Open banking is gaining significant traction in Europe and holds the potential to revolutionise the financial industry. It is reshaping how businesses and consumers engage with financial data. At its core, open banking offers a secure and user-friendly platform for sharing financial information with third-party providers.

Here, we examine open banking in Europe and its regulation and adoption in various European countries.

Open Banking Regulation in Europe: PSD2 and PSD3

The open banking movement in Europe began with strong regulatory support. Specifically, the Second Payment Services Directive (PSD2) and the forthcoming Third Payment Services Directive (PSD3) are shaping the sector.

Introduced by the European Commission in 2015 and implemented in 2018, PSD2 ended banks’ exclusive control over customer data. It requires banks to share data, such as account balances and transactions, with authorised third parties, providing consumers with consent, democratising financial services, and fostering innovation.

PSD2 also enhanced consumer protection by introducing Strong Customer Authentication (SCA), which requires at least two authentication factors for most transactions, thereby significantly reducing the risk of fraud.

PSD2 applies across the European Economic Area (EEA) and its extensions, such as Monaco, and continues to influence frameworks in regions like the UK.

But PSD2 isn’t the end. The European Commission unveiled draft legislation for PSD3 (and its companion, the Payment Services Regulation, PSR) in June 2023. As of 13 June 2025, the Council reached a compromise text and began negotiations with the European Parliament. PSD3 aims to refine the open banking framework, improving API quality, strengthening fraud protections, clarifying liability, introducing standardised Verification of Payee (VoP), and enhancing user consent controls. Following approval, PSD3 and PSR will allow an 18-month transition, making full implementation likely around late 2026 to early 2027.

