The open banking technology is gaining momentum in Europe, and France is among the leaders in adoption. Although still behind the UK and Germany, France is embracing the revolutionary trend. The majority of its biggest banks have shared APIs with third-party providers, and API calls are skyrocketing.

Here, we take a look at the French open banking overview, how the sector is regulated, and what are the adoption trends.

What is Open Banking?

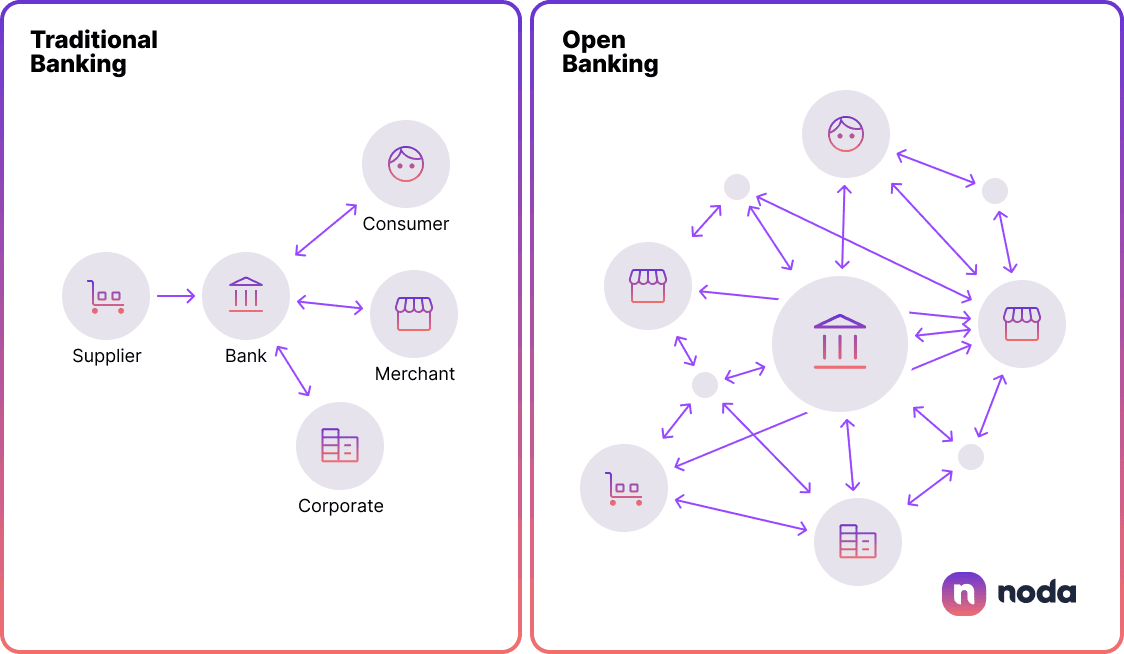

At its core, open banking is a modern approach that breaks away from the confines of traditional banks’ infrastructure, embracing the boundless possibilities of the digital world. But what exactly is open banking, and how does it work?

Power of APIs

Open banks hinge on the use of open APIs—Application Programming Interfaces. These are essentially bridges that allow different software systems to communicate and share information with each other seamlessly. Imagine it as a kind of universal translator, converting jargon from one software into a language another software understands.

In the realm of open banking, APIs play a crucial role in securely sharing financial data among banks and authorised third-party service providers. This exchange of data promotes the development of innovative financial products and services that can effortlessly integrate with existing banking systems.

Open Banking Regulation in France: PSD2

Europe, often referred to as the “cradle” of the open-banking market, saw the concept originate with its implementation of the Revised Payment Service Directive (PSD2) in 2018. The new derivative shattered the monopoly European banks held over customer data, requiring them to share Application Programming Interfaces (APIs) with third-party providers.

This has democratised financial information and resulted in better, more personalised products for clients. The regulation is adopted by the states within the European Economic Area (EEA), including France.

