Traditional card payments, once the default, are now being challenged by a new wave of cardless payment solutions. Merchants are embracing them to avoid ongoing issues such as high card fees, slow transaction times, and the risk of abandoned checkouts. With modern solutions like open banking and QR codes, accepting payments has never been easier.

This article explains what cardless payment is, how cardless payments work, and why they’re becoming a go-to choice for businesses. We’ll explore popular cardless payment methods, their benefits, and practical examples to help you decide which solution suits your business. With verified statistics and real-world insights, this guide is designed to help UK merchants navigate the world of cardless transactions.

Cardless Payments Explained

What is cardless payment? Simply put, it's any transaction where the payer does not use a physical or virtual card. Instead, the payment is completed through:

- Open banking (pay-by-bank).

- Direct debit.

- Manual bank transfer.

- QR code payments.

These methods are collectively known as cardless payment solutions or cardless payment systems.

How to Do Cardless Payment?

To execute a cardless payment, customers usually follow these steps:

- Choose a Merchant: Customers select a product or service they wish to purchase.

- Select Payment Method: At checkout, they choose the cardless payment option, such as open banking.

- Authenticate Payment: Customers are redirected to their bank’s app or website, where they log in and authorise the payment.

- Confirmation: Once the payment is approved, the merchant receives confirmation, and the transaction is complete.

This method not only simplifies the payment process but also enhances security by using bank authentication.

Why Are Cardless Payments Gaining Popularity?

The shift towards cardless payment technology isn't just a trend—it's backed by compelling data.

