Are card processing fees eating into your profits? The costs of accepting credit and debit card payments can quickly add up. Every month, these fees chip away at your revenue, leaving you wondering if there’s a better solution.

There is, and, in short, it’s open banking payments. By cutting out card networks and their associated fees, open banking offers a cost-effective, transparent solution for businesses.

There are other options too. Here, we take a look at different strategies and tactics of how to lower credit and debit card processing fees for merchants.

What Are Merchant Fees?

Merchant fees is a broader term that encompasses all charges a business pays for accepting card payments. They usually include Merchant Service Charge (MSC), which pay for card processing costs, account fees, and other incidental charges. How much you pay depends on factors like:

- the method of payment method used (for example, a card payment or an open banking payment)

- if it’s a card payment, the card network used (such as Visa, MasterCard and American Express) would set interchange and scheme fees, which take up a big part of payment processing costs

- the payment processor and their pricing model

- transaction volumes and values

| Description | Typical rate range | |

| Merchant Service Charge (MSC) | The core fee associated with processing card payments | 0.25%–3% plus interchange and scheme fees set by card networks |

| Incidental fees | Also known as additional fees,they cover various other charges that may apply to a merchant account, such as payment gateway, chargebacks, and more | Vary depending on the fee type |

Merchant Service Charge (MSC)

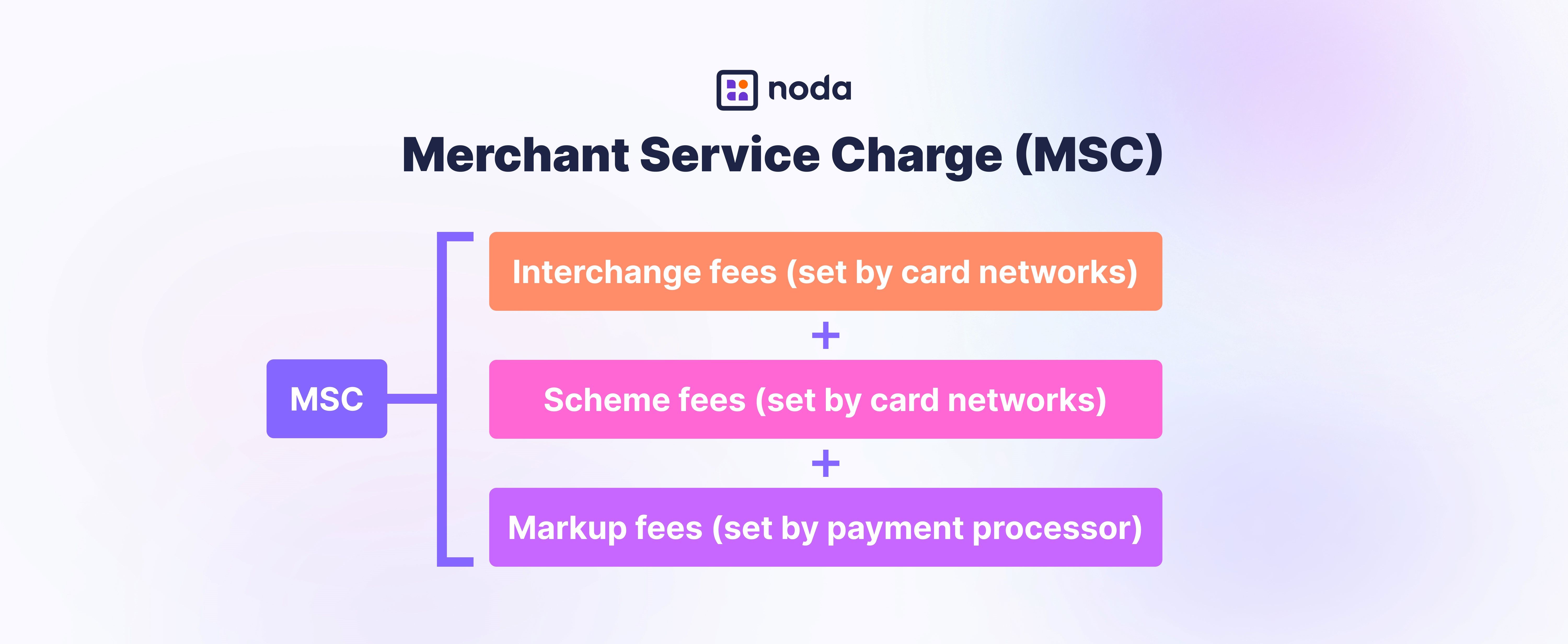

Merchant fees and merchant service fees are often used interchangeably, but there's a subtle difference. Merchant fees are a much broader term, while MSC refers specifically to the percentage-based merchant transaction fees charged by payment processors for each card or contactless payment a customer made to buy something from your business.

