AISPs and PISPs are the two types of third-party providers (TPPs) in the European PSD2, a groundbreaking regulation that started open banking in Europe. Enacted by the European Commission in 2018, PSD2 required traditional banks to share data with TPPs while obtaining consumer consent.

AISPs and PISPs in PSD2

The PSD2 regulation was adopted by the European Economic Area (EEA), Monaco, and the UK. Plus, in June 2023, the European Commission released draft legislation called PSD3, which aims to advance open banking in Europe further.

PSD2 brought about a plethora of terms, such as PISPs, AISPs, TPPs, and more. To put it simply, TPPs, including AISPs and PISPs, are third-party companies, often in the fintech sector, that engage in open banking to create innovative products.

What is PISP?

A Payment Initiation Service Provider (PISP) is a key player in the open banking infrastructure. These providers can access read-only financial data shared by traditional banks with consumer consent, and authorise payments on consumers’ behalf.

As a result, PISPs eradicate the need for consumers to insert their debit or credit card details, ensuring a smooth user experience. PISP services are often used by merchants who want to simplify their online payment journey.

How do PISPs work?

In the banking ecosystem, banks use application programming interfaces (APIs) to transfer consumer data to TPPs, including PISPs, securely, provided consumers have consented to this.

APIs, therefore, act like a software bridge between banks and PISPs. In Europe and the UK, banks are legally required to share their API, but only with authorised TPPs that are permitted to use them.

