Almost everyone today has a smartphone. To stay relevant, businesses should leverage this behavioural trend. Statista estimated that worldwide mobile app purchases reached $149.9bn in 2022. This year, m-commerce is projected to amount to almost half - 43.4% - of total retail sales, according to eMarketer.

Android users take the majority share. StatCounter estimated that Android takes up 69.74% of all mobile operating systems as of October 2023. Therefore, having an Android app with an efficient payment gateway is essential to take advantage of mobile revenues.

Here, we take a look at Android payment gateways, how to choose the best provider and complete Android app payment gateway integration.

What is a Payment Gateway for Android Apps?

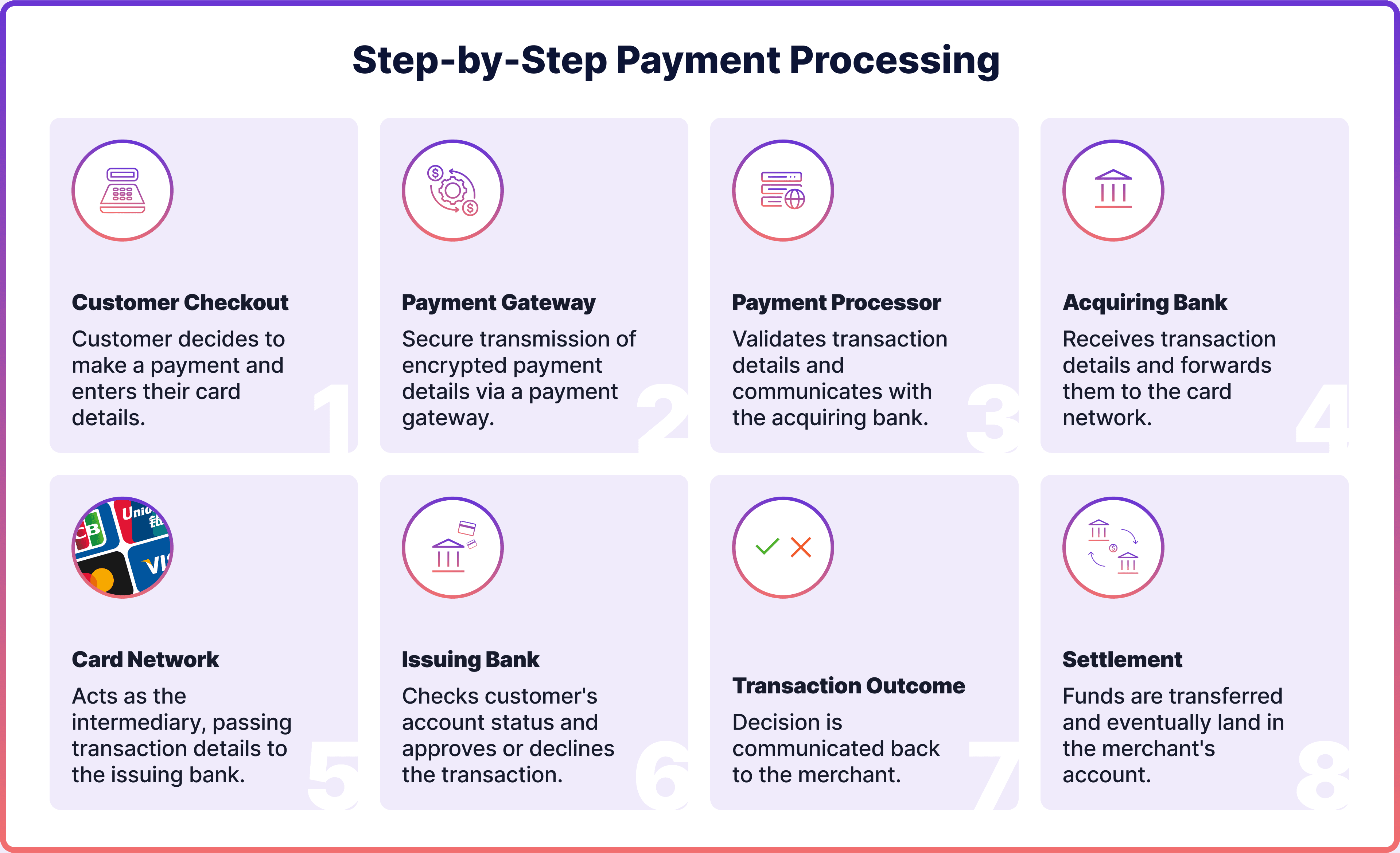

A payment gateway is a crucial piece of technology that enables businesses to accept and process payments securely. In the context of mobile applications, it plays a role similar to that of a card machine found in a traditional store. While a physical terminal reads a customer's card and transmits payment data to the financial institution, a payment gateway within an Android app does the same job digitally.

