Payment methods refer to the channel through which businesses and customers complete transactions. It serves as the link between exchanging value for products or services.

In the age of continious digital innovation, modern consumers have a wide array of options when it comes to payments. Understanding various payment methods and how they evolve can help businesses improve customer experience, streamline operations, and stay on top of the latest trends in consumer behaviour.

Here, we take a look at the most popular payment methods, how they work and how you can integrate them into your payment process.

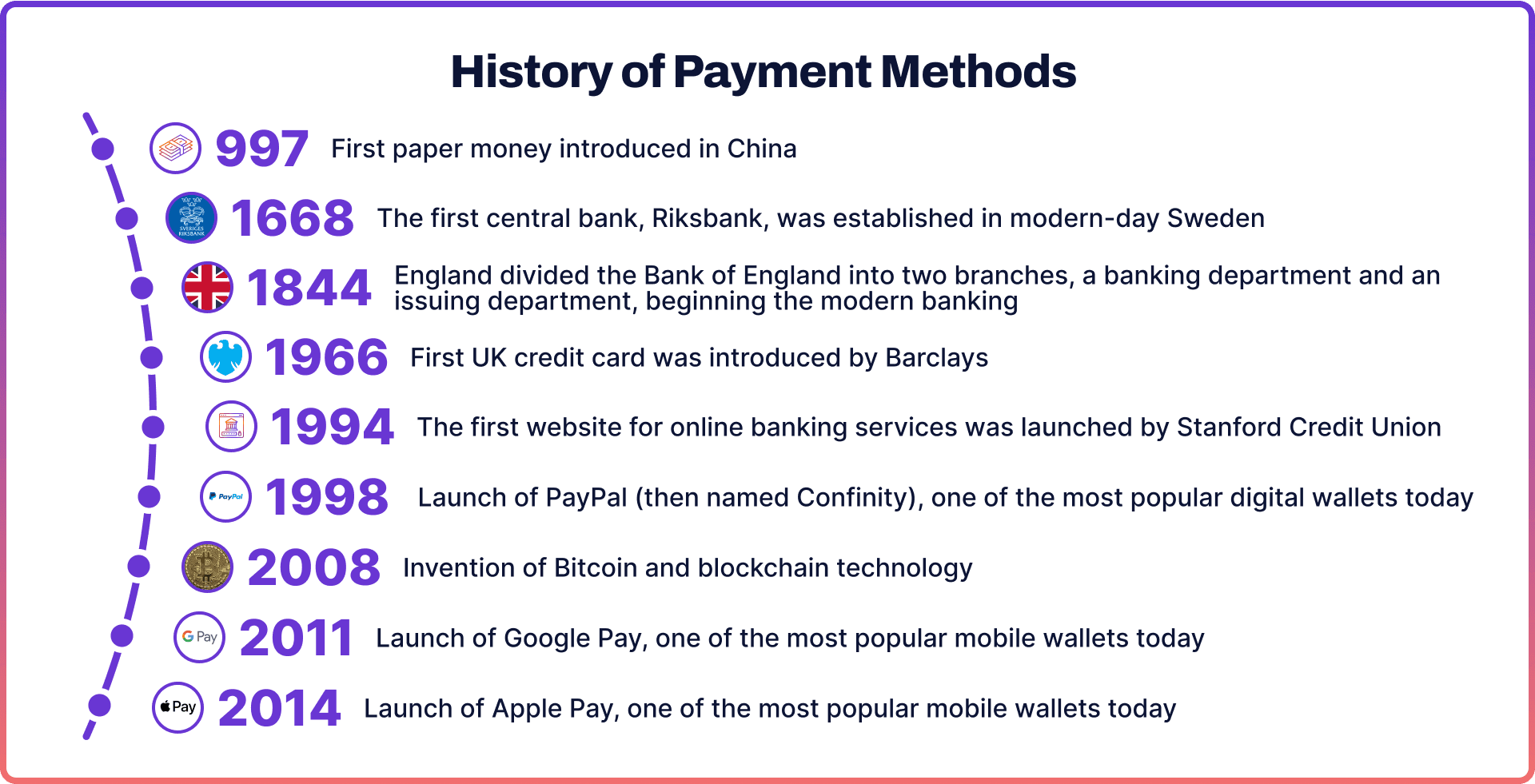

History of Payment Methods

The evolution of payment methods reflects human innovation and our constant search for efficiency. In ancient times, trade relied on barter systems where goods were exchanged directly for other goods. However, as societies grew and traded more extensively, the limitations of bartering became evident. This led to the introduction of commodity money, such as shells, salt, and eventually metal coins.

