brazil’s adult population remains unbanked, although this figure is gradually decreasing due to innovations such as digital wallets and the PIX instant payment system.

Powering Real-World Open Banking Uses with Noda

The true value of open banking lies in its ability to solve real problems for real businesses. Whether it is streamlining e-commerce payments, automating financial management, verifying income for faster lending decisions or simplifying compliance processes, the use cases are both diverse and impactful. At Noda, we provide the infrastructure that makes these outcomes possible.

Our comprehensive open banking and payments platform is designed to help businesses operate more efficiently, connect with customers more meaningfully and scale with confidence. From enabling instant bank payments that reduce costs and boost conversion rates, to delivering real-time financial insights that support smarter decision making, we offer solutions tailored to the demands of modern digital commerce.

As a global provider of payment and open banking technology, Noda combines secure connectivity with advanced AI-driven analytics. This allows us to offer seamless payment facilitation, powerful financial data tools and an intuitive interface that puts businesses in control of their transactions.

With Noda, open banking is not just a concept. It is a practical, high-performance solution that helps businesses thrive in a fast-changing financial landscape.

Choose Open Banking with Noda

- Broad Bank Connectivity

Connect with 2000+ banks in 28 countries across Europe through a single, seamless integration. - Low Transaction Fees

Optimise your margins with competitive, cost-effective pricing designed for high-volume growth from 0.1%. - Instant Settlement

Get paid in seconds with real-time account-to-account transfers—no intermediaries, no delays. - Effortless Integration

Go live quickly using plugins for leading e-commerce platforms or flexible APIs for custom setups. - Multi‑Rail Payments

Offer customers more choice by combining open banking, cards, and digital wallets in one streamlined platform. - No‑Code Tools

Accept payments with ease - create links or QR codes without a website or integration required. - Hands-On Support

Enjoy expert guidance from a dedicated manager to ensure a smooth launch and ongoing success.

FAQs

Why do people use open banking?

People use open banking as it improves their user experience and offers more personalised services. If they consent to the secure sharing of their financial data with trusted fintech providers, they get better product offerings.

What problems does open banking solve?

Open banking solves issues like inefficient banking processes and high transaction costs. It promotes financial innovation and transparency.

Why is open banking good for small businesses?

Open banking helps small businesses by offering access to a broader range of financial services. It simplifies processes like accounting and payment processing.

What business can benefit from open banking?

A wide range of open banking opportunities for businesses, particularly those in financial technology, e-commerce, lending (including mortgage, business, and consumer lending), and any business requiring efficient payment processing or financial data analysis.

Where is open banking used?

Open banking is primarily used in regions with supportive regulations: the EU, the UK and Australia. It's also gaining momentum in countries like Brazil, where the government is promoting open finance, the next stage of open banking.

Latest from Noda

Alternative payment methods: 2026 Guide for Businesses

Open Banking Payments: SME E-Commerce Guide (UK)

Payment Methods in Spain 2026: A Guide for Online Merchants