If you’re a UK ecommerce merchant, switching to open banking – commonly referred to as pay-by-bank – could cut your payment costs significantly. But how much will it really save you?

In this article, we break down all the cost components, compare them to card fees, give real UK provider examples, and help you understand hidden trade-offs so you can make an informed decision.

Key Takeaways

- Open banking payments cost less: Typical UK rates range from 0.1–1.0% or £0.20–£0.50 per transaction – far below the 1.5–3%+ common with card payments.

- Faster settlement: Funds move instantly via the Faster Payments system, improving cash flow compared to multi-day card settlement cycles.

- Negotiable pricing: High-volume merchants can often secure discounts, SLAs, or performance guarantees by negotiating with providers.

- Operational trade-offs: There are no chargebacks under open banking, so merchants must manage refunds and disputes directly and communicate policies clearly.

Understanding Merchant Card Payment Fees

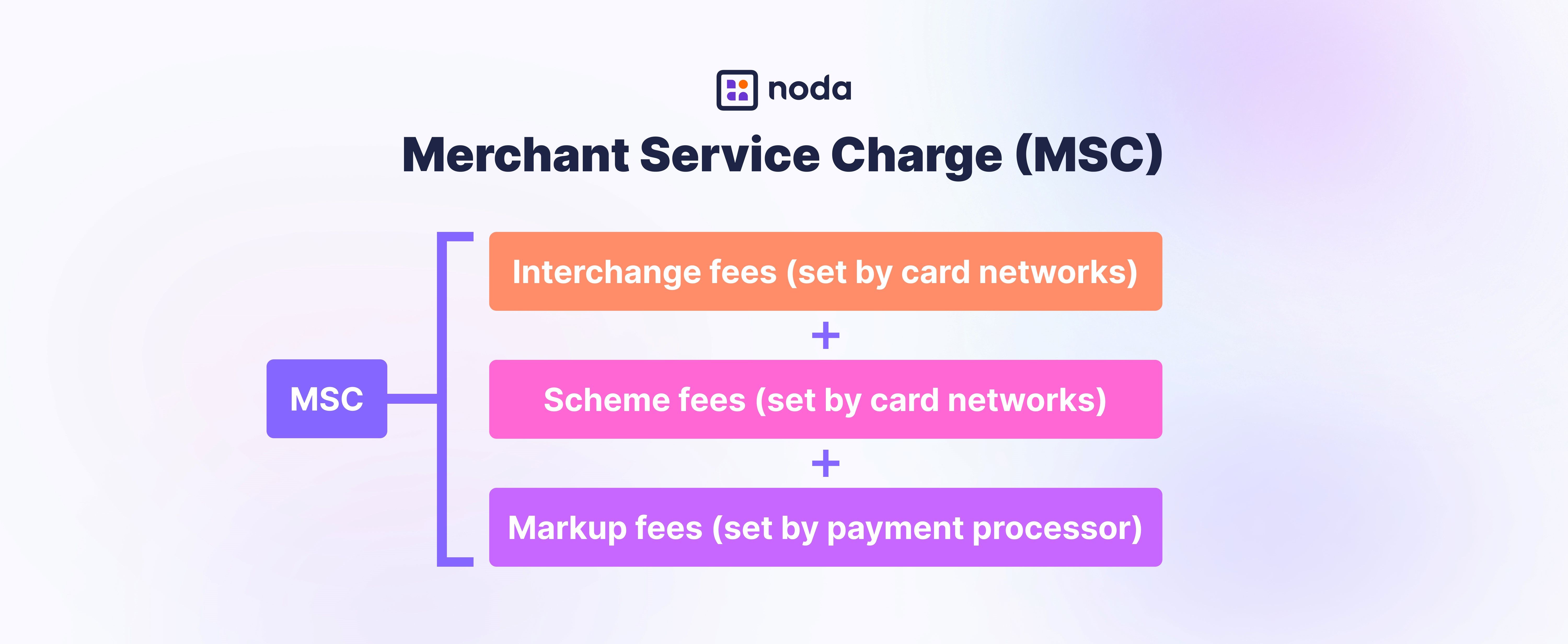

Card payment fees consist of three components: interchange fees, scheme fees, and an acquirer’s markup.

