QR apps have completely transformed how transactions occur in our modern technology era. These innovative applications provide a smooth, touchless, and highly efficient method for businesses and consumers to handle their payments seamlessly.

However, with an abundance of options to pick from, one may wonder how to select the most suitable QR code app for their business payments. In this article, we aim to unravel the world of QR payments and understand their functionality.

How Does a QR Code App Work?

A QR (Quick Response) code payment app is a type of digital payment solution that utilises QR codes to initiate transactions. These codes, which can be scanned using smartphones, have become increasingly popular due to their convenience and contact-free nature, especially during COVID-19, when QR codes were used to prove a person’s vaccination status.

Businesses, including retailers and restaurants, started using QR codes for things like digital menus and contactless payments to reduce physical contact between staff and customers. Even well-known payment providers such as PayPal introduced QR codes as a touch-free and cashless payment alternative at checkout.

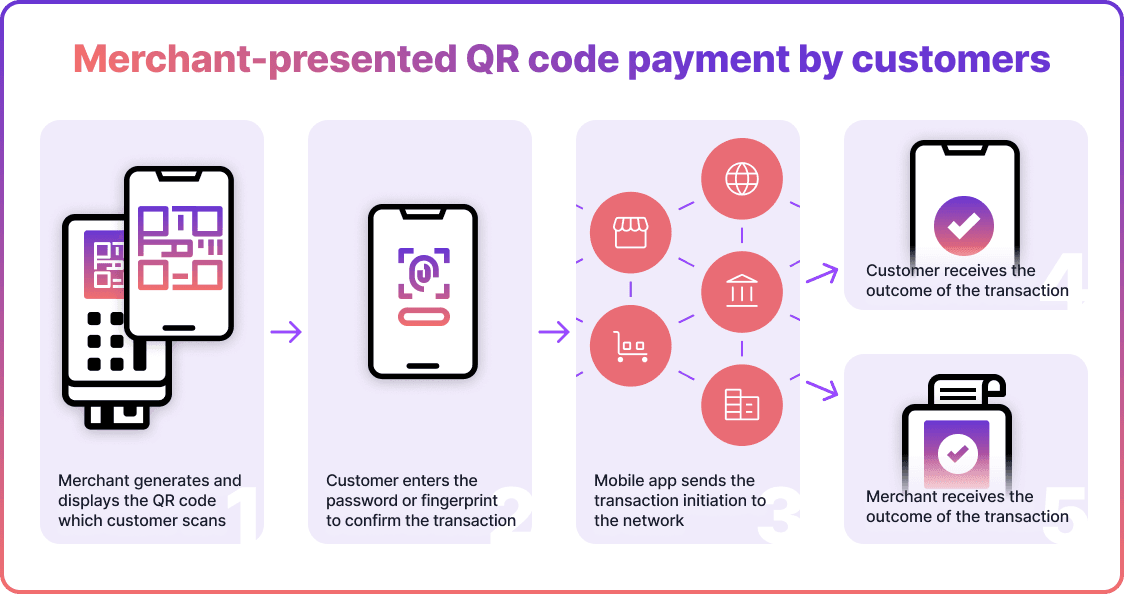

Here is how it works:

- Payments Between Apps: Both the payer and the recipient open their respective apps. The payer then scans the recipient’s unique QR code displayed in the app, confirms the payment amount, and completes the transaction.

- Smartphone Scanning the Business's QR Code: Users open their preferred QR code payment apps and scan to pay at the checkout counter, on products, websites, or printed bills. After confirming the price, the transaction is completed. Users will usually need to input their credit card details to pay.

- Retailers Scanning a QR Code on the User’s Phone: After confirming the total transaction amount in their point-of-sale (POS) system, retailers can scan a unique QR code displayed by the user's payment app, identifying their card information.

QR codes offer a contactless payment option that reduces the need for physical interaction and, therefore, promotes safety. These codes are versatile and can be used across various platforms, such as livestreams, social media, websites, and printed materials. Moreover, they provide convenience as modern smartphones have built-in QR code scanners on both Android and iOS devices. This simplifies the process of scanning and completing payments for users.

