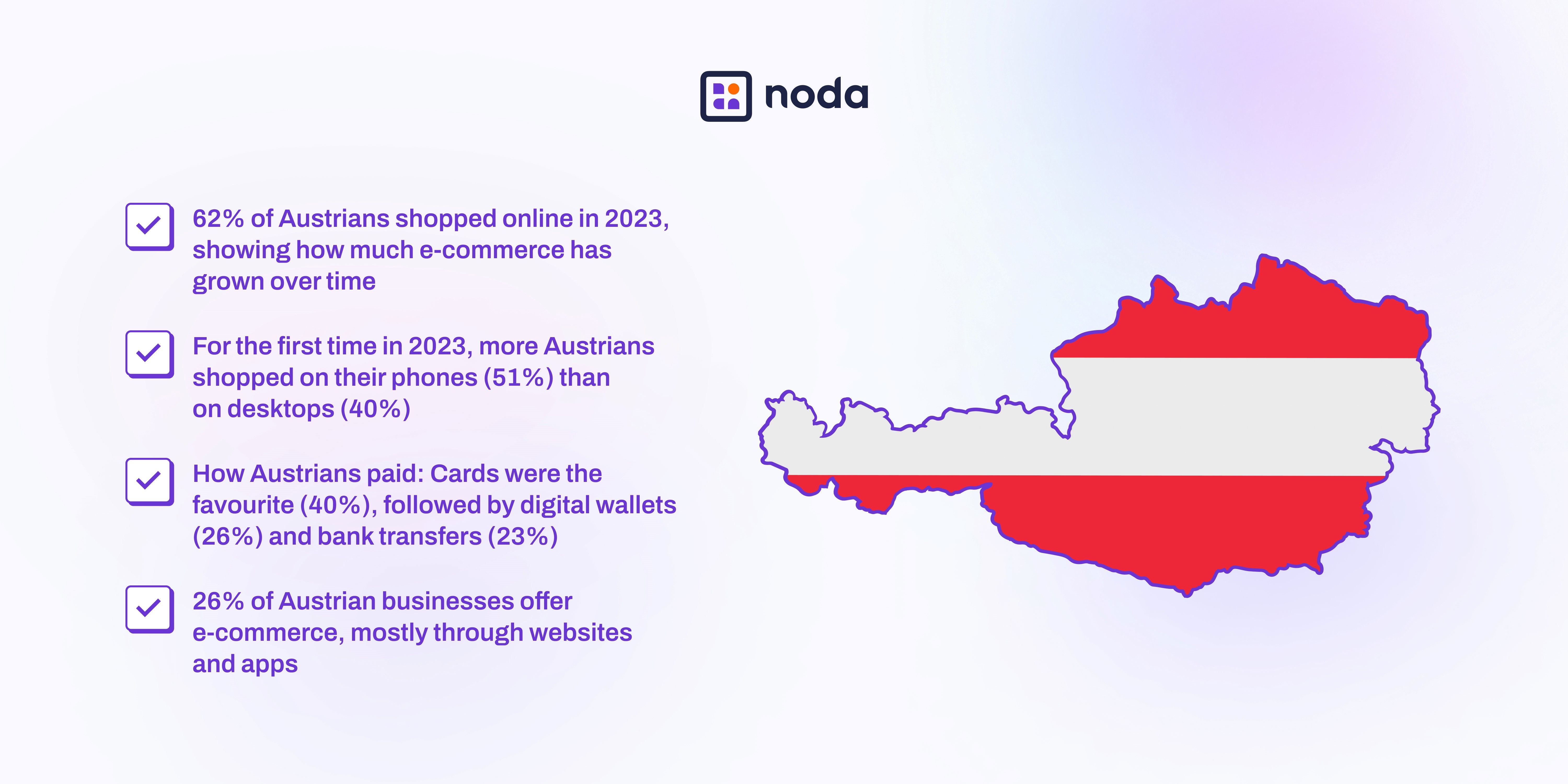

Austria’s financial sector is transforming through open banking, driven by PSD2 compliance and growing demand for digital financial services. With digital payments reaching €30.5 billion in 2023 and 59% of consumers opting for mobile banking, the country is shifting towards innovative financial solutions that meet the needs of both businesses and consumers.

This comprehensive guide explores Austria's open banking landscape, from regulatory frameworks and banking standards to leading payment gateways and processors. For merchants focused on optimising payments or fintech professionals pursuing market insights, discover how open banking is reshaping financial services in Austria.

What is Open Banking?

Open banking is a secure, regulated system that allows authorised third-party providers (TPPs) to access financial data and handle transactions using secure APIs. It’s guided by the EU’s PSD2, which promotes transparency and innovation in payments.

In Austrian e-commerce, digital payment methods such as PayPal, Google Pay, Klarna, and payment by invoice dominate 62% of online transactions. However, these traditional methods often come with high fees and settlement delays of 2-5 business days. Open banking offers a more efficient alternative by addressing these issues directly.