Card Interchange Fees

Interchange fees are payments made by the payment processor to the card issuer (typically the customer’s bank). They cover costs such as credit risk, fraud prevention, and processing card transactions.

While these fees go to the banks, they’re actually determined by the card networks (like Visa or Mastercard) and can differ depending on the card type, payment channel, and region.

In many markets, interchange fees are regulated and capped. For instance, within the EEA, they’re limited to 0.2% for debit cards and 0.3% for credit cards on domestic transactions.

Following the UK’s exit from the EU, payments between the UK and the EEA were reclassified as cross-border, meaning the EEA caps no longer applied. As a result, Visa and Mastercard increased interchange rates for card-not-present (online and phone) payments.

| Card type | Transaction type | Card present | Card not present |

| Debit | Domestic | 0.2% | 0.2% |

| Inter-regional | 0.2% | 1.15% | |

| Credit | Domestic | 0.3% | 0.3% |

| Inter-regional | 0.3% | 1.5% |

Source: Merchant Savvy, October 2025

You can check up-to-date regional interchange Visa debit and credit processing fees here, and Mastercard processing fees here.

American Express (Amex) doesn't technically have interchange fees like Visa and Mastercard, as it operates as both the card network and issuing bank, handling everything in-house. Amex uses a structure called discount fees that function similarly to interchange fees. They don’t disclose their fee structure, but typically Amex cards incur higher costs.

Card Scheme Fees

Interchange fees go to the issuing bank, while scheme fees go to card networks for using their rails, and they’re non-negotiable. For example, Visa and Mastercard charge various scheme fees for EEA domestic customer transactions.

| Card type | Scheme fee |

| Visa Credit | 0.0140% + £0.0145 |

| Mastercard Credit | 0.0398% + £0.0054 |

| Visa Debit (incl. prepaid) | 0.0100% + £0.0145 |

| Mastercard Debit (incl. prepaid) | 0.0398% + £0.0054 |

Source: Merchant Savvy, October 2025

Some payment processors combine interchange and scheme fees into their advertised rates. In such cases, these costs are built into a flat-rate or tiered pricing model, meaning merchants don’t pay the fees separately.

Read: How to Reduce Card Processing Fees

Acquirer Fees

Markup fees (also known as acquirer fees) represent the portion of the fee that the payment processor or acquirer retains as revenue for handling the transaction. These fees are typically negotiable.

Overall, this fee usually falls between 0.25% and 3% of the transaction amount, depending on factors such as the card type (debit, credit, or commercial) and whether the payment is made in person or remotely. Online card payments are classed as card-not-present transactions.

Cost Components for Pay-by-Bank Fees

Open banking payments remove the need for traditional card processing altogether.

Why Open Banking Payments Are Cheaper

Funds move directly between customer and merchant accounts, avoiding card networks and their associated interchange and scheme fees. For merchants, this results in a more cost-effective way to accept payments.

At Noda, for example, pay-by-bank fees start at only 0.1% per transaction. Calculate your savings when switching to Noda.

Refunds & Dispute Handling

One nuance of open banking payments in the UK is that they don’t come with standard consumer protections like Section 75 or chargeback rights available with cards. Instead, disputes and refunds are managed through your provider’s or business’s own refund policies.

While for e-commerce merchants this is an obvious cost-saving – no chargebacks means no expensive chargeback fees, it may be a nuisance for consumers. It’s best to stay transparent with customers about this and outline clear refund and dispute policies.

What UK Merchants Actually Pay: Open Banking Fees UK

Open banking providers in the UK typically charge either a flat fee per transaction or a small percentage of the transaction value, depending on the business model and volume.

- Flat fees: many providers charge between £0.20 and £0.50 per transaction. This model suits merchants with higher average order values (AOV), as the fixed cost remains predictable regardless of purchase size.