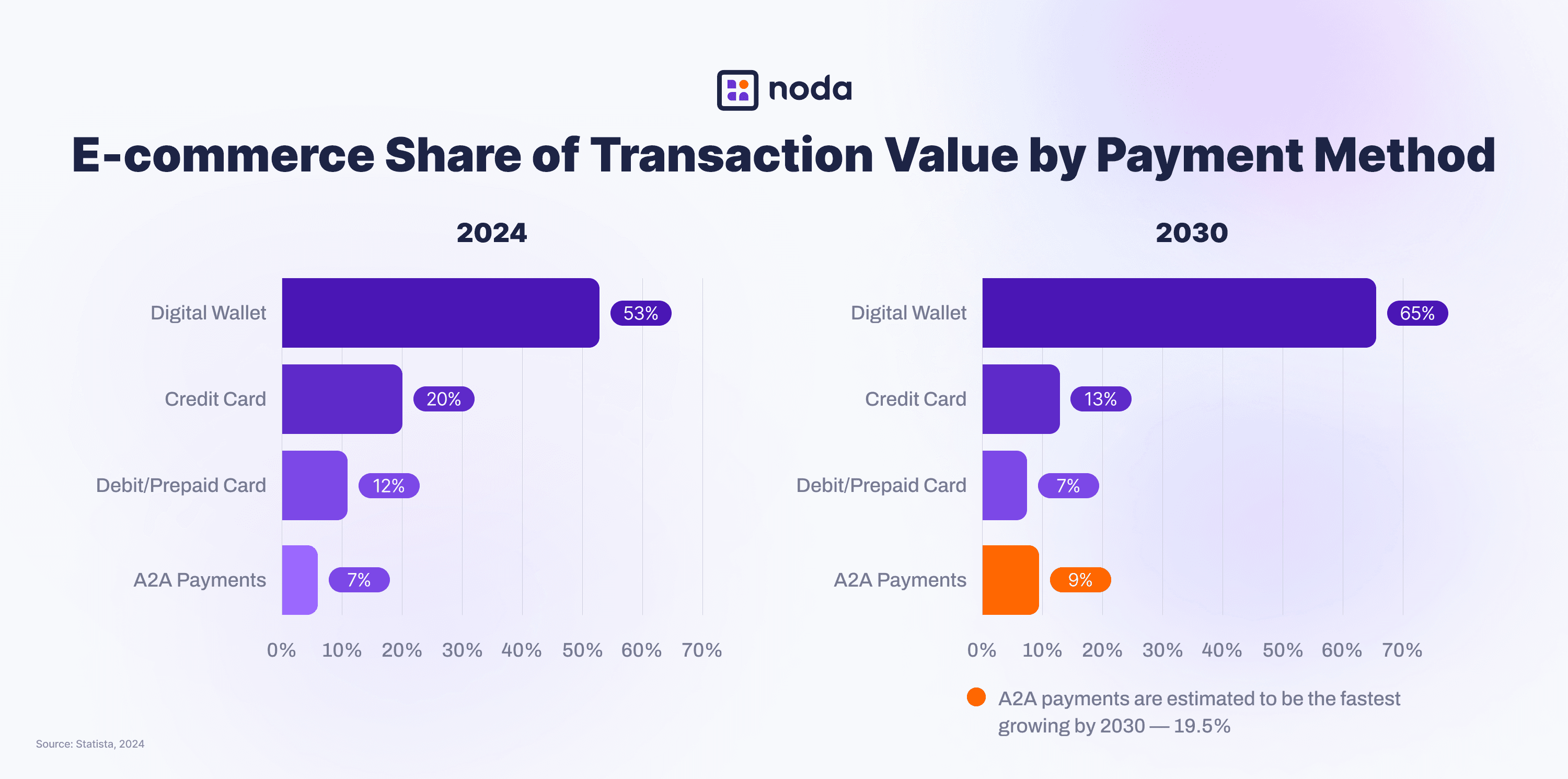

- Cards still account for 27% of global e-commerce transactions as of 2024, but their share is shrinking. By 2030, credit card transactions are forecasted to grow by just 0.8%, while debit cards will decline by 1.9%.

- In contrast, digital wallets are set to rise by 18.1%, and account-to-account (A2A) cardless payments—such as open banking—are expected to grow the fastest at 19.5%.

- Global transaction volumes are projected to reach $15.7 trillion in 2024, with over 80% of retailers utilising contactless payment options.

Several factors are driving the adoption of cardless payment methods:

- Cost Savings: By avoiding card networks, merchants save on interchange and scheme fees. For example, open banking payments can reduce transaction costs compared to card payments.

- Speed: Cardless transactions are often instant. Open banking payments in the UK settle in seconds unlike card payments, which can take 1–3 days.

- Security: Cardless payment systems use bank-grade authentication, such as biometrics or two-factor authentication, minimising fraud.

- Customer Preference: Younger generations, particularly Gen Z, favour seamless digital experiences. A 2024 survey by Mastercard found that 72% of 18–24-year-olds prefer cardless payment apps over traditional cards.

Cardless Payments in the UK: A Market in Transition

According to Statista, cards remained king in the UK’s payments landscape, especially for POS payments due to the widespread integration of contactless (tap-to-pay) technology. But the landscape is clearly shifting towards cardless payments and digital alternatives.

The UK’s regulatory environment is also playing a crucial role in shaping the future of payments.

A Push for Account-to-Account (A2A) Payments

Although the UK has a very strong payments infrastructure and adoption rates of account-to-account (A2A) payments are growing quickly, it still lags behind some other European nations in A2A adoption. Countries like Poland with BLIK and the Netherlands with iDEAL have established strong domestic cardless payment apps used for everything from peer-to-peer payments to e-commerce, while the UK has so far relied heavily on international card brands and mobile wallets.

Past experiments such as Paym (a mobile-to-mobile bank transfer service that shut down in 2023) show that domestic innovation has been attempted, but no A2A system has yet achieved mass-market traction. The Faster Payments cardless payment technology underpins real-time transfers and is widely used in banking apps, but it has not translated into a mainstream e-commerce checkout option.

In November 2024, the UK government’s National Payments Vision report highlighted the opportunity for merchants to save costs by broadening access to account-to-account (A2A) payments. While a single household-name domestic scheme does not exist, open banking has already laid strong foundations. The report emphasises the need to scale consumer awareness and merchant adoption so that A2A can become a mainstream alternative alongside cards.

Cardless Payment Methods for Online Merchants

Let’s compare the most common cardless payment methods and how they stack up against traditional cards.

While digital wallets like Apple Pay, PayPal, and Google Pay are widely used, they often still rely on card connections, so they won’t be included in this discussion.

| Method | Costs | Settlement Time | UX | Market Research / Acceptance |

| Cards | High fees due to interchange, scheme fees, and chargebacks | 1–3 days (varies by provider) | Familiar, requires card details, CVV, and 3D Secure | High (globally accepted, widely recognized payment method). |

| Open Banking (Pay-by-bank) | Lower cost, no card networks, no chargebacks | Instant | Seamless — users pay via their bank app | Growing, but strong primarily in Europe/UK; limited global reach currently. |

| Direct Debit | Lower than cards; processing fees may apply | ~3 days (Bacs in UK) | Automated; great for recurring payments | Strong in specific regions (e.g., Europe, UK, US for ACH); less ideal for cross-border. |

| Manual Bank Transfer | Usually no fees, but manual tracking needed | Varies (hours to days) | Manual entry of IBAN; error-prone | Universal (any bank transfer), but inconvenient for real-time online checkout. |

Cardless Payment Methods for UK Merchants

UK Merchants can choose from several cardless payment solutions, each suited to different business needs. Below, we explore the most common options, their benefits, and limitations.