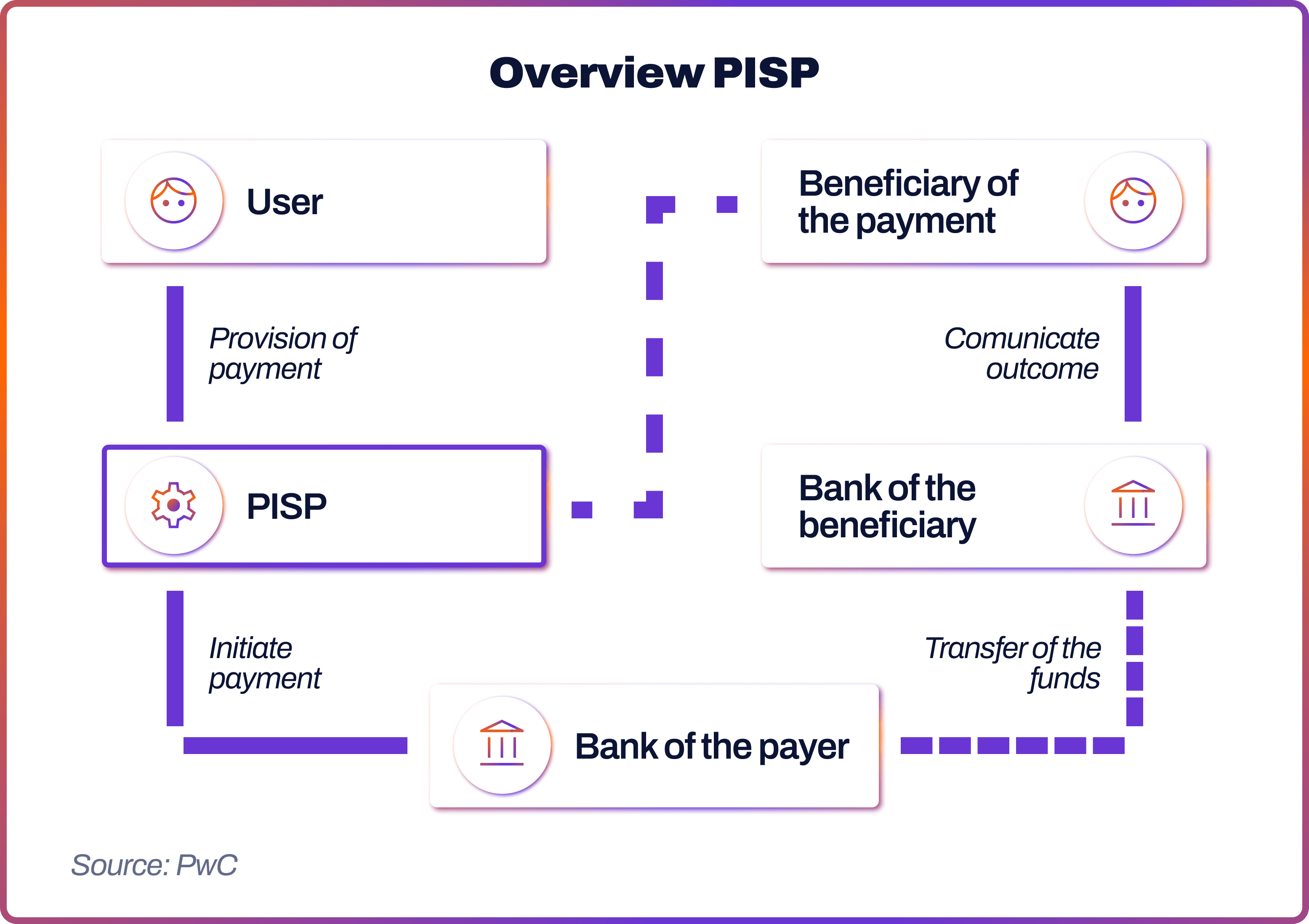

Merchants use PISP services to power their online payment flow with open-banking functionality. Within the flow, the user, or consumer, first initiates the purchase and consents to the payment. Then, the PISP signals payment initiation to the consumer’s bank, which then transfers the funds to the merchant’s bank.

Benefits of PISP

- Better User Experience: It’s self-evident that the open banking infrastructure provides a simplified user experience for customers. Instead of inserting their payment details manually, clients are transferred to their mobile banking app to complete the transaction.

- Security: The sharing of APIs is typically more secure, depending on the open banking regulation. Under PSD2, for example, Strong Customer Authentication (SCA) is a legal requirement, which means customers must use multi-factor verification to authorise payments.

- Efficiency: PISP bank-to-bank payments are quicker and more affordable for merchants, ensuring faster checkout experience and fund receipt.

What is AISP?

Account Information Service Provider (AISP) is the second type of TPP and the key open banking actor. AISPs are authorised to view customer data, such as bank account information, but don’t have the payment initiation functionality.

While PISPs typically act on the customers’ behalf to initiate payments, AISPs may also act on behalf of entities, such as banks, to access customers’ information. For example, credit agencies commonly require AISP services to access a customer’s credit history. Another example of AISP usage is budgeting tools that allow users to view all of their accounts within a single app.

How Do AISPs Work?

Similarly to PISPs, AISPs access the data by the power of open APIs. Companies need to obtain AISP certification in order to do this.

