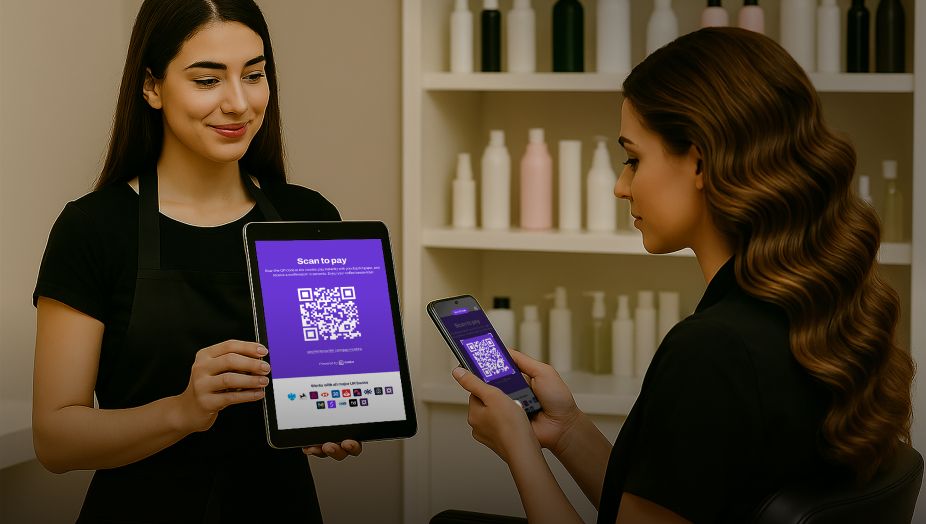

No cash, no cards, no hassle – just quick, simple payments via a QR code.

Whilst Brits are still partial to carrying a bit of cash in their pockets, a Natwest survey revealed that only 8% of adults in the UK use cash regularly, with digital payments preferred by 76% of the adult population.

In fact, cash use is expected to continue to decline to just 6% of total payments made in the UK by 2033.

A cashless payment QR code enables businesses to meet modern customer payment preferences for a fraction of the cost of accepting card payments. Here we look at how QR payments offer a great alternative for businesses looking to accept cashless payments.

What is a QR code for cashless payment?

Before tackling the topic of QR code cashless payments, let’s first examine what QR codes are.

We’ve become pretty used to seeing QR codes around, from product packaging to restaurant tables, to promo flyers. The 2D squares (or even circles) contain a matrix code that’s packed with complex information that can be scanned with QR code readers, most commonly, smartphone cameras.

Scanning directs users to the associated webpage, which could be a digital menu, transport schedules, product technical sheets, social media pages... in fact QR codes can take users just about anywhere online.

A QR code cashless payment is initiated when, after scanning, users are directed to a secure payment gateway or web checkout.

How does a cashless payment QR code work?

For QR codes to be used for cashless transactions, they need to be supported by a Payment Service Provider (PSP).

A Payment Service Provider (PSP) facilitates electronic payment transactions between businesses and customers, enabling businesses to accept various payment methods like credit and debit cards, digital wallets, and direct bank transfers. They act as a bridge between merchants and the financial system.

The PSP you choose for your business will determine how your QR code payments are processed. The most common QR code payment methods include:

- Web checkout form: Like any online payment form, where card details are entered manually.

- Digital wallets: Customers are prompted to complete the payment via their digital wallet, such as Apple Pay or Google Pay.

- Payment apps: Works similarly to a digital wallet check-out.

- Banking apps: Open banking PSPs can enable direct Account-to-Account payments.

Users accept the amount and authorise the payment via the associated payment method.

Other types of cashless and contactless payments

The first contactless payment card in both the UK and the EU was launched back in 2007 by Barclays. Now, contactless card payments account for almost four out of ten payments in the UK, and 85% of people use contactless payment methods on a regular basis.

Key in-store contactless payment methods include:

- Card payments: Contactless credit and debit card payments enable customers to pay by tapping their card on a card reader terminal. Currently, single transactions are limited to a set amount. How much depends on the country issuing the card – the UK, for example, is £100 per transaction.

- Digital/mobile wallets: A third of adults make contactless payments using services like Apple Pay and Google on their mobile devices (smartphones, smartwatches, wristbands, etc.). By storing card details, the mobile device effectively takes the place of a physical debit or credit card. They add an extra layer of security, with PIN, password or biometrics (fingerprint or face recognition) required to access your phone; payments can therefore exceed the £100 limit.

- QR Pay: By scanning a code, customers can complete a contactless transaction via the associated payment method of the QR code provider.

Other regular cashless payments that are mostly for online use include Direct Debits, bank transfers, online card payments, Buy Now Pay Later (BNPL) or cashless QR code payments online.

What are the benefits of using QR codes for cashless payments?

QR code payments offer businesses a digital payment service that meets modern consumer demands for seamless mobile-based transactions.

When supported by an open banking PSP like Noda, you and your customers experience the most efficient payment process for QR code cashless payments.

The benefits of open-banking QR codes with Noda:

- Versatile: Can be used for online web-check outs and shared digitally via SMS/email/chat, as well as offline (for UK customers) by displaying in-store, on QR code stands, on mobile/tablet screens and on printed materials.

- Low Cost: No costly card terminals, no hardware maintenance, no monthly fees and no expensive card networks.

- Faster Funds: Enjoy instant to one-day bank transfers, directly from the customer’s account to yours, bypassing slow card-payment settlements.

- Ultra-Low Fixed Transaction Fees: Only £0.20 per transaction.

- Watertight Security: Advanced encryption and strong customer authentication (SCA) to protect sensitive financial information and reduce fraud. PSD2 compliant, FCA registered (UK).

- 24/7 Customer Support: With Noda, you have a dedicated manager who knows your business and understands your needs. We’re always here for you.

By choosing Noda, businesses can leverage these benefits to enhance their payment processes and boost customer experience. No wallet needed; simply scan, pay, and go.

How to set up a QR code for cashless payments

At Noda, we can have you onboarded with a day and accepting cashless payments with QR codes within seconds. Here’s how it works:

- Log in and navigate to ‘QR codes’: Then enter the transaction price (or let your customer enter the details on their smartphone) and generate your QR code.

- Display the QR Code: Place the QR code on you online check-out page, share digitally or display at your in-store POS (UK only).

- Ready to scan: Customers are routed to their banking app to authorise the payment. Funds are transferred to your account, and you receive an instant payment notification.

Speak to the Noda team today to find out how QR codes could benefit your business.

FAQs

Does a QR code cashless payment work online?

Yes, QR codes are very versatile and can be used by a variety of businesses, both online and offline.

At Noda, our online QR codes are available across the UK and EU and enable e-commerce and online merchants to display QR codes as a check-out method or share instant payment links via digital channels such as SMS/email/chat functions.

What is the difference between contactless payment(s) and a QR code cashless payment?

Contactless payments are a way of paying for goods and services by simply tapping credit/debit cards on a card reader terminal. It also includes contactless payments made with mobile wallets (on smartphones and smartwatches for example).

QR codes are a way of initiating a contactless payment, by scanning the code with smartphone cameras and paying via the associated check-out method of that QR code.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each