The United Kingdom (UK) and its transatlantic cousin, the United States (US), are both reaping the benefits of open banking. Ending the data monopoly previously held by traditional banks, open banking fosters fintech innovation and better, more personalised products.

Yet the two countries are taking a drastically different approach. The UK is at the forefront of the European PSD2 regulation and has developed its own legal framework for open banking implementation. The US, on the other hand, preferred a market-driven strategy, letting businesses.

Here, we take a look at the differences in open banking in the UK vs the US, including regulation, adoption rates and critical players.

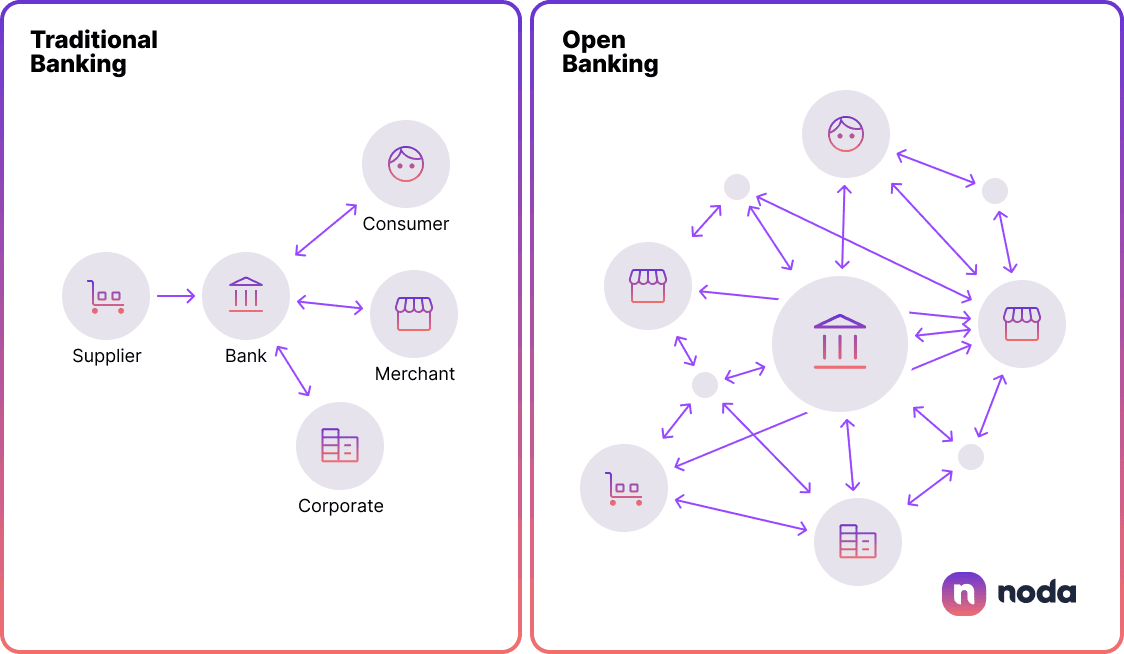

What is Open Banking?

Open banking is a framework that requires traditional banks to share consumer data with third-party providers (TPPs), usually fintech companies, to create better products for clients. Consumers have to consent to their data being shared.

The whole framework hinges on using Application Programming Interfaces (API). These are essentially bridges that allow different software systems to communicate and share data seamlessly. This enables third-party developers to build applications and services around the financial data.

Open Banking in the UK: Regulation

Before Brexit, the UK's open banking fell under the European Payments Services Directive 2 (PSD2) enforced in 2018. Under the directive, the EU banks were required to share data with TPPs.

The UK, however, took its own initiative, and in 2016, its regulator, the Competition and Markets Authority (CMA), initiated an investigation into retail banking. As a result, CMA requested the nine largest UK banks, collectively referred to as the ‘CMA9’ to implement open APIs and establish an open banking framework.

That’s how the Open Banking Implementation Entity (OBIE) was founded in 2017. It was since renamed Open Banking Limited, and is aimed at setting industry standards and guidelines to drive open-banking innovation.

UK Open Banking Guidelines

The kingdom has a specific set of guidelines for open banking implementation. They include:

- Open Banking API standard: It provides technical documentation, swagger files, and usage for Read/write API, Open Data API, Directory, Dynamic Client Registration, and MI Reporting.

- Security profiles: These cover third-party onboarding, redirect, and decoupled flows, ensuring secure data sharing between banks and third-party providers.

- Customer experience guidelines: These combine regulatory requirements and extensive customer research to help TPPs and account providers deliver consistent customer experience and avoid unnecessary friction.

- Operational guidelines: These support account providers in implementing high-performance interfaces and assist them in their regulatory obligations, design and testing, problem resolution, and management information.