How to Choose the Best QR Payment App

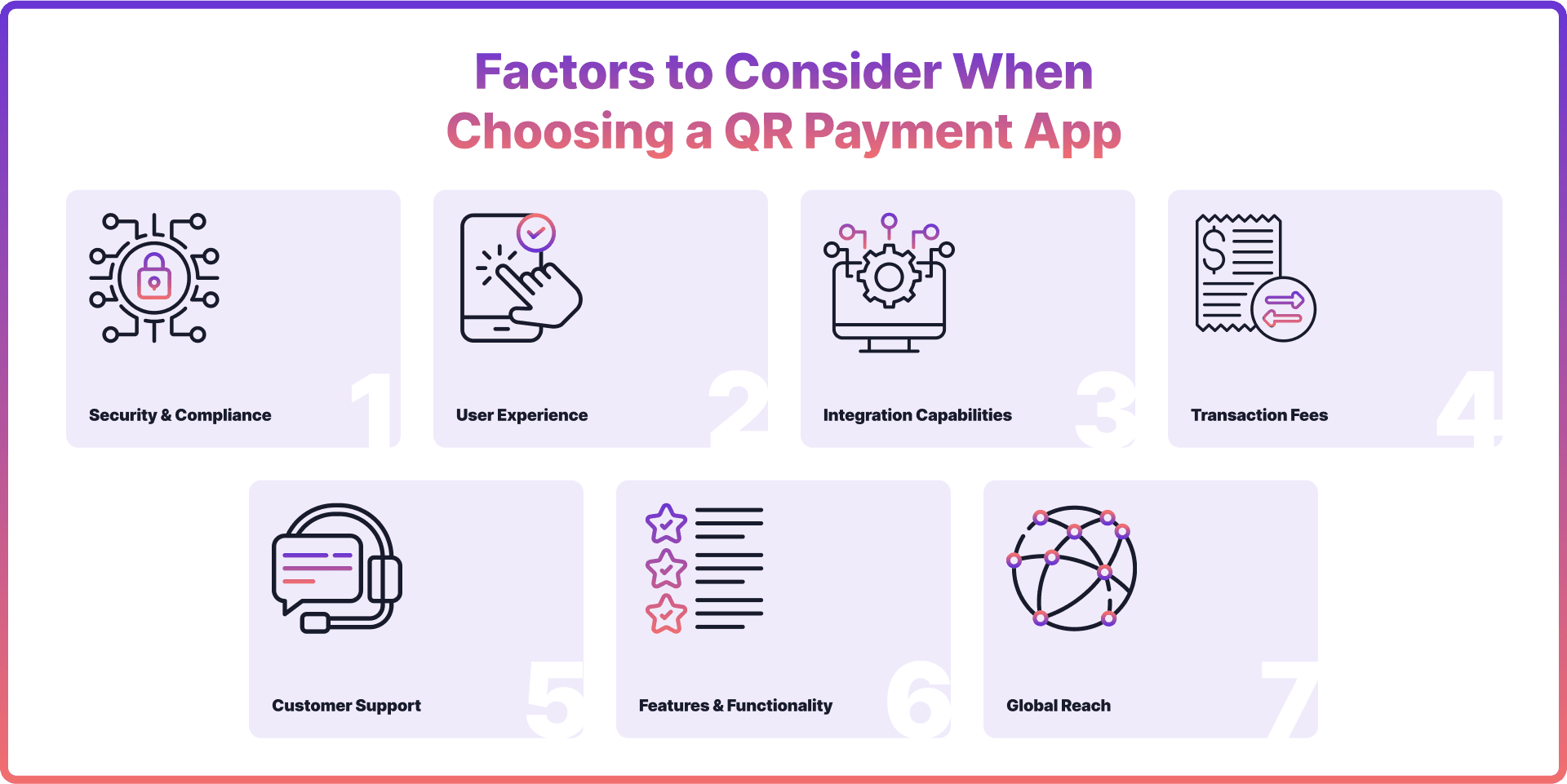

When navigating the ever-changing digital landscape, selecting the appropriate payment application for your business is paramount. It goes beyond mere convenience to encompass seamless transactions, improved customer experience, and heightened security. Here are a few factors you should bear in mind.

Security and Compliance

Businesses prioritise the security of their transactions above all else. When choosing a payment app, it is crucial to select one that adheres to global security standards and complies with local regulations. Look for features such as end-to-end encryption and two-factor authentication, which provide additional layers of security.

