With the rapid evolution of technology in today's digital age, our approach to managing money and conducting transactions has undergone significant changes. One notable innovation is the emergence of digital wallets.

Let’s delve into the meaning of digital wallets in modern finance, and how they are reshaping everyday commerce by making cashless the new norm.

What is a Digital Wallet?

A digital wallet, also known as an e-wallet, is a secure application that stores payment information such as credit and debit cards. It is used online as well as on smartphones and tablets.

While all digital wallets are designed to store and facilitate electronic transactions, mobile wallets is a subcategory of digital wallets that is created for use on mobile phones.

What are Digital Wallets Used For?

Apart from finances, digital wallets can store gift cards, loyalty cards, event tickets, hotel reservations, identification cards, and much more. During Covid-19 pandemic, digital wallets were used to store vaccination certificates.

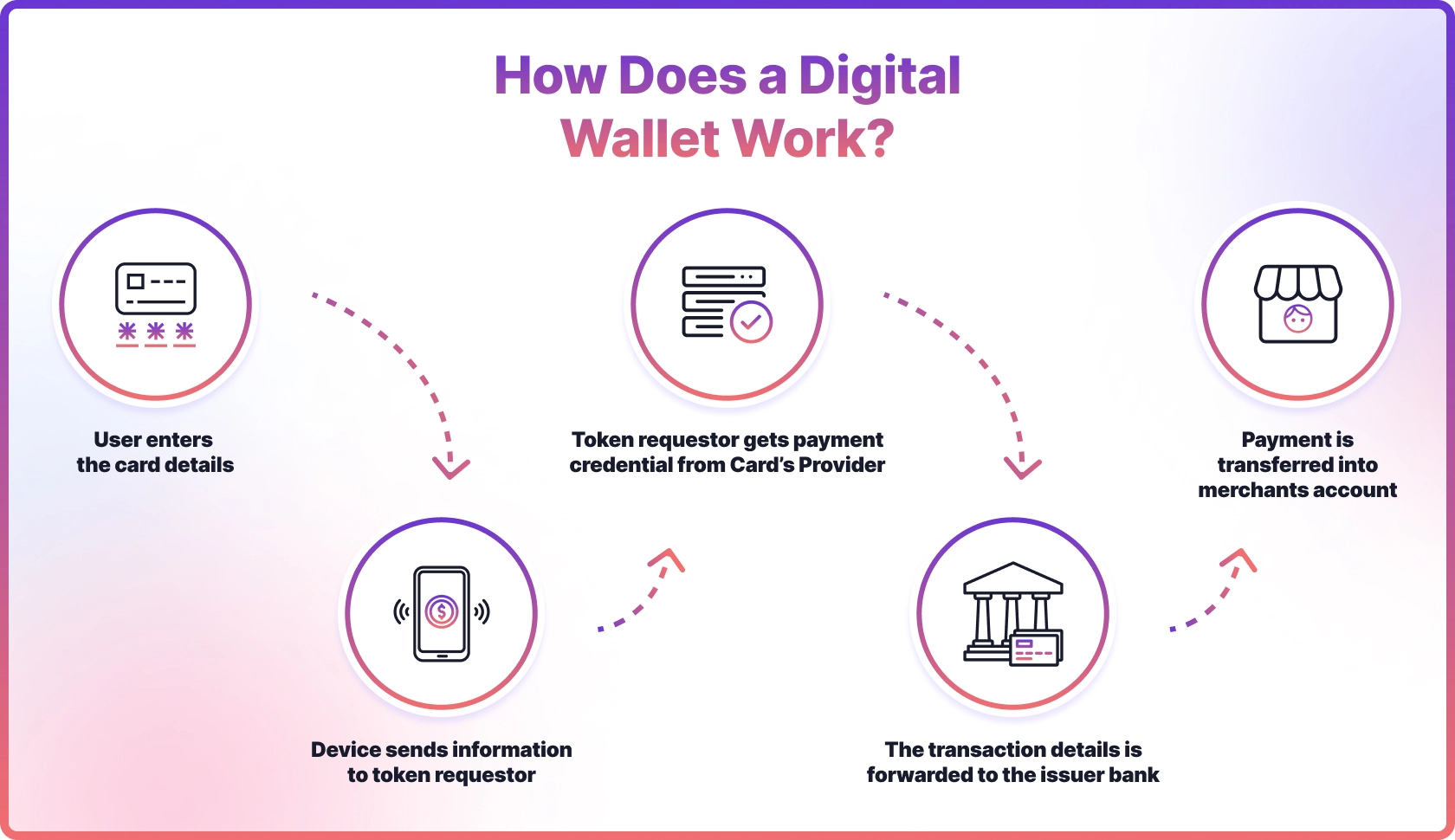

How Does a Digital Wallet Work?

For merchants, understanding how digital wallets work is crucial in order to ensure smooth payment experience.

Technology Behind a Digital Wallet Explained

Digital wallets use advanced technologies to provide a seamless and secure transaction experience. Here are some of them:

- QR Codes, also known as Quick Response codes, are matrix barcodes that store information. They can be scanned using a device's camera to initiate payments or access information.

- Near Field Communication (NFC) is a technology that enables two devices to exchange data through close proximity. It is commonly used in mobile wallets such as Apple Pay and Google Pay. In order for a transaction to take place, the merchant must have a card reader that is compatible with NFC.

- Magnetic Secure Transmission (MST) is a technology that replicates the magnetic stripe found on regular payment cards. Samsung Pay, for example, utilises both MST and NFC to enable convenient mobile payments.

When a user starts a transaction, the digital wallet sends the relevant card information to the point-of-sale terminal. This process involves various intermediaries such as payment processors and banks to successfully complete the payment.

Digital wallets prioritise security by using authentication mechanisms and data encryption to protect personal information from potential risks.