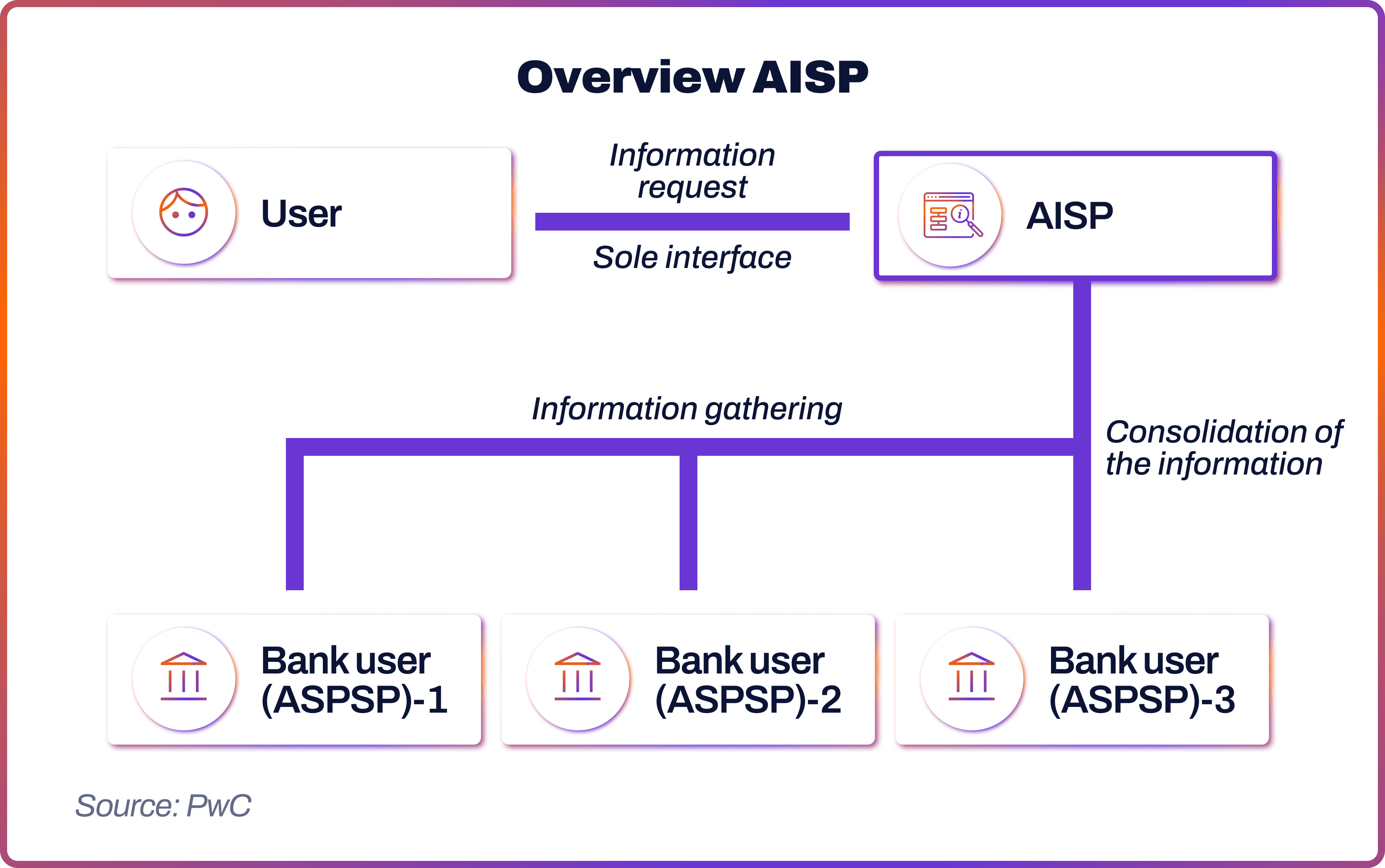

After a user request, an AISP gathers data from banks and then consolidates it into a unified piece of information.

Benefits of AISP

- Data Access: AISPs provide access to customer data for companies, which they can use to improve their products.

- Efficiency: AISPs offer streamlined and integrated data access without having to insert account details manually.

- Customised Products: The AISP functionality can help companies gain insights into users’ financial behaviour to create more tailored products and services.

PISP vs AISP: Key Difference Explained

The key difference between PISP and AISP is in their functionality. AISP focuses on accessing and aggregating financial data from multiple banks or financial institutions. Meanwhile, PISPs are able to initiate payments on behalf of a user. While AISPs can help in enhancing financial transparency and management, PISPs facilitate secure online payments.

AISP & PISP Examples

PISP examples include payment service providers like Noda and other business tools that integrate with the back office to allow companies to manage payments securely. Financial management tools and saving apps that regularly transfer a proportion of a customer’s balance to a savings account are another example of PISP and the application of open banking.

AISP examples include money management tools that gather and digest financial data for consumers. These include budgeting, accounting, and personal finance tools. Some credit agencies may use AISP functionality to access credit data on the individual or a business applying for a loan.

How to Choose an Open Banking Provider

Merchants and other companies may want to use AISP and PISP services to enable open banking functionality for their business needs. They may want to consider the following factors:

- Regulatory Compliance: Ensuring that the PISP or AISP is fully compliant with PSD2 and has a necessary license is key to avoiding legal risks.

- Security Standards: Businesses may want to evaluate the security standards of a provider, including encryption, data storage protocols and how they handle data breaches.

- Data Privacy: Given the sensitivity of financial data, strong data privacy policies and adherence to GDPR are key.

- Integration: Choosing a provider that offers smooth integration with existing systems is beneficial.

- User Experience (UX): Seamless and intuitive UX is vital to streamline the payment flow and avoid cart abandonment.

- Customer Support: Prompt and helpful customer support for both the business and its end-users is critical.

- Transparent Fees: Understanding the provider's cost structure is essential as it needs to align with the business budget.

Noda: Your Trusted AISP and PISP Provider

When it comes to leveraging open banking services, Noda offers both Payment Initiation and Account Information capabilities, allowing businesses to streamline payments and gain valuable financial insights.

With Noda’s PISP services, merchants can accept direct bank payments, offering customers a secure, frictionless checkout experience across 28 countries in the UK, EU and beyond, without the need for card details. This helps reduce costs, eliminates chargebacks, and speeds up settlement times.

Noda’s AISP functionality provides businesses with access to real-time financial data, enabling better customer insights, streamlined KYC processes, and more personalised services. By combining payment facilitation and data access, Noda’s platform empowers businesses to harness the full potential of open banking for improved efficiency and customer satisfaction.

If you’re exploring AISP or PISP solutions for your business, Noda can help you get started quickly with a seamless integration and robust support. Talk to us today to learn more!

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know