User Experience

To provide an optimal user experience, a payment app should be designed to seamlessly guide users through the setup process and offer intuitive navigation. It should also prioritise speedy transaction processing. Importantly, a positive user experience fosters customer loyalty and encourages repeat business.

Integration Capabilities

When choosing a payment app, it's important to consider how well it integrates with your existing systems. This includes considering its compatibility with your POS systems, accounting software, and customer relationship management (CRM) systems. Seamless integration not only saves you time and reduces errors but also provides a more comprehensive view of your business finances.

Transaction Fees

When choosing an app, it may be tempting to opt for the least expensive option. However, it's crucial to fully understand the fee structure before making a decision. Some apps may appear to have lower transaction fees but might impose hidden charges. Ensure you are aware of all costs involved, including monthly fees, transaction fees, and any additional charges.

Customer Support

When it comes to choosing a payment app, reliable customer support can make all the difference, especially during busy times. Look for an app that provides strong customer support through various channels like chat, email, or phone. Having quick problem resolution capabilities can greatly enhance trust and satisfaction.

Features and Functionality

Beyond basic payment processing, what other features does the app offer? This could include analytics, inventory management, or loyalty programs. Choose an app that aligns with your business needs and offers features that can drive growth.

Global Reach

If your business serves customers worldwide, it's important to choose a payment app that supports multiple currencies and is available in the regions where you operate. This will simplify cross-border transactions and provide a consistent experience for all your customers.

Step-by-Step Guide to Choose the Best QR Code App

- Access Your Needs: Take the time to assess your business's specific requirements. For example, do you need a simple payment processing app or one that offers more advanced features?

- Do Your Research: Research different payment apps available in the market. Take the time to read reviews, check ratings, and gather user feedback.

- Consider Security: Security is a crucial consideration when choosing a payment app. Ensure the app meets global security standards and complies with all necessary regulations.

- Evaluate Costs: Take the time to access the fee structure of the payment app, including transaction fees and any potential hidden charges.

- Test User Experience: Test the app from a user's perspective if possible. This will provide valuable insights into its usability and features.

- Check Integration Capabilities: Ensure the app seamlessly integrates with your existing systems, such as POS, CRM, and others

- Finalise Your Decision: After conducting thorough research and evaluations, select the QR payment app that best fits your business needs.

Choosing the right payment app is a crucial decision that can impact your business operations and customer satisfaction. By considering the factors mentioned above and following the step-by-step guide, you can make an informed choice that benefits your business in the long run.

Benefits of Offering QR Payments for Your Customers

- Contactless and Safe: In the wake of the COVID-19 pandemic, QR payments offer a touch-free alternative, reducing the risk of virus transmission and ensuring both customer and staff safety.

- Quick and Efficient: QR payments speed up the transaction process, allowing customers to make payments swiftly without needing physical cards or cash.

- Enhanced User Experience: With the simplicity of the scan and pay system, customers enjoy a seamless and hassle-free payment experience.

- Cost-Effective: QR payments often come with lower transaction fees, making them a cost-effective solution for businesses.

- Versatile Use Cases: QR codes can be displayed on various platforms, from online sites and social media to printed materials, offering businesses multiple avenues to facilitate payments.

- Global Reach: QR payments cater to a global audience, supporting multiple currencies and ensuring consistent experience across borders.

In the digital age, businesses must adapt to evolving customer preferences and technological advancements. QR payments, with their myriad benefits, offer a modern solution that enhances customer experience, ensures safety, and streamlines business operations.

As the world continues its shift towards digital and contactless solutions, integrating QR payments into your business model is not just a trend but a strategic move towards future-proofing your operations.

QR Payments with Noda

Elevate your business with Noda’s QR code payments solution. Drive increased sales and save valuable time through streamlined processes. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Unlock your business potential with Noda - your payments are our priority.

FAQs

Which QR code payment app is right for your business?

When selecting a QR code payment app for your business, it is crucial to consider factors such as security standards, user experience, integration capabilities, transaction fees, and global reach. Conduct thorough research and evaluate various apps to determine which one best suits your specific business requirements.

Are QR code payment apps safe?

Yes, QR code payment apps tend to prioritise security and implement measures to protect transactions. They adhere to globally recognised security standards and incorporate features such as end-to-end encryption and two-factor authentication for enhanced safety. However, it is essential to select trustworthy apps and stay informed about recommended security practices.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each