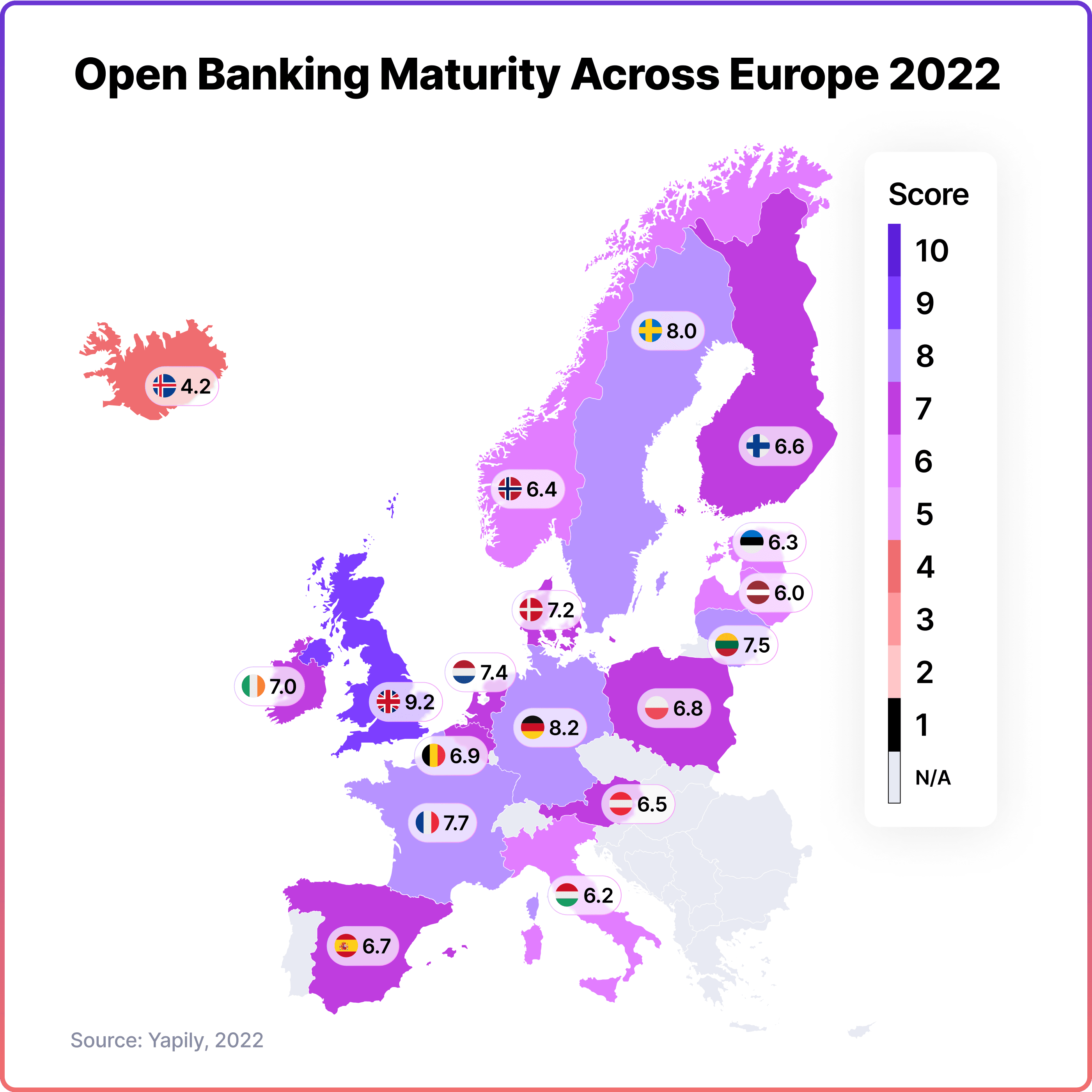

Open Banking in Europe: Market Maturity

Although European regulations enabled open banking, there is a significant discrepancy in the maturity of the open banking market across the region. According to the analysis by Yapily published in 2022, followed by their new report in 2025, the UK is leading the way with more than 13 million users, followed by Germany, Sweden, and France. Other countries are behind, but on a steady incline.

Open Banking in Northern Europe

UK: OBIE and Impact Report

The UK remains a top leader in open banking in Europe, with a 2025 maturity score of 9.2/10. Its Faster Payments System enables fast, secure bank transfers, supporting widespread adoption. The Open Banking Implementation Entity (OBIE), formed by the nine largest banks, has driven key innovation and standardisation. The UK was also among the first to launch a comprehensive Open Banking Standard, featuring robust APIs and robust security. According to OBL’s newest report, as of March 2025, over 13.3 million users (up from 1 million in 2020) now use open banking services.

Find out more about the UK Open Banking scene.

Ireland

Ireland is slowly but steadily advancing in open banking, driven by PSD2 regulations and a growing fintech sector. According to BPFI Payments Monitor, online and mobile banking payments jumped by 60% since 2018, with the trend expected to continue in the future. Irish banks must offer access to Payment Initiation and Account Information Service Providers, enabling faster payments and consolidated financial insights. Looking ahead, stronger industry collaboration, user education, and national API strategies will be key.

Discover the world of Open Banking in Ireland.

Scandinavia

Scandinavia is well-positioned for open banking, thanks to high digital adoption, robust infrastructure, and increasing consumer interest. As of 2025, Open Banking in Sweden ranks among the most advanced in Europe. Leading the region, it is home to major fintechs like Klarna and Tink and has over 8 million users of Swish, a real-time account-to-account payment system.

Norway's maturity score in the Yapily report is 6.4. It benefits from the widespread use of Vipps and BankID, which support secure digital payments and identity verification.

Open banking in Denmark came to a very well-prepared groundwork, with the country being highly digital, and with near-universal internet and bank access. While open banking use is still low, interest is rising. Platforms like MobilePay and P27, along with providers such as Noda and Aiia, support further growth.

Benelux Countries

Open banking in Belgium and the Netherlands is evolving rapidly, driven by PSD2, strong digital adoption, and a modern financial infrastructure. In Belgium, 87% of households use online banking, and credit card use is declining in favour of low-cost, instant bank payments, which serve as perfect groundwork for progressing further into the world of open finance. The Netherlands leads with 95% iDEAL usage, 50+ active APIs, and a fintech-friendly environment backed by €2.6 trillion in banking assets.

