Open banking represents a seismic shift in the global financial services industry, offering an array of opportunities to enhance customer experiences, bolster competition, and ignite innovation. By serving as a conduit between banks and third-party providers, open banking enables the exchange of consumer banking data through secure Application Programming Interfaces (APIs), thereby forging a more integrated and accessible financial ecosystem.

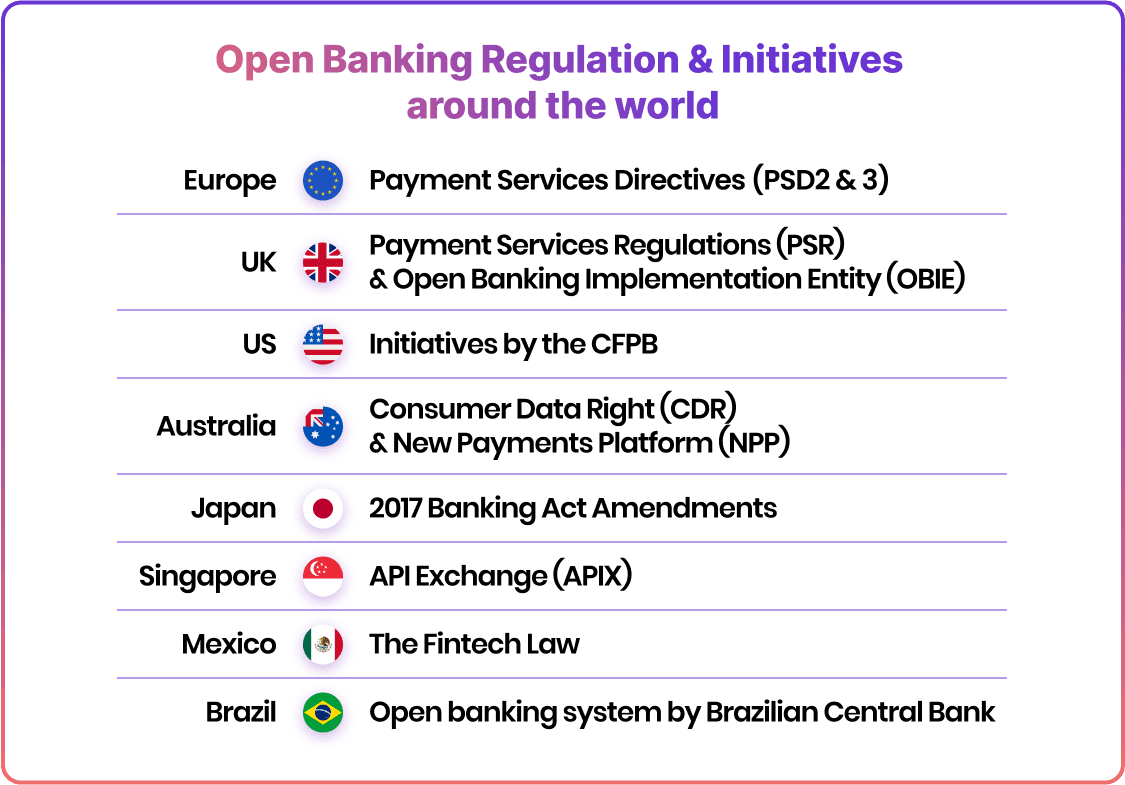

The application and expansion of open banking in different countries vary significantly, driven by factors such as the regulatory landscape, technological capabilities, and market receptivity. For example, the regulation of the open banking landscape has different names in various countries.

Open banking regulation & initiatives around the world

To better comprehend how open banking is revolutionising the world's financial sector, let’s take a look at its adoption and evolution in various places around the world.

Open banking in Europe

So far, Europe has been setting the pace in open banking from the regulatory perspective. The journey in this region has mostly been shaped by regulations, especially with the revised Payment Services Directive (PSD2), which came into effect in 2018.

Fast forward to July 2023, and the European Commission released its third version, PSD3. With the aim of building on the progress from the PSD2, the new PSD3 is paired with a fresh Payment Services Regulation, all in an effort to propel the sector further.

This EU open banking movement has significantly transformed the financial landscape in Europe, sparking plenty of innovation. A Forrester report suggests that open banking services adoption is expected to more than double across European countries between 2022 and 2027.

Open banking in the UK

Alongside the European region, the UK has been paving the way for open banking adoption and regulation.

In 2017, the stage for open banking was set with the creation of the Payment Services Regulations (PSRs). These acted as the legislative scaffolding, translating the European directive, PSD2, into UK law, and officially kickstarted the country’s open banking journey.

In 2018 the Open Banking Implementation Entity was introduced. This unique body was brought to life by the Competition and Markets Authority (CMA) in an effort to spur competition. The core mission was to develop a unified open banking standard that facilitates account access.

In 2018, the UK government mandated the nine largest UK banks, commonly known as the 'CMA9', along with a selection of other financial institutions, to use open APIs to allow authorised third-party providers (TPPs) to access customer-permitted data.

