With the advent of open banking, a future where paying by bank is as common as using debit or credit cards is within reach. This is already a reality across Europe and many other countries.

Merchants can notably reduce fees and enhance user experience (UX) by adopting this innovative payment method. Here, we explore all aspects of the payment by bank account, including its functionality and how merchants can integrate it.

What Is Pay-by-Bank?

Pay-by-bank is also known as account-to-account (A2A) or an open banking transaction. It’s a payment method that lets customers make online purchases directly from their bank accounts, removing card networks from the equation. Customers use their online banking credentials to authorise a payment and transfer funds directly to the merchant's account.

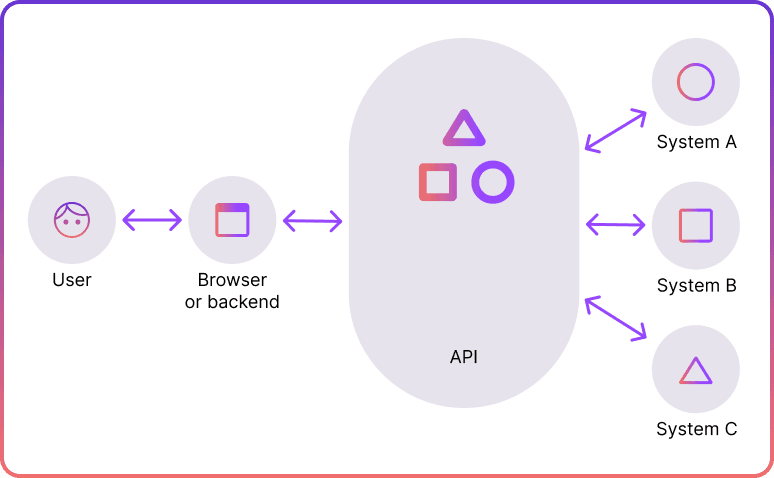

Since 2018, the EU's PSD2 regulation has mandated banks to share customer data with authorised fintech firms via application programming interfaces (APIs). APIs act as a software bridge, enabling secure communication between different systems. This makes A2A payments faster, cheaper and more secure.

A2A payments also improve UX. With pay-by-bank, users avoid manually entering their payment details, as the system redirects them from the payment page to their trusted bank’s interface.

What Is a Pay-by-Bank App?

Pay-by-bank UK apps differ from the overall pay-by-bank A2A payments. Major UK banks like Barclays and HSBC offer their own Pay-by-Bank apps, which function similarly to A2A, but they operate on a proprietary network rather than through the open banking infrastructure. Because these apps are managed by the banks themselves, they adhere to bank-specific rules, resulting in varying conditions for merchants.

How Does Pay-by-Bank Work

Below is a step-by-step payment-by-bank flow.

- User selects the 'Pay by Bank app' option at checkout

- User selects their bank from the options provided

- User logs in to their banking app, using the required verification method such as Face ID, Touch ID, Mobile Banking PIN, or others

- User selects the account from which they would like to send money

- User reviews the on-screen details, including payee, amount, their chosen account and delivery address if displayed