The Baltics

The Baltic states, comprising Estonia, Latvia, and Lithuania, are emerging as agile players in open banking, supported by robust digital infrastructure and high fintech adoption. Estonia leads with a 91 per cent internet banking penetration and the widespread use of digital ID systems, such as Smart ID and Mobile ID, making open banking integration seamless.

Lithuania, home to over 100 licensed electronic money institutions, has emerged as a European fintech hub, thanks to the Bank of Lithuania's supportive regulation. Latvia is also progressing, with PSD2 compliant APIs and growing consumer interest in account-to-account payments. Strong players in the region like Noda enable businesses across the Baltics to leverage open banking for instant, secure, and cost-effective payments, positioning the region for continued innovation and cross-border growth.

Eastern & Central Europe

Germany: Berlin Group

Open banking in Germany continues to gain momentum following the implementation of PSD2, accelerated by digitalisation trends and increased demand for cashless payments. As of 2025, Germany ranks as the second most mature open banking market in Europe.

The Berlin Group (TBG) remains central, having developed the widely adopted NextGenPSD2 API standard, which has enhanced collaboration between banks and third-party providers. Unlike the UK’s OBIE, whose standards are mandatory for major banks, participation in TBG’s framework is voluntary.

Find out more here.

Poland

Poland is advancing rapidly in fintech and open banking. In 2018, the Polish Bank Association launched the PolishAPI project to create a PSD2-aligned framework for third-party providers.

The country boasts a dynamic digital payments landscape exemplified by BLIK, a widely used mobile payment app that enables instant bank transfers and ATM withdrawals. By late 2021, over 10 million users actively used BLIK, up 44% from the previous year. This shows strong consumer demand for fast, digital payment options and reflects Poland’s readiness for open banking.

Czech Republic

The Czech Republic is cautiously progressing in its adoption of open banking. In 2021, the Czech Banking Association introduced a rulebook outlining standards for implementing PSD2, providing guidance for the financial sector. As of 2025, 30% of Czech consumers express interest in their data being used for open banking initiatives (according to Yapily).

Despite the good framework, adoption remains modest, with considerable untapped potential for growth and innovation in the market as awareness and demand for open banking services continue to develop.

Austria

Austria’s open banking ecosystem is expanding rapidly under PSD2, driven by increasing consumer demand for digital services and fintech innovation. In 2023, digital payments reached €30.5 billion and 59% of Austrians preferred mobile banking, indicating a shift toward real-time financial tools.

Regulatory sandboxes launched by the Financial Market Authority in 2020 support fintech testing, while banks collaborate with startups to deliver APIs for real-time payments and automated services. Providers like Noda connect directly to major Austrian banks, enabling secure and cost-efficient account-to-account payments and reinforcing Austria’s move toward an open, data-driven financial environment.

Find out more about the state of Open banking in Austria.

Romania

Romania is emerging as a promising open banking market in Europe, driven by the PSD2 and Strong Customer Authentication (SCA) standards for secure data sharing. Although only 76% of its 19 million citizens use banking services, the country has a growing fintech infrastructure, with 15 bank and account providers offering 52 APIs.

Few licensed third-party providers currently operate, but upcoming PSD3 reforms are expected to accelerate adoption. Open banking offers Romanian merchants and consumers instant payments, reduced costs, and better financial insights, all accessible through familiar banking apps, making Romania an emerging hotspot for digital payments innovation.

Learn about the scene of Open banking in Romania.

