SEPA, or Single Euro Payments Area, is a payment network that covers European countries. It allows bank accounts across borders to send and receive money transfers.

SEPA payment system facilitates transfers exclusively in euros. It is regulated by the European Payments Council (EPC) and handles more than 50 billion euro transactions in SEPA, including over 29 billion credit transfers.

SEPA aims to standardise transactions between European financial institutions, providing a uniform framework. Before SEPA was established, European countries operated as separate national markets, which complicated cross-border transactions. In the US, for example, the equivalents to SEPA are the ACH and Fedwire networks.

SEPA Countries

As of July 2025 SEPA region countries includes 41 European nations, including several countries which are not part of the euro area or the EU, such as the UK, Switzerland, and the newest member – Serbia.

SEPA has also expanded its reach, with Serbia becoming the newest member in May 2025. SEPA transfers to and from Serbia will roll out fully by mid 2026.

| EU / EEA SEPA Countries | Non-EEA SEPA Countries |

| Austria | Albania |

| Belgium | Andorra |

| Bulgaria | Moldova |

| Croatia | Monaco |

| Cyprus | Montenegro |

| Czech Republic | North Macedonia |

| Denmark | San Marino |

| Estonia | Serbia |

| Finland | Switzerland |

| France | United Kingdom |

| Germany | Vatican City State |

| Greece | |

| Hungary | |

| Iceland | |

| Ireland | |

| Italy | |

| Latvia | |

| Liechtenstein | |

| Lithuania | |

| Luxembourg | |

| Malta | |

| Netherlands | |

| Norway | |

| Poland | |

| Portugal | |

| Romania | |

| Slovakia | |

| Slovenia | |

| Spain | |

| Sweden |

History of SEPA Transfers

SEPA was launched in 2008 for credit transfers and expanded to include direct debits by 2009. The full implementation of the programme was achieved in 2014 for Eurozone countries and by 2016 for non-euro SEPA states.

The legal framework for SEPA was developed by the ECB in close collaboration with the European Commission. It primarily relies on several key regulations: the Cross-border Payments Regulation, the Payment Services Directive (PSD/PSD2), the SEPA Migration End-Date Regulation, and the Interchange Fee Regulation.

SEPA established common standards, procedures, and infrastructure that all member states agreed to use for fund transfers. The initiative lowered the barriers to transferring money between accounts but also reduced the costs of moving capital across the EU and nearby countries.

Since 2022, SEPA has been shifting into a faster and more secure phase, with a stronger focus on real-time payments and fraud prevention. This effort led to the introduction of the EU Instant Payments Regulation in 2024, which brought in some major changes. From 9 January 2025, all banks in the euro area must be able to receive SEPA Instant Credit Transfers. Then from 5 October 2025, sending SEPA Instant Payments will become mandatory, marking a turning point where both inbound and outbound instant transactions must be supported. The update will go live at 03:30 CET on 5 October 2025—earlier than the usual evening system updates to minimise downtime. At the same time, the existing €100,000 limit for instant transfers will be lifted, enabling larger payments to be processed instantly.

Banks and payment service providers must also meet strict new compliance rules. Every step of a transaction must now be completed within a strict time frame. For example, the recipient's bank has just nine seconds to respond, and if something goes wrong, a refund has to be issued within ten seconds. To tackle fraud, banks must also check that the account holder's name matches the IBAN before a payment can go through. This verification of payee rule will apply to all payment types, including large batch files.

Altogether, these changes represent the biggest update to SEPA since it was launched. They also bring new pressure for banks and providers to stay compliant around the clock, carry out real-time checks for fraud and sanctions, and maintain enough liquidity to keep instant payments running smoothly across Europe.

How Does SEPA Work?

SEPA enables direct debits from any EUR-denominated bank account within the SEPA region. This also makes payments within any member country straightforward and cost-effective.

SEPA account holders can receive direct payments and make electronic payments from their bank accounts, even when travelling in another country. For consumer transactions, SEPA enables businesses to debit accounts within any member country directly.