Open Banking Payments (Pay-by-Bank)

What is it? Open banking, or pay-by-bank, allows customers to pay directly from their bank account using a cardless payment app. Customers authenticate transactions via their bank’s secure interface, often with biometrics or a password.

This cardless payment method is rapidly gaining traction with global account-to-account (A2A) transactions, a key component of open banking, projected to grow by 209% from 60 billion in 2024 to 186 billion by 2029.

How Do Cardless Payments Work with Open Banking?

- At checkout, the customer selects “Pay by Bank.”

- They are redirected to their bank’s secure environment.

- The customer approves the payment using their login or biometric authentication.

- Funds are transferred instantly to the merchant’s account.

These cardless transactions are processed through secure, PSD2-compliant APIs that banks share with licensed providers like Noda. By bypassing traditional card networks, open banking eliminates interchange fees and chargeback risks, making it a cost-effective cardless payment solution.

Benefits for UK Merchants with Noda

- Lower Costs: Noda's open banking solution eliminates interchange and scheme fees, reducing payment processing costs. With fees starting at just 0.1%, Noda offers a highly cost-effective alternative for merchants.

- Better UX: Noda provides a seamless checkout experience within customers' trusted bank apps, with a high potential to reduce cart abandonment compared to card-based checkouts.

- Instant Settlement: Unlike card payments, which can take 1–3 days to clear, Noda ensures funds settle in seconds (or up to 1 working day), improving merchant cash flow.

- No Chargebacks: Noda's bank-authenticated payments eliminate fraudulent chargebacks, which costs UK merchants as high as £128 million in the UK on yearly basis.

- Seamless Integration: Noda provides no-code plugins for WooCommerce, Magento, OpenCart, and PrestaShop, along with a flexible Open Banking API for custom builds. For one-off payments, instant payment links are available and require no integration whatsoever.

- Enhanced Security: Noda uses PSD2-compliant APIs and bank-level authentication to ensure secure transactions, protecting against fraud.

- Scalability: Noda's platform is designed to scale with your business, handling payment processing needs efficiently for both small startups and large enterprises.

Direct Debit: Automated Cardless Payment Solution

Direct debit is another cashless payment method that enables businesses to collect recurring payments from customers’ bank accounts. Customers authorise payments by signing a digital mandate, and funds are pulled on a set schedule.

- In the UK, direct debits are processed via the Bacs system, taking about three days.

- SEPA Direct Debit offers similar functionality across 36 European countries.

Direct debit is ideal for subscriptions and memberships, where automation and reliability are key.

How to Integrate Direct Debits

- Merchants have two options for accepting direct debit payments: using a third-party provider or managing the process themselves.

- Third-party providers handle everything – compliance, customer authorisation, and payment processing – making setup quick and easy.

- Managing direct debits in-house requires a Service User Number (SUN) and strict compliance with regulations like the Direct Debit Guarantee and GDPR. Businesses must get customer consent, securely store data, and keep accurate records.

Direct Debit benefits for UK Merchants:

- Cost-Effective: Usually lower fees than card payments.

- Automated: Ideal for subscriptions or memberships.

- Secure: Regulated by the Direct Debit Guarantee.

Limitations:

- Slow setup due to mandate requirements.

- Three-day processing delays via Bacs.

- Risk of failed payments if funds are insufficient.

- Risk of chargebacks.

Manual Bank Transfers: Low-Cost Cardless Transactions

Manual bank transfers require the customer to send money directly from their own online or mobile banking app to the merchant’s account, oftenr using details provided at checkout in a separate invoice. This method is most common for B2B, high-value, or service-based transactions.

How to Integrate Manual Bank Transfers

To integrate manual bank transfers, merchants should provide clear payment instructions when sending an invoice to a client.

Since these transfers don’t update in real-time, a system for tracking payments and communicating with customers is essential. Manual transfers require more administrative effort from both businesses and customers.

Manual Bank Transfer benefits for UK Merchants:

- Low Cost: Minimal or no processing fees.

- No Chargebacks: Reduces financial disputes.

- Flexible: Suitable for high-value transactions.

Limitations:

- Customers must leave checkout and log into their bank.

- Extra steps can discourage customers and lead to abandoned purchases.

