Open banking is revolutionising payments in Europe, and Sweden is leading the way in this transformation. The country’s dedication to embracing digital innovation is evident in its open banking landscape and the level of digital advancement in its society. Combined with a regulatory environment that promotes proactive measures, Sweden has positioned itself as a leading hub for fintech innovation throughout Europe.

Here, we provide a Swedish open banking overview, explain how the market is regulated in the Scandinavian country and its key initiatives.

Open Banking Regulation in Sweden

The Swedish open banking regulation derives itself from the European Payment Service Directive 2 (PSD2), which reshaped the financial industry in Europe.

This groundbreaking regulation promotes competition, innovation, and security in the payment services sector. Under PSD2, banks, and other account-servicing providers must share customer data such as application programming interfaces (APIs) with third-party providers (TPPs), but only with the explicit consent of the customers. This framework has opened up opportunities for a broad range of innovative financial services and products, empowering consumers with greater choices and control over their financial information.

As an active member of the EU's financial ecosystem, Sweden has implemented PSD2 into its system, emphasising payment account information. The Financial Supervisory Authority, or Finansinspektionen, is the key regulator of Swedish banking standards, which is overlooking open banking too.

API Data-Sharing with TTPs

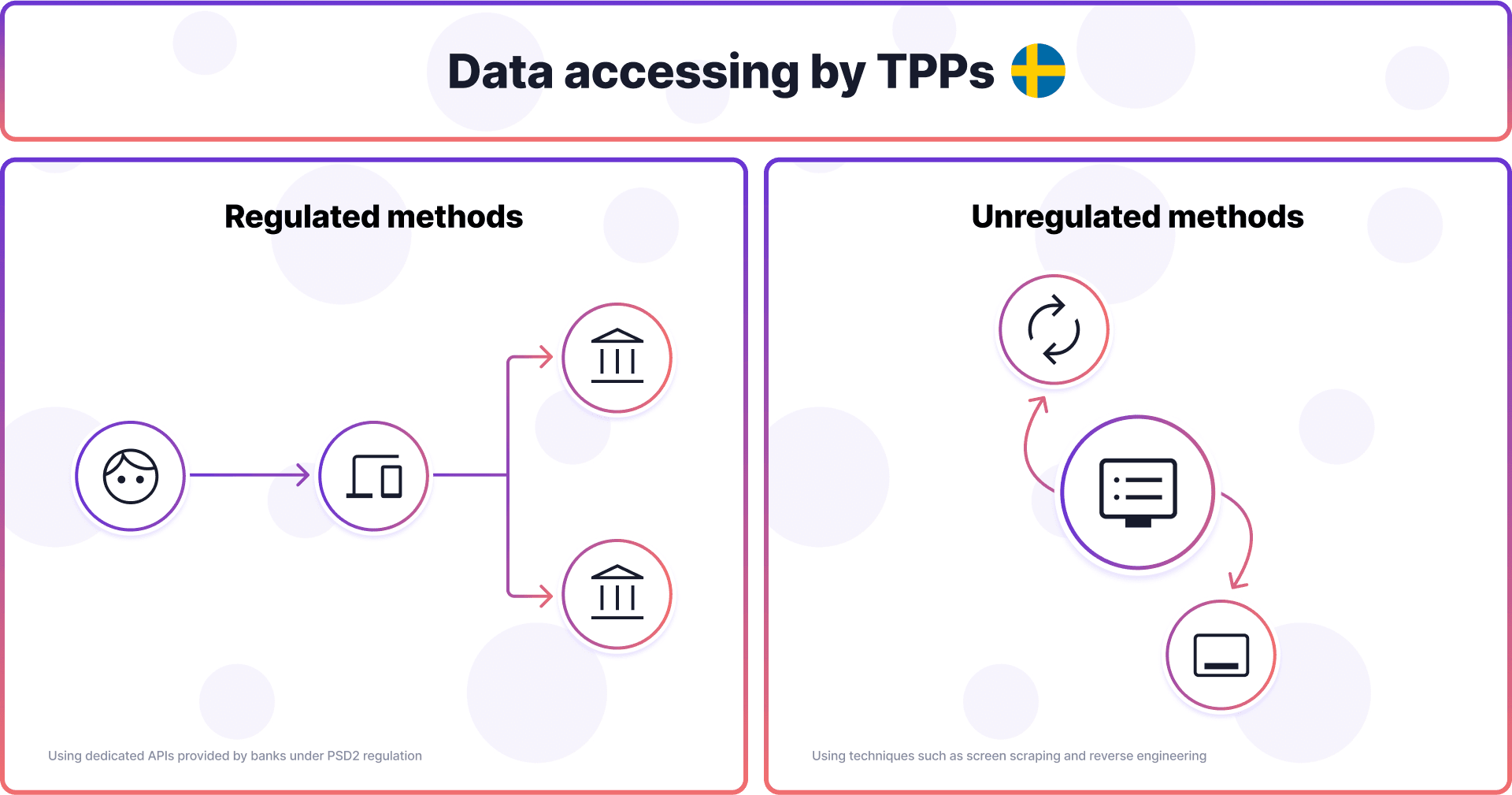

In Sweden, the open finance landscape offers both regulated and unregulated options for accessing data. The regulated method, as required by PSD2, involves using dedicated APIs provided by banks. On the other hand, unregulated practices, such as screen scraping or reverse engineering, don't rely on an interface supported by the counterparty. Since these methods are not regulated, third-party providers do not have guaranteed access rights to customer data, and there is no standardised process for retrieving the data.

Additionally, a few financial service providers in Sweden have created premium APIs for TTPs. However, these offerings are not widely available or comprehensive and are often limited to specific partners, making them exclusive rather than open to all.

The country’s open banking path hasn't been without its obstacles, according to Finansinspektionen’s June 2023 report Open Finance in Sweden. Several TPPs have reported difficulties, citing concerns about data accessibility and functionality requirements. Conversely, banks have observed that certain TTPs opt for unregulated methods such as screen scraping instead of using the designated interfaces.