The MSC consists of three main types of fees:

- Interchange fees

These are paid by the payment processor to the card issuer (e.g., the customer's bank). They cover costs like credit risk, fraud prevention, and handling card transactions.

Although they are paid to the banks, they are actually set by the card networks (e.g., Visa, Mastercard) and therefore vary based on card type, transaction method, and region.

Interchange fees are subject to local regulation, which may apply a cap. For example, in the EEA, the interchange fees for consumer cards remain capped at 0.2% for debit cards and 0.3% for credit cards for domestic transactions.

When the UK left the EU, this meant that the transactions between the UK and EEA became non-domestic and the regulatory cap no longer applied, which led to Visa and Mastercard raising their interchange fees for card-not-present (online or over the phone) transactions.

Below are the interchange debit and credit card fees for business owners charged for customer transactions as per EEA regulation.

| Card type | Transaction type | Card present | Card not present |

| Debit | Domestic | 0.2% | 0.2% |

| Inter-regional | 0.2% | 1.15% | |

| Credit | Domestic | 0.3% | 0.3% |

| Inter-regional | 0.3% | 1.5% |

Source: Merchant Savvy, December 2024

You can check up-to-date regional interchange Visa debit and credit processing fees here, and Mastercard processing fees here.

Note that for business-card transactions (which means the transaction would be made between your business and a business card), interchange fees are typically higher.

American Express (Amex) doesn't technically have interchange fees like Visa and Mastercard, as it operates as both the card network and issuing bank, handling everything in-house. Amex uses a structure called discount fees that function similarly to interchange fees. They don’t disclose their fee structure, but typically Amex cards incur higher costs.

- Scheme fees

While interchange fees go to the card-issuing bank, scheme fees are paid to card networks for using their payment infrastructure. They are set by the card networks and are non-negotiable.

For example, here are some of the scheme fees charged by Visa and Mastercard for EEA domestic customer transactions.

| Card type | Scheme fee |

| Visa Credit | 0.0140% + £0.0145 |

| Mastercard Credit | 0.0398% + £0.0054 |

| Visa Debit (incl. prepaid) | 0.0100% + £0.0145 |

| Mastercard Debit (incl. prepaid) | 0.0398% + £0.0054 |

Source: Merchant Savvy, December 2024

Note that some payment processors may already include the interchange fee and the scheme fee in their advertised fee. The processors bundle these costs into their flat-rate or tier pricing models, so merchants do not pay interchange or scheme fees separately.

- Markup fees (or acquirer fees)

This is the portion of the MSC that the payment processor or acquirer keeps as their revenue for processing the transaction. The markup fee can often be negotiated with the payment processor.

The total MSC typically ranges from 0.25% to 3% of the transaction value, depending on factors such as card type (debit, credit, or commercial) and whether the transaction is in-person or without card present. Online credit card processing fees count as a card-not-present transactions.

When looking to lower credit card merchant fees, this is your place of negotiation. Since the markup fee isn’t set in stone, like the interchange and scheme fees, you can usually negotiate with your provider to get a better deal.

Other Merchant Fees

The other types of merchant fees are typically referred to as incidental fees or additional fees, outside of transaction fees. These include:

| Description | Typical range | |

| Setup fee | One-time charges for initiating an account | Up to £150 |

| Payment gateway fee | Typically a monthly fee for using a payment gateway via APIs or hosted checkout pages | £20–£75 per month |

| PCI compliance fee | Costs associated with maintaining PCI DSS standards | £2–£20 per month |

| PCI non-compliance fee | Costs associated with failing to maintain PCI DSS standards | 0.30% |

| Chargeback fee | Charges applied when a customer disputes a transaction | Typically £15 per customer chargeback |

| Refund | Charges applied when a customer requests a refund | 30p-50p |

| Minimum monthly service charge | A minimum fee if transaction volumes are low | £5–£25 per month (when a minimum threshold isn’t met) |

| Terminal rental fees | Charges for renting in-person card payment terminals | £14-£35 per month |

| Virtual terminal rental fees | Charged for renting a software to support telephone and mail-order transactions | £15 -£75 per month |

| Early termination fee | Fee for terminating a contract early | Varies |

Source: MerchantSavvy, December 2024

How to Avoid Credit Card Fees for Businesses

You typically have two ways to reduce credit and debit card processing fees: exploring more cost-efficient payment methods, such as open banking, or negotiating with your provider to lower their markup fees.

Eliminate