Buy now, pay later (BNPL) payments are not new, but their popularity surged in recent years. For merchants, this means adding BNPL as a payment method is key to stay relevant; failing to do so could mean losing out to competitors.

BNPL has clear benefits for consumers, but there are significant wins for businesses too. Higher sales, customer loyalty, and appealing to a broader clientelle, just to name a few. In this article, we take a look at the Buy Now Pay Later for merchants and how this once alternative payment option can meet your business needs.

What Is BNPL?

BNPL, which means buy now, pay later, is a payment method that lets consumers buy products immediately and pay for them later. This allows customers to buy without full payment upfront and settle their debt in installments over a set period.

Merchants typically provide Buy Now Pay Later schemes through partnerships with providers who manage the financing and payment processing.

While the specifics can differ by country, BNPL services generally offer three payment plans:

- Pay Later: Pay the full amount in 30 days.

- Pay in Installments: Divide the payment into three or four equal, interest-free parts.

- Extended Financing: Spread the cost over up to 36 months for larger purchases, with interest possibly being charged.

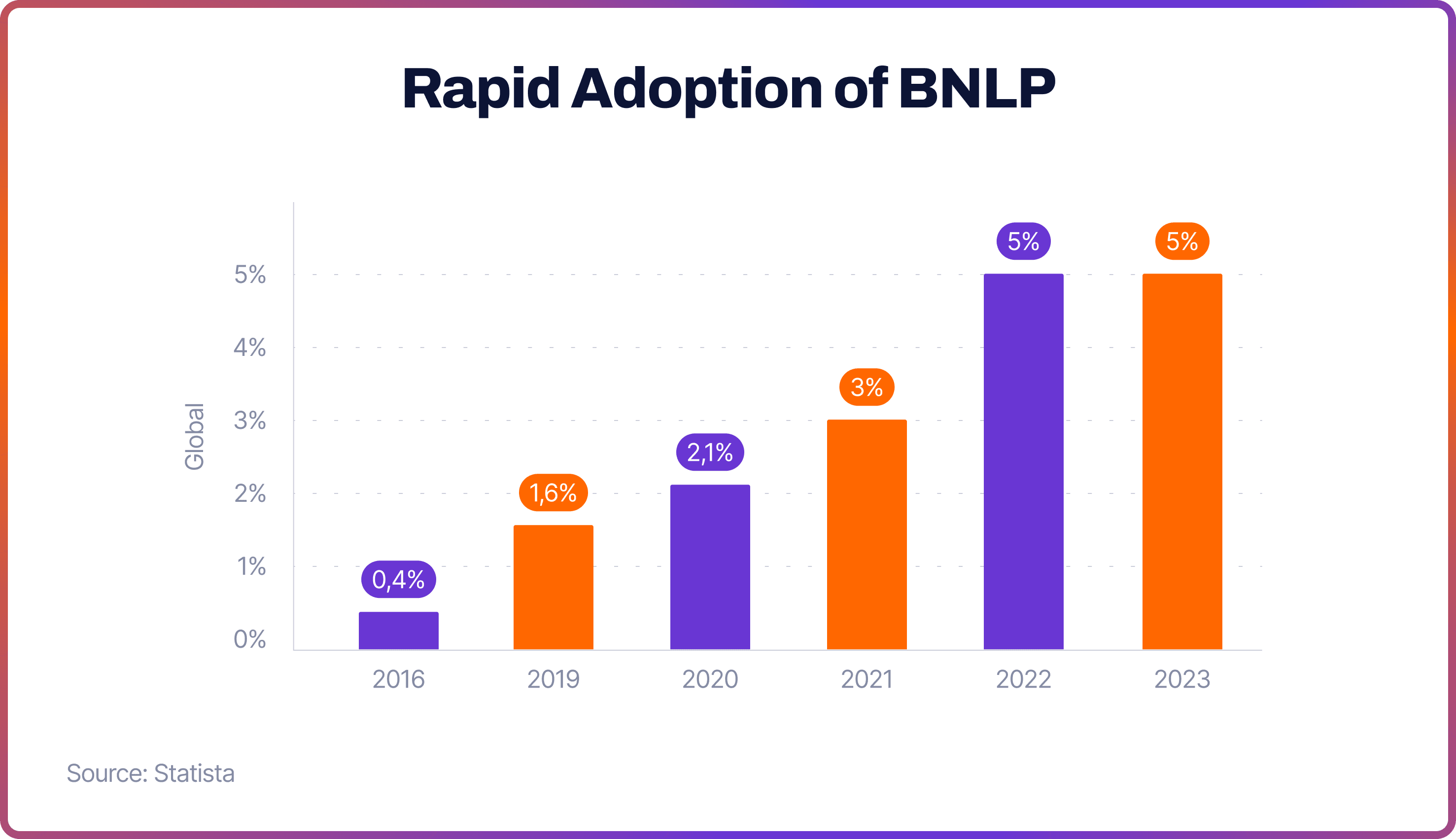

Rapid Adoption of BNPL

Since the COVID-19 pandemic began, customers have gradually been moving away from traditional credit cards. Factors such as high interest rates, reduced credit limits, and ineffective rewards programs have accelerated this trend.