When integrated into an Android application, a payment gateway acts as a secure bridge between the customer and the merchant. It captures payment details entered by the user, encrypts the information, and then transmits it safely to the payment processor or acquiring bank. Once the transaction is approved or declined, the gateway relays that response back to the app, allowing the merchant to complete the sale or notify the user accordingly.

Payment gateways support various payment methods, including cards, wallets, bank payments, BNPL solutions and various other alternative or regional payment methods. Their implementation ensures that sensitive data is protected during transmission, complying with regulations such as PCI DSS.

Comparing Payment Gateway Integration on Android and iOS

Payment gateway integration is supported on both Android and iOS, but the process differs due to platform-specific development environments and policies. Android apps, built using Java or Kotlin, allow greater flexibility in integrating third-party payment gateways, offering custom checkout experiences and broader support for wallets and card payments. iOS apps, developed in Swift or Objective-C, often face tighter restrictions, especially when dealing with digital goods, where Apple mandates the use of its in-app purchase system or Apple Pay.

Additionally, Apple’s guidelines require rigorous compliance and app review, which can impact how and when a payment gateway is approved or updated. Android’s more open ecosystem allows for faster implementation and testing of gateway SDKs. While most payment gateway providers support both platforms, the depth of features, ease of integration, and policy constraints can vary. These factors must be carefully considered to ensure secure, smooth, and compliant payment experiences across platforms.

Top Payment Gateway For Android Apps

Below, we choose some of the best Payment Gateway solutions for Android Apps, focusing on the EU and UK markets. We analyse pros and cons of each payment gateway whilst focusing on the needs of the UK and EU app developers.

1. Noda

Noda offers a fully API-driven payment gateway built with mobile-first applications in mind, making it ideal for Android apps. It enables pay-by-bank functionality through open banking, combined with support for card and wallet transactions.

Noda’s API is made especially for fast, smooth integration and is complemented by no‑code tools like payment links and QR codes, which are perfect for smaller merchants or those without a website. Our API supports both pay-ins and pay-outs. The platform supports connections with 2000+ banks across 28+ countries in Europe, powering instant payments in most European currencies. While many other providers tend to focus heavily on card-based payments, which can be more expensive, Noda leads with open banking as a smart, modern alternative, whilst providing cards as an additional method for added payment flexibility. In addition, all merchants using Noda benefit from direct support via a dedicated account manager.

2. Stripe

Stripe is favoured by developers for its elegant SDKs and API support for Android apps. It allows businesses to accept a wide variety of payment methods, including but not limited to cards, wallets, bank transfers, BNPL, vouchers and local payment methods. With tools for subscriptions, fraud detection and marketplace payments, Stripe works well for tech-savvy teams building feature-rich Android apps with growth in mind.

3. Fondy

Fondy offers a flexible Android SDK with support for cards, digital wallets and popular local European methods like iDEAL and BLIK. With coverage in over thirty countries and more than three hundred supported payment methods, Fondy is ideal for merchants looking to scale across borders without sacrificing local relevance. However, its lower brand recognition compared to major global gateways may reduce initial user trust in some regions.

4. Paysafe

Paysafe is a widely used payment platform that delivers a dedicated Android SDK, enabling developers to easily integrate secure, in-app payment functionality. It supports card payments, including its own Paysafecard, wallets like Skrill and Neteller, and other payment methods, while ensuring compliance with 3D Secure and PCI requirements. This makes it particularly well-suited for Android applications that require a high level of transaction security and user authentication. Paysafe is a well-known choice in the iGaming industry, where transaction security, user verification, and card acceptance are top priorities. While it's a strong option for Android apps that prioritise secure card payments, Paysafe offers limited support for open banking and some alternative local payment methods, which may reduce flexibility in certain markets.

5. PayU

PayU is particularly valuable for Android applications operating in emerging markets like India, Latin America, and countries like Poland, Romania and Hungary among others in Eastern and Central Europe. Its SDKs support card payments, mobile wallets and growing open banking services. PayU balances global access with local flexibility, making it ideal for developers targeting diverse geographies with a single solution.

