Small businesses rely on efficient payment processing for their operational success. From the point of sale to the business's bank account, the journey of a customer's payment is vital. It requires precision to guarantee security, speed, and satisfaction for everyone involved.

Mastering digital payment processing is not just about facilitating transactions for small businesses; it's about building trust, improving the customer experience, and establishing a strong foundation for growth.

Here, we take a look at the payment options for small businesses, the key challenges they face, and how to choose the best merchant services for small businesses.

What is Payment Processing for Small Businesses?

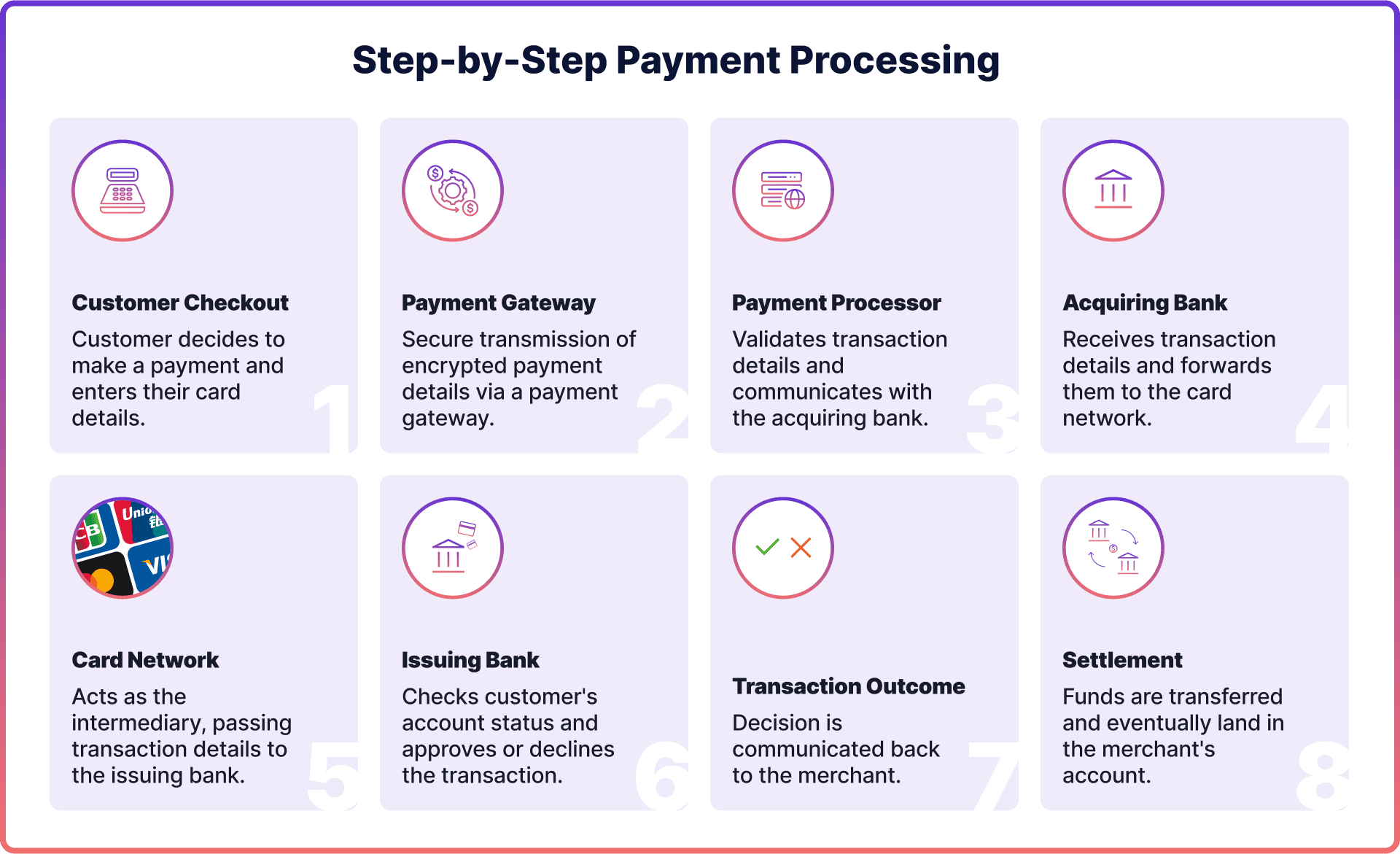

Online payment processing for small businesses is the essential process that allows companies to receive payments from their customers for products or services. It involves different stages and key players.

- Customer: Initiates the payment by providing their payment information.

- Merchant: The business that accepts the payment.

