Open banking is a relatively new concept and can be confusing. Yet it’s important to understand it, whether you're a business or a customer, as the adoption of open banking is growing rapidly around the world. Here, we define open banking in simple terms for beginners.

What Does Open Banking Mean?

Open banking is an initiative where banks and financial institutions share customer data with licensed third-party providers, usually fintech companies, with customer consent.

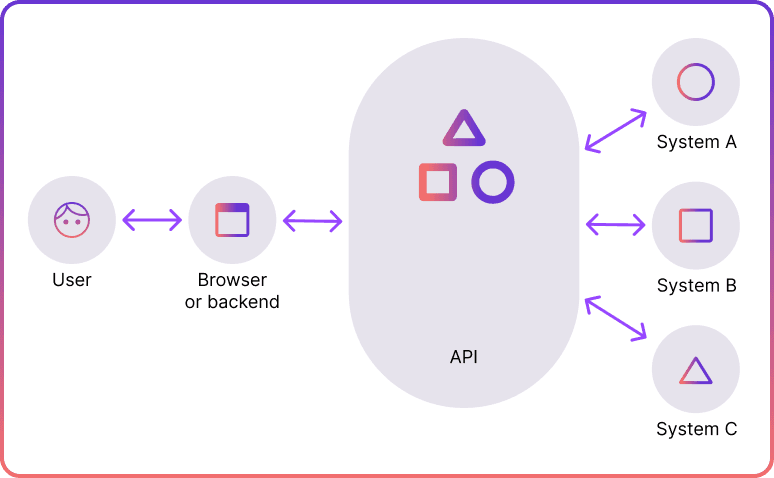

This means that people – like you and me – can allow an app or company to access their financial information. The data sharing happens via secure and regulated application programming interfaces (APIs).

Third-party providers use this data to create better products and services. Some of the open banking examples are account-to-account (A2A) payments enabled by the ecosystem and budgeting apps that combine data from multiple bank accounts.

What Makes Open Banking Different?

In today’s digital age, we all have a unique financial footprint. Every food grocery purchase, every train ticket, and every meal ordered online adds to this record.

Before open banking, big banks and financial services held most of this financial information exclusively. They decided if and how your data was shared, essentially having a monopoly over its use.

Therefore, it was challenging for consumers and fintech companies to utilise all this information due to the lack of a standardised and secure sharing method. This often led to less secure practices, like screen scraping.

Open banking ended the banks' monopoly over data. This means new paths for innovation and product development for financial service providers. For businesses, open banking offers better tools, particularly in payments. Customers benefit from improved ways to borrow, spend, and invest.

How Does Open Banking Work?

From a technological standpoint, data sharing in open banking happens via APIs. They are sets of instructions that allow different software systems to communicate with each other. Essentially, APIs are a structured and secure way to enable third parties to access financial data from banks.

The API standards are normally agreed upon and approved by open banking regulators, such as the European Commission. Then, the baton goes to the banks, which must develop and implement them. From there, third-party providers can begin accessing APIs and creating innovative products.

Regulation of Open Banking Explained

Open banking regulation varies across the world. For example, in Europe, it was put into law by the Second Payments Services Directive (PSD2), enforced in 2018, which mandated all the banks to share APIs. The API standard was set by the European Commission, which is currently working on the regulatory update - PSD3.

In the UK, the equivalents are Payment Services Regulations (PSR) and Open Banking Limited, which overview all the open banking-related rules such as API standards.

In Australia, data sharing is governed by the Consumer Data Right (CDR) and the New Payments Platform (NPP) initiative. In the United States, the Consumer Financial Protection Bureau (CFPB) is currently proposing open banking regulations.

Why Do We Need Open Banking?

As mentioned, banks held a monopoly over data and often didn't use it efficiently. Their rigid legacy systems often made it slow to develop new products. That's why we need open banking—to spark competition and drive innovation in financial services.

Open banking is similar to the internet in that it allows people to build great things on top of it. Without open banking, we wouldn't have instant account-to-account payments, efficient budgeting tools, and other innovative products that are yet to come from this framework.

What Banks Use Open Banking?

All European banks are legally required to use the open banking framework - it’s been mandated by PSD2. You can find what banks are using open banking in Europe (and the rest of the world) via this directory.

In the UK, the nine largest banks and building societies were legally required to make data available via open banking by the Competition and Markets Authority (CMA). They are:

- AIB Group UK (trading as First Trust Bank in Northern Ireland)

- Bank of Ireland UK

- Barclays Bank

- HSBC Group (including First Direct and M&S)

- Lloyds Banking Group (including Bank of Scotland and Halifax)

- Nationwide Building Society

- NatWest Group (including NatWest, Royal Bank of Scotland and Ulster Bank NI)

- Northern Bank Limited (trading as Danske Bank)

- Santander UK

However, as open banking became widely adopted, more and more banks now join the initiative. You can find all banks that use open banking in the UK in this directory.

Open Banking Payments

One of the key innovations of open banking services for businesses is payments. These are also known as A2A or Pay-by-Bank. Essentially, it’s a payment method that lets customers pay directly from their bank account, bypassing expensive card networks like Visa and Mastercard.

When choosing an A2A payment, the customer is redirected to their trusted bank interface to authorise the transaction and is then returned to the merchant’s app. This eliminates the need to enter lengthy payment details, improving user experience and reducing shopping cart abandonment.

A2A as a payment method offers several benefits to businesses, including lower costs (since no card networks are involved), faster fund transfers, and higher conversion rates. According to Statista, A2A accounted for 9% of global e-commerce payment transactions in 2022.