6. GoCardless

GoCardless is a reliable choice for Android apps that rely on recurring payments or subscriptions. Built around direct debit and open banking, it offers an efficient way to handle customer payments across markets, especially in the UK and EU. Its API allows Android developers to integrate features such as automated retries and real-time status updates, which are valuable for membership-based or SaaS services.

7. PayPal / Braintree

PayPal and Braintree provide popular options for Android app developers, with robust SDKs and global reach. PayPal offers rapid integration and user trust, while Braintree delivers a more flexible developer experience, supporting cards, digital wallets and alternative payments. While versatile, these platforms typically come at a higher cost compared to open banking-first providers.

8. Worldline

Worldline supports in-app payments for Android apps across Europe, focusing on enterprise clients with high transaction volumes. It offers card payment processing and strong acquiring support for card transactions. With secure SDKs and a focus on compliance, it is best suited to retailers looking for an omnichannel solution that integrates physical and mobile commerce.

9. Adyen

Adyen is a global acquiring bank that delivers extensive mobile SDKs for Android, making it a strong fit for enterprise-level Android apps needing cross-border support. It enables in-app acceptance of card payments, bank transfers and local methods, while giving developers full control over the user experience. Adyen is trusted by large retailers for its infrastructure, scalability and unified commerce capabilities, but is not well suited for smaller businesses because of minimum monthly turnover requirements.

What To Consider When Choosing Payment Gateway For An Android App?

The quest for a perfect payment gateway for an Android app may seem overwhelming at first. The market is practically saturated with different providers. Below are the key factors to consider when starting your research.

Unique Business Needs

The intricacies of your business will always come first. For example, would your Android app require any special features? Do you offer one-off in-app purchases or a subscription cycle? In the case of the former, you’ll need the recurring payments feature. Think about your unique business needs before starting your search. Note that some payment processors provide a payment gateway as part of their package, combined with a merchant account and other functions.

Customers

Your clients and their unique needs are of utmost importance, too. Have you conducted sufficient market research to find out who your clients are, where they’re from, and what are their preferred payment methods? For example, for global clientele, your Android app would need a payment gateway that can operate worldwide. In terms of payment methods, Android app users are likely to need Google Pay. Credit and debit cards are essential, as well as other digital wallets such as PayPal.

Security

The payment gateway you choose for your Android app will be handling your clients’ financial information. This means you have to make sure that your clients’ data is in safe hands. Ensuring that the payment gateway follows industry-standard security protocols is crucial. The Payment Card Industry Data Security Standard (PCI DSS) is what you are looking for, so filter out providers that are not PCI DSS-compliant.

Pricing

When choosing a payment gateway, you may notice that providers charge different amounts. Watch out for the payment structure, transparency in transaction fees, setup and cancellation charges, chargeback and monthly fees. Establish your budget prior to the research, and thoroughly evaluate the fees to identify a provider that meets your criteria.

UX Design

Opt for intuitive and user-friendly design to enhance the experience of your clients. A bad UX design can cost revenues and damage your brand. You can trial the gateway by requesting a demo version or documentation outlining the payment process step-by-step.

How to Choose a Payment Gateway for Android App

- Define your Business Needs and Budget

Determine your desired features in a payment gateway, whether you require recurring payment or integration. You should also decide your budget at this stage.

- Research Different Providers

Compare different payment gateway providers, paying attention to the various features they offer as well as customer reviews and testimonials. Filter down to only DCC-compliant providers.

- Review Fees & Pricing

Evaluate the fee structure and pricing of the providers, making sure they fit into your budget. Look out for hidden fees. The best providers will demonstrate transparency in pricing.

- Trial the service

When you have finalised a list of providers that meet your business needs, test their services. Most payment companies will offer you a trial period without the payment commitment. This is a very important step before integrating payment gateway in your Android app.