- User clicks send and confirms the transaction

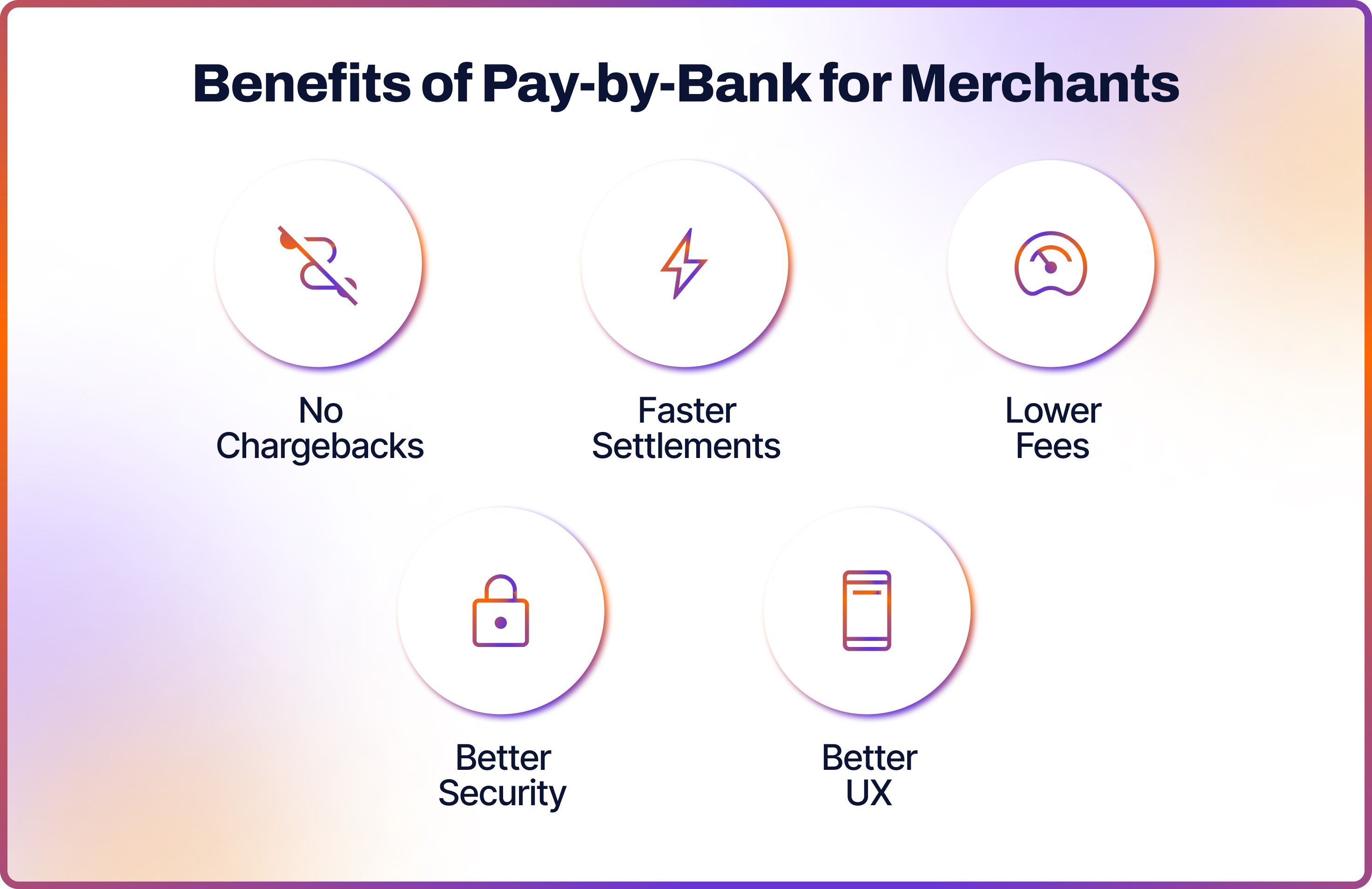

Benefits of Pay-by-Bank for Merchants

There are many reasons why to use pay-by-bank, for both customers and merchants. Let’s take a look at some of them in more detail.

No Chargebacks

Unlike card payments, instant bank transfers do not include a chargeback mechanism, protecting merchants from chargeback fraud. Additionally, with no card networks involved, merchants avoid the substantial fees associated with chargeback processing.

Faster Settlements

Slow settlements are a frequent issue for merchants using traditional payment methods like cards and BACS, which can take up to three days to clear and disrupt cash flow. In contrast, pay-by-bank payments are credited to merchants' accounts almost instantly, allowing businesses to accurately track their cash flow in real-time.

Lower Fees

Pay-through-bank is more cost-effective than traditional card transactions, as it involves no interchange fees. Pay-by-bank means money transfers directly between bank accounts, so they involve lower fees than card-based methods, bypassing costly card networks.

Better Security

Pay-by-bank provides enhanced security because customers don't have to share their credit or debit card details to make a payment. Instead, data is shared through regulated APIs, reducing the risk of fraud and better protecting customer data. This method is significantly more secure than screen scraping.

Better UX

Paying using a bank account is especially convenient for customers who don’t have a credit or debit card or prefer not to use them online. One significant advantage of open banking for UX is app-to-app redirection. The flow bypasses the mobile device’s default browser, directly connecting users to their trusted banking app to grant consent. If the banking app is not installed, users are automatically redirected to a mobile-optimised banking website.

Learn More About Open Banking with Noda

With connections to 2,000+ banks in 30 countries and support for multiple currencies, we provide global open banking payments (pay-by-bank), payout, and data solutions designed to fuel your business growth.

Our AI-optimised checkout forms ensure frictionless transactions, while no-code payment links and QR codes make setup effortless – even for teams with limited tech resources.

Go beyond payments with Noda’s advanced data tools, offering secure bank login verification and customer insights to drive smarter decisions. Simplify payments, enhance conversions, and grow your business – all with Noda.

