Open banking for consumers is changing the way people in the UK manage and move their money. It lets you securely connect your bank to trusted financial apps, make faster payments – via pay-by-bank, and take control of your data, all under strict regulation.

Also known as consumer open banking, it’s designed to be transparent, consent-based, and safer than ever. This guide explains how it works, how quick open banking payments really are, and how you can use it confidently in your daily life.

Key Takeaways

- You stay in control: Open banking lets you link your bank to trusted apps and make instant payments – only with your consent.

- It’s safe and regulated: Licensed providers use secure bank APIs and Strong Customer Authentication to protect your data. In the UK, open banking is overseen by the FCA and PSR, with rules originally mandated by the Competition and Markets Authority (CMA).

- Manage access easily: You can view or revoke app permissions anytime in your banking app settings.

- Faster payments: Pay-by-bank moves money instantly through the UK Faster Payments system.

- What’s next: Variable Recurring Payments and open finance will give you more control over bills, savings, and investments.

What Open Banking Means for You

Open banking lets you connect your bank accounts securely, and make payments straight from your bank account – but only when you give permission. It works through regulated technology called Application Programming Interfaces (APIs), which connect your bank to authorised apps and providers.

This setup allows you to:

- View all your bank accounts in one place.

- Make instant pay-by-bank payments without cards.

- Track your spending and set budgets automatically.

- Apply for credit faster using verified financial data.

Open banking in the UK operates under the Payment Services Regulations 2017, which implemented European PSD2 before Brexit, and is overseen by the Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR). Only licensed companies can access your data, and they must explain clearly what they’ll use it for.

How to Withdraw Consent in Open Banking

Data sharing in open banking is completely optional – nothing happens without your consent. You can grant or withdraw access anytime by managing permissions in your bank app.

To see which apps are connected to your bank, log in to your banking app and open Settings (or a similar menu). Look for Open Banking connections or Connected accounts. There, you can view, manage, or remove any third-party apps that have access to your data.

Once you withdraw consent, the connection stops instantly, and your data is no longer shared.

Everyday Examples of Open Banking in Action

Open banking is already part of everyday life in the UK, even if you don’t realise it. In 2018, there were just 320,000 pay-by-bank payments in the UK. Today, the country boasts 15 million active open banking users, growing 34% in the last year.

“From paying taxes to ordering dinner, millions of UK consumers and businesses are embracing open banking to manage their money with greater control, speed and confidence.” – OBL

Open Banking Payments: Online and Offline

When you pay by bank on an e-commerce website, that’s open banking in action. You skip card entry, approve the payment through your banking app, and the money lands instantly in the merchant’s account.

For example, Wargaming, a leading multi-platform game publisher, partnered with Noda to launch instant open banking payments for its games – creating a faster, smoother checkout. Gamers are redirected to their trusted banking app and can confirm payment in just a few clicks.