The next big innovation happened In China, where paper money was introduced in the 10th century during the Song Dynasty. The establishment of modern banking institutions facilitated safer and larger transactions through checks. Credit cards emerged in the 20th century as a groundbreaking development that propelled us into the electronic payment era, becoming one of the most common payment methods.

The digital age led to a rapid evolution of payment methods in the 21st century. Online banking, digital wallets, and mobile payments emerged, bringing unparalleled convenience and enhanced security. Another groundbreaking development in payment methods was the introduction of blockchain technology, which paved the way for cryptocurrencies like Bitcoin.

Most Popular E-Commerce Payment Methods

Customer satisfaction and operational efficiency are greatly influenced by the ease of transactions in the digital age. Here, we take a look at the best payment methods for selling online.

Debit and Credit Cards

Debit and credit cards have been the trusted method for online transactions, offering a secure and convenient way for customers to make purchases or pay for services. Businesses find it almost essential to accept these cards in order to reach a wide customer base.

The process is simple: customers provide their card information, and the funds are securely transferred. With advancements in technology, even physical card usage has become more efficient through contactless payments. The trust and familiarity associated with debit and credit card transactions make them the preferred choice among consumers and business owners alike.

Digital Wallets

Digital wallets have become a popular and secure alternative to traditional payment methods with the rise of digitalisation. Online wallets like PayPal provide individuals and businesses with a convenient platform for transactions, eliminating the need for physical cards or cash. Additionally, mobile wallets such as Apple Pay and Google Pay allow users to store card information on their devices, enabling quick and contactless payments.

The user-friendly interface, combined with advanced security features like biometric authentication, makes digital wallets an appealing option. By incorporating digital wallet payments into their operations, businesses not only meet current consumer demand but also ensure compatibility with future trends.

ACH & Swift Transfers

In the world of global business operations, two essential components play a crucial role in financial transactions: Automated Clearing House (ACH) and Society for Worldwide Interbank Financial Telecommunication (SWIFT) transfers.

ACH transfers are primarily used domestically within the US, facilitating direct deposit payments and business-to-business transactions. Known for their cost-effectiveness and efficiency, they are a reliable tool for domestic financial operations.

On the other hand, SWIFT transfers take the lead when it comes to international transactions. This method provides a secure network that allows financial institutions worldwide to exchange information regarding financial transactions securely.

Electronic Checks

Traditional checks have adapted to the modern era in the form of Electronic Checks or e-checks. These electronic versions maintain the familiar elements of paper checks while harnessing the advantages of digital processing.

E-checks provide businesses with a cost-effective way to accept payments, particularly advantageous for those dealing with high transaction volumes. Additionally, e-checks offer enhanced security and fraud prevention measures, making them a reliable choice.

Bank Transfers

Bank transfers have long been a reliable and secure method for individuals and businesses to move funds. They offer a trusted way to conduct significant transactions, known for their security and authenticity.

With the rise of online banking, bank transfers have become even more convenient, allowing businesses to receive payments directly into their accounts. This is particularly beneficial for B2B transactions. The traceability and transparency of bank transfers also provide an added layer of trust, making them an ideal choice for businesses looking to maintain strong financial practices.

