Welcome to the era of open banking. It's a groundbreaking shift in the financial sector, captivating in its complexity and allure. Open banking revolves around transparency and collaboration, shattering conventional divisions within the financial world with the power of Application Programming Interfaces (APIs).

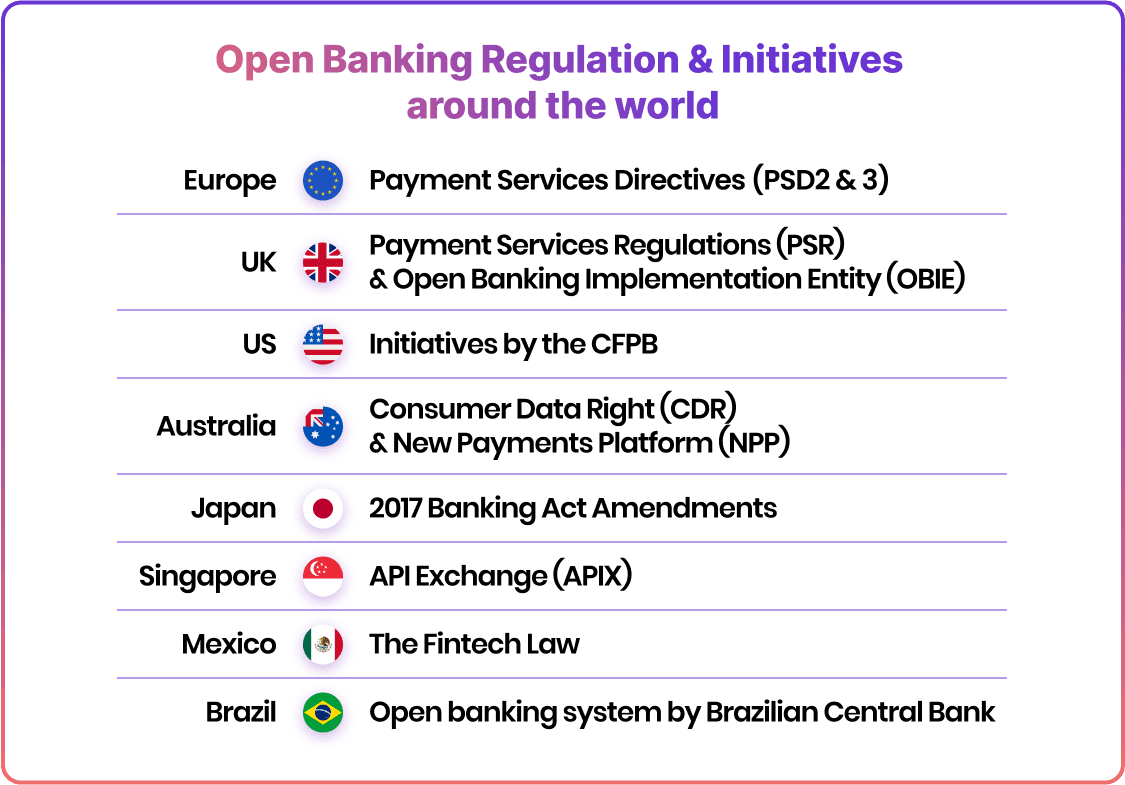

However, like any transformative concept, it thrives within a framework of open banking laws and rules that govern its implementation. This creates a diverse landscape as nations worldwide embrace this movement.

Here we take a look at the most prominent open banking standards around the world in more detail.

Open banking regulation in Europe

Europe, commonly referred to as the “cradle” of open banking, has pioneered the regulation in the field with extensive Payment Services Directive 2 (PSD2), and most recently PSD3.

PSD2

The revised PSD2 regulation came into effect in 2016. Its purpose is for banks to establish efficient mechanisms that allow third-party providers to access and utilise their services and customer data with consent.

PSD2 objectives include promoting a more integrated and streamlined European payments market, enhancing payment security and safety, and offering better protection, for both consumers and businesses. The PSD2 requirements for banks and service providers include:

- The issuance and use of strong customer authentication solutions

- The offering of transaction and device monitoring

- Provision of a standardised and reliable access interface to payment accounts (i.e. an application programming interface, API)

In essence, PSD2 encourages innovation and competition in payments while prioritising the security of transactions and safeguarding consumer information.

PSD2 represents a stride towards establishing a Digital Single Market in Europe aiming to adapt the EUs market to the demands of the digital era. Moreover, these measures ensure that all payment service providers operating within the EU adhere to supervision and appropriate regulations.