- Certification service: This service can be used by account providers as evidence of conformance to the Standard when they request an exemption from the contingency mechanism with their competent authority.

US Open Banking Regulation

On the other side of the Atlantic, the US praised itself for its laissez-faire approach to government intervention. Open banking is no exception, and as of November 2023, the world’s biggest economy has no legal framework for implementing open APIs.

Yet the tides may be about to turn. In June 2023, Rohit Chopra, the director of the Consumer Financial Protection Bureau (CFPB), revealed plans for upcoming open banking regulations. These new rules, based on Section 1033 of the Dodd-Frank Act, seek to promote competition among financial service providers in the US.

Chopra envisions a future where institutions are required to give consumers the ability to share their financial data with fintech companies, other banks and online lenders. The regulations are expected to be finalised in 2024, and currently, the CFPB has invited comments on the proposal to be submitted by the end of December 2023.

Adoption of Open Banking: UK vs USA

Meanwhile, the adoption of open banking in both the US and the UK is expanding in scope. One in five US consumers saw open banking as a valuable technology in 2019, with the highest interest among millennials and Gen Z, according to a Deloitte Insights report. Respondents, voiced concerns about privacy, security and the use of personal data in open banking. Meanwhile, a separate Mastercard survey revealed that 81% of US adults are already connecting their bank accounts to third-party applications.

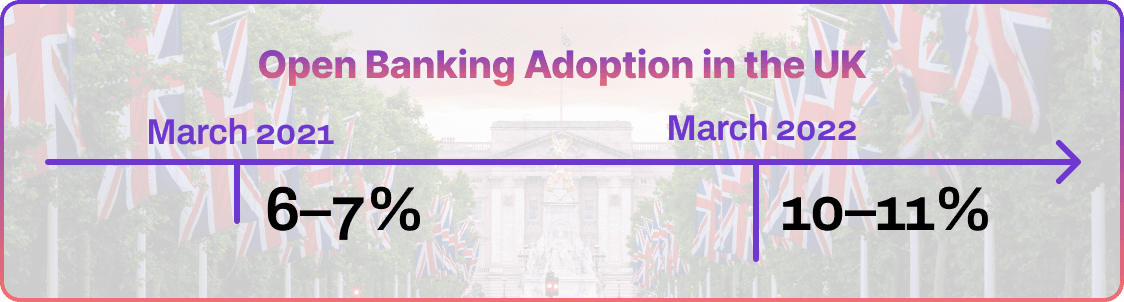

On the other side of the globe, the UK population is expressing enthusiasm too. According to the OBIE’s Open Banking Impact Report published in March 2023, 10-11% of digitally-enabled consumers were active users of at least one open banking service. This number increased from 7-8% in December 2021. Meanwhile, in August 2023, OBIE estimated that the open UK banking payments reached 11.4 million in July 2023.

Future of Open Banking

The open banking future looks promising in the US, especially after the planned regulation is implemented. Global Market Insights (GMI) estimated that the US open banking market, valued at $20.2bn in 2022, will grow at a compound annual growth rate of 20.5% between 2023 and 2032.

“The rising demand for digital banking is propelling the market growth,” GMI said. “Advanced technologies enable innovation, enhance operational efficiency, improve the customer experience, expand market reach, empower data-driven decision-making, enable collaboration, and drive industry transformation.”

In the UK, meanwhile, the regulators are working on enhancing the open banking architecture. In February 2023, the Open Banking Strategic Working Group Secretariat (SWG), working with the key industry stakeholders, identified the main gaps between the current state and the optimal future state for UK open banking. These included issues in payments, data sharing and the ecosystem overall.

Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

What is the future of open banking in the UK?

In the UK, the open banking infrastructure is regulated and highly developed, yet there is still room for improvement. In February 2023, Open Banking SWG revealed the main gaps in the country’s open banking payments, data sharing and the ecosystem overall, proposing potential solutions.

What is the future of open banking in the USA?

Open banking is likely to become regulated in the US in 2024. In June 2023, CFPB revealed plans for the new rules based on Section 1033 of the Dodd-Frank Act, which will increase collaboration between traditional banks and fintech companies.

Is open banking allowed in the US?

Open banking is allowed in the US, yet it’s not regulated yet as the country follows a market-driven approach. Yet this is likely to change in 2024, as CFPB revealed plans to enact rules for open banking into the law.

Is open banking successful in the UK?

Open banking succeeded in the UK, with 10-11% of digitally enabled UK consumers being active users of at least one open banking service as of March 2023. In August 2023, OBIE estimated that the open UK banking payments reached 11.4 million in July 2023.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each