Open banking is strongly associated with the banking sector due to its name. However, it’s a much more versatile tool and offers applications across industries. Here we take a look at how open banking can be used for Know Your Customer (KYC) — a prime example of its broad utility beyond finance.

What is KYC?

KYC in finance refers to compliance practices that companies use to verify the identity of clients. This is used before onboarding to assess the risks of the client being involved in illegal activities.

KYC is a crucial part of Anti-Money Laundering (AML) laws designed to prevent fraud, corruption, and funding of terrorism. The KYC process flow varies between organisations but generally follows certain steps based on the customer acceptance policy and the clients' risk levels.

Verification

In this step, companies request business-related information and personal details of their potential clients. These could be names of directors, business addresses, and social security numbers, along with supporting documents.

To confirm this data, companies cross-reference it against public resources and government lists, including those related to law enforcement, sanctions, and terrorism affiliations.

Risk Evaluation

After gathering the necessary data, companies assess whether the risk level associated with a potential client is within their threshold. If the risk is too high, enhanced due diligence (EDD) is required.

The evaluation considers various risk factors such as sanctioned territories, politically exposed persons (PEPs), ultimate beneficiary owners (UBO), non-resident clients and cash-intensive businesses.

Ongoing Monitoring

Even after a client is onboarded, the KYC process continues. Companies must regularly update KYC checks as company details, regulations, and KYC verification methods evolve.

Continuous monitoring and repeated diligence are essential to comply with changing legal requirements and maintain accurate, up-to-date data.

How Open Banking Can Help KYC

When checking a company's background, businesses collect vast amounts of unstructured data. This includes bank statements, company registrations, PEP lists, and much more. Before open banking, compiling this data into a comprehensive risk profile involved extensive manual effort. Compliance specialists would spend hours searching for information.

Even with digital tools, the flow remained cumbersome, slow, and inefficient. Fenergo found that globally, the average cost of carrying out a single KYC review has increased by 17% since 2022 to $2,598 in 2024.

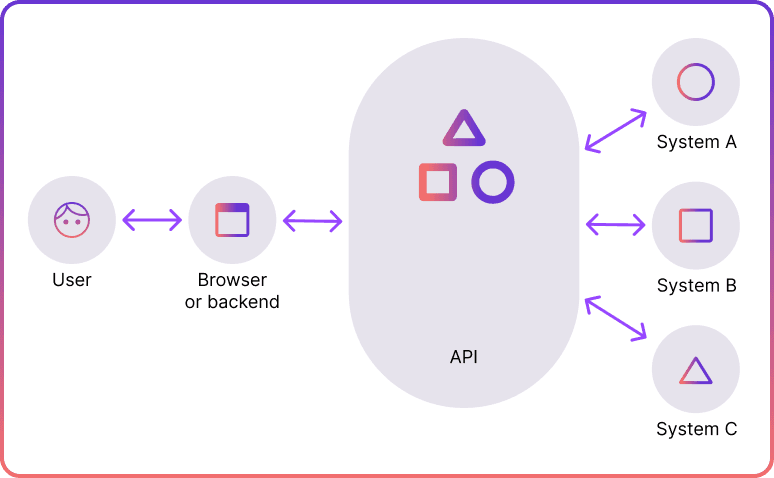

Open banking can streamline KYC processes by using application programming interfaces (APIs) to share data securely. This technology simplifies the collection of user information, verification of sources of wealth, and access to transactional data. This means faster and more accurate data retrieval for businesses.

Access Transaction Data

Before open banking, companies could only see a small portion of a client's transaction history. With secure API sharing, they can gain a full view, including detailed information on whom clients transact with and the locations of these transactions. This can help in analysing data and establishing the sources of wealth safely.

Digital Data

Open banking digitises all KYC-related activities, eliminating the need for physical documents and manual data entry. This automation speeds up processes and reduces the time and cost involved, enabling companies to evaluate client risks and predict potential fraud quickly.

Streamlining Verification

Many open banking providers offer ready-to-use verification tools for onboarding. This means KYC checks are fully streamlined.

For example, Noda offers a Pay&Go KYC solution, which allows businesses to onboard their customers with non-ID upload and liveness detection. This feature fully covers the entire onboarding process.

Noda provides non-doc identity verification and full documental checks, including AML checks based on the customer's full name, address, and date of birth. If Noda is unable to match the data, the customer needs to pass the full verification flow by uploading the ID document.

Aggregate Data

Businesses often struggle to consolidate KYC data from various platforms and tools. This can result in information silos that are hard to access and merge.

Open banking APIs simplify this by integrating all relevant data into a single customer view, allowing team members to access it easily from one place. This reduces the need to switch between multiple systems and helps in making well-informed decisions quickly.

How to Integrate Open Banking and KYC

- Define Business Needs

Start with determining your business and compliance needs. Decide if you need solutions for onboarding, additional verifications, and the specific regulations you must comply with. Also, consider your budget for these services. This will guide you in selecting a suitable provider.

- Choose an Approved KYC Provider

Start by consulting reliable sources and checking online reviews. Compile a list of potential KYC providers that offer open banking features. Evaluate their reputation in your industry to ensure they have a proven track record of efficient solutions.

It’s also important to compare their fees, including monthly, setup fees, and any costs for additional software. Choose the provider that offers transparent and cost-effective pricing.

- Integrate via Know Your Customer APIs

When selecting a KYC open banking provider, consider testing their services first through a demo or trial period. This allows you to assess the functionality and effectiveness of their KYC solutions.

If satisfied, proceed to request detailed documentation and start integrating their APIs. A reliable provider will support you throughout the process, from initial testing to full integration.

Open Banking & KYC with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine user experience, Noda is your partner in growth.

FAQs

How can open banking help KYC?

Open banking can streamline the KYC process using APIs to securely share data, which simplifies collecting and verifying customer information. This technology enhances the speed and accuracy of building risk profiles and conducting risk assessments.

Is open banking data sharing safe?

Yes, open banking data sharing is safe as it uses secure APIs. This ensures that all shared information is encrypted and only accessible to authorised parties, maintaining privacy and security standards.

What are the advantages of KYC combined with open banking?

Combining KYC with open banking enables faster and more efficient verification processes, reduced costs, and the ability to access a comprehensive view of a customer's transaction history and financial behaviour. This integration helps businesses assess risks accurately and detect potential fraud swiftly.

What business sectors benefit from KYC open banking?

The KYC use cases are versatile. Generally, financial institutions, e-commerce platforms, and fintech companies would see the greatest benefit as these sectors can use open banking to enhance customer onboarding and improve compliance with anti-money laundering laws. But KYC open banking can be applicable to many more sectors or business types.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know