Open Banking in Southern Europe

France

France is emerging as a strong force in Europe’s open banking sector, driven by PSD2 and supervised by the ACPR and Banque de France. While initial resistance from traditional banks slowed progress, initiatives like the STET interbank platform have supported exponential growth in API sharing, with API calls skyrocketing from 34 million in 2021 to over 828 million in 2022. Leading banks such as BNP Paribas and Société Générale, along with 21 API aggregators, are central to this momentum. As PSD3 approaches, France is set to further strengthen its open banking ecosystem by enhancing API quality and regulatory clarity. Consumers benefit from faster transactions, reduced reliance on card networks, and access to tailored financial services, while providers like Noda help businesses tap into this expanding digital landscape.

Find out about the world of Open banking in France.

Spain

Spain has adopted open banking through progressive regulation and digital innovation, supported by a regulatory sandbox introduced in 2020 that fosters the development of fintech. With a maturity score of 6.7 and 69% online banking penetration as of 2023, Spain's digital transformation has accelerated, particularly following the COVID-19 pandemic. The instant payment platform Bizum has become central to mobile banking, with 20.5 million users by 2022, and is expanding into e-commerce and retail payments. The country’s strong real-time payment infrastructure, supported by broad participation in SEPA Instant Credit Transfer, further enables the rapid growth of open banking and digital payment solutions.

Learn more about Open banking in Spain.

Italy

Italy’s open banking development began in 2018 with the implementation of PSD2 through national legislation, establishing a regulatory framework supervised by the Bank of Italy. Although the market remains in its early stages, with limited end-user participation, regulatory efforts, such as the 2021 fintech sandbox, are encouraging innovation and experimentation within a controlled environment.

This sandbox enables fintech firms to test new services while engaging directly with authorities such as Banca d’Italia, CONSOB, and IVASS. Despite slow consumer uptake, Italy’s commitment to innovation and evolving user data practices signals strong potential for future open banking expansion and greater fintech collaboration.

Portugal

Portugal is gradually adopting open banking, guided by PSD2 and supported by Decree-Law No. 91/2018, which enforces secure API-based data sharing with customer consent. While the fintech ecosystem is growing, open banking adoption remains limited due to Multibanco's market dominance, a trusted national payment system.

As of late 2024, no domestic third-party providers are registered, reflecting both regulatory and consumer awareness challenges. However, initiatives such as FinTech Portugal and a strong digital infrastructure indicate long-term potential. With continued innovation, skilled talent, and a shift toward diverse financial services, Portugal is well-positioned to expand its open banking presence in the coming years.

Check out the scene of Open banking in Portugal.