PSD3

The European Commission proposed the Third Payment Services Directive (PSD3) in June 2023. Its primary goal is to leverage the advancements achieved through PSD2 and propel open banking further. The new directive proposal has four goals:

- To bolster security and consumer protection with stricter requirements for strong authentication, risk management, transparency, and accountability.

- To foster innovation and competition by enabling entrants like Payment Initiation Service Providers (PISPs) and Account Information Service Providers (AISPs) to bring alternative solutions to traditional payment methods.

- To harmonise regulations across Europe by creating a framework for all payment services regardless of whether they are national or cross-border.

- To promote the use of sustainable payment methods such as instant payments, mobile payments, and digital currencies.

The adoption of PSD3 is a process that requires approval, from both the European Parliament and the Council of the EU.

Directives, like PSD3, must be translated into the legislation of member countries whereas regulations, such as the implemented Payment Services Regulation (PSR) are directly and consistently applicable throughout the European Union.

Open banking rules in the UK

The UK has played a significant role in driving the adoption and regulation of open banking alongside the European region. It has integrated Europen PSD2 and created Open Banking Implementation Entity (OBIE).

Payments Services Regulation (PSR)

The UK’s Payment Services Regulations (PSR) introduced in 2017, implemented the Europen PSD2 into the UK’s national law. The regulation expanded the concept of Open Banking by allowing trusted third-party providers to access payment accounts that are available online as long as they obtain the explicit consent of the customer.

Open Banking Implementation Entity (OBIE)

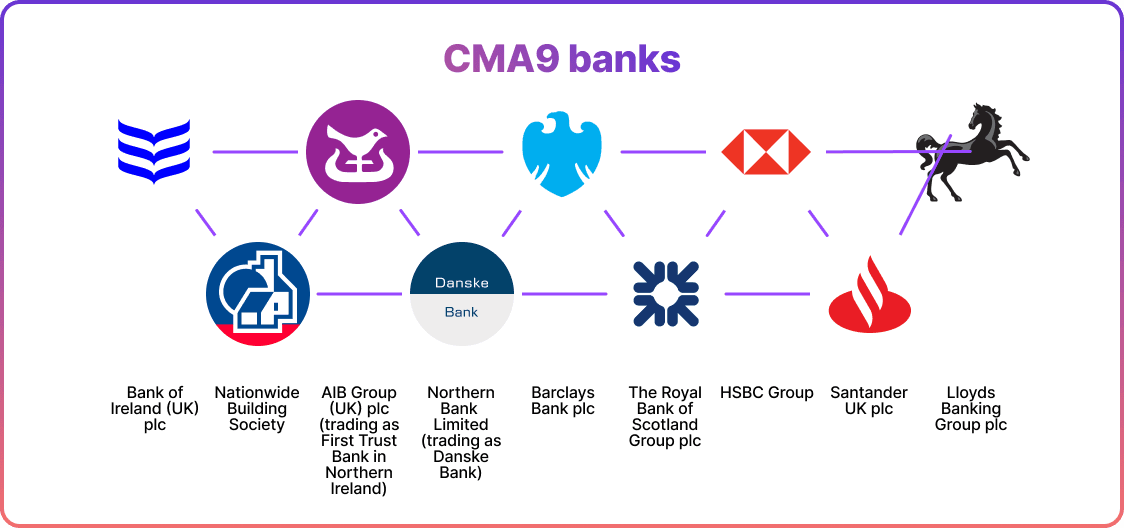

UK’s Competition and Markets Authority (CMA) introduced the Open banking regulation in 2017 after conducting a market investigation into the retail banking sector. In response, the CMA directed the nine largest current account providers, often referred to as the CMA9, to establish and fund the Open Banking Implementation Entity (OBIE).

The OBIE is responsible for setting the API standard for open banking implementation. The body provides guidelines for API specifications, user experience, and operations to ensure that account providers meet their obligations under PSD2 and offer access to account information for Third-Party Providers (TPPs).

The UK Open Banking standard includes documentation, usage examples, and OpenAPI files that establish a comprehensive set of best practices. These are more clearly defined than those in the EU. The standard also offers endpoints for payments, international payments, scheduled payments, and file-based payments. To ensure role access the APIs are intelligently categorised with a defined basePath, in the API specification.

Open banking regulation in the US

Currently, open banking in the US operates differently from Europe. It is influenced by market dynamics and industry practices. However, there is a noticeable shift towards regulation with the recent initiatives by the Consumer Financial Protection Bureau (CFPB).

Consumer Financial Protection Bureau (CFPB)

The CFPB is a US government agency, which is currently working on implementing open banking regulations. Their main goal is to empower individuals by giving them control over their data and facilitating consumer access to their records. To achieve this, the CFPB actively seeks guidance on the rules governing data accessibility.