Types of Digital Wallets

From the development perspective, there are three main types of digital wallets:

- Open Wallet: An open e-wallet functions similar to a bank card and is mainly provided by banks or their affiliates. It allows users to conveniently buy goods, transfer funds, and even withdraw cash from ATMs. PayPal serves as a prominent example of this type of e-wallet.

- Closed Wallet: A closed digital wallet is designed to be used solely within a particular platform, limiting payments to services provided by the issuing entity. An excellent example of this type of wallet is Amazon Pay.

- Semi-closed Wallet: A semi-closed wallet strikes a balance between the two previous types. It gives users the flexibility to make transactions with various merchants, both online and offline. However, for smooth transactions, merchants must have an official agreement with the wallet issuers. Additionally, these wallets can also be provided by entities that are not traditional financial institutions.

Meanwhile, among the myriad of digital wallet brands available, the following stand out as the most popular and widely adopted:

- Apple Pay: A product of Apple Inc., it's seamlessly integrated into iPhones, iPads, and Apple Watches.

- Google Pay: Designed for the Android ecosystem, Google Pay offers a simple and secure way to pay, both online and offline.

- Samsung Pay: Exclusive to Samsung devices, it stands out with its dual MST and NFC capabilities.

- PayPal: A pioneer in the online payment space, PayPal has expanded its services to offer a digital wallet.

- Venmo: Owned by PayPal, Venmo is more than just a payment platform. It combines social media elements, allowing users to share and comment on transactions, making money transfers a social experience.

- AliPay: Developed by Alibaba Group, AliPay dominates the Chinese market.

- WeChatPay: Integrated within China's most popular messaging app, WeChat, this digital wallet is essential for many in China.

Final Thoughts

The digital wallet space is blossoming and constantly innovating. While the platforms mentioned above have gained global recognition, the popularity and usage of specific digital wallets can vary depending on regional preferences and technological capabilities. Therefore, it's crucial to stay informed about key digital wallet trends.