Modern consumers like fast, mobile-based transactions. In fact, a whopping 76% of the UK adult population prefer digital transaction methods when it comes to paying for things.

It’s no wonder UK businesses are constantly on the lookout for better, cheaper alternative payment solutions to traditional card networks or the inconvenience of handling cash. Cue QR codes for stores — a revolutionary approach that can reduce payment processing costs, facilitate instant transactions and meet today’s consumer demands.

Whatever your business, this guide un-picks the why’s and wherefores of using QR codes for retail businesses, and how Noda’s efficient, convenient and competitively priced solutions can future proof your payments.

What are QR code payments?

QR codes are like a super-advanced product barcode – their 2D matrix patterns store information that can be scanned, decoded and used to direct users to just about anywhere online. They can be scanned with smartphone cameras, enabling businesses to easily share information such as menus, product sheets, promotional pages, schedules and timetables, hotel-check-ins or social media sites.

For QR code payments, scanning the code directs users to a secure check-out process to authorise transactions. It typically involves entering card details, or paying via their digital wallet, payment app or banking app.

What are QR codes for shopping and how do they work?

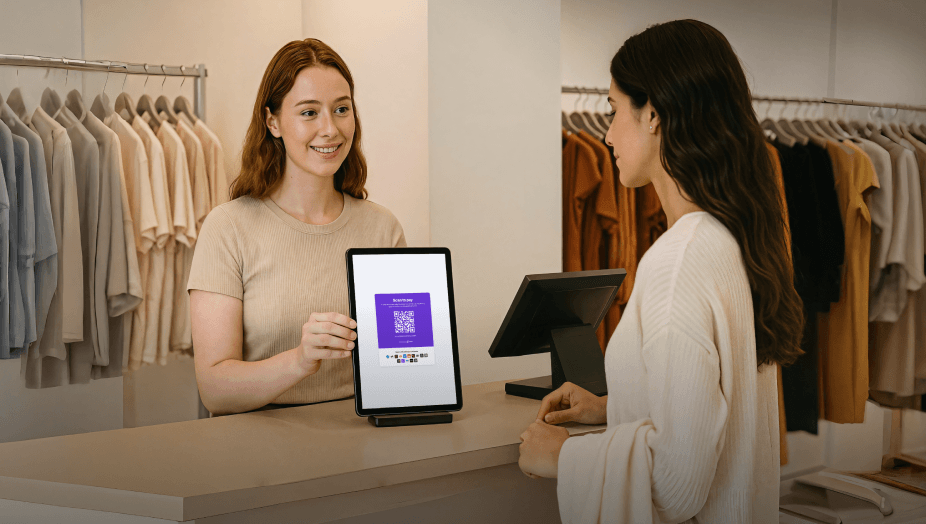

QR codes for shopping offer an on-the-spot, contactless payment method for customers. Merchants can display codes on QR stands around the store, at the sales counter or share on mobile and tablet screens.

They work via a Payment Service Provider (PSP), which facilitates the generation of unique QR codes for processing payments. The payment process after scanning the code depends on the PSP and has a big effect on how efficient the customer experience is.

Some QR code payment systems for retail might work with a credit/debit card check-out process, or digital wallet, and some providers require a payment terminal or integration with existing terminals. In which case the disadvantages of card networks apply – slow settlement times, percentage-based transaction fees, monthly costs and maintenance costs.

Noda’s QR codes for retail and customer facing business leverage account-to-account transfers, enabling customers to scan and authorise payments directly in their banking app. Merchants completely bypass the expensive card networks and benefit from instant payments.

In store QR code payment examples

Retailers using QR codes for in-store payments are vast and varied. Here are just a few examples:

- Cafes, bakeries and restaurants

- Hairdressers, barbers and beauty salons

- Retail stores, from clothes to carpets to the local newsagents

- Car and automotive services

Benefits of QR code payments for stores

Cost-Effective

One of the most significant advantages of QR code payments is the reduction in costs. With some PSPs, accepting payments via QR codes doesn’t require any technical setup or additional hardware (so no hardware maintenance costs). Open banking-powered PSPs utilise direct bank transfers, avoiding traditional card networks and their associated high fees.

Enhanced Security

QR code payments are known for their robust security features. Transactions authorised through digital wallets, payment apps and banking apps require two or more factors for verification, such as biometrics, passwords, or device verification. This multi-factor authentication significantly reduces the risk of fraud and chargebacks compared to traditional card payments.

