Open banking is rapidly growing in Europe, bringing major changes to the financial sector. It’s transforming how businesses and consumers access and share financial data. Essentially, open banking creates a secure and user-friendly way to share financial information with authorised third-party providers, which opens avenues for smoother payments and data insights.

In this Spain’s open banking overview, we’ll explore how the ecosystem is evolving, the regulations guiding it, and the potential opportunities it presents for merchants and consumers.

What Is Open Banking?

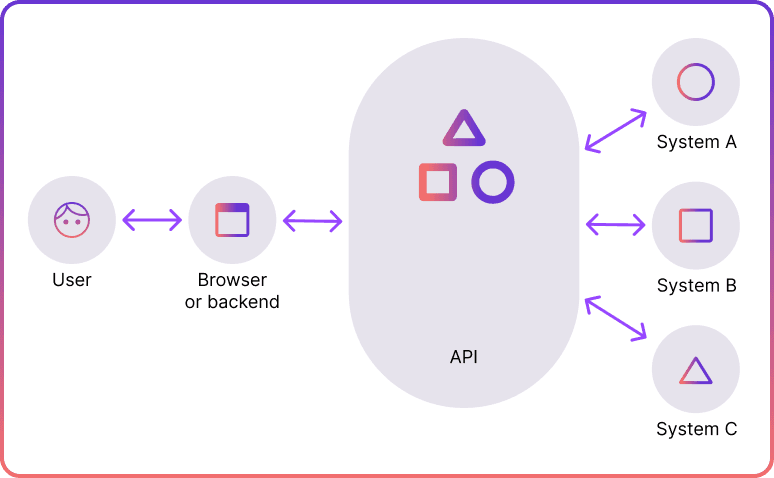

Open banking allows banks to share customer data with licensed third-party providers, like fintech companies, with the customer’s consent. This data sharing happens securely through Application Programming Interfaces (APIs), letting providers access financial information in a controlled way.

APIs are sets of instructions that allow different software systems to communicate securely. Regulators, like the European Commission, set API standards that banks must follow. Once implemented, third-party providers can use these APIs to build new products.

In the past, traditional banks had full control over financial data, making it hard for customers and fintechs to access or use it securely. Open banking changed this by providing a standardised, secure method for data sharing. This shift enables new innovative services, like pay-by-bank payments and account aggregation in budgeting tools.

Open Banking Regulation in Spain: PSD2 & PSD3

Regulatory efforts have played a key role in driving open banking in Europe, especially through the Second Payment Services Directive (PSD2) and the upcoming PSD3.

The European Commission introduced PSD2 in 2015, and it became effective in 2018. PSD2 broke banks' control over customer data, allowing licensed providers to access this data with customer consent.

PSD2 also enhanced consumer protection by requiring Strong Customer Authentication (SCA). Users must verify their identity using multiple factors, to reduce fraud. The regulation covers Monado, the UK and European Economic Area (EEA), including Spain.

While the PSD2 sets the framework and requirements for open banking across the EU, each member state has the responsibility to adapt these rules into their own legal systems. Spain was one of the last EU members to ratify PSD2 in November 2018, over nine months after the directive came into force in January 2018.

Open Banking Standard in Spain

Some EU countries have developed their own open banking API standards. For instance, France uses STET, Germany and the Berlin Group follow NextGenPSD2, the UK has OBIE, and Poland uses PolishAPI. Unlike them, Spain doesn’t have an official standard for open banking APIs. Most Spanish banks rely on a private aggregator for API access, which has become the unofficial standard.

Even without an official API framework, this private standard aligns closely with the Berlin Group’s guidelines on open finance. This ensures that many Spanish banks use similar practices, even for more advanced open banking features.

Open Banking Adoption in Spain

Countries like Sweden, Denmark, Norway, and the UK are often seen as leaders in open banking adoption and progress across Europe. However, a Mastercard report, Four European Takes on open banking, highlights Spain, France, Switzerland, and the Netherlands as emerging players in this space.

According to the report, interest in open banking is growing in Spain, with 60% of Spanish consumers showing interest, as found in a 2021 analysis. This growing interest isn't just local; Spain had the highest number of “passported-in” third-party providers (TPPs) across the EEA and the UK, totaling 129 by the end of 2022. While Spain has only 13 domestic TPPs, trailing behind France’s 28 and the Netherlands’ 29, the report suggests that many international TPPs see great potential in the Spanish market.

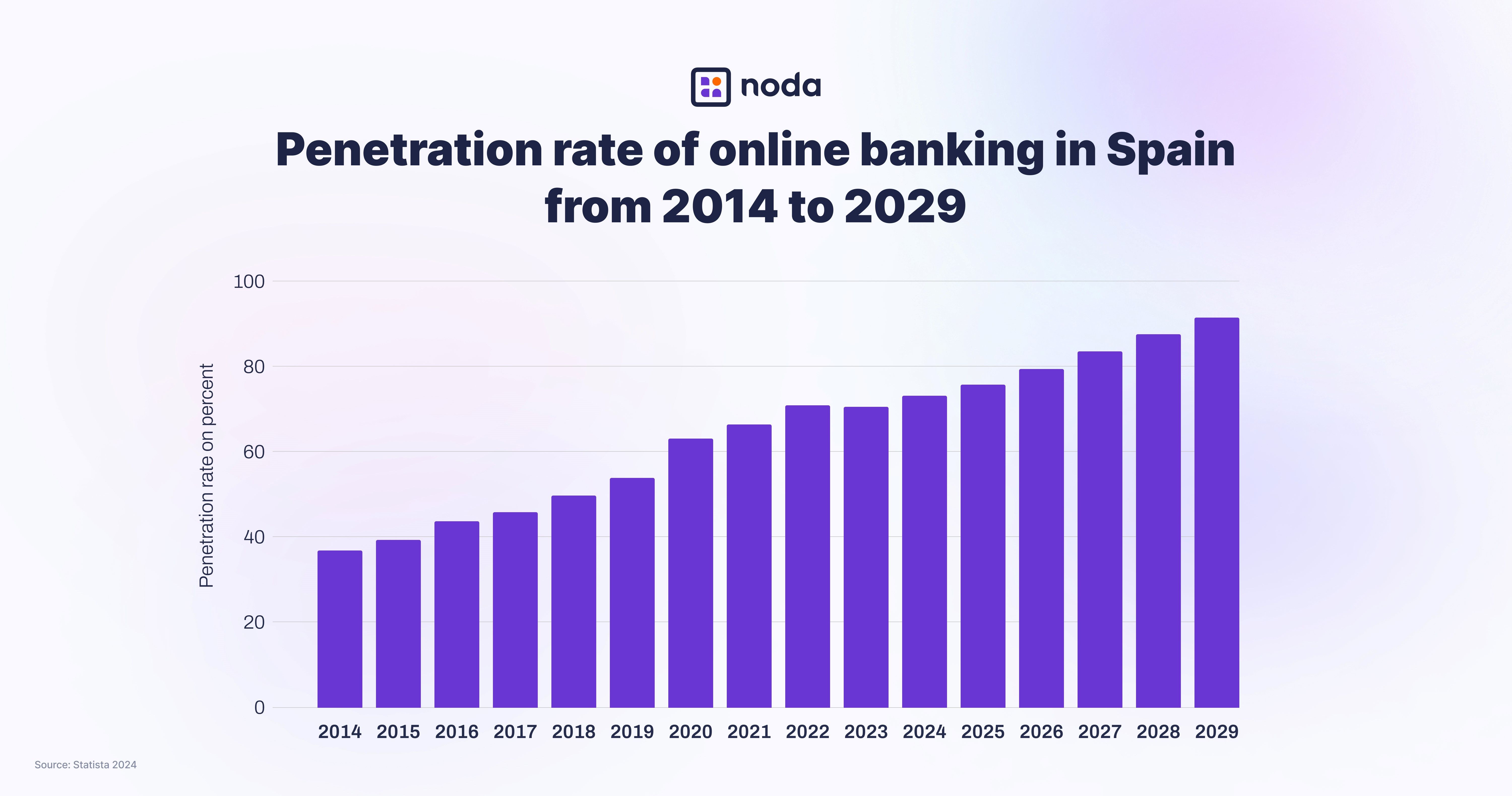

Meanwhile, Spain has an open banking maturity score of 6.7, as reported by Yapily. The country’s digital banking landscape is evolving quickly, with 69% of the population using online banking by 2023.