How to Integrate Payment Gateway in Android

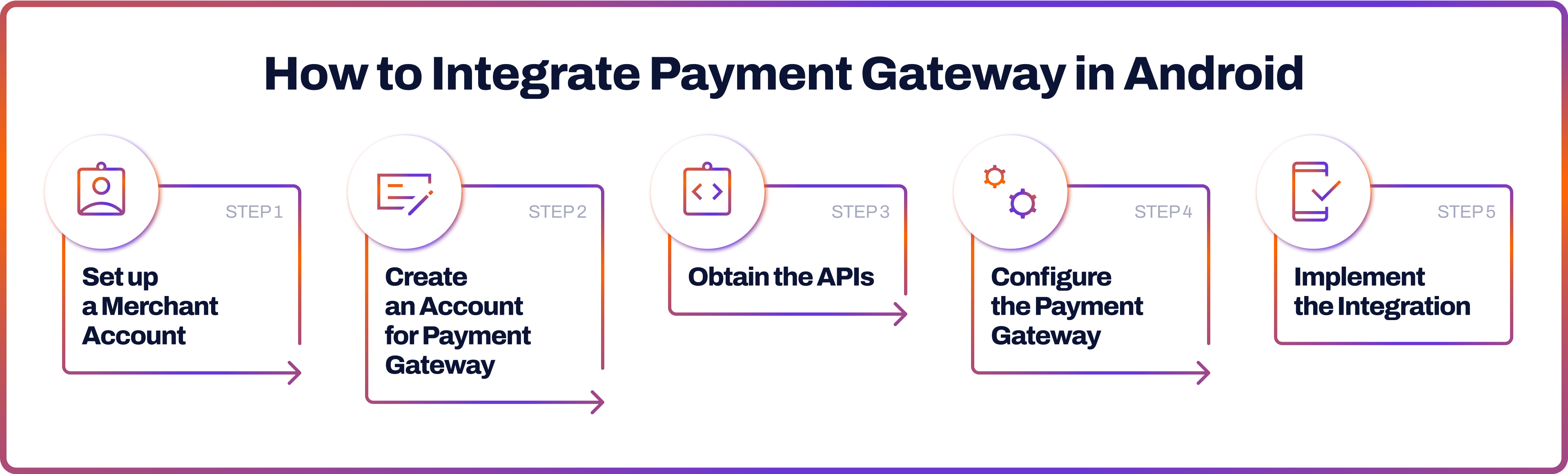

Set up a Merchant Account

The merchant account would typically be offered by your payment processor. As mentioned before, some payment processors provide payment gateways too. This is a special type of account that allows you to accept payments. However, in order to accept open banking payments, you don't need a special merchant account. Open banking payments are initiated directly from customers bank into your business bank account, making the process quicker, smoother, and less to worry about.

Create an Account for Payment Gateway

When you’ve chosen the right payment gateway, it’s time to set up an account. As mentioned before, it may be more convenient if your payment processor and gateway are provided by the same company. After setting up, you’ll be able to connect your payment gateway to the merchant account.

Obtain API credentials

Create the Application Programming Interface (API) via your payment gateway provider. This step is essential to establish communication between your app and the gateway.

Configure the Payment Gateway

Configuration will depend on your provider and the features they offer. For example, your Android payment gateway integration may require enabling recurring payments or selecting specific payment methods that you want to accept.

Integrate the Payment Gateway

At this stage, your provider would typically send you whatever you need for payment gateway integration in Android. This will typically include code snippets and documentation. Make sure to test, and do not hesitate to consult with your provider.

Why choose Noda for your Android app?

- Broad Bank Connectivity

Connect with 2000+ banks in 28 countries across Europe through a single, seamless integration. - Low Transaction Fees

Optimise your margins with competitive, cost-effective pricing designed for high-volume growth from 0.1%. - Instant Settlement

Get paid in seconds with real-time account-to-account transfers—no intermediaries, no delays. - Effortless Integration

Go live quickly using flexible APIs for custom setups. - Multi‑Rail Payments

Offer customers more choice by combining open banking, cards, and digital wallets in one streamlined platform. - Hands-On Support

Enjoy expert guidance from a tech team ready to help with your Android App’s integration, and a dedicated manager to ensure a smooth launch and ongoing success.

Contact Noda for a no-obligation demo. Our open banking experts will be happy to look into your unique business case.

FAQs

Which payment gateway is best for Android apps?

The best choice for an Android payment gateway will depend on your app’s unique needs and requirements. Determine your desired features in a payment gateway, whether you require recurring payment or fraud prevention.

How do I add a payment gateway to my Android app?

You should first choose your payment gateway provider. To add a payment gateway to the Android app, you would need to set up a merchant account and obtain API credentials. From there, you can configure the payment gateway and implement the code snippets serviced by your provider.

What should I consider when choosing a payment gateway for an Android app?

You should evaluate your business needs, target audience, preferred payment methods, security requirements, pricing structure, and the overall user experience the gateway provides.

Which payment gateway works well on Android?

Gateways like Noda, Stripe, Braintree and Adyen are built for mobile, supporting fast, secure checkouts and mobile wallets like Google Pay.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each