Open banking has revolutionised the financial landscape, altering the way we manage and interact with our financial data. Through the use of technology, open banking provides a secure and customer-centric approach that grants consumers unprecedented access and control over their financial information.

What are the benefits of open banking? Here we take a look at the numerous pros, examining its impact on consumers, businesses, and banks.

What is Open Banking?

Open banking is revolutionising the way customers and merchants interact with financial services by putting control and choice directly into their hands. For consumers, it means smoother, more transparent money management—whether that’s seeing all your accounts in one place, getting personalised budgeting advice, or unlocking flexible payment options at checkout. For businesses and online merchants, open banking delivers instant payments that cut out card fees, reduce transaction risks, and speed up settlement times. It also offers richer customer insights, so you can tailor offers, streamline refunds, and boost conversion rates.

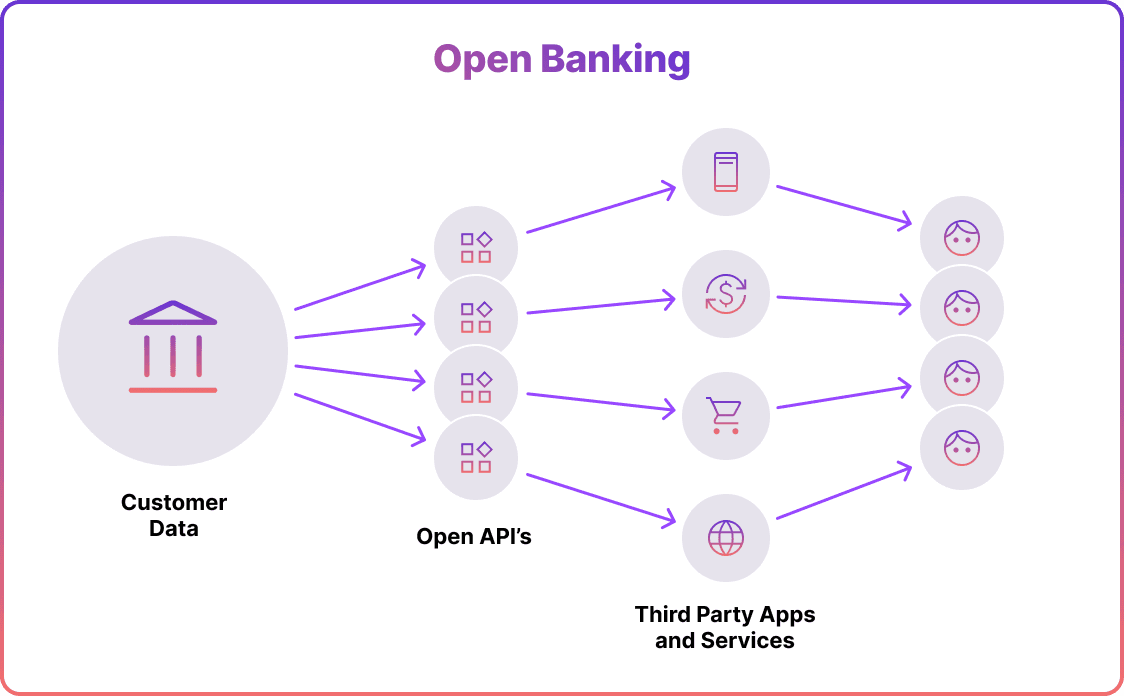

Behind the scenes, all this is powered by secure application programming interfaces (APIs). These APIs enable banks and licensed third‑party providers to share customer‑approved financial data—balances, transaction histories, account details—safely and seamlessly, laying the foundation for all the innovative services that customers and merchants now enjoy.

Open banking adoption

The consumer adoption of this ground-breaking technology has been on the rise in recent years, especially in Europe and the UK.

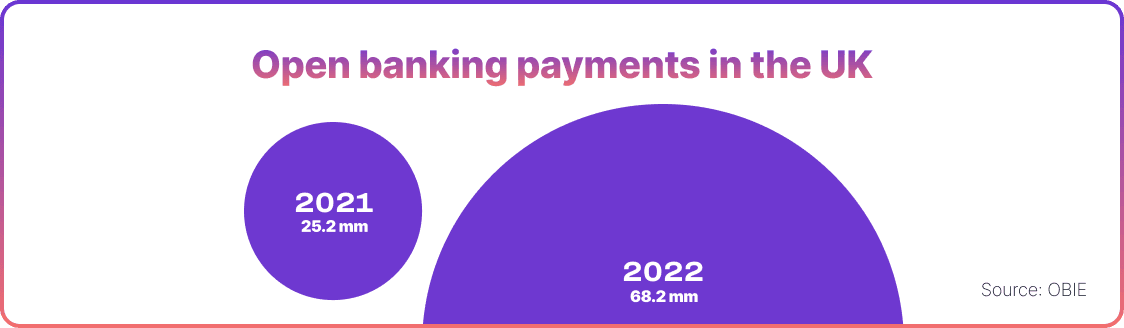

According to the recent UK’s Open Banking Limited report, open banking payments in the UK have witnessed a significant increase from 25.2 million in 2021 to 68.2 million in 2022. As of March 2025, there are 13.3 million active open banking users in the UK, which is an increase by 40% from the previous year. 1 in 13 Faster Payments in that month were open banking payments, which accounts to around 31 million transactions. Altogether, as many as 223.9 million open banking transactions were made in the UK in 2024.