This decline has created an opportunity for alternative payment methods, including BNPP. According to Statista, the global usage of BNPL platforms in e-commerce transactions surged from 0.4% in 2016 to 5% in 2023. The top BNPL markets include Sweden, Germany and Norway.

Meanwhile, a 2022 report from the CFPB revealed that the number of BNPL loans in the US increased dramatically from 16.8 million in 2019 to 180 million in 2021. Initially, this type of financing was most commonly used for beauty and apparel items, but it has since expanded to include travel, pet care, groceries, and gas. Typically, BNPL loans vary from $50 to $1,000, with the average loan amounting to $135 over a six-week period.

In the UK, a 2023 report from the Money Pensions Service indicated that an estimated 10.1 million people have used BNPL in the past year. Additionally, the report highlighted a growing trend of using BNPL to purchase day-to-day essentials.

Who Are Target Customers of BNPL?

Historically, BNPL has primarily targeted Millennials and Generation Z. A Forbes study found that BNPL usage among Gen Z has increased by 600% since 2019, and tripled among Millennials in 2021. Additionally, the Money Pensions Service report also noted that most BNPL users were under 40 in 2023, but its adoption is rising among all age groups.

How Does Buy Now Pay Later (BNPL) Work

Merchants can add BNPL payment options by partnering with a BNPL provider or a payment service that offers BNPL.

When a customer chooses BNPL, the provider conducts a soft credit check at the checkout page. This confirms the customer's ability to repay. Once approved, the provider pays you the total amount your customer owes at purchase. The customer pays an initial sum and the rest in installments over a set period, which varies based on their capability and the provider's terms.

Typically, this service is interest-free for customers. As a merchant, you pay a transaction fee, usually between 2-8% of the sale price. Using a BNPL service typically doesn't impact your customers' credit scores. However, providers will charge a late fee if a customer misses an installment.

BNPL and Chargebacks

Chargebacks—when a bank reverses a transaction and refunds the customer from the merchant’s account—do not impact the merchant directly in a BNPL setup. The BNPL provider deals with all payment processing costs and pays on behalf of the customer.

If a customer initiates a chargeback, the provider initially absorbs the cost. However, if the chargeback is related to product delivery issues or faults, the BNPL provider may pass this cost back to the merchant.

Benefits of Buy Now Pay Later (BNPL) for Merchants

Offering BNPL can make your products accessible to more clients, helping to attract and retain customers and grow your business. Below are some other key benefits of BNPL payment methods.

More Sales

Offering BNPL makes it easier for customers to afford purchases upfront. This can lead to more sales as customers enjoy the convenience and flexibility. Extra tip: promoting BNPL payment option on product pages rather than at the checkout can boost sales.

More Customers

Investing time and effort in acquiring new customers is more effective when you provide the options they prefer at the checkout. Offering BNPL can increase repeat business, particularly among Millennials and Gen Z.

These younger consumers are most likely to shop online but generally have less wealth than older generations and are less likely to own a credit card. By allowing them to spread costs over time, BNPL makes purchases more manageable, which helps attract and retain these younger customers.

Less Cart Abandonment

Cart abandonment is a major issue for online retailers. To reduce this, it's crucial to limit interruptions at checkout. By offering a variety of payment methods, including BNPL, merchants can give customers fewer reasons to leave without purchasing.

Buy Now Pay Later for Small Businesses

Offering BNPL can be a game-changer for small enterprises looking to expand their market reach. With less resource, they can attract a broader audience, and cultivate loyalty especially among Millennials and Gen Z who favor online shopping but prefer less immediate financial commitment.

How to Avoid BNPL Fraud

When it comes to money and payments, security must always be a key concern. For merchants, the majority of liability in fraud disputes falls on BNPL providers. In fact, a Bain report indicated that 23% of merchants saw a reduction in fraud with Buy Now Pay Later solutions.

However, customer fraud still occurs, whether it’s through scammers using stolen identities or cases of family fraud, such as children inadvertently making charges on their parents' cards.

Under PSD2, advanced security protocols are a legal requirement. For example, Strong Customer Authentication (SCA) mandated multi-factor verification for all customer-initiated online and contactless transactions.

FAQs

What are the benefits of Buy Now Pay Later for e-commerce?

Buy Now, Pay Later (BNPL) can boost e-commerce, increase average order value and purchase frequency. It can also reduce cart abandonment by offering a fast and straightforward checkout process, while attracting a broader clientele, especially among GenZ and Millenials.

What are the Buy Now Pay Later options for businesses?

Businesses can integrate BNPL options like Pay in 30 days, interest-free installments, and extended financing for larger purchases. Popular Buy Now Pay Later apps include Klarna, Affirm, and Afterpay. BNPL payment methods may also be available through a third-party payment provider.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each