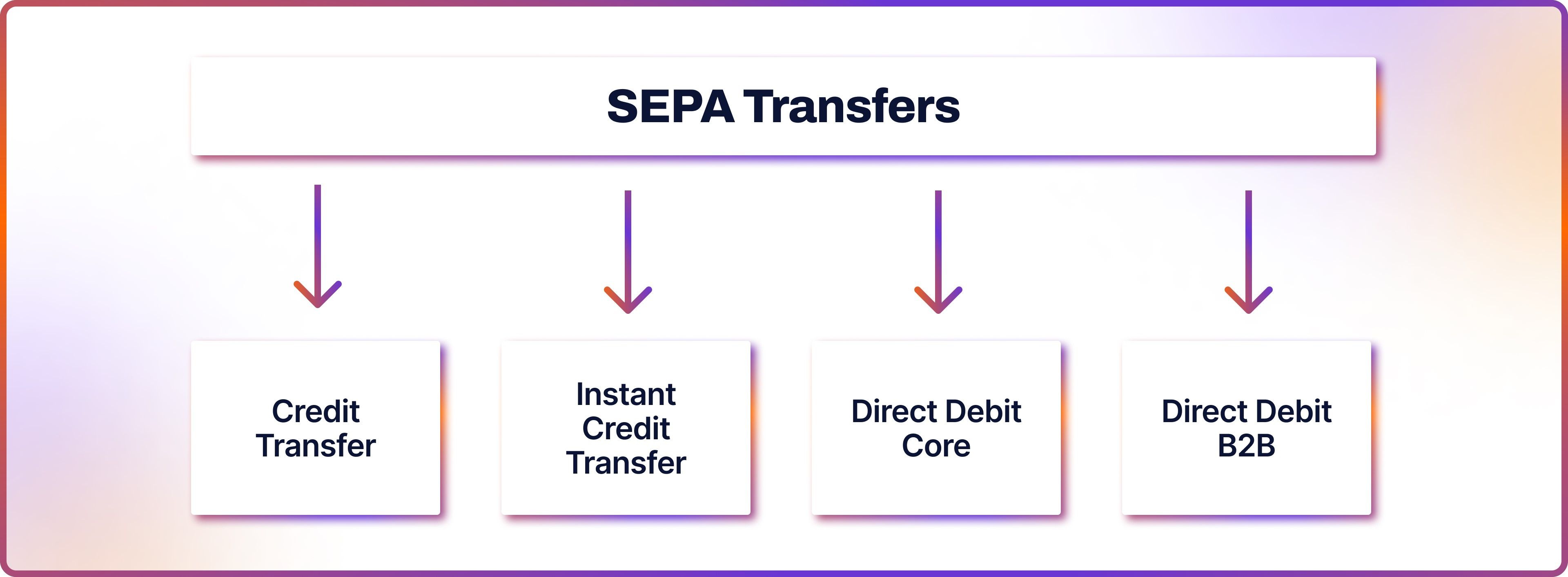

SEPA Transfers Explained

There are four main types of SEPA money transfers. Let’s take a look at them in more detail.

Sepa Credit Transfer

SEPA Credit Transfers are single-time transfers between banks that use IBAN codes. They are carried out in euros, and are typically utilised for consumer purchases within SEPA countries. If your business is outside the SEPA area, you would not use this type of transfer, as both the sending and receiving banks need to be located in the SEPA territory.

SEPA Instant Credit Transfer

SEPA Instant payments enable real-time transactions of up to €100,000, unlike typical SEPA transfer duration that can take hours or days to process. With this method, any two account holders in the SEPA area can complete euro-based transactions instantly, at any time and on any day. Ninety-nine per cent of these transactions are processed within five seconds and can be done using smartphones.

Sepa Direct Debit Core

A SEPA Direct Debit is a recurring payment that needs to be set up only once. This allows businesses to automatically collect varying amounts at regular intervals directly from a customer's bank account. Customers must give their permission through an agreement, such as for subscriptions or recurring payments. This method helps improve cash flow and reduce missed or late payments.

SEPA Direct Debit B2B

SEPA Direct Debit B2B payments are used for transactions between companies or with authorities, such as loan repayments, tax payments, and large purchases. Unlike SEPA Direct Debit Core payments, B2B payments require mandate verification and have different refund rules. The mandate must be registered by the debtor's Payment Service Provider (PSP) before processing, a step that ensures extra security.

How to Make a SEPA Payment

Every bank account in the SEPA area has an International Bank Account Number (IBAN). SEPA transfers require the IBAN codes of all European accounts involved in the transaction.