An earlier report by the entity showed that around 10-11% of digitally-enabled consumers were actively utilising at least one open banking service as of June 2022. This was up from 6-7% in March 2021.

According to a study conducted by Accenture in 2021, 76% of banks worldwide anticipated a significant surge in customer adoption and the utilisation of Open Banking APIs. These financial institutions expected this increase to reach 50% or more by 2024-2026.

This forecast has proven accurate. By March 2025, the UK recorded 13.3 million active open banking users, according to Open Banking Limited — a dramatic rise from just 1 million in 2020 and 3 million by mid-2022. The upward trajectory continued into May 2025, with the user base expanding to 13.56 million, including 1.1 million new users onboarded in that single month alone. Open banking is no longer an emerging trend; it has become a mainstream financial infrastructure pillar, driven by demand for faster, seamless, and more transparent digital payment experiences.

Benefits of Open Banking for Consumers

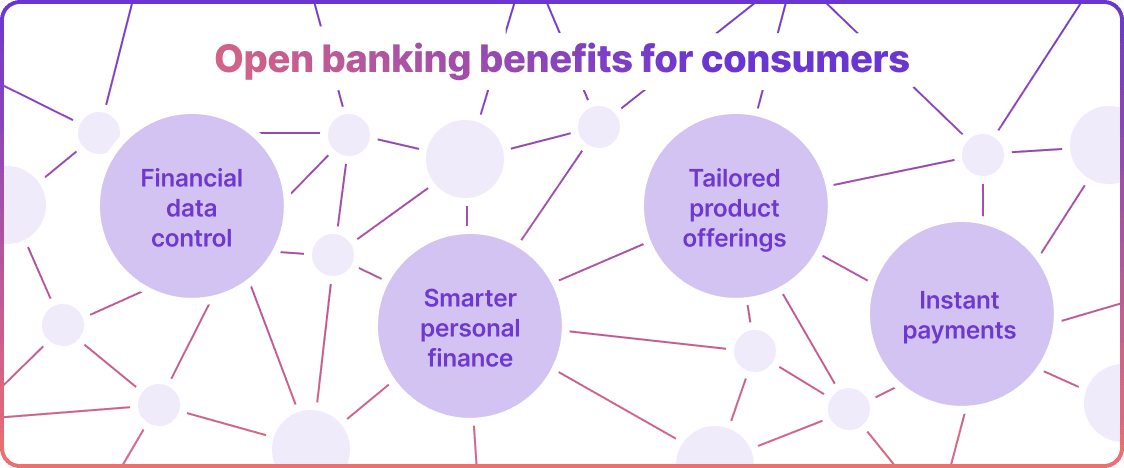

The rapid rise of adoption comes as no surprise, considering the numerous advantages of open banking consumers. By granting individuals unprecedented control over their financial data and enabling tailor-made financial products, open banking has become a truly transformative force in the financial industry.

Control over financial data

Open banking brings numerous benefits to consumers, with one of the most significant being the control they gain over their financial data. In the traditional banking model, banks held exclusive custody of this information. However, open banking has changed that by empowering consumers themselves.

They now have the authority to determine who can access their data and for what purposes. This transformative shift not only promotes transparency but also fosters trust between consumers and financial service providers.

Additionally, it enables secure sharing of banking information with third-party companies. These firms can leverage such data to create tailored financial products and services that enhance overall consumer experience in a highly personalised manner.

Smarter personal finance management

Open banking is revolutionising the way individuals manage their personal finances. By allowing users to gather data from multiple financial institutions, open banking offers a comprehensive overview of their financial well-being in one convenient location.

This empowers individuals to effectively budget, monitor spending habits, and make sound financial choices. With this holistic approach, users can easily identify areas for potential savings, avoid unnecessary expenses, and efficiently plan for future financial goals.

Tailored financial products and services

Open banking drives the development of customised financial products and services. Granting access to financial data enables providers to gain a deeper understanding of consumers' finances, resulting in highly personalised offerings.

As more consumers opt to share their financial data securely, financial companies can build increasingly relevant products based on real behaviors, not assumptions.

This leads to more accurate credit scoring, dynamic loan offers, and a broader range of services tailored to various life stages or needs. Whether it’s insurance coverage, investment advice, or budgeting tools, the ability to match consumers with products that truly fit them is now within reach, often through a single mobile app interface.

