Account-to-Account (A2A) payments are transforming the financial landscape. This guide explores the meaning of A2A payments, their role in open banking, and their impact on businesses and consumers.

What are A2A Payments?

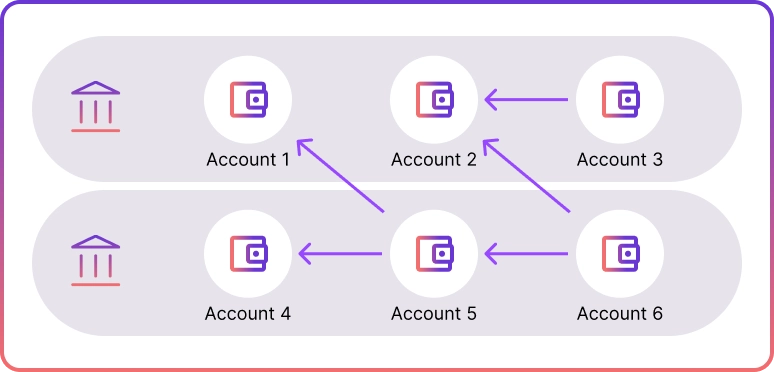

A2A transactions, or account-to-account payments, refer to transactions made directly between two bank accounts. They offer an efficient alternative to involving credit cards or third-party apps. This direct method often leads to reduced transaction fees.

Although A2A payments have been in existence for some time, recent technological advancements and regulatory changes have enhanced their practicality and popularity.

Types of A2A Payments Explained

A2A payments can be classified into two primary types: push and pull payments.

- Push payments refer to one-time transactions initiated by the payer, who manually transfers funds to the recipient's bank account. An example of a push payment is a bank transfer.

- Pull payments occur when a merchant or service provider deducts money from a consumer's account, usually for subscriptions or recurring payments.

A2A Payment Rails

In the past, A2A payments were facilitated through banking rails owned by banks. These rails were established before the digital era and weren't designed to cater to international transactions.

However, the introduction of open banking APIs has revolutionised this landscape, making it possible for seamless payments from bank accounts within third-party services.

Open Banking and A2A Payments

Open banking has had a significant impact on A2A payments. It has enabled A2A payments to become more accessible through mobile devices and driven by APIs. As a result, new types of A2A payments have emerged, such as peer-to-peer (P2P) payments and Payment Initiation Services (PIS).

Furthermore, open banking has made A2A payments more cost-effective, faster, and safer by minimising intermediaries and leveraging advanced authentication technology. This development has revolutionised the way individuals handle transactions within their accounts.

A2A vs PIS Payments

A2A and PIS payments are often used interchangeably, but they have distinct differences. PIS is a specific type of A2A payment that utilises open banking technology. While both types offer the advantages of low cost and high security, PIS payments provide enhanced user experiences and higher conversion rates through their API-driven and embeddable features.

Benefits of A2A Payments

- Enhanced security: A2A payments enhance security through strong customer authentication methods and compliance with legal requirements.

- More options: They offer consumers a wider range of payment options, simplifying transactions for all involved parties.

- Cost reduction: A2A payments can reduce costs by eliminating the need for card networks and lowering transaction fees for merchants.

- Faster payment processes: A2A payment processing is faster, including reconciliation, especially in countries where real-time payments are available.

Final Thoughts

In conclusion, A2A payments, driven by open banking, offer a secure and cost-effective alternative to traditional methods. As they continue to evolve, they are set to play an increasingly vital role in global transactions, benefiting both businesses and consumers.