To make a SEPA transaction, start by gathering the recipient's bank details. This includes their full name, IBAN, and country, along with their SWIFT or BIC if necessary.

Visit your local bank branch with this information and your own account details. The bank agent will help process the transfer. They will inform you about any fees, which are similar to domestic transfer costs, and currency exchange charges if applicable. Normally, transfers take one business day, but if both banks support ‘SEPA Instant’, it will take about 10 seconds.

How Long Does SEPA Transfer Take?

Most SEPA transfer time does not exceed one to two business days, if sent before the cut-off time. SEPA Instant Credit Transfers settle in just 10 seconds. SEPA B2B Direct Debit transactions take at least three business days.

Do I Need SEPA for My Business?

European businesses do not require a specific bank account to use the SEPA network. SEPA is not a bank but a system used by banks within its member countries. If your business bank account has an IBAN and is in a SEPA member country, you can use SEPA services.

Should non-SEPA area businesses open a European bank account to use SEPA? If you have European subsidiaries or operations within SEPA countries, getting an IBAN by opening a local bank account could be beneficial. This can allow access to SEPA Credit Transfers and Instant Credit Transfers, and cheaper cash withdrawals across Europe.

If your business operates in Europe and already has an IBAN, using SEPA is typically straightforward. For those based outside the SEPA area, opening a local European bank account can offer easier access to Euro payments and lower transaction costs when operating within the region.

Once your business is set up to send or receive SEPA payments, the next step is choosing the right partner to manage them efficiently.

Accept SEPA Payments with Noda

If you are an e-commerce merchant looking to elevate your online sales, Noda is where you should be looking. Our open banking platform enables online merchants to accept SEPA payments in Europe, Faster Payments in the UK, and other local pay-by-bank methods – instantly, securely, and with minimal costs. We work with over 2,000 banks across 28 countries, giving you access to more than 30,000 bank branches. Whether you are expanding across Europe or focusing on local customers, Noda’s support for multiple currencies and flexible plans can meet your needs.

Why choose Noda for SEPA Payments?

1. Broad connectivity

Connect to 2,000+ banks across 28+ countries in Europe and beyond through a single integration, covering all major financial institutions in countries like Germany, France, Italy, Spain, the Netherlands, the Nordics, the Baltics, and many more.

2. Extremely low transaction fees

Start from 0.1% per transaction – a fraction of typical card fees. Pass savings onto your customers or boost your bottom line with higher margins.

3. Instant account-to-account settlement

Receive funds in seconds, not days. No card networks, no delays, just fast, secure payouts via open banking rails.

4. Plug & play integration

Go live in minutes with plugins for WooCommerce, Magento, Prestashop, and OpenCart or use our flexible API for custom integration.

5. All-in-one payment platform

Support multiple payment rails in one place – open banking, card payments, Apple Pay, Google Pay, and more for maximum checkout flexibility.

6. No-code payment tools

Create payment links and QR codes instantly. Accept bank payments online or offline. No developer required.

7. Personalised

Work with a dedicated account manager who will understand your market, ensure a smooth onboarding process and provides responsive support.

Ready to get started? Book your demo with Noda today and bring instant payments to your checkout.

FAQs

What is the difference between a bank transfer and a SEPA transfer?

A bank transfer refers to any electronic movement of money, which can be domestic or international. This includes wire transfers and ACH transfers. A SEPA transfer, on the other hand, is specific to the Single Euro Payments Area, meaning it only facilitates euro transactions across Europe. SEPA transfers are standardised using IBANs, are typically faster, and incur lower fees than traditional bank transfers. They are regulated under EU law.

Do banks charge SEPA transfer fees?

Almost all SEPA transfers are free. Banks that handle SEPA payments usually form a network of intermediary banks that facilitate cross-border transfers, or they maintain direct business relationships with other banks. This setup makes SEPA transfers cost-efficient.

Is SEPA the same as SWIFT?

No, SEPA and SWIFT are not the same. SEPA is a system that simplifies bank transfers in euro across Europe. SWIFT (Society for Worldwide Interbank Financial Telecommunication), on the other hand, is a global network that enables financial institutions worldwide to send and receive information about financial transactions. SWIFT is used for international transactions involving multiple currencies and countries, unlike SEPA, which is limited to Euro transactions within Europe.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each