Open banking is enabling new ways for people to share financial data with approved providers securely. In Europe, regulations like PSD2 ensure that customer data can be accessed with their consent, using standardised and secure APIs. This change is helping new financial services emerge, offering customers more choice and flexibility.

In Portugal, open banking is still catching up, partly due to the popularity of long-standing local payment methods. In this Portugal’s open banking overview, we take a look at the key payment trends, how PSD2 regulation works, and key initiatives in the country’s digital payments landscape.

What Is Open Banking?

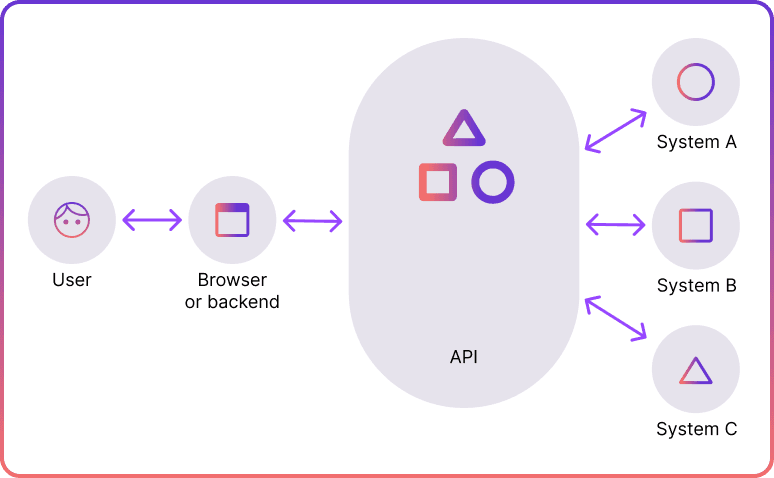

Open banking enables banks to securely share customer data with approved third-party providers (TPPs), such as fintech firms, but only when the customer agrees. This data exchange is carried out via secure Application Programming Interfaces (APIs), allowing access to financial data in a controlled manner.

APIs are essentially sets of guidelines that allow different software platforms to communicate safely. Regulatory bodies, like the European Commission, establish standards for these APIs, which banks then implement. Once in place, authorised third parties can use these APIs to develop new financial products and services.

Previously, traditional banks controlled financial data, making it difficult for fintech companies to access or use it securely. Open banking transformed this by establishing a secure, standardised way to share data. This change has paved the way for innovative services, like pay-by-bank options and tools that aggregate accounts to help with budgeting.

Open Banking Regulation in Portugal

European regulations have been central to open banking's growth, especially through the Second Payment Services Directive (PSD2) and the forthcoming PSD3. The European Commission launched PSD2 in 2015, enforcing it in 2018. PSD2 broke banks' exclusive hold on customer data.

PSD2 also improved consumer protection by introducing Strong Customer Authentication (SCA), requiring users to confirm their identity with multiple factors to reduce fraud. The directive applies across the European Economic Area (EEA), including Portugal, and the UK. Although PSD2 sets EU-wide standards, each member state must adapt these rules within its own legal framework.

In Portugal, the Bank of Portugal ensures PSD2 compliance under Decree-Law No. 91/2018. Additionally, Portugal’s open banking standard follows Berlin Group’s NextGenPSD2, enabling interoperability with other European countries.

Open Banking Adoption in Portugal

Portugal’s thriving startup scene and large pool of skilled talent suggest a promising foundation for open banking’s growth. However, as of October 2024, there are still no officially registered TPPs within Portugal, as per Open Banking Tracker. In practice, several TPPs operate in the country, alongside 30 account providers, 52 bank APIs, and 23 aggregators.

One reason for the lack of registered domestic providers lies in the strong presence of local payment solutions like Multibanco managed by SIBS, Portugal's central payment processing network. SIBS has a powerful grip on Portugal’s payments landscape, restricting market access for newer payment solutions, including open banking. The Portuguese Competition Authority (AdC) has fined SIBS for abusing its dominant position in the payment sector in March 2024.