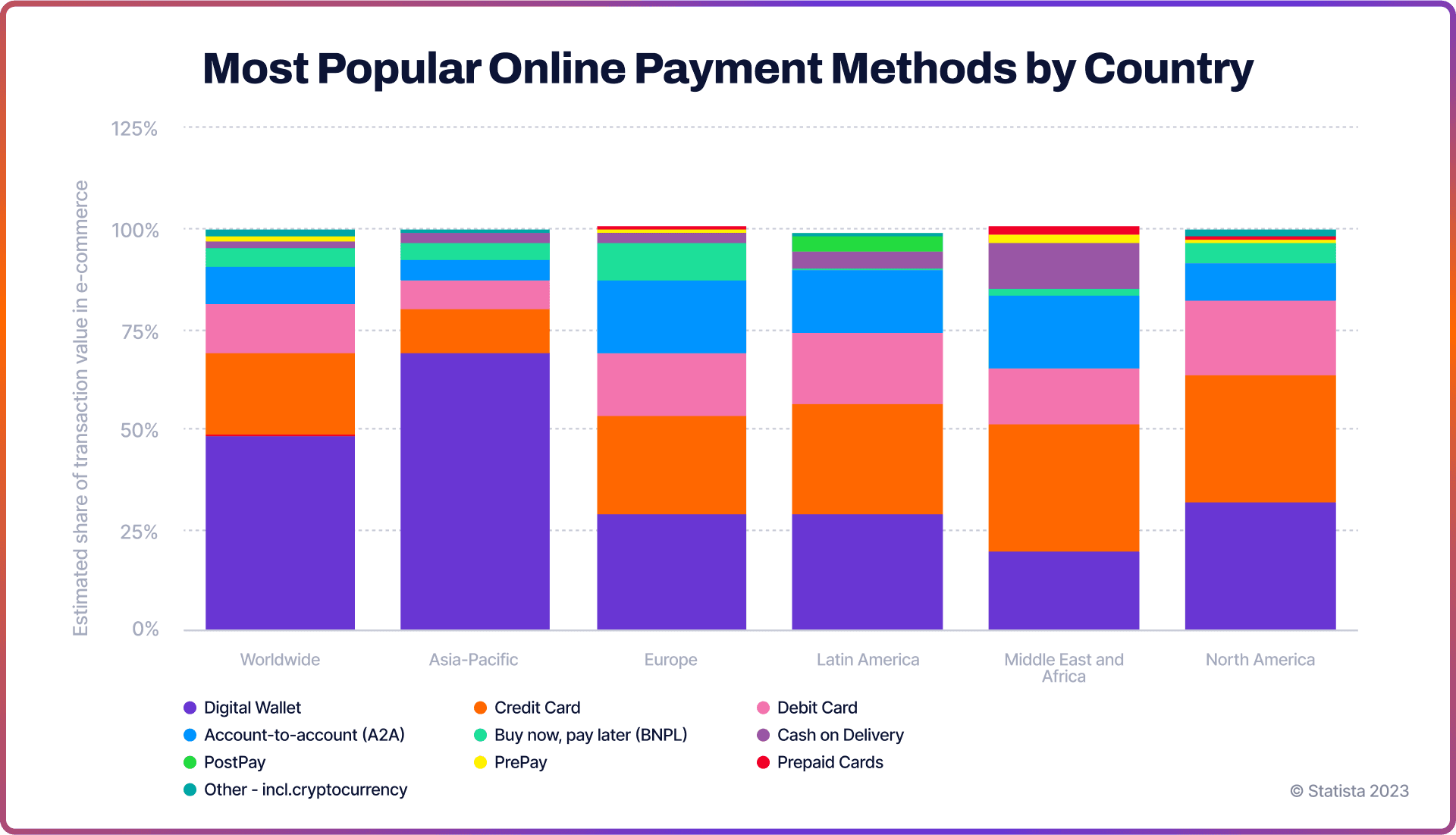

Most Popular Online Payment Methods by Country

Below are the best online payment options in 2022, according to the research by Statista.

- Digital Wallets

Digital wallets, credit and credit cards are the top two online payment methods across all regions, but most of all in Asia-Pacific.

- Credit & Debit Cards

Meanwhile, credit and debit cards were the most used payment methods online in Latin America and Middle East & Africa.

- A2A Payments

In some regions, such as Europe, Latin America, the Middle East & Africa, A2A (account-to-account) payments were taking a significant share of e-commerce payments.

- BNPL

An alternative payment method, Buy Now Pay Later (BNPL), was also popular in Europe, North America and Asia-Pacific.

Online Payment Methods with Noda

Elevate your business with Noda’s payments and open banking solution. Drive increased sales and save valuable time through streamlined processes. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Unlock your business potential with Noda - your payments are our priority.

FAQs

What should you consider when choosing an online payment method?

When choosing an online payment method, consider the security, ease of use, and the preferences of your target audience. It's also crucial to evaluate the cost-effectiveness and the integration capability of the payment method with your existing business systems.

What is the most secure payment method?

Bank transfers and SWIFT transfers are highlighted as secure payment methods due to their authenticity, traceability, and the secure networks they operate within. They are preferred for significant transactions and international financial exchanges, respectively. Yet other payment methods are secure, too.

What is the best payment method for online shopping?

Debit and credit cards, along with digital wallets like PayPal, Apple Pay, and Google Pay, are at the top of the list of online payment methods that are most popular for online shopping. They offer a straightforward, secure, and quick way for customers to complete transactions.

How do you set up online payment for a small business?

Setting up online payment for a small business involves selecting a mix of popular and secure payment methods like debit and credit cards and digital wallets. It's advisable to integrate these payment methods through a reliable payment gateway or platform that complies with financial regulations and ensures a smooth transaction process for both the business and its customers.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each