Other Open Banking Use Cases

Apart from payments, open banking data sharing enables a range of valuable tools and features. Here are some of its applications.

Personalisation

Open banking can greatly enhance user experience and personalisation. With vast amounts of data, businesses can analyse customer behaviour and spending patterns and tailor products precisely to clients’ needs. For example, budgeting or investing apps can use open banking data to offer personalised insights.

Verification

Another application of open banking data is streamlining income and wealth verification, along with affordability checks and risk assessments for sectors like renting, lending, and insurance. Traditionally, teams in these companies would manually analyse an individual's credit history and income, which is time-consuming and vulnerable to human error. Open banking simplifies this by aggregating financial data.

Compliance

Open banking data can also enhance compliance, fraud prevention, and Know Your Customer (KYC) processes. It offers a comprehensive view of a client's transaction history, making identity verification, wealth source verification, and risk evaluation simpler. Additionally, open banking data is fully digital, eliminating the need for paper documents.

Financial Management

Open banking data makes managing finances much easier for both individuals and companies. Third-party providers can collect information from multiple bank accounts and institutions, consolidating it in one place. This is ideal for budgeting and accounting tools, as it allows users to view all their transactions in a single interface.

Future of Open Banking

The future of open banking is bright as it continues to gain momentum globally. A 2021 study by Accenture found that 76% of banks expect customer adoption to increase by 50% or more between 2024 and 2026. Juniper Research predicts that open banking payments will reach a total transaction value of $330 billion by 2027.

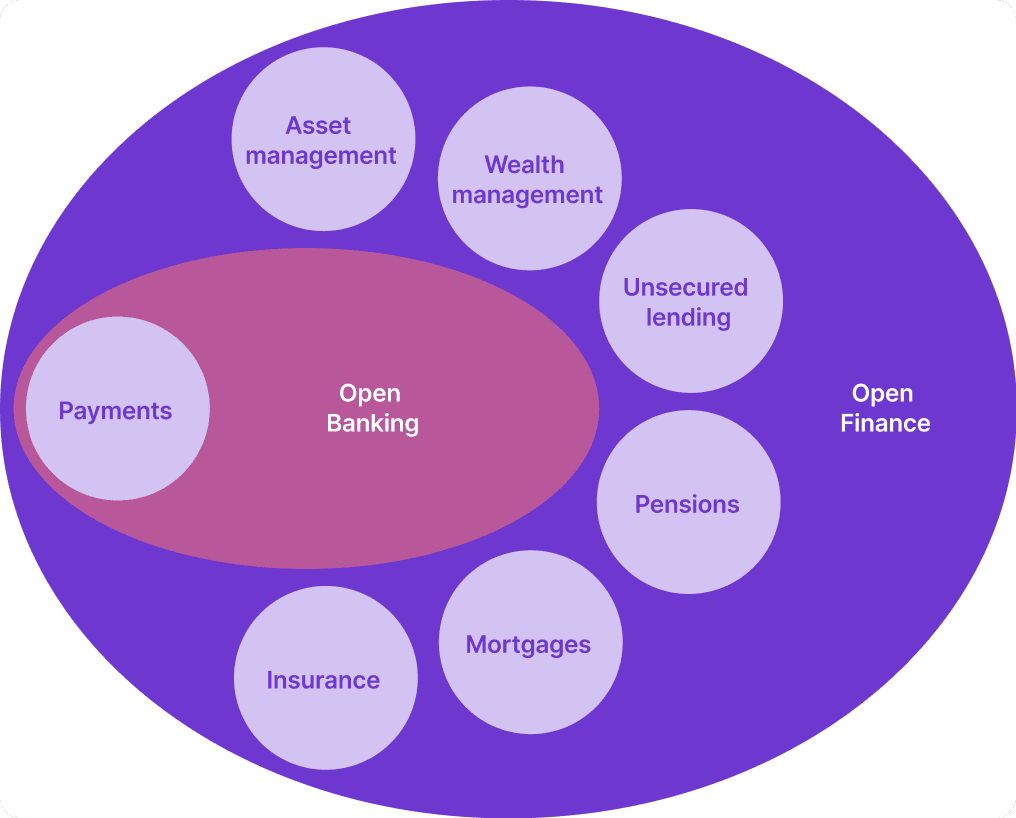

Open finance goes beyond open banking by sharing data across a wider range of financial sectors. This includes investments, insurance, pensions, mortgages, lending, and more. Although open finance is not yet widely adopted globally, Brazil is one of its pioneers, starting its final implementation step in March 2022.

Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine user experience, Noda is your partner in growth.

FAQs

Is open banking a good idea?

Yes, there are numerous benefits of open banking. It promotes competition, drives innovation in financial services, and offers customers better ways to pay, save, manage their finances, and much more.

Who can access open banking data?

Licensed third-party providers, such as fintech companies, can access open banking data with customer consent. This allows them to create innovative financial products and services.

Which banks are using open banking?

All European banks are required to use open banking under PSD2. In the UK, the nine largest banks and many others participate in open banking. You can find the directories in the article above.

What is the principle of open banking?

The principle of open banking is data transparency– to allow banks and financial institutions to share customer data securely with licensed third-party providers, with customer consent. This facilitates the development of new financial products and services.

Is open banking safe?

Yes, open banking is safe. It uses secure APIs and strict regulatory standards to ensure data protection and privacy.

How do I get into open banking?

To get into open banking, you can start by giving consent to a licensed third-party provider to access your financial data. Businesses can integrate with open banking APIs by partnering with regulated entities and adhering to relevant compliance standards.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each