Open banking has revolutionised the way we move money. One of its most exciting features is payment initiation. Rather than relying on cards or third-party apps, customers can now initiate payments directly from their bank accounts — with the help of a Payment Initiation Service Provider (PISP).

If you're a business looking for faster payments, lower fees, and improved conversion, or a customer after more control, open banking payment initiation could be the game-changer you didn’t know you needed.

In this guide, we’ll talk about what payment initiation means, how it works, and why it matters – with a look at how Noda helps merchants and customers benefit from faster, simpler, and more secure payments.

What is a Payment Initiation?

Open banking payment initiation is a service that lets customers pay businesses directly from their bank accounts — without using cards or manual transfers. It’s powered by regulated third parties, known as PISPs, who securely connect with a customer’s bank to initiate the payment on their behalf.

Unlike traditional payments that rely on card networks or multiple intermediaries, payment initiation uses open banking APIs to move money straight from the customer’s account to the business in real time. The result is a faster, more secure, and more cost-effective way to pay.

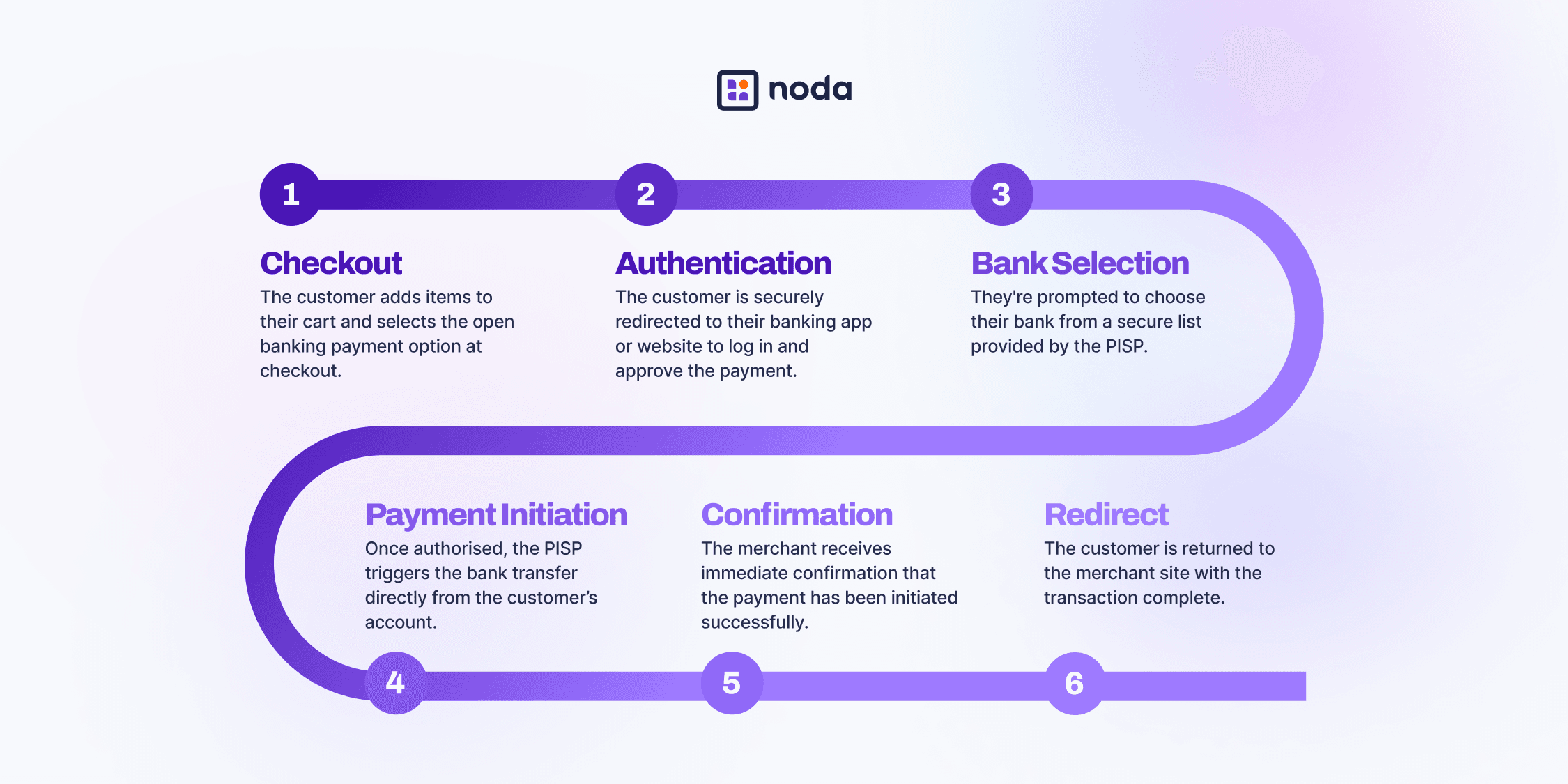

How Does the Payment Initiation Service Work?

