What is an Open Banking API?

Open banking APIs are changing how we build and use financial services. The number of open banking Application Programming Interface (API) calls is forecast to grow from 137 billion in 2025 to 722 billion in 2029 – a 427% increase. Europe continues to lead the way, with a growing number of regulated third-party providers driving widespread adoption.

If you’ve ever used an app to view your balance, set a budget, or send money from your bank account, you’ve likely used an open banking API without realising it. These APIs are now critical to the financial ecosystem – powering faster payments, better user experiences, and more competitive products.

In this guide, we’ll break down what open banking APIs are, how they work, why they matter, and how Noda’s open banking API helps businesses connect with banks and deliver secure, real-time financial services.

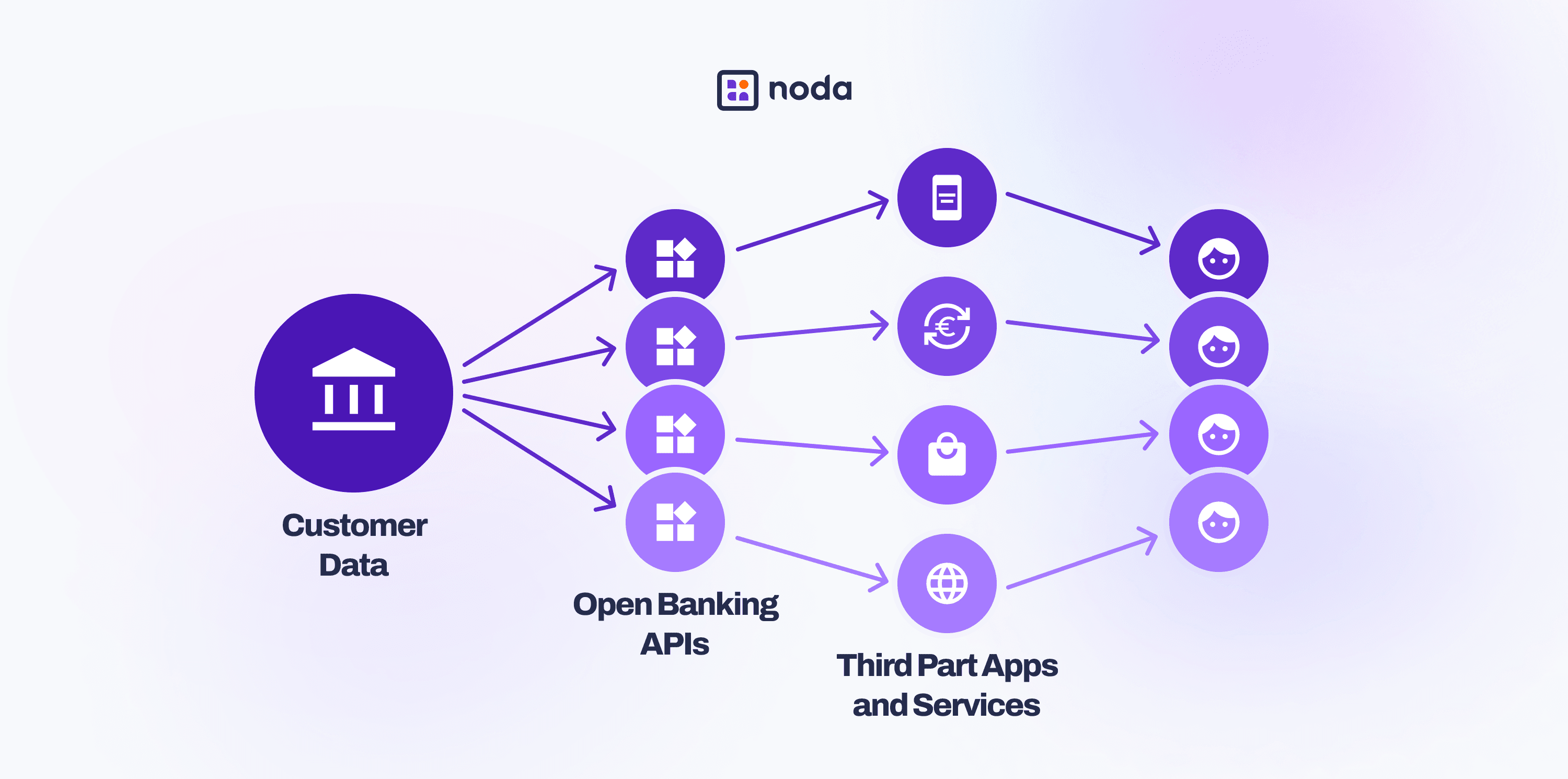

An open banking API is a secure tool that allows banks to share financial data with approved third-party providers like budgeting apps, payment platforms, or financial services with the customer’s consent.