Final thoughts

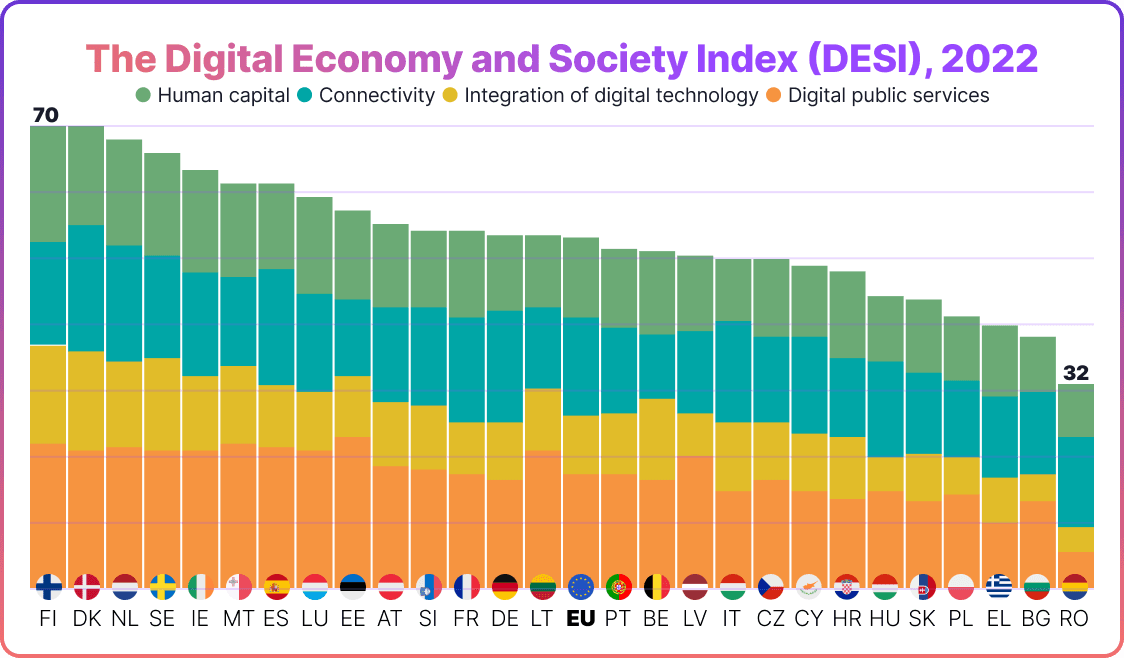

The EU’s open banking framework is revolutionising the financial industry in the region by granting wider access to financial data. Key regulatory initiatives, such as PSD2 and PSD3, have played a crucial role in driving this transformation.

Leading the way in terms of market maturity are the UK, Germany and Sweden. Notable systems such as the UK's Faster Payments System and Germany's Berlin Group stand out for their innovative approaches. Additionally, countries like Denmark, Poland, Spain, Norway, Italy, and the Czech Republic are making significant progress in adopting open banking practices.

Although adoption rates may vary across these nations, it is evident that open banking has immense potential to reshape Europe's financial landscape.

Expand Across Europe with Noda

Europe is primed for open banking-powered e-commerce: Over 90% of consumers in key markets like UK, Germany, the Nordics, the Netherlands, and the Baltics actively use internet banking, and there is a growing demand for fast, seamless, and secure payment experiences.

Why choose Noda for European coverage?

1. Pan-European bank connectivity

Connect to 2,000+ banks across Europe through a single integration, covering all major financial institutions in countries like Germany, France, Italy, Spain, the Netherlands, the Nordics, the Baltics, and many more.

2. Extremely low transaction fees

Start from 0.1% per transaction – a fraction of typical card fees. Pass savings onto your customers or boost your bottom line with higher margins.

3. Instant account-to-account settlement

Receive funds in seconds, not days. No card networks, no delays, just fast, secure payouts via open banking rails.

4. Plug & play integration

Go live in minutes with plugins for WooCommerce, Magento, Prestashop, and OpenCart or use our flexible RESTful API for custom integration.

5. All-in-one payment platform

Support multiple payment rails in one place – open banking, card payments, Apple Pay, Google Pay, and more for maximum checkout flexibility.

6. No-code payment tools

Create payment links and QR codes instantly. Accept bank payments online or offline. No developer required.

7. Support across Europe

Work with dedicated account managers who understand your market. Our team ensures a smooth onboarding process and provides responsive support.

Book a free demo with Noda today.

Our open banking experts are ready to help tailor a solution for your European business needs, whether you’re just starting or scaling fast.

FAQs

What Is Open Banking And How Does It Work?

Open banking is a regulatory framework that enables banks to securely share customer financial data with authorised third-party providers (TPPs) via application programming interfaces (APIs), provided that the customer has given explicit consent. This enables new services such as instant bank payments, account aggregation, and personalised financial tools, all while preserving consumer control over their data.

Where In Europe Is Open Banking Available?

Nearly every country in Europe has adopted open banking, thanks to the EU’s revised Payment Services Directive (PSD2), which was enforced in 2018. Countries like the UK, Germany, Sweden, the Netherlands, and France are leading in implementation, but adoption is steadily growing across the continent.

Is Open Banking Safe In Europe?

Yes, open banking is safe across European countries. PSD2 mandates strict security standards, including Strong Customer Authentication (SCA) and the use of encrypted data sharing. Regulatory bodies such as the European Banking Authority (EBA) and national financial authorities oversee compliance, ensuring that consumer data remains protected while promoting innovation.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each