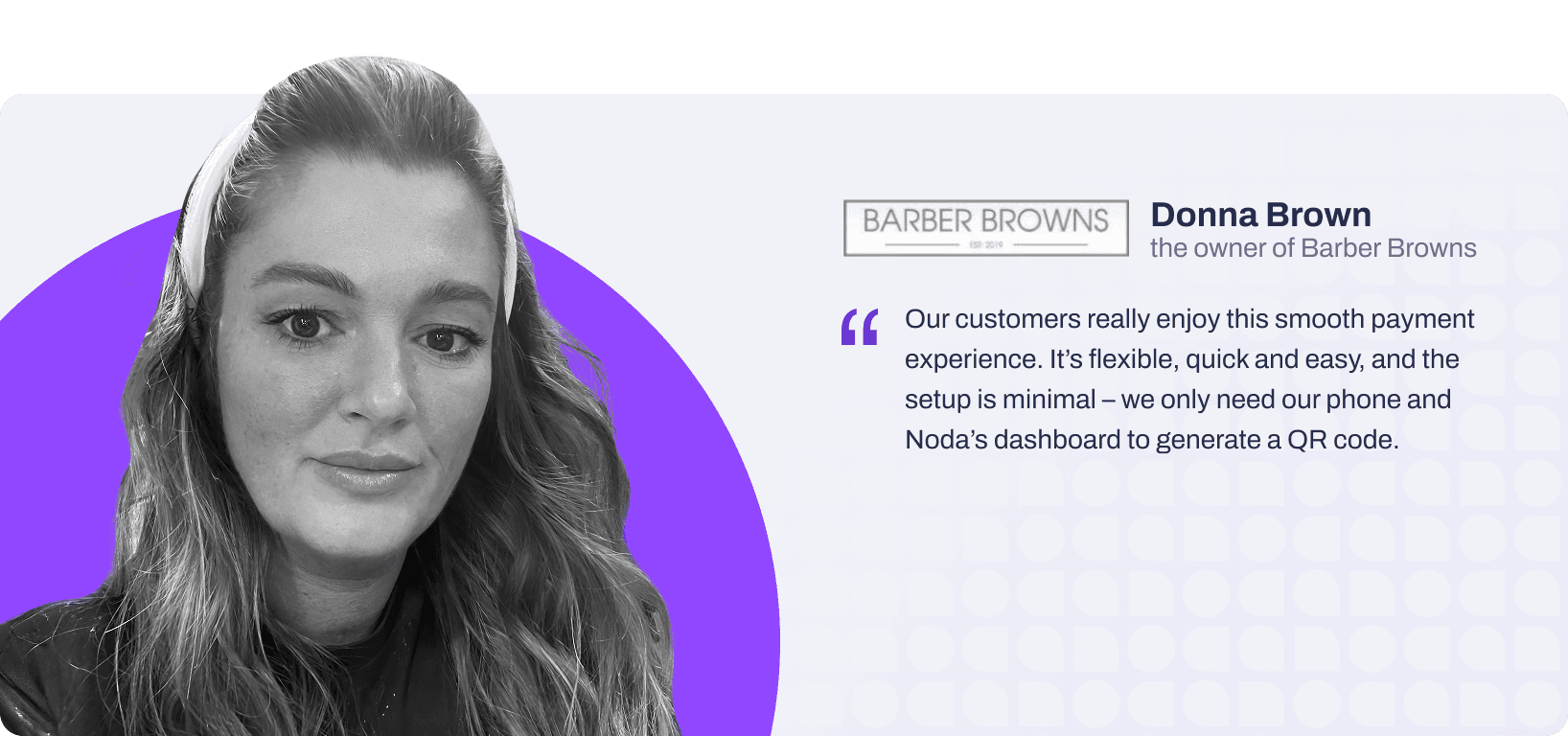

Open banking payments aren’t just for online stores. Barber Brown, a Glasgow-based barbershop, also partnered with Noda to let customers pay by bank via QR codes, bringing the same speed and convenience to in-person payments.

Open Banking Data: Budgeting Apps & More

Open banking also lets you connect all your accounts in one place. Budgeting apps like Emma use it to track your spending and display every account in a single, easy-to-read dashboard – making money management effortless.

When you apply for a loan or rental with some providers, your income can be verified automatically through secure bank data, so there’s no need to upload payslips or bank statements manually.

It’s all about removing friction, cutting out paperwork, and giving you faster, smarter financial experiences – safely and always with your consent.

Read More: Open Banking Explained for Beginners

Variable Recurring Payments (VRPs)

VRPs allow customers to make payments of different amounts at regular intervals – like subscriptions or bills – using open banking technology instead of traditional direct debits.

With VRPs, customers authorise a licensed fintech to make payments directly from their bank account under agreed conditions (e.g. limits on amount or frequency). Customers give consent once, and payments run automatically. The mandate stays active until the customer cancels it.

VRP adoption is growing rapidly: they now account for 13% of total open banking payments in the UK. And their growth is expected to accelerate as the commercial VRP rollout is planned for 2025 and 2026.

There are two kinds of VRPs – sweeping and non-sweeping (commercial). Sweeping moves money between a customer’s own accounts – for example, automatically transferring funds from a current account to pay off a credit card or top up a savings account.

In late 2022, six of the UK’s major banks implemented VRPs for sweeping, leading to the doubling of VRP transactions within a month, according to Open Banking UK.

Non-sweeping (Commercial) VRPs are payments between a customer and a merchant. They’re still new, as banks aren’t yet required to support them – but progress is accelerating.

- Some banks, like NatWest, began testing commercial VRPs in 2022, partnering with three providers.

- In January 2025, the FCA and Payment Systems Regulator (PSR) announced plans for an independent operator to manage VRPs across sectors like utilities, government, and finance.

- This initiative is backed by 31 financial institutions, including Barclays, HSBC, Revolut, and Monzo. The rollout starts in 2025, with wider use – including e-commerce and subscriptions expected in 2026.

How Open Banking Payments Work Behind the Scenes

Here are the basics of an open banking flow:

- Customer selects Pay-by-Bank at checkout

- Customer chooses their bank – at Noda, we cover 2,000+ banks in the UK and EU; full UK bank coverage.

- Multi-factor authentication via their online banking app, typically with biometric authentication

- Customer reviews details and confirms payment

- Funds are debited instantly

If you’re using open banking to connect your data, the process works much like a payment. You simply authorise data access through your trusted bank’s secure interface.

Open banking user experience (UX) is extremely smooth as users are not required to enter any details manually, all data is transferred via secure APIs.

Is Open Banking Safe for Consumers?

Yes – open banking in the UK is highly regulated and secure. As mentioned above, it’s overseen by FCA, and only licensed companies (AISP or PISP licences) can access data or initiate payments.