Key benefits include:

- Quick Payments: Instant, smooth transfers between accounts.

- Better Data Use: Real-time financial insights for smarter decisions.

- Multi-layered Protection: Strong Customer Authentication (SCA), encrypted APIs, and comprehensive data safeguards combine to ensure secure transactions.

The business case for open banking is compelling: it opens potential for improved cash flow, lower costs, and happier customers.

Open Banking Regulation in Austria

Austria follows the EU's PSD2 regulation, which requires banks to securely share data with authorised third-party providers through APIs. This forms the foundation of open banking in Austria, allowing customers more transparency, control, and improved access to financial services.

In 2020, Austria’s Financial Market Authority (FMA) introduced regulatory sandboxes to encourage innovation. These sandboxes give fintech companies a safe way to test their ideas, helping Austria lead in open banking and fintech.

Austria’s fintech sector is thriving, with over 300 companies exploring areas such as:

- Digital Payments Solutions: Simplifying payments with secure mobile options, contactless methods, and alternative solutions tailored for consumers and businesses alike.

- Financial Management: Platforms like Xencio offer SMEs real-time cash flow insights and automated tools through open banking APIs, simplifying financial management.

- Investments and Insurance Innovation: Platforms that integrate financial planning with embedded insurance services to simplify consumer finances.

Open Banking Guidelines in Austria

In addition to building on the EU's PDS2 framework, open banking in Austria also incorporates local nuances. Here are the core guidelines that keep the system running smoothly and securely:

Explicit Consent

Before any data sharing happens, customers need to clearly agree to it. This is more than a routine formality — it’s about making sure people know exactly what’s being shared and why. Consent under PSD2 is also distinct from GDPR-defined consent, adding an extra layer of clarity.

Data Minimisation

Banks and third-party providers can only process the data that’s absolutely necessary for their service. This ensures a lean, privacy-focused approach that aligns with GDPR principles.

Transparency Requirements

Providers have to be upfront about their data practices. Under GDPR Articles 13 and 14, they’re obligated to explain what data they’re using and how they intend to use it.

Security Protocols

Open banking ensures security through a layered approach. Secure APIs, Strong Customer Authentication (SCA), strict regulatory oversight, and robust data protections form a safety net that keeps every interaction between banks and service providers safe and reliable.

With consumer privacy and data integrity at its core, this framework creates a secure foundation for trusted and efficient financial interactions.

Open Banking Adoption in Austria

Open banking in Austria is on the rise, supported by PSD2 regulations and secure APIs. In 2023, digital payments totaled €30.5 billion.

By mid-2024, 59% of consumers preferred mobile banking, showcasing a shift towards faster and more convenient financial management. This change reflects the demand for digital financial services that offer instant payments, automated account management, and integrated financial tools.

Austria’s neobanking market is estimated to have approached €13.22 billion in transaction value by the end of 2024, driven by increasing demand for instant payments, automated account management, and integrated financial tools. This trend underscores open banking’s role in driving innovation and empowering consumers with greater control over their finances.

Austrian banks are actively participating in open banking opportunities through their APIs, partnering with fintechs to develop new services. For consumers, this collaboration brings simpler payments, tailored services, and better financial tools.