PIS are built on a foundation of strong regulation designed to protect both businesses and their customers.

Authorised Providers

To offer this service, a provider must be authorised by a financial regulator. This ensures they meet strict standards for security, compliance, and operational reliability. Authorisation also grants access to secure bank APIs — enabling direct, safe connections without relying on outdated methods.

Key Regulations

In Europe, services like this are regulated under PSD2, a framework that promotes innovation while safeguarding users. Other countries follow similar models to ensure customer protection, data security, and fair access across the ecosystem.

Security by Design

A key requirement under these regulations is Strong Customer Authentication (SCA). This means customers must approve payments using secure methods like biometrics or mobile banking apps, reducing the risk of fraud and improving trust in each transaction.

For businesses, this regulatory clarity means you can offer modern, secure payment options with confidence — knowing both you and your customers are protected.

Role of Payment Initiation Service Providers

A PISP is a licensed third-party provider that initiates payments directly from a customer’s bank account — with their consent. A PISP doesn’t hold or access the customer’s funds. It acts as a secure bridge between the customer’s bank and the merchant.

Here’s what a PISP does:

- Connects securely to the customer’s bank via open banking APIs

- Requests payment from the customer’s account once authorised

- Confirms transaction status to the merchant in real time

By removing the need for cards or manual transfers, PISPs streamline payments for both users and businesses. Examples of PISPs include Noda, Yapily, and Token — all of which are authorised and regulated under PSD2 in the EU or equivalent frameworks in other regions.

Open Banking Payment Initiation vs Traditional Payment Rails

If you're wondering about the difference between open banking payment initiation services and a payment rails provider, it all comes down to efficiency.

Traditional payment rails, like card networks (Visa, Mastercard), rely on multiple intermediaries, causing delays, hidden fees, and potential errors.

Open banking payment initiation simplifies the process by enabling direct bank-to-bank transfers, often in real time.

Without card involvement, businesses avoid chargebacks and complex reconciliations. While traditional rails run on decades-old infrastructure, open banking is built for today’s digital-first economy, offering faster, more cost-effective transactions.

Benefits of Payment Initiation for Customers

Faster Settlement

Payments are processed in real time, so customers see the funds leave their account immediately. No waiting for pending charges or unclear payment statuses—just instant clarity and peace of mind.

Fewer Fees

Open banking payments often come with lower or no added charges for customers. Without card networks or middlemen adding extra costs, customers get a more transparent and fair payment experience.

Reduced Fraud Risk

Authorising payments through your own bank adds a layer of security with strong customer authentication. There’s no need to share card details, which means less exposure to fraud and scams.

Improved Customer Experience

A smoother, faster checkout process means fewer abandoned carts and higher conversion rates. Customers appreciate the convenience of paying directly from their bank accounts without needing to enter card details.

Benefits of Payment Initiation for Businesses

Increased Conversion Rates

A faster, frictionless checkout reduces cart abandonment and encourages more customers to complete their purchase. Fewer clicks and fewer distractions at checkout help keep customers engaged right through to payment.

Lower Transaction Fees

Fewer intermediaries mean lower processing costs compared to card networks, saving money on every payment. These savings can be reinvested in growth, customer rewards, or pricing strategies.

Improved Cash Flow

Real-time bank transfers ensure quicker access to funds, reducing settlement delays and improving liquidity. Faster access to revenue supports smoother day-to-day operations and better financial planning.

Access to New Markets

Open banking enables secure payments from international customers without relying on card infrastructure. It opens the door to new geographies and customer segments that prefer direct bank payments.

Set Up Open Banking Payments in Minutes with Noda

Noda is a licensed payment initiation service provider that lets businesses accept direct bank payments through open banking. Instead of entering card details or using third-party checkouts, customers authorise payments directly through their banking app.

- Instant payments, no delays – Real-time bank-to-bank transactions mean instant payouts with no delays or settlement waits.

- Secure by design, no chargebacks – No card details are shared, cutting fraud risk and removing chargebacks entirely.

- Simple, low-cost pricing – Fees start at just 0.1%, with no subscriptions, fixed costs, or hidden charges.

- Built for businesses and customers – Faster payouts and better visibility for you, with a simpler, more secure checkout for them.

Noda is fully PSD2-compliant and uses strong customer authentication — including biometrics and secure bank logins — to protect every transaction. Designed for e-commerce, SaaS, travel, gaming, and marketplaces, its API is easy to integrate and delivers a seamless experience for you and your customers.

Now that you know what’s possible with payment initiation, let’s make it work for your business — book a demo today.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each