Have you ever uninstalled an app because it was too complex? A PWC study shows that 32% of customers would abandon a beloved brand after a single poor experience. They expect a smooth journey from beginning to end.

Focusing on the user experience (UX) is crucial for businesses. Forrester Research found that seamless UX design can significantly increase conversion rates by as much as 400%. Yet, only 1% of users feel that e-commerce sites consistently meet their expectations, according to another survey by CEI . Open banking could play a key role in enhancing UX for merchants by streamlining financial transactions and aggregating accounts.

What is User Experience (UX)?

UX encompasses the path users follow when engaging with a product, service, or system, including its functionality, design, and content. It's about every aspect that influences how users feel during their interaction, whether positive, negative, or neutral.

A good UX typically offers simplicity and satisfaction, making transactions smooth. Conversely, a poor UX leads to complexity and frustration, complicating user interactions.

What is UI?

The User Interface (UI) is what users see and interact with in digital systems, and it’s crucial for good UX. UIs include menus, buttons, and design elements that make software user-friendly. The system's backend also plays a vital role, ensuring quick responses and optimal performance for a seamless experience.

UX vs CX

UX focuses on the immediate interaction between users and products or services. Customer Experience (CX), on the other hand, covers all aspects of a customer's engagement with a company, including buying processes, delivery speed, and post-sale support.

What Is Open Banking?

Open banking, driven by the PSD2 regulation in the EU, mandated traditional banks to share customer data with approved fintech companies. It broke the banks' exclusive control over data. This system is tightly controlled and requires clear customer consent for data sharing.

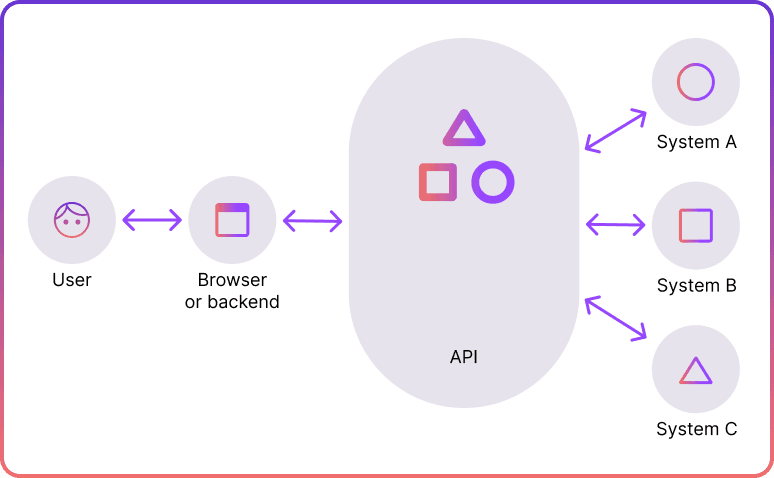

Open banking uses Application Programming Interfaces (APIs) to enable interaction between different software. Banks, therefore, share data securely via APIs. This new paradigm encouraged innovation in finance, leading to improved products and smoother user experience in open banking.

App-to-App

App-to-app redirection is a significant UX benefit of an open banking flow. It enables users to smoothly transition between apps for necessary actions or data sharing.

App-to-app redirection skips the mobile device's default browser, directing users straight to their banking app to grant the consent. If a user doesn't have the bank app, they're automatically taken to a mobile-optimised banking website instead.

App-to-app redirection streamlines the process for users to give their consent to connect with banks, leading to higher conversion rates. This method improves the overall UX and deepens user engagement with third-party applications.

Open Banking User Expeirence: Use Cases

Let’s take a look at the examples of open banking user experience and how businesses can leverage data sharing to enhance UX and achieve better results.

Account Aggregation

Today's customers often have multiple bank accounts – for current spending, savings, and business transactions, just to name a few. The optimal UX would involve viewing all these accounts in a single interface.

Account aggregation providers historically relied on screen scrapping, which poses security risks. Open banking solves this problem via mandatory API sharing, enhancing security and convenience.

In Europe, Account Information Service Providers (AISP) gather data from multiple accounts into a single interface via APIs. App-to-app redirection significantly improves UX of account aggregation without compromising cybersecurity.