Payment Gateways and Processors in Austria

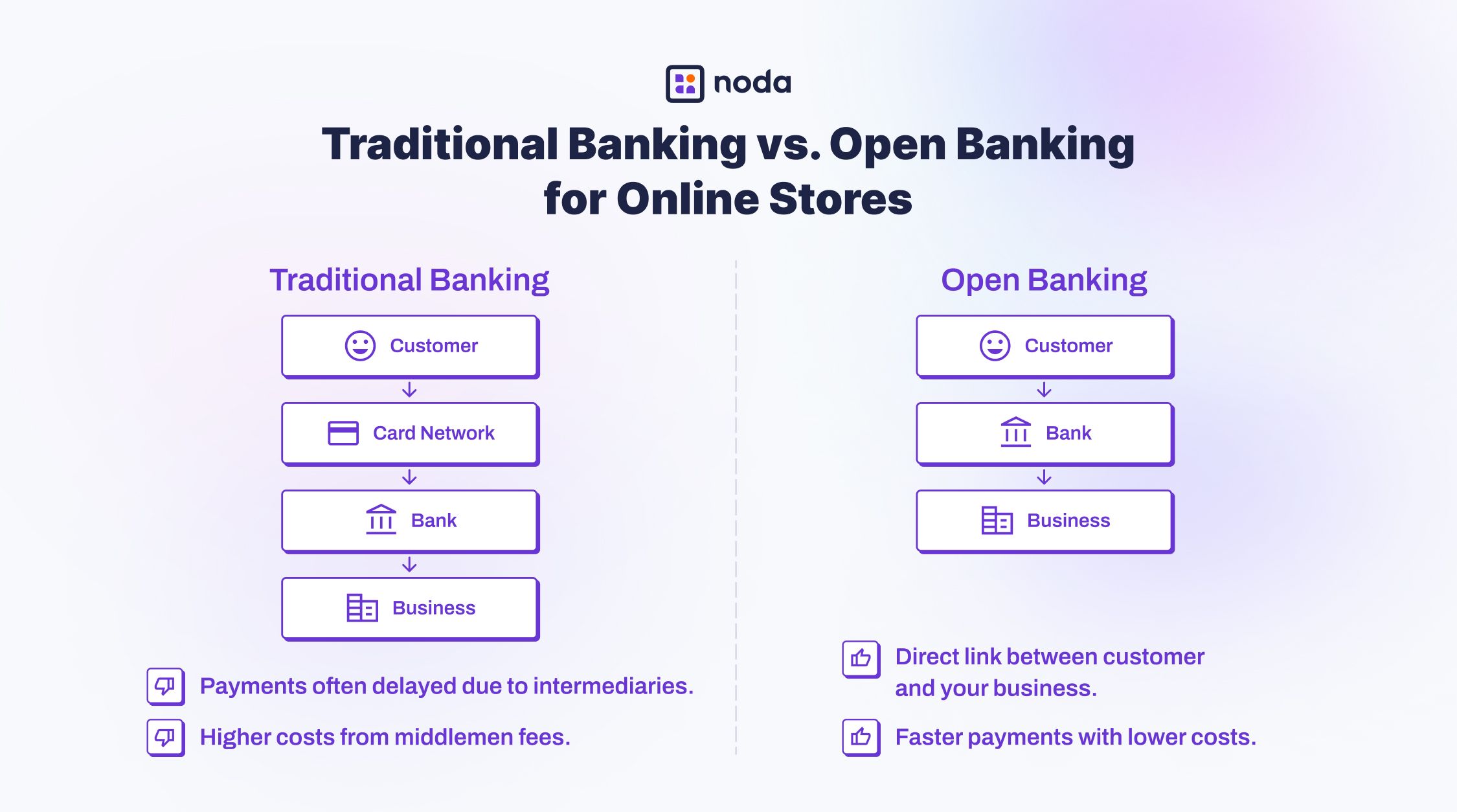

Open banking solutions like Noda integrate directly with Austrian banks through secure APIs, offering account-to-account payments that bypass card networks. This setup benefits merchants with reduced costs, faster settlements and a streamlined checkout process, all while ensuring shopper data stays secure.

Open banking doesn’t replace traditional methods but complements them, solving issues of cost and efficiency in the digital payment space.

Open Banking vs Traditional Banking Services in Austria

While traditional banking remains common in Austria, open banking infrastructure and digital-first banks (neobanks) are reshaping the financial sector. Open banking enables secure and efficient data sharing through APIs, while neobanks provide consumers and businesses with fully digital services.

Digital banking adoption in Austria is on the rise, with the neobanking market approaching €13.22 billion in transaction value in 2024. This change reflects the demand for digital financial services that offer instant payments, automated account management, and integrated financial tools.

The Future of Open Banking in Austria

The future of open banking in Austria looks promising, driven by consumer demand for integrated financial services and business needs for more efficient payment solutions. While regulators refine the framework, payment providers like Noda are developing solutions that turn open banking’s potential into tangible benefits for merchants and consumers.

As the sector evolves, the focus is on expanding advancing payment systems and innovative financial tools. Achieving this will require ongoing collaboration between banks, fintechs, and regulators to establish robust API standards and deliver consistent services across the ecosystem.

Why Choose Noda for Open Banking in Austria?

Noda provides a comprehensive open banking solution for businesses operating in or entering the Austrian market. By integrating payments processing, account-to-account transfers, and financial data services, Noda reduces transaction costs, speeds up settlements, and delivers actionable insights to businesses.

With direct API connections to Austria’s leading banks like Erste, UniCredit, Raiffeisen, and BAWAG, as well as integration with over 2,000 banks across 28 countries, Noda allows businesses to manage transactions seamlessly across borders through a single API integration or e-commerce plugins.

Our focus is on expanding open banking in Austria, enabling businesses to use bank-to-bank payments and financial data to optimise operations and improve customer experiences.

FAQs

Does Austria have open banking?

Yes, Austria has implemented open banking through the EU’s PSD2 directive. This allows third-party providers to access banking data securely and with customer consent, fostering innovation in the financial sector.

Which Austrian banks offer open banking?

Most major Austrian banks have adopted open banking. This includes traditional banks and newer digital-first banks that provide secure APIs for payments and data sharing. The exact services can vary by bank, but the majority are compliant with PSD2 standards.

How does Austria ensure open banking is safe and regulated?

Austria’s open banking system operates under the EU’s PSD2 directive, which mandates secure APIs and strict customer consent requirements. This ensures data is shared securely between banks and authorised third-party providers, protecting consumer privacy and enabling innovation.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each