- Payment Gateway: A service that authorises and encrypts the payment information, ensuring a secure transaction.

- Payment Processor: The entity that communicates between the merchant, the payment gateway, and the financial institutions, ensuring the transaction is successful.

- Issuing Bank: The financial institutions that approve or decline the transaction based on the customer’s available funds or credit.

- Acquiring Bank: The merchant’s bank where the funds are deposited post-approval.

Common Challenges of Small Business Payments

Small businesses face unique challenges when establishing a seamless payment processing system. Overcoming these hurdles requires a combination of technological understanding and strategic planning. Let's take a closer look at some common challenges and their implications.

Integration

When implementing a payment processing system, the integration process is key to its success. However, merging the new system with existing business operations and software solutions can be quite challenging.

Without seamless integration, businesses may face issues like data silos, operational inefficiencies, and a disjointed customer experience. To overcome these challenges, it is crucial to select payment solutions that can easily integrate with your current systems. This will ensure a smooth flow of data and create a unified operational framework for your business.

Processing Costs

Processing payments can be expensive, especially for small businesses that rely on thin profit margins. These costs include transaction fees, monthly service fees, and equipment expenses.

It's important to carefully consider the fee structure of various payment processing solutions and select one that fits within your business's financial framework while also providing competitive rates.

Lack of Support

Having reliable support and guidance from your payment processing provider is crucial, particularly when facing technical issues or looking to enhance system performance.

Insufficient support can result in extended periods of downtime and a loss of revenue. It's important to partner with providers that offer strong customer support and technical assistance to avoid these challenges.