Instant Payments

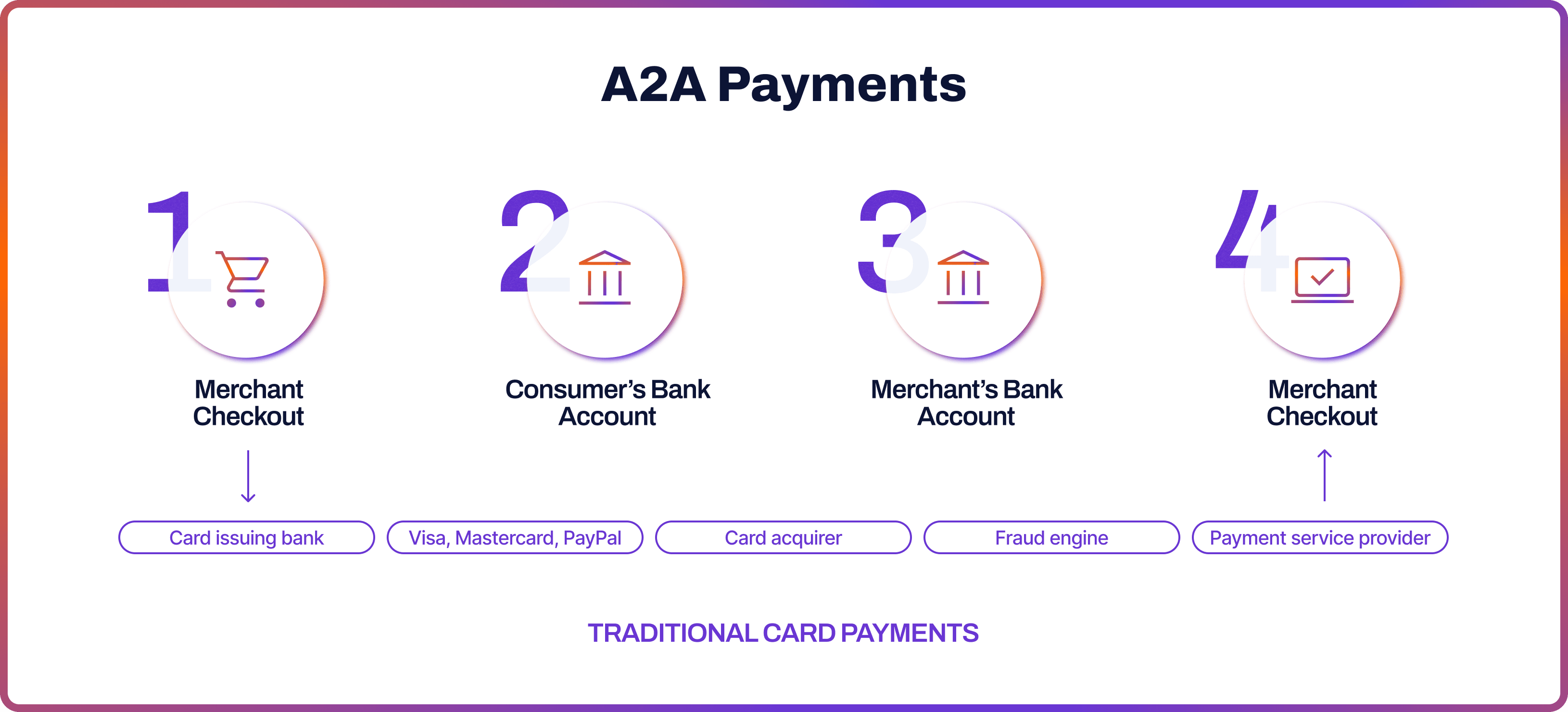

Historically, payment delays have been a major inconvenience for bank customers, which can lead to missed loan payments and overdraft charges at worst. Open banking introduces a solution. With API-driven approach, banks and service providers can make and receive funds via account-to-account (A2A) payments, often referred to as “pay-by-bank”.

For example, in an e-commerce transactions, customers using A2A would connect to their bank to approve the payment without manually inserting lengthy payment details. The open banking UIs would smoothly navigate the user to their online banking app and back to the e-commerce platform through app-to-app redirection. The result is a win-win: better UX for the customer, and readily available funds for the merchant.

Credit Assessment

Applying for a mortgage or loan usually needs a good credit score, which often involves a time-consuming and document-heavy credit check process. Additionally, some might not have a credit history due to various reasons like immigration. With open banking, there are alternative methods to demonstrate financial reliability.

Open banking allows customers to let third-party providers access their banking history via APIs. This inherently enhances the UX by reducing wait times, as customers can simply link their bank accounts instead of manually submitting statements.

Onboarding

Similarly to credit assessment, onboarding new clients traditionally involved collecting extensive documentation to conduct verification checks. This process can be time-consuming for both the companies and their clients.

Open banking can change this process by enabling clients to grant third-party providers access to their banking data through APIs. This shift to data sharing simplifies verification, allowing for automated checks, a better UX flow and an improved overall customer experience in open banking. For instance, instead of manually submitting proof of income and address, clients can simply connect their bank accounts, enabling the provider to quickly verify their information.

Personalisation

Finally, open banking can enhance UX by enabling personalisation of journeys.

By accessing shared data, companies can understand users' financial behaviors and preferences more deeply, enabling them to tailor experiences.

For example, a banking app could analyse spending patterns to offer personalised budgeting advice or savings solutions. This level of customisation would build a more engaging and valuable service, improving overall satisfaction and loyalty.

Benefits of Open Banking UX

- Better Payment Flow: Open banking improves UX via A2A and app-to-app redirection, enabling instant payments without manually inserting card details.

- Easier Verification: Open banking can automate the authentication process, streamlining user onboarding, credit assessment and reducing manual input.

- Higher Security: Open banking uses secure APIs for data sharing, which is superior to screen scrapping methods.

- Data-Driven Decisions: Access to financial data enables better personalised services and product offerings.

Future of Open Banking UX: Open Finance

Open finance expands open banking by sharing data across a broader range of financial sectors. This includes sectors like investments, insurance, pensions, mortgages, and lending. This development could further improve open banking customer experience by opening up new avenues for innovation and personalisation across all these financial services.

While open finance is not yet a common practise globally, Brazil is a pioneer in adopting this framework. The country began its final implementation step in March 2022.

Improve UX with Noda

Elevate your UX with Noda’s payment and open banking solution for businesses. Streamline transactions with open banking payments and gain powerful insights with our AI-driven financial analytics.

At Noda, we understand the user experience’s role in open banking and therefore provide intuitive UX with effortless integration to leading e-commerce platforms. Noda operates in the UK, EU, Brazil and Canada, supporting a wide range of currencies for globally-minded clients. We offer partnerships for companies of all types and sizes, with scalable plans to fuel your business growth and meet your needs.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know