Fintech apps can then utilise data APIs to identify spending patterns and deliver tailored savings recommendations. This level of personalisation enhances the overall financial experience and promotes a competitive market where providers strive for innovative solutions that meet individual consumer needs.

Instant online payments

Open banking is transforming the payment landscape by enabling instant online transactions. Traditional payment methods often involve complex data entry and waiting periods for funds to settle. However, open banking payments provide a seamless, mobile-first experience with immediate settlement.

This means that businesses receive their funds promptly, eliminating the wait typically associated with other payment options. Moreover, open banking payments offer enhanced security measures and reduced susceptibility to fraud, bolstering consumer trust.

This streamlined payment process not only enhances the customer's overall experience but also offers substantial benefits for businesses, including improved cash flow and lower transaction costs.

Salary on Demand and New Use Cases

Open banking is unlocking entirely new financial models that were once out of reach for many consumers. One standout example is salary-on-demand services, which allow workers to access a portion of their earned wages before payday, offering much-needed flexibility and reducing reliance on high-interest short-term loans.

These innovations also extend to areas like installment payments, digital mortgage approvals, and streamlined rental applications. Consumers who may not have had access to traditional financial services are now being included through smarter, more responsive tools that better reflect their real-world financial behavior.

As financial data becomes more portable and accessible, the possibilities for innovation continue to expand. Startups and fintechs are leveraging open banking to introduce services that address long-standing pain points, from simplifying tax preparation to automating savings, investing, and even subscription management.

This evolving ecosystem is enabling consumers to take full advantage of their data, opening doors to financial opportunities that are more inclusive, affordable, and user-friendly than ever before.

Benefits of open banking for businesses

- Higher conversion rates: Open banking has been found to boost conversion rates by enhancing the user journey. By streamlining the payment process, it effectively reduces the chances of abandoned transactions. This improvement leads to higher conversion rates for businesses and merchants.

- Increased acceptance rates: Open banking transactions boast a remarkable success rate, guaranteeing seamless transactions and minimising the likelihood of payment failures.

- Lower transaction fees: This is one of the key advantages that businesses can experience through open banking. By utilising this innovative approach, they can enjoy significant cost savings as compared to traditional payment methods like cards.

- Faster settlement: Open banking ensures faster settlement, resulting in businesses receiving their funds instantly. This improvement increases cash flow and facilitates smoother financial transactions.

- No chargebacks: Open banking eliminates the risk of chargebacks, granting businesses greater certainty in their revenues. By removing chargeback concerns, open banking enhances financial stability and provides a more secure environment for businesses.

Benefits of open banking for banks

- No more screen-scraping: Open banking eliminates the necessity of outdated procedures such as screen-scraping. As a result, it enables faster connections, reduces disturbances, and enhances data accuracy.

- Customer view: Open banking provides banks with a comprehensive customer view. It allows them to access and analyse a customer's complete balance sheet, enabling the provision of personalised advice and tailored services to meet individual needs.

- Adoption: Open banking leads to increased adoption by reducing link breakage and improving system efficiency. As a result, customer satisfaction and loyalty can be enhanced.

- Enhanced security: Open banking incorporates secure APIs to bolster the safety of financial transactions, thereby mitigating the risk of fraudulent activities.

- Innovation: Open banking creates new opportunities for innovation. It allows banks to develop and introduce fresh products and services, enhance their competitive positioning, and drive overall growth.

Final Thoughts

Open banking, in summary, is a transformative force within the financial sector. It brings numerous advantages to consumers, businesses, and banks alike.

By enabling control over financial data, enabling smarter personal finance management, and providing personalised financial products and services, it significantly enhances the overall consumer experience.

Furthermore, businesses and banks benefit from higher conversion rates, reduced fees, faster settlements, while gaining a comprehensive understanding of their customers' financial well-being.

As open banking evolves further, it has the potential to redefine the entire landscape of finance by boosting efficiency, security levels, and prioritising customer-centric approaches.

Why choose Noda for your business?

- Broad Bank Connectivity

Connect with 2000+ banks in 28 countries across Europe through a single, seamless integration. - Low Transaction Fees

Optimise your margins with competitive, cost-effective pricing designed for high-volume growth from 0.1%. - Instant Settlement

Get paid in seconds with real-time account-to-account transfers—no intermediaries, no delays. - Effortless Integration

Go live quickly using plugins for leading e-commerce platforms or flexible APIs for custom setups. - Multi‑Rail Payments

Offer customers more choice by combining open banking, cards, and digital wallets in one streamlined platform. - No‑Code Tools

Accept payments with ease - create links or QR codes without a website or integration required. - Hands-On Support

Enjoy expert guidance from a dedicated manager to ensure a smooth launch and ongoing success.

Contact Noda for a no-obligation demo. Our open banking experts will be happy to look into your unique business case.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each