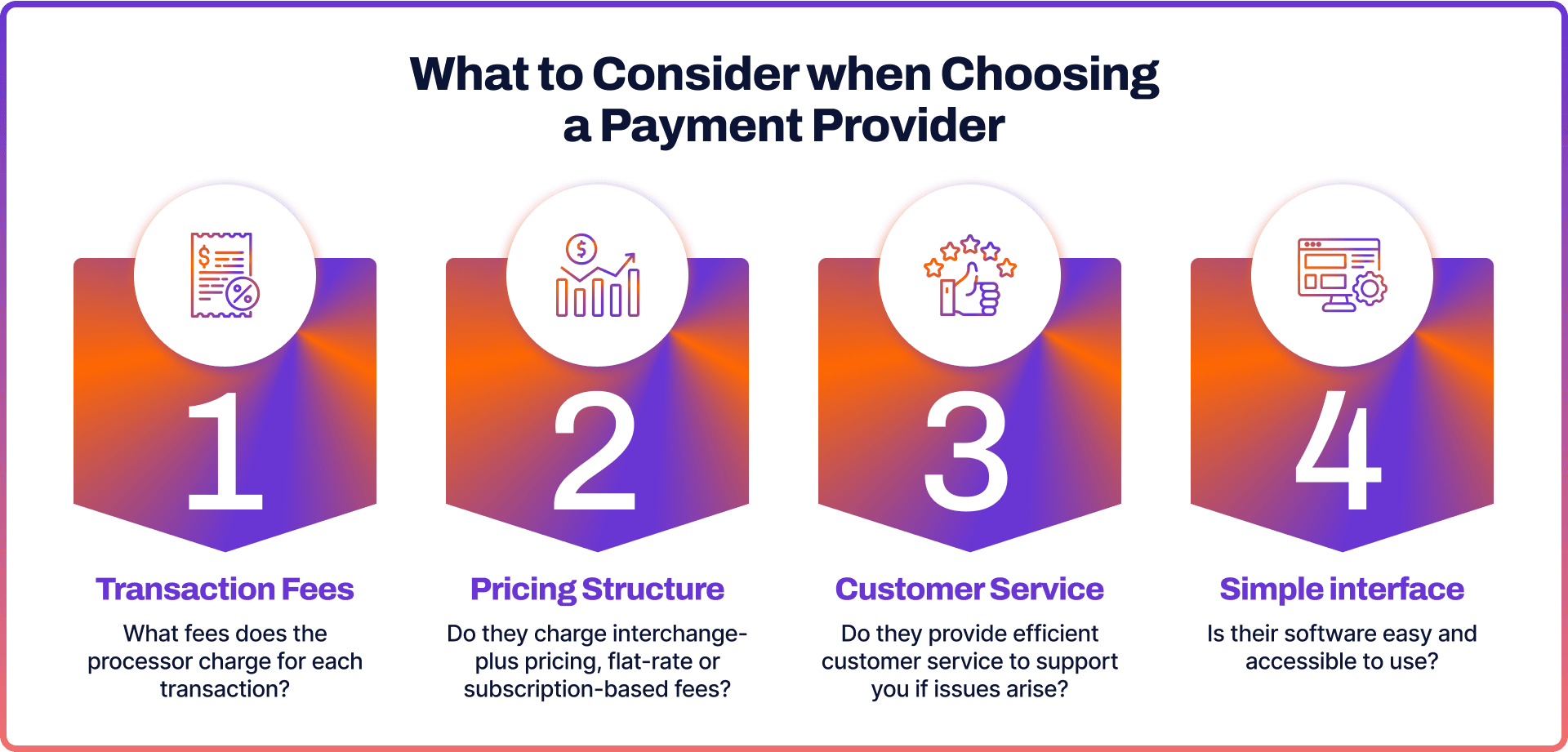

Factors to Consider When Choosing a Payment Provider

Choosing the right payment system for a small business is a crucial decision that can have a major impact on your business's efficiency and customer satisfaction. To help you navigate this important selection process, we have outlined some key factors to consider and provided a step-by-step guide.

Transaction Fees

It's important to evaluate the fees that processors charge for each transaction carefully. These fees can significantly impact your profitability, especially if your business handles a large volume of transactions.

Pricing Structure

Payment software for small businesses may provide different pricing models, including interchange-plus, flat-rate, and subscription-based pricing. It's important to understand the details of the each model and how they align with your business's financial structure.

- Interchange-plus pricing is transparent, showing the interchange fee and the processor’s markup separately.

- Flat-rate pricing is straightforward but may be higher than interchange-plus pricing.

- Subscription pricing involves a monthly fee plus a small per-transaction fee, which could be beneficial for businesses with high transaction volumes.

Customer Service

When choosing a processor, it's important to consider customer service as well. Opt for a reputable brand known for providing excellent support in case any issues arise. Make sure to read customer reviews to evaluate this point.

Simplicity

Implementing a user-friendly and intuitive payment processing system can greatly reduce the learning curve for your business, resulting in smoother operations. Request detailed information about their services and payment process explained step-by-step.

How to Choose a Payment Processor for a Small Business

1. Analyse Consumer Behaviour

Identify the preferred channels of your customers for making purchases, whether it's in-store, online, or mobile. Select a processor that is proficient in managing transactions across these various channels.

2. Evaluate Transaction Volume

Evaluate the typical number of transactions your business processes. If your business handles a large volume of transactions, a subscription pricing model may be advantageous. On the other hand, if your transaction volume is lower, flat-rate pricing may offer more cost-effective options.

3. Determine Your Required Features

When selecting a provider of online payments for a small business, it's important to identify the key features that are essential to your operations. This may include recurring billing capabilities, mobile payment options, or integration with your existing point-of-sale system. It is crucial to ensure that the chosen processor can accommodate these specific needs in order to streamline your payment processes effectively.

Payment Processing with Noda

Elevate your business with Noda’s open banking and payment platform for small businesses. Drive increased sales and save valuable time through streamlined processes. Our all-in-one platform prioritises customer understanding, efficient operations, and growth.

Noda is a worldwide payment and open banking provider for seamless business transactions. From payment facilitation and AI-powered financial analytics for businesses to customer clustering and user-friendly verification, Noda has got you covered. Our platform uses cutting-edge AI and machine-learning technologies. Unlock your business potential with Noda - your payments are our priority.

FAQs

What is the best credit card processing for small businesses?

The best payment solution for small businesses would be one that offers competitive transaction fees, a transparent pricing structure, excellent customer service, and a user-friendly interface. It should also cater to the specific needs of the business, such as multi-channel payment processing and seamless integration with existing systems.

How do small businesses process payments?

Small businesses process payments in a similar manner as any other businesses. The key players of the process include the customer, merchant, payment gateway, payment processor, and financial institutions (issuing and acquiring banks). To ensure secure transmission of payment information, it passes through a payment gateway to reach the payment processor. From there, the processor interacts with financial institutions to authorise and complete the transaction.

What to consider when choosing payment processing for small businesses?

When small businesses are considering payment processing options, it's important to take into account several factors. First, carefully evaluate the transaction fees and pricing structures available, such as interchange-plus, flat-rate, or subscription models. Next, consider the level of customer service provided by the payment processor and how user-friendly their system is. Additionally, it's crucial to understand your customers' preferred shopping methods while analysing your transaction volume. Finally, determine the essential features necessary for smooth business operations.

How does a merchant account for a small business work?

A merchant account for small businesses functions as a specialised bank account designed to facilitate flexible payment options, primarily through debit and credit cards. It operates as an intermediary between the payment processor and the business's own bank account, temporarily holding funds until they are securely transferred. This setup guarantees a seamless transaction process for both parties involved.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each