Data-Driven Insights

Every QR code transaction generates digital records, providing valuable data on customer behaviour. Businesses can analyse this data to identify peak hours, top-selling products, customer demographics, and order frequency. These insights enable businesses to make informed decisions, optimise operations, and tailor marketing strategies to boost profitability.

Why stores with QR codes by Noda are winning

Noda’s open banking platform offers one of the best, most efficient QR code payment processes, with ultra-competitive pricing for UK merchants and businesses.

Here’s what sets Noda apart:

Seamless Integration

Noda’s QR codes can be used alongside your existing point-of-sale (POS) systems or simply as a stand-alone solution, with no tech, no set-up and no technical skill required to get started. You can have your shopping QR codes set up and ready to accept payment within a day of onboarding with Noda. Plus, our user-friendly interface is sleek and simple to use for both customers and businesses.

Compliance and Security

Keeping your customer’s data safe when they shop via QR codes is essential. Noda is fully compliant with the latest security standards and regulations, including PSD2 and Is FCA registered. Our tech uses advanced encryption technology, and we continually update our software, ensuring minimal risk of security breaches and fraud. Providing peace of mind for both businesses and customers.

Real-Time Analytics

With Noda, businesses can access real-time analytics, enabling transaction monitoring as it happens, as well as customer behaviour, so you can make data-driven decisions. Stay agile, respond to trends and future-proof your business operations.

The benefits of Noda’s QR code payments for stores, at a glance:

- No setup costs: No card terminals or hardware required, no hardware maintenance costs and no technical skills required for set up.

- Simple Onboarding: An easy setup process can have you onboarded within a day, with continued support from your Noda representative.

- Low Transaction Fees: Fixed fee of just £0.20 per transaction, with no monthly fees, saving you up to 80% compared to traditional card networks.

- Real-Time Reporting: Instant visibility of transactions for easy accounting and cash flow management.

- Instant bank transfers: Payments directly from the customer’s account to yours, with Faster Payments Services, making it easier to manage cashflow.

- Compliant and secure: Advanced encryption technology, PSD2 compliant, FCA registered.

- Support whenever you need it: A dedicated manager who knows your business and understands your needs. We’re here for you, 24/7.

- Data-driven reporting: Know Your Customer (KYC), insights and analysis with Noda’s unique data service.

How to set up QR codes for shops and businesses

Adopting QR code payments with Noda is straightforward. Here’s a step-by-step guide on how to get a QR code for your shop:

- Generate your QR codes: After onboarding with Noda, login to your dashboard, navigate to ‘QR codes’ and generate your unique payment code.

- Display your QR codes: Position your codes at your check-out counter, on QR stands or display to customers on your mobile or tablet.

- Customers scan and pay: After scanning the code, customers can enter the transaction amount (or you preset the amount) and then authorise the payment directly in their banking app. Funds are transferred to your account, and you receive an instant notification to your dashboard.

Quick, convenient, cheaper: Get started with QR code payments

Accepting contactless payments in stores is essential for your business to meet modern consumer shopping hand payment habits.

QR codes for shop payments represent a significant advancement in the way UK businesses handle transactions. With lower costs, enhanced security, and valuable data insights, they offer numerous benefits over traditional cash and card networks.

Noda's open banking powered payments provide a seamless, secure, and data-driven approach to QR code payments, helping businesses thrive in a competitive market.

By embracing QR code payments, UK businesses can not only improve their bottom line but also enhance the overall customer experience. If you want to bring the future of payments to your store, speak to the Noda team today.

FAQs

What stores accept QR codes for payment?

QR codes in the retail industry have become widely adopted in the UK, from large retailers like Asda to small local shops, cafes, beauty salons, and restaurants, accept QR code payments. This payment method is becoming increasingly popular across various sectors due to its convenience and efficiency for customers and cost-saving benefits for merchants.

Are QR payments safe in store?

Yes, QR payments can be a much safer alternative for in person transactions than traditional card payments, but it depends on the technology and compliance standards of the Payment Service Provider and the associated payment method behind the QR code.

The safest way of processing payments is directly through banking apps, which involve multi-factor authentication and therefore significantly reduces the risk of fraud and chargebacks. Businesses also benefit from instant fund transfer from customer account to merchants.

How do QR payments work in stores?

QR payments work by having customers scan a QR code, displayed in QR stands around the store or at the sales counter, with their smartphone. This action directs them to a secure payment portal where they authorize the payment through their banking app (with open banking payment service providers). The transaction is completed quickly and securely, without the need for physical contact or card swipes.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each