If you’d like extra reassurance, you can use the Open Banking Directory to check which payment or data providers are authorised. You can also visit the FCA Firm Checker to confirm whether a company is licensed to provide payment services.

All open banking payments use Strong Customer Authentication (SCA) – the same security standard your bank uses. This means you confirm each payment or data connection through your own banking app, usually with biometrics or a passcode.

Importantly, you never share your bank login details with any app or website. Open banking connections rely on secure encrypted tokens, not passwords.

How Fast Are Open Banking Payments?

In the UK, open banking payments are typically processed almost instantly, via the Faster Payments network, which operates 24/7, all-year-round. Payments are confirmed within seconds to a few minutes, depending on each bank’s infrastructure and security checks.

Consumer Rights and Protections in Open Banking

One thing to be aware of is that pay-by-bank payments don’t have the same protections as card payments. They’re not covered by Section 75 or chargeback rights, which means you can’t ask your bank to reverse a payment if something goes wrong.

If there’s a problem with a purchase, you’ll need to contact the business or payment provider directly to sort it out. Make sure the company is clear about its refund and dispute policy before you pay – a good provider will always be transparent about how issues are handled.

How to Use Open Banking Safely

Using open banking is safe when you stay aware and make a few simple checks.

- Always use trusted apps – only those listed on the FCA Register or Open Banking Directory (or merchants using the payment providers on the list).

- When making a payment or giving access, check that you’re redirected to your bank’s official page or app before entering any details.

- Only share the permissions the app actually needs, such as account balance or transaction data. You can manage and review these in your bank’s app – it’s good practice to check this regularly, at least once every month.

Stay alert for anything unusual, like unexpected payment requests or messages asking for personal details. If you’re finished with an app or no longer use it, withdraw access right away to keep your information secure.

Common Myths About Open Banking

Myth 1: “Apps can see everything in my account.”

False. They can only access what you allow. “Open” doesn’t mean your data is public. Apps must be licensed by national regulators, like the FCA in the UK, before they can connect to your bank. They can only view the information you choose to share – nothing more.

Myth 2: “Once I connect an app, it stays forever.”

False. You’re in full control. Your consent isn’t permanent. You can remove an app’s access anytime through your bank settings, and most permissions expire automatically after a set period.

Myth 3: “It’s less secure than using cards.”

False. It’s often safer. Open banking runs on secure bank APIs, not card networks. You authorise payments inside your own banking app – no card numbers, no middlemen. Strong Customer Authentication (SCA) adds another layer of protection using Face ID, fingerprint, or passcode.

Myth 4: “Only big banks offer it.”

False. Open banking covers thousands of banks. Smaller and regional banks are part of the network too. According to Open Banking Tracker, more than 4,400 banks in 70+ countries now support open banking – and providers like Noda connect to over 2,000 across the UK and EU, with full UK coverage.

Future of Open Banking: What’s Next for Consumers

- Variable Recurring Payments (VRP): VRP adoption is growing rapidly: they now account for 13% of total open banking payments in the UK. And their growth is expected to accelerate as commercial VRP rollout is planned for 2025 and 2026.

- Open Finance: Open banking will expand to cover investments, pensions, and insurance. The FCA plans to publish a roadmap within the next year as part of its new five-year strategy, including the key standards of open finance. The regulator aims to have the first Open Finance framework ready by 2027.

- Open Data Economy: The UK government is also laying the groundwork for a broader smart data economy through Data (Use and Access) Act 2025 (DUAA). The law builds on open banking and open finance, aiming to make data sharing easier and more secure across sectors. It will come into effect gradually, with full implementation expected by June 2026.

Useful Open Banking Links for Consumers

- Open Banking Regulated Providers: to verify licensed companies.

- FCA Firm Checker: confirm whether a firm is authorised to provide payment services.

- OBL News & Insights: latest news about open banking.

FAQs

What can open banking do for me?

It helps you connect your bank account to trusted apps for budgeting, payments, and easier financial management.

Is open banking safe in the UK?

Yes. It’s regulated by the FCA and PSR, using secure APIs and multi-factor authentication.

Can I stop sharing my data?

Absolutely. You can revoke access anytime through your bank’s online dashboard or app.

Do I pay to use open banking?

No. Open banking is free for consumers. Some apps may charge optional premium fees.

What happens if I’m scammed?

If you are scammed into sending money (through an authorised push payment), new rules from the PSR effective from 7 October 2024 mean your bank will usually refund you, up to £85,000 per case.

What’s the difference between data sharing and payments?

Data sharing (AIS) lets apps view information; payment initiation (PIS) lets them make payments you approve.

Can I still use cards if I use open banking?

Yes. Open banking complements cards – it doesn’t replace them.

What’s coming next?

Open finance and VRPs! You’ll soon be able to manage recurring payments and data sharing in one place across different financial services such as pensions and investments.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each