- Payment details can be entered incorrectly.

- Merchants may wait hours or days to verify funds.

Cardless Payments In-Store: QR Codes and Beyond

Cardless payments are not limited to online commerce. In physical shops, QR codes have become a popular cardless payment technology, allowing retailers to accept cardless credit card payments via digital wallets—no terminal required.

The Rise of QR Code Payments:

- The global QR payments market is projected to reach $45.9 billion by 2032, with a CAGR of 16.27%.

- By 2025, 42% of in-store mobile transactions are expected to use QR codes globally.

- In China, QR code adoption for payments exceeds 85%.

How Cardless QR Payments Work:

Instead of using a card, customers just scan a QR code, confirm the payment on their phone, and they’re done – no extra hardware, no PINs.

Merchants can instantly generate a unique QR code linked to a branded checkout page. Customers scan it, check the details, choose their bank and approve the transaction, all in a matter of seconds.

Noda QR codes for face-to-face payments do exactly that. The technology allows merchants to create:

- Dynamic QR codes: Customers manually enter the amount before paying.

- Fixed-amount QR codes: Pre-set payment amounts (e.g., £10, £20, £50).

- Merchant-controlled QR codes: The business sets the amount before generating the code.

QR Payments Benefits for Merchants:

- Lower costs: No need for card terminals, just a smartphone and a QR code.

- Faster checkouts: Customers scan, pay, and go.

- Easy setup: Merchants can start instantly, no complex integration.

- Instant settlement: Funds arrive in real time.

Limitations:

- Requires customers to have a compatible cardless payment app.

- QR code payments typically require internet access, which can be a barrier in areas with poor connectivity or technical outages.

Which Online Cardless Payment Method is Best for Your Business?

Selecting the optimal cardless payment system requires matching your business model with the right technology. Here's how each solution stacks up:

| Feature | Open Banking | Direct Debit | Manual Transfer | QR Code Payments |

| Best for | All business types including E-commerce, B2C | Subscriptions, B2B | High-value, B2B | In-store/physical retail |

| Settlement Time | Instant (Faster Payments) | 3 days (UK Bacs) | Instant (if sent via Faster Payments) | Instant (if bank payments are the chosen payment method) |

| Fees | Low | Low | None/Low | Low |

| Chargebacks | No | Yes | No | No |

| User Experience | Excellent | Automated | Poor | Seamless |

| Integration | API, plugins | Provider, in-house | Manual instructions | QR code generator |

The Verdict: Open Banking for Growth-Focused Businesses

If you're prioritising cost reduction, customer experience, and operational efficiency, open banking delivers on all fronts followed by QR Code Payments. These are among the best cardless payment solutions that simultaneously cuts costs, speeds up transactions, eliminates chargebacks, and provides instant settlement.

1. Open Banking: The Top Choice for Most Businesses

Why Open Banking Leads:

- Zero interchange fees (save 1.5-3% per transaction)

- Instant settlement improves cash flow immediately

- No chargebacks due to bank authentication

- Superior customer experience through familiar banking apps

- Real-time payment confirmation eliminates uncertainty

Best for: E-commerce, service businesses, and any merchant prioritising cost reduction and customer experience.

2. QR Code Payments: Perfect for Physical Stores and Tradespeople

Why QR Codes Rank Second:

- Minimal setup costs (no card terminals needed)

- Works online and in-store seamlessly

- Instant payments with immediate confirmation

- Easy implementation requires only smartphone access

- Growing consumer adoption especially post-pandemic

Best for: Retailers with both online and physical presence, restaurants, and small businesses wanting flexibility.

Take Payments Anywhere with Noda’s QR Codes

Noda’s QR Payments is a simple, low-cost solution designed for physical payment needs. Generate dynamic or fixed-amount QR codes in seconds, display them on your till, invoices, or marketing materials, and let customers pay instantly via their banking apps. With fees of just £0.20 per transaction, no card terminals, and instant settlement, Noda’s QR payments cut costs and speed up cash flow.

FAQs

What is a cardless payment?

Cardless payment is any payment method that doesn’t require a physical card. This includes open banking (pay-by-bank), QR code payments, direct debits, and manual bank transfers.

How do I make a cardless payment?

To make a cardless payment, customers use methods like scanning a QR code, authorising a payment in their banking app, or setting up direct debits. The process depends on the payment type but always skips the need for a physical card.

How do cardless payments work?

Cardless payments work by moving money directly from a customer’s bank account to the merchant without using card networks. They are typically faster, more secure, and lower-cost than traditional payment methods.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each