Rather than asking users to manually input data or share login credentials, these APIs let apps connect directly to a user’s bank, retrieve the exact information they’ve authorised, and complete tasks like checking balances, verifying accounts, or making payments.

Everything happens through a controlled and encrypted connection. The bank handles authentication, permissions are clearly defined, and access is limited to specific data. It’s a safe, standardised way to connect different financial services giving users more control, and businesses better tools to work with.

Open banking APIs allow third-party applications like budgeting tools, payment platforms, or financial dashboards to securely connect with a user’s bank account, with permission. Instead of sharing login details, users authorise access through their bank, creating a safe and controlled data exchange.

Banks expose secure API endpoints that let these apps request specific data, such as account balances, transaction history, or account verification. Once the user gives consent, the bank issues a secure token to the app, which allows access only to the information that was authorised – nothing more.

In many cases, businesses work with open banking providers like Noda to simplify this process. Rather than building and maintaining individual connections with every bank, they integrate once with Noda’s API, which connects them to a wide network of banks across multiple markets. This means they can offer account-to-account (A2A) payments, identity checks, and real-time data services with a single integration.

Here’s how a typical connection works:

This process ensures full compliance with local regulations, including PSD2 in Europe, and prioritises security, transparency, and user control at every step.

Open banking APIs make it easier to build secure, user-friendly financial services. The process starts with customer consent. From there, your app connects to their bank through a regulated open banking API platform.

The bank authenticates the user and issues a secure token that grants access to approved data like checking balances or initiating payments. It’s a fast, reliable way to offer modern financial features without handling sensitive login details.

It enables personalised, real-time financial experiences. Users benefit from:

Businesses can offer smarter, more efficient financial services. It allows them to:

It gives businesses a smarter way to offer financial services. They’re not just for fintechs – any company handling payments, customer data, or identity checks can benefit from their speed, security, and flexibility.

One of the biggest advantages is secure access to financial data, always based on user consent. Customers choose what to share, and businesses only see the data relevant to their service. With protocols like OAuth 2.0 and strong encryption, everything remains protected and compliant.

APIs replace time-consuming manual steps with fast, automated flows. What used to take hours, like verifying income or reviewing bank statements, can now be done in seconds. This helps reduce friction, paperwork, and errors.

As more banks and platforms move toward API-led models, it’s easier to build modular, scalable services that adapt to changing market needs. Businesses can go to market faster and integrate with minimal development effort.