Swedish Open Banking Ecosystem

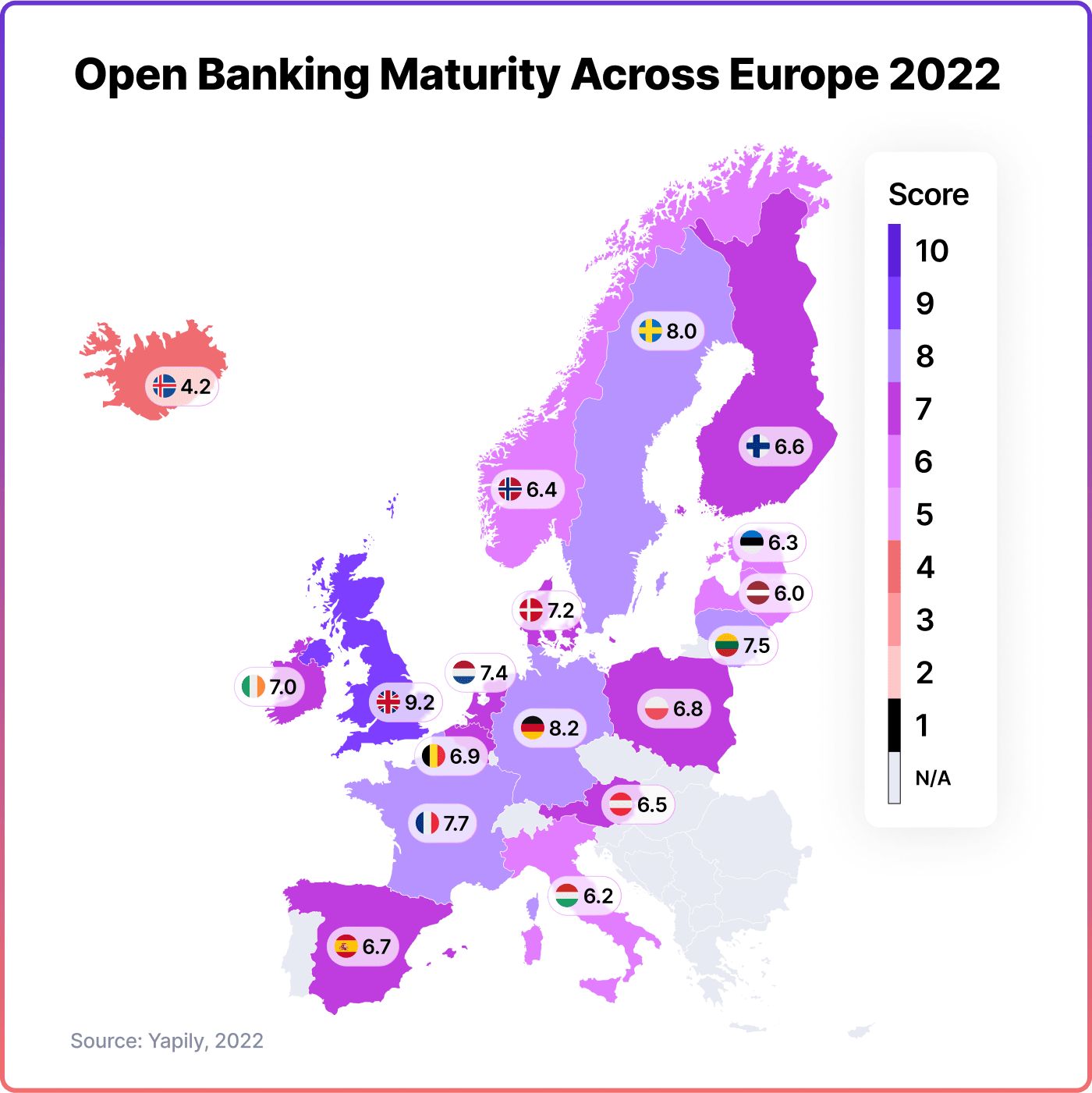

Sweden is the frontrunner in open banking and fintech among Nordic countries, with a market maturity score of 8, according to a report by Yapily published in 2022. The country’s open banking sector is the most developed in Europe after the UK and Germany.

The country has been recognised by the European Commission's Digital Economy and Society Index (DESI) as Europe's fourth most digitised society in 2022. Meanwhile, according to the Mastercard report, an impressive 96% of households in Sweden had internet access, and 84% of 14-76 year-olds were using digital banking in 2021.

The high level of market maturity and welcoming regulations made the country a significant contributor to the European fintech landscape. Prominent Swedish fintech companies like Klarna and Tink have played a pivotal role in transforming the industry.

Sweden’s A2A Platform: Swish

Swish, the nation's real-time platform for account-to-account (A2A) transfers, is central to Sweden's open banking success. Born out of a collaboration between six major Swedish banks in 2012, Swish was envisioned as a solution to streamline payments in an increasingly digital economy.

The platform's success surpassed expectations. Swish boasts over 8 million users, representing approximately 80% of Sweden's population. The platform set a benchmark for payment systems across Europe by offering a reliable, real-time payment solution.

Nordic Collaborative Models & P27

The report Mastercard revealed that Sweden, Denmark, and Norway are leading the way in terms of their open banking ecosystems. These Nordic countries have been able to establish a strong position due to their innovative regulatory frameworks, advanced digital infrastructure, and collaborative efforts across the region.

The Pan-Nordic collaborative models and initiatives like P27 have played a significant role in fostering the readiness for open banking in these countries. Many of the major banks in this region, including Nordea Group and DNB Bank, have embraced open banking strategies.

P27 is a payments platform created to enhance collaboration among the Nordic countries. Its main goal is to offer a seamless and efficient payment experience to the 27 million residents in the region.