Yet the PSD2 may be just the beginning. In June 2023, the European Commission released a draft legislation PSD3. The new regulation will aim to further advance open banking and tackle issues like API quality.

PSD2 Implementation: ACPR & Banque de France

In France, the process of PSD2 implementation faced several hurdles and cultural challenges. French banks were initially reluctant to embrace open banking practices.The Autorité de Contrôle Prudentiel et de Résolution (ACPR) was appointed as the regulatory body responsible for overseeing the implementation of PSD2.

In 2022 speech, Banque de France first deputy Denis Beau has expressed a commitment to open finance in France, but it is taking a cautious approach. Beau admitted that some of the key challenges for open banking in France were the technical complexity of standardised APIs development, and service providers’ reliance on traditional institutions.

In his sentiment on the future of open finance in Europe Beau said: “Should there be an extension of sharing to other financial data, the PSD2 directive calls for a more explicit definition of shareable data, a clearer allocation of responsibilities for authentication, and the promotion of the use of standardised APIs.”

Open Banking in France: Current State & Adoption

According to Banque de France, the number of financial agents registered with the ACPR has risen by more than 40% between 2021 and 2022, with almost 3,300 registrations in 2021. This means more players within the French open banking system.

According to the Open Banking Tracker as of October 2023, there were 89 bank APIs and 21 API aggregators in the country. This included French biggest banks BNP Paribas, Societe Generale and Credit Agricole.

Among the key enablers of the French open banking ecosystem is Systèmes Technologiques d'Échange et de Traitement (STET), an interbank clearing platform developed by a group of major French banks in 2004. STET is also a PSD2-compliant API provider for many large banks offering features like authentication, authorisation, proof management and fraud detection.