Additionally, limited consumer awareness may be another factor slowing adoption. Many Portuguese customers are not yet fully informed about the advantages of open banking, which may have restricted uptake across the country.

Portugal Digital Payments Landscape

It’s impossible to talk about payments in Portugal without discussing the above-mentioned Multibanco. It’s more than just an ATM network—it enables users to pay for goods and services online or in-store through various methods. Portuguese customers can make payments via Multibanco ATMs or through online banking for convenient, secure transactions.

The Multibanco network includes a comprehensive electronic funds transfer system known as Multibanco Automatic Payment. It also extends to mobile and internet banking services, including TeleMultibanco and MBNet, supporting options across devices.

The popularity of established local payment methods, like Multibanco, could make it challenging for new payment innovations to gain traction in Portugal’s financial landscape. Since Multibanco is widely trusted and deeply rooted in Portuguese finance, open banking may face hurdles in adoption among consumers who already rely heavily on these traditional methods.

Additionally, SIBS—the major national payment provider—has considerable influence over the payment ecosystem, as mentioned above. This dominance can limit market opportunities for newer payment gateways in Portugal and stifle competition.

However, the outlook isn’t entirely discouraging. The creation of FinTech Portugal, a government-supported initiative, seeks to boost fintech innovation and foster collaboration within the industry. Since its launch in 2016 as the country’s first non-profit fintech community, it has evolved into a network that connects startups and established players, which is a positive development for the future of open banking in Portugal.

Open Banking in Portugal with Noda

Looking for a simple and efficient open banking payment processor in Portugal? Noda is a great solution, especially for small and medium-sized businesses. Our platform offers everything you need for smooth, secure payments and easy integration.

Why Choose Noda?

Noda does more than process payments. With Noda’s Open Banking API, you can offer direct bank payments with better user experience, lower fees and no chargebacks. That means a smoother, more secure payment flow for your customers and more savings for your business.

With payment plugins for popular e-commerce platforms like OpenCart, WooCommerce, Magento, and PrestaShop, or no-code payments, Noda is easy to set up and use. Whether you’re starting out or scaling, we’ve got flexible plans to fit your needs.

Reach More Customers

We offer instant bank payments with flexible fees and a great acceptance rate, partnering with over 2,000 banks in 28 countries, including the EU and more, supporting many currencies.

Noda lets you leverage pay-by-bank technology internationally, saving money on avoiding middlemen fees and chargebacks and offering your customers the convenience of paying through their trusted local banks.

Grow Your Business

From helping with customer verification to improving the user experience and providing customer insights, Noda’s tools are designed to grow your business. We help you make payments easier and forecast long-term value.

FAQs

Does Portugal have open banking?

Yes, Portugal regulates open banking under the EU’s Second Payment Services Directive (PSD2) directive. This framework, enforced by the Bank of Portugal, allows licensed third-party providers (TPPs) to access customer data securely, with their consent.

Which Portuguese banks offer open banking?

Prominent Portuguese banks participating in open banking include Caixa Geral de Depósitos, Novo Banco, Millennium BCP, and Banco BPI.

Is open banking legal in Portugal?

Yes, open banking is legal in Portugal and is regulated under the Second Payment Services Directive (PSD2). The Bank of Portugal oversees compliance with PSD2.

What is the status of open banking in Portugal in 2024?

While Portugal has a growing fintech, the country has no domestically registered TPPs, as of October 2024. Despite this, many foreign TPPs operate in Portugal, and local interest in open banking is gradually increasing.

How does Portugal compare with other European countries in open banking?

Portugal lags behind other European countries in open banking adoption due to the dominance of local payment solutions like Multibanco. While other nations like the UK are leading with open banking innovation, Portugal is slowly advancing with government support for fintech initiatives.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each