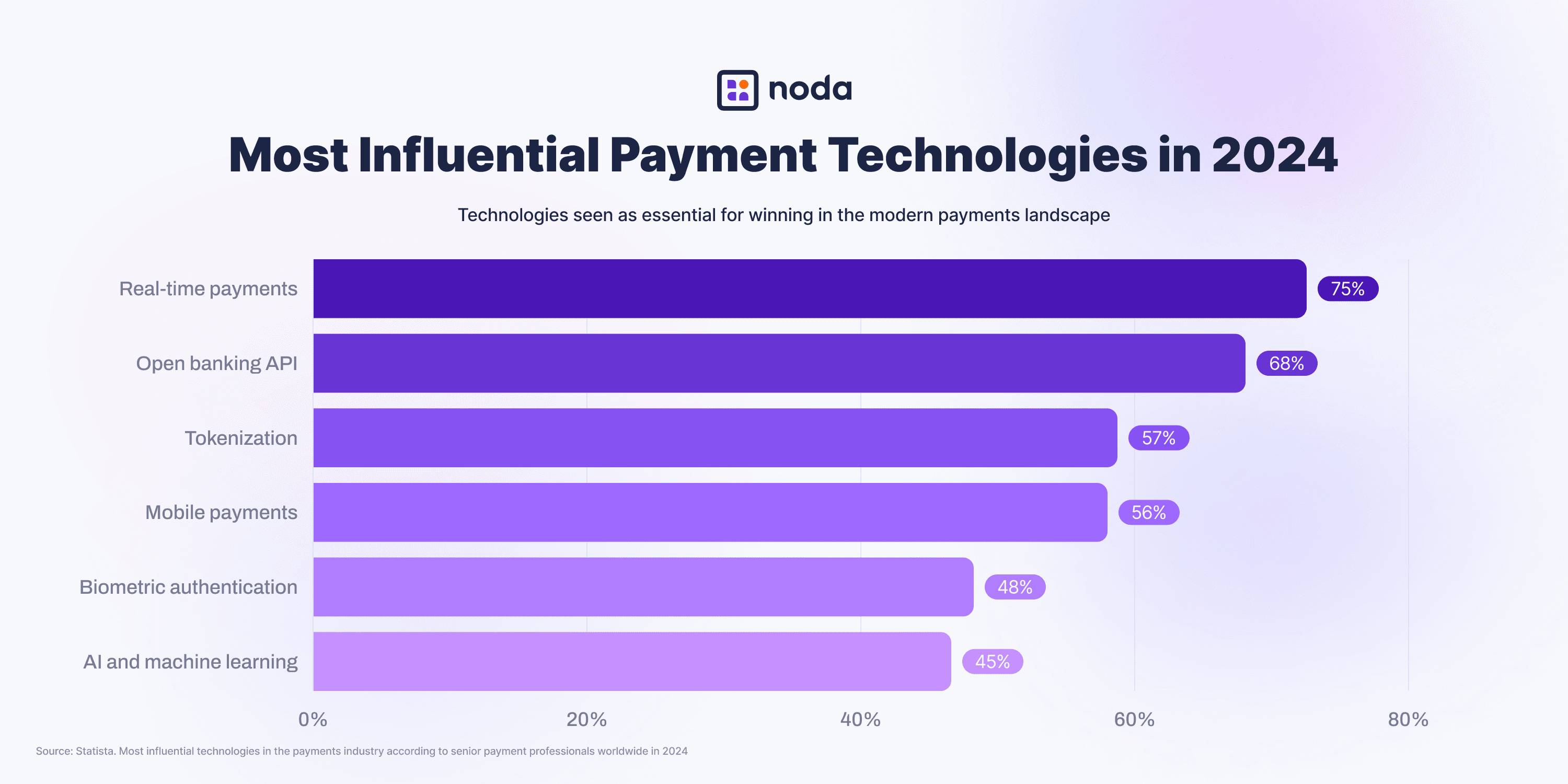

A recent global survey of senior payments professionals confirmed what many in the industry are already seeing: open banking APIs are expected. Adoption is rising fast, especially in the UK. In just six years, monthly open banking API calls grew from 1.9 million in June 2018 to over 1.6 billion by September 2024 – the highest volume recorded to date.

Noda simplifies how businesses connect to open banking. Through one API, companies in industries like e-commerce, travel, fintech, gaming, and digital services can access a large network of banks, offer secure payments, and build better user experiences – without the usual technical complexity. Everything is designed to be fast, flexible, and compliant with open banking API regulations.

Here’s how Noda helps bring open banking to life:

Access to financial services used to be limited by legacy systems and gatekeepers. Today, thanks to open banking APIs, consumers have more control, more choice, and more convenience than ever before.

With Noda, users can move between secure bank payments, financial tools, and digital platforms – all connected through a single API. This shift has made everyday tasks like paying online, verifying accounts, or managing subscriptions faster and more intuitive.

Open banking is no longer a concept – it’s the infrastructure behind better experiences. Noda’s API platform helps businesses unlock this potential and build products that work the way people expect them to.

The easiest way is to partner with a regulated provider like Noda. You’ll get access to features like A2A payments and real-time bank data – no license needed. If you are regulated (as an AISP or PISP), you can also connect directly to banks or use an aggregator. Once integrated, you’ll receive API credentials, set up secure authentication, run tests, and go live.

Examples include APIs for account information, payment initiation, and identity verification. These let apps check balances, make bank-to-bank payments, and confirm user details securely – with the customer’s consent.

In open banking, an API is a secure way for banks to share financial data with authorised third-party providers. API and open banking work together to enable services like payment initiation, account verification, and balance checks – safely and with the customer’s consent. This setup is key to delivering faster, more flexible financial services.