Why Open Banking & Pay-by-Bank?

We’re passionate about open banking because we believe it’s the future.

Why? It’s fast-growing, highly profitable, and incredibly efficient. We also prioritise open banking education to help businesses unlock its full potential. Discover our ethos and explore common open banking myths debunked here.

How to Integrate Pay-by-Bank

The most common way to integrate pay-by-bank payments is via a payment initiation service provider (PISP) like Noda, which may already support your existing payment methods. There are several types of integration:

- Direct Open Banking API integration offers a customisable payment journey but demands more time and technical knowledge for implementation.

- Integration tools such as hosted payment pages (HPPs) or software development kits (SDKs) provide a smoother, easier integration experience for developers, though they offer slightly less customisation.

The type of integration required depends on your desired payment flow and the developer resources available to you. Although integrating may seem daunting initially, a dependable provider can guide you through the process and recommend the best integration approach to meet your objectives. Make sure to discuss the following questions with your provider:

- Integration Template & Timeline: A trustworthy provider will assist you in navigating the integration process and establishing an implementation timeline.

- Objectives: Things like enhancing conversion rates are crucial. Your integration team should offer insights on designing a payment flow that improves these rates.

- UX/UI Recommendations: Drawing on experience with other clients, your partner can provide specialised UX and UI advice tailored to your specific needs and objectives.

The integration process involves collaboration between your existing systems and your chosen provider. Delays on your part, such as scarce developer resources or competing priorities, can prolong the timeline.

How to Integrate Pay-by-Bank with Plugins

Some providers may also offer e-commerce plugins to seamlessly integrate open banking payments in just a few clicks. This is a relatively easy and quick way to leverage pay-by-bank payments if you’re selling on a popular e-commerce platform.

For example, at Noda we offer plugin integration for WooCommerce, Magento, OpenCart, PrestaShop and soon BigCommerce. Merchants can implement them by installing the archive file from the admin panel, and then adding API keys available through Noda Hub.

Future of Pay-by-Bank

Pay-by-bank is already transforming how we pay bills – but in the next few years, it’s set to dominate everywhere. Why? The answer lies with digital natives.

In the UK alone, millennials and younger generations now make up over half the population (Statista). These tech-savvy consumers demand fast, secure, and modern payment options — and pay-by-bank delivers.

The numbers tell the story: Juniper Research predicts the pay-by-bank transaction volume to rise from 60bn in 2024 to 186bn in 2029; an increase of 209% in five years.

With no cards, lower fees, and instant transactions, pay-by-bank is not just the payment method of the future — it’s what your customers want now.

Integrate Pay-by-Bank with Noda

At Noda, we make open banking integration effortless. With our Open Banking API, you can seamlessly connect to advanced features, while our ready-to-use plugins for top e-commerce platforms like OpenCart, WooCommerce, and Shopify simplify setup – no developers required.

Ready to get started? Just fill out the form, and our team will guide you through the process. Unlock the power of open banking with Noda – simple, seamless, and designed for growth.

FAQs

Is pay-by-bank safe?

Yes, pay-by-bank is highly secure. It uses bank-grade authentication and encryption, ensuring your information is protected at every step. No sensitive card details are shared during the transaction. It’s also regulated under PSD2 in Europe.

How do I pay-by-bank transfer?

Select "Pay by Bank" at checkout, log into your online banking through a secure interface, and approve the payment. The amount is transferred directly from your account to the merchant.

What does pay-by-bank mean?

Pay-by-bank is a direct bank transfer method that bypasses cards. It lets you make payments directly from your bank account to a merchant or service provider using open banking technology.

If I pay-by-bank transfer, am I protected?

Yes, you're protected. Payments are authorised through secure bank systems, and any unauthorised transactions can be investigated under your bank's fraud protection policies.

Is pay-by-bank the same as open banking?

No, pay-by-bank is not the same as open banking. Pay-by-bank is an account-to-account payment method enabled by the broader framework of open banking and secure data sharing.

What are the main benefits and challenges of pay-by-bank?

The main benefits of pay-by-bank include faster settlements, lower transaction fees, enhanced security, and a better UX due to app-to-app redirection. Challenges might include dependency on customer access to online banking and the initial integration effort required for merchants.

How do I use pay-by-bank with Noda as a merchant?

First, you should be onboarded with Noda. Simply fill out the form, and our sales team will contact you shortly. Our payment processor smoothly integrates with API and front-end components, ensuring seamless merging into your platform.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know