The CFPB’s open banking initiative is currently in the process of developing a series of regulations aimed at addressing data rights. These data protection regulations have a twofold purpose: to remove obstacles, foster healthy competition, and safeguard individuals' financial privacy. The basis for these proposed regulations originates from the previously untapped authority granted by Congress back in 2010. As part of their timeline, the agency plans on presenting their proposals in 2023 with the aim of finalising the CFPB open banking rules and regulations by 2024.

In June 2023, Director Rohit Chopra of the Consumer Financial Protection Bureau (CFPB) emphasised the importance of avoiding excessive control over open banking. Instead, he said that the agency should harness the already established market standards and create a unified open banking system.

Open banking regulation in Australia

Australia, similar to Europe, has chosen a regulatory approach for implementing open banking. However, progress in Australia has been comparatively slower.

Consumer Data Right (CDR)

The Consumer Data Right (CDR) is a comprehensive framework established in Australia to facilitate consumer data portability. It came into existence as a response to various government reviews.

In 2017, then Treasurer, the Hon. Scott Morrison MP, initiated the Review into Open Banking in Australia. Its goal was to determine the most suitable approach for open banking. Consequently, the CDR was implemented, and in May 2017, the Australian Government received a report from the Productivity Commission regarding their Inquiry into Data Availability and Use. This report included 41 recommendations and proposed establishing comprehensive data right throughout the economy.

The CDR enables individuals to grant accredited businesses access to their personal data. This allows tailored products and services to be offered based on individual needs. The CDR is specifically available in the banking sector and operates as an optional service, giving consumers the decision-making power regarding data sharing. Importantly, consumers maintain complete visibility over who their data is being shared with and the purpose behind such sharing.

New Payments Platform (NPP)

The New Payments Platform (NPP) in Australia is an open-access infrastructure introduced in February 2018 for open banking. It emerged as a result of collaborative efforts within the industry to facilitate fast payments. This platform empowers households, businesses, and government agencies by enabling simple payments with almost instantaneous fund availability for recipients around the clock.

The Reserve Bank of Australia played a significant role in guiding the industry's efforts and establishing its overall direction of NPP. In addition, the central bank developed a settlement component called the Fast Settlement Service within the platform. This service enables transactions to be settled individually 24/7, almost in real-time.

Open banking regulation in Asia

Asia's open banking journey showcases a varied landscape, with countries at different stages of adoption. Some nations, such as Japan, are taking a regulatory approach, while others, such as Singapore, lean towards market-driven practices and innovation.

Japan’s Banking Act amendments in 2017

In 2017, Japan’s Banking Act was amended twice by the Bank of Japan to promote open banking.

In April-May 2017, the first amendment was implemented to stimulate investment by allowing banks to increase their ownership in fintechs. Additionally, a regulatory framework was introduced for electronic payment service providers, encompassing both payment initiation service providers (PISPs) and account information service providers (AISPs). A registry process for third-party providers (TPPs) was also established.

By March 2018, banks were obligated to disclose their affiliations and collaborations with PISPs & AISPs. Furthermore, the revised banking act mandated that 80 Japanese banks establish open APIs.

Singapore’s API Exchange (APIX)

Although not a formal regulation, the API Exchange (APIX) is a collaboration platform introduced by the Monetary Authority of Singapore (MAS) to promote open banking. It stands as the first-of-its-kind global platform, fostering cross-border connectivity and facilitating financial innovation and inclusivity not only in ASEAN but also worldwide.

Since its launch in November 2018, this platform has bridged financial institutions and fintech firms, enabling seamless connection and fruitful collaborations in designing exceptional experiences through APIs.

APIX was established through a collaboration between the World Bank's International Finance Corporation, the Monetary Authority of Singapore, and the ASEAN Bankers Association. This groundbreaking initiative pioneers the world's first cross-border, open-architecture API marketplace and sandbox platform. Its primary objective is to foster collaboration between financial institutions and fintech companies.

Conclusion

As the journey through open banking regulation unfolds, it becomes evident that the terrain is both diverse and complex.

Across continents, we witness a range of approaches to open banking compliance and regulation. Europe follows a directive-driven method while the US adopts market-led initiatives, and Asia combines various tactics. Each country or region aims to strike a delicate balance between fostering innovation, ensuring security, promoting competition, and safeguarding consumers' interests.

The regulatory outlook will undoubtedly continue to evolve as open banking progresses, are influenced by technological advancements, market dynamics, and customer demands. The voyage of open banking regulation is far from reaching its conclusion; it remains an ongoing narrative that will significantly shape the future of financial services in our digital landscape.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each