As stated in the June 2022 Open Banking Report from the Open Banking Implementation Entity (OBIE), approximately 10-11% of digitally savvy UK consumers have embraced the use of at least one open banking feature.

Open banking in the US

Currently, open banking, in the US operates differently from Europe and is shaped by market dynamics and industry practices. However, there is a shift towards data sharing within the US financial sector.

Spearheading this transformation is the Financial Data Exchange (FDX), a consortium consisting of institutions and fintech companies. Their primary objective is to establish a framework for data exchange.

Some progress has been made in open banking regulation too. In June 2023 Rohit Chopra, the director of the Consumer Financial Protection Bureau (CFPB) announced that they will propose an anticipated open banking rule in the coming months aiming to finalise it by 2024.

This rule, mandated under Section 1033 of the Dodd-Frank Act, will pave the way for increased competition among US financial service providers. As per Chopra’s vision, this rule will require institutions to provide consumers with the right to request the sharing of their financial data, with fintech companies, other banks, and online lenders.

Meanwhile, a survey conducted by Mastercard in 2021 revealed that 81% of US adults were connecting their bank accounts to third-party applications. This widespread adoption of banking highlights its increasing popularity among US consumers.

Open banking in Canada

In Canada, open banking still needs to be fully operational, yet preparations are being made to implement it securely.

The Canadian government took a step in 2018 by initiating a review of open banking and appointing an Advisory Committee to provide recommendations. At present the process is in its third phase with Abraham Tachijan being appointed in March 2022 to oversee the development of the framework.

According to the Advisory Committees' report, a proposed Canadian open banking system should include regulations for all participants, an accreditation process for third-party providers, and technical specifications that ensure secure and seamless data transfer. These measures aim to promote safety and efficiency in the sharing of information.

Open banking in Australia

Australia, much like Europe, has taken a regulatory approach toward implementing open banking. However, progress has been relatively slower in comparison.

The introduction of the Consumer Data Rights (CDR) legislation was a step in empowering Australians to have control over their data. Nevertheless, its implementation has been gradual and phased to prioritise security measures and mitigate risks.

A crucial development in Australia’s open banking journey came with the establishment of the New Payments Platform (NPP). This platform enables payments between banks operating round the clock. Despite these advancements, the open banking ecosystem in Australia still faces challenges such as accreditation processes and limited awareness among consumers. These issues need attention to achieve adoption.

In 2020 an insightful study conducted by fintech Frollo and lending technology provider NextGen highlighted the anticipation surrounding open banking within the country’s financial services industry. Around 71% of respondents, including banks, brokers, and fintechs, expressed their intention to utilise CDR data.

Open banking in Asia

Asia's open banking journey exhibits a diverse landscape, with countries at different stages of adoption. Open banking in Asia is often driven organically by consumers’ willingness to share data, high digital adoption rates, and a culture of digital innovation.

In Japan, the Banking Act amendments in 2017 mandated banks to collaborate with third-party providers. It has led to a steady increase in financial innovation, with many fintech launching new services.

In Singapore, the Monetary Authority of Singapore (MAS) is a key driver of developments in the open banking space. One of the key initiatives that MAS has taken to support open banking in Singapore is laying a strong foundation by introducing API Exchange (APIX), a collaboration platform.

Though there is no mandatory requirement for banks in Singapore to open up their data, systems, and services, recent research by Finastra has revealed a high appetite for open banking among financial institutions

Open banking in Latin America

Latin America, although a relatively recent adopter of open banking, is enthusiastically embracing this paradigm shift. Mexico has opted for a regulatory path similar to Europe. Brazil, on the other hand, is entering into a fully regulated open banking model. Meanwhile, other countries like Argentina and Peru still lack regulation.

Mexico, known for its proactive fintech regulations, introduced open banking laws in 2020, with Comisión Nacional Bancaria y de Valores (CNBV) publishing general provisions related to APIs. Although the regulation is quite advanced, there are still many unknowns about the implementation and deadlines. In 2023, additional rules are expected to further enhance the sector.

Brazil, the largest economy in Latin America, launched its open banking system, which moved to the fourth stage in 2021. The Brazilian Central Bank mandated a phased implementation with a strong emphasis on transparency and customer consent.

Final thoughts

The roll-out of the open banking infrastructure is disrupting and transforming traditional financial landscapes. Its adoption, though at different stages across continents, indicates a paradigm shift towards more inclusive, interconnected, and innovative banking services. The journey is ongoing, and the destination - a truly open and connected global financial ecosystem.

FAQs

Which countries have open banking?

Open banking has been adopted in several countries, including but not limited to, the UK, several nations in Europe, the United States, Australia, Singapore, Japan, Brazil, and Mexico.

What is the potential of open banking?

Open banking has immense potential. It can enhance customer experiences, bolster competition, and ignite innovation in financial services. Additionally, it can foster financial inclusion by providing better access and more personalised services to customers. It also enables the creation of a more integrated and accessible financial ecosystem.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each