In February 2018, several major financial institutions came together with the goal of establishing a unified Nordic payment infrastructure. The aim was to improve efficiency, standardisation, and cost optimisation within the region.

The project is a collaborative effort between six of the largest banks in the Nordics: Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB, and Swedbank. The ownership of P27 is equally distributed among these banks. The rollout of P27 will occur in phases, with the full release expected after 2025.

Final Thoughts

Sweden has taken a strategic and practical approach to open banking, positioning itself as a leader in the European landscape. By adopting the PSD2 framework early on and integrating platforms like Swish successfully, the country has made significant advancements.

The presence of major players like Klarna and Tink in Sweden's fintech sector further demonstrates its dedication to digital financial innovation. This serves as a clear blueprint for businesses and policymakers, emphasising the importance of prioritising digital infrastructure, fostering innovation, and aligning with regulations in open banking.

Open Banking with Noda

Elevate your business with Noda’s open banking and payments solution. Drive increased sales and save valuable time through streamlined processes. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide online payment processing and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Unlock your business potential with Noda - your payments are our priority.

FAQs

What is the future of open banking in Sweden?

Sweden's open banking sector is set to embrace digital innovation and foster collaboration. With successful platforms like Swish already paving the way and initiatives like P27 striving for a unified Nordic payment infrastructure, Sweden is well-positioned to enhance standardisation, efficiency, and cross-border cooperation in its open banking landscape.

How can Sweden benefit from open banking?

Open banking can provide numerous advantages, including promoting a competitive and innovative financial ecosystem. This grants consumers more control over their financial data and enables them to access personalised financial services that cater to their specific needs.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each