- Percentage fees: Percentage-based pricing usually falls between 0.1% and 1.0% of the transaction value. At Noda, for example, transaction fees start from 0.1%. This structure can be more cost-effective for lower-value transactions, offering flexibility for businesses with diverse order sizes.

Compared to traditional card processing, which often ranges from 1.5% to 3%+ once interchange, scheme, and acquirer fees are added, open banking remains a significantly cheaper alternative for UK e-commerce merchants.

Public Pricing vs Custom Quotes

Open banking pricing in the UK isn’t always transparent. While some providers publish clear rates, others operate on custom quotes – making direct comparisons tricky.

- Public pricing: A few players, like Noda, list transaction-based pricing starting from around 0.1% or a low flat fee. These companies often highlight transparency and accessibility for SMEs, letting merchants estimate savings before signing up.

- Custom quotes: Larger providers such as TrueLayer, Yapily, Token.io, and GoCardless typically avoid publishing standard rates. Instead, they offer tailored quotes based on transaction volume, integration scope, and region.

- Free trials and sandbox access: Many providers advertise free trials or sandbox environments to attract merchants. These are testing spaces for API or checkout integration, but transaction fees usually apply once live.

Fee Negotiation Leverage

There’s room to negotiate your open banking fees, especially for merchants with consistent or high volumes. Here are the common tactics to use:

- Volume discounts: Most providers offer tiered pricing once you exceed certain transaction thresholds. Merchants processing large or recurring volumes can often secure lower per-transaction rates or waived setup fees.

- Service Level Agreements (SLAs): While uptime and API reliability are key differentiators, many providers don’t publish formal SLAs by default. Negotiating guaranteed uptime, settlement speed, and support response times can add real value – particularly for high-traffic merchants.

- Performance guarantees: Some newer players may offer onboarding incentives or performance-based terms, such as fee rebates tied to conversion targets or uptime metrics.

UK Open Banking Providers: Fee Comparison Table

Provider fees as of October 2025. For more up-to-date pricing, please visit the providers’ websites.

Noda Helps You Control Payment Costs

Noda gives merchants full control over payment costs with one unified platform for open banking, cards and digital wallets – including automatic fallback when a bank isn’t supported.

You get transparent, low pricing, fast settlement via Faster Payments, and an optimised checkout that boosts conversion.

Noda’s plug-and-play plugins for WooCommerce, PrestaShop, OpenCart, and Magento make setup effortless. You can also use no-code tools like hosted payment pages, QR codes for in-person payments, or instant payment links. For full flexibility, Noda offers an Open Banking API to build custom payment experiences.

FAQs

Is pay-by-bank always cheaper than card payments?

Usually it is cheaper. Card fees stack up from multiple layers (1.5–3%+), while pay-by-bank usually costs 0.1–1% or £0.20–£0.50 per transaction.

What pricing models do open banking providers use in the UK?

They use flat, percentage, or hybrid fees. Rates range from 0.1–1%, and large merchants often get custom quotes.

How much can I save? Can you run numbers?

If you process £250K/month at 2.2% card fees, that’s £5,500. At 0.7% Pay by Bank, it’s £1,750 – saving ~£3,750/month (~68%).

Will open banking payments settle instantly?

Usually yes. They use Faster Payments for near-instant settlement, though provider batching may cause small delays.

Do I lose consumer protection since there are no chargebacks?

There are no automatic chargebacks, but refunds and disputes go through your provider or internal policy. It’s important to have a transparent dispute and refund policy to gain customer trust.

How do I pick an open banking provider in the UK?

Check bank coverage, API reliability, fees, settlement time, refund support, and contract flexibility.

Will VRP change pricing or replace card subscriptions?

Eventually yes. VRP enables variable recurring payments, but pricing is still evolving – expect hybrid models.

Are there hidden or operational costs?

Depends on the provider. Factor in integration, refunds, fraud tools, reconciliation, and customer support.

Can open banking work for small or low volume merchants?

Yes, but savings are smaller. For very low-priced items, flat fees can eat margins, so hybrid checkout (cards + Pay by Bank) is often best.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each