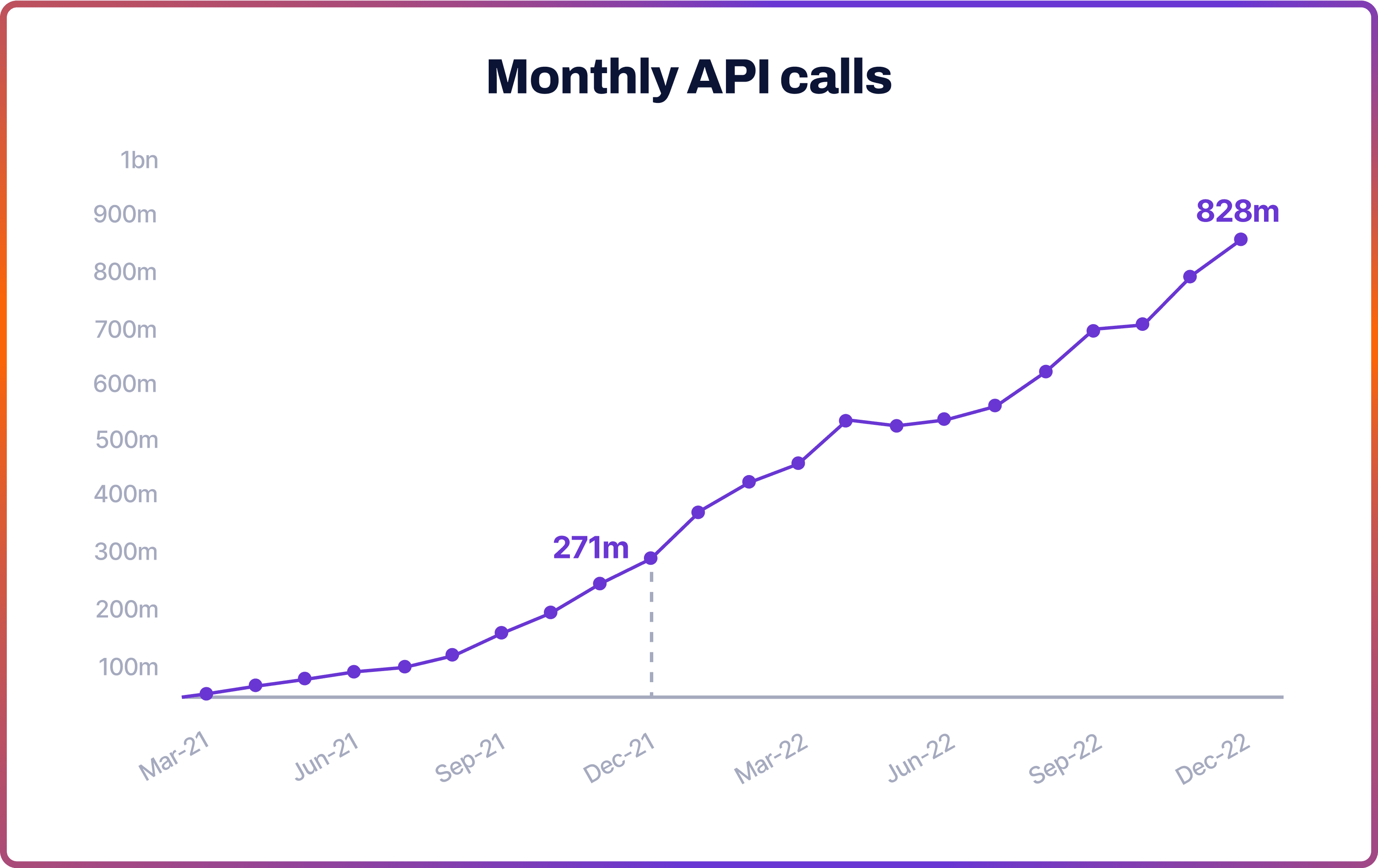

Open banking adoption in France is growing rapidly. According to data from Konsentus, monthly API calls in France amounted to 828 million by December 2022. That’s a staggering growth of 2335% compared to 34 million in March 2021. France was only outpaced by the UK and Germany, with 1.79 billion and 951 million API calls. Konsentus explains the surge by the shift to digitalisation due to the global pandemic.

Future of Open Banking in France

The European forecasts for growth look promising, this is including open banking opportunities in France. Forrester, for example, expected open banking adoption in Europe to double across countries and use cases between 2022 and 2027.

“We expect the gap between consumer interest and adoption to narrow through 2027 as the open banking ecosystem resolves some key challenges,” said Jacob Morgan, Forrester’s principal analyst.

The agency expected the pace of adoption to slow between 2022 and 2024 “due in part to the greater complexity of open banking solutions and deployments, before accelerating again through 2024–’27”.

Meanwhile, regulation is likely to play a key role in shaping the open banking landscape in France. The PSD3 directive, although still not approved by the European Parliament and Council, will aim to improve security and consumer protection and standardise regulations across Europe.

Benefits of Open Banking

- Personalised Banking Services: Traditional banks historically underused consumer financial data. Open banking empowers clients to consent to sharing their data. In turn, they can receive personalised financial services.

- Accelerating Transactions: Open banking speeds up transaction times, facilitates direct payment initiation, bypasses slower traditional payment networks, and enhances operational efficiency.

- Boosting Innovation: In a landscape where banks compete with tech companies, open banking leverages API sharing for collaborative innovation. This encouraged banks to collaborate with fintechs and third-party service providers.

Open Banking with Noda

Elevate your business with Noda’s payments and open banking solution. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Your payments are our priority.

FAQs

How can France benefit from open banking?

Open banking brings about efficiency, innovation, accelerated transactions and more personalised financial services. The rising adoption of open banking in France will deliver these advantages to the country.

Is open banking legal in France?

Yes, open banking is legal and regulated in France under the PSD2 directive. The derivative shatters the monopoly European banks held over customer data, requiring them to share Application Programming Interfaces (APIs) with third-party providers.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each