The online banking penetration rate in Spain was forecast to continuously increase between 2024 and 2029 by Statista, which will likely encourage more adoption and is a positive development for the future of open banking in Spain.

As of October 2024 data from Open Banking Tracker, Spain had 96 banks & account providers; 9 TPPs; 46 Bank APIs and 25 API Aggregators.

Digital Payments Landscape in Spain

Below are some of the key developments that support Spain’s digital payments landscape, paving the way to a better open banking ecosystem.

Iberpay & SCT Inst

Spain has made significant progress in digital payments and open banking, partly through supporting global and local standards. In November 2017, Iberpay, Spain’s national payment system, became the first domestic network to integrate the EPC SEPA Instant Credit Transfer (SCT Inst, part of SEPA Transfers). SCT Inst allows for real-time euro transfers between banks in SEPA countries, ensuring fast and seamless transactions.

As of January 2023, 79% of Spain’s SEPA participants also use SCT Inst, according to a Mastercard report. This is much higher than 52% in France, 41% in the Netherlands, and almost no adoption in Switzerland. Spain’s SCT Inst coverage includes 98% of its payment market, with nearly half (48%) of all credit transfers in the country processed through SCT Inst.

Digital Transformation of Financial System

Spain has also focused on broader financial innovation. In July 2018, before PSD2 took effect, Spain proposed a draft bill to digitally transform its financial system. The law, approved in November 2020, placed Spain among a few European countries—like the Netherlands and Switzerland—that have regulatory sandboxes for testing fintech.

These sandboxes provide a controlled space for banks and fintech firms to experiment with new technologies, ensuring consumer protection while easing regulatory challenges. CaixaBank (formerly Bankia) was the first to submit an open banking use case under this new framework.

Bizum

Spain’s account-to-account payment service, Bizum, aligns with SCT Inst standards and is supported by the central bank and almost all Spanish banks. In 2022, Bizum joined the European Mobile Payment Systems Association, alongside iDEAL.

However, Bizum started with peer-to-peer transfers, which remain its primary use case as a payment gateway in Spain. It has gradually expanded into e-commerce and recently ventured into in-store payments using QR codes.

The popularity of Bizum has driven rapid adoption of instant payments in Spain. According to Yapily, by 2022, around 20.5 million people, or 47% of Spain’s population, were using the service, boosting mobile banking experiences across the country.

Open Banking in Spain with Noda

Looking for a simple, smart open-banking payment processor in Spain? Noda is a great solution, especially for small and medium-sized businesses. Our platform offers everything you need for smooth, secure payments and easy integration.

Why Choose Noda?

Noda does more than process payments. With Noda’s Open Banking API, you can offer direct bank payments with better user experience, lower fees and no chargebacks. That means a smoother, more secure payment flow for your customers and more savings for your business.

With payment plugins for popular e-commerce platforms like OpenCart, WooCommerce, Magento, and PrestaShop, Noda is easy to set up and use. Whether you’re starting out or scaling, we’ve got flexible plans to fit your needs.

Reach More Customers

We offer instant bank payments with flexible fees and a great acceptance rate, partnering with over 2,000 banks in 28 countries, including the EU and more, supporting many currencies.

Noda lets you leverage pay-by-bank technology internationally, saving money on avoiding middlemen fees and chargebacks and offering your customers the convenience of paying through their trusted local banks.

Grow Your Business

From helping with customer verification to improving the user experience and providing customer insights, Noda’s tools are designed to grow your business. We help you make payments easier and forecast long-term value.

FAQs

Does Spain have open banking?

Yes, Spain has open banking. It follows the European PSD2 regulation, which lets banks share customer data securely with approved third-party providers if customers give permission.

Which Spanish banks offer open banking?

Several Spanish banks support open banking. Major banks like CaixaBank and Santander participate through API aggregators rather than a national standard, often aligning with European frameworks such as the Berlin Group.

Is open banking legal in Spain?

Yes, open banking is legal in Spain. The PSD2 directive, adopted in Spain in 2018, regulates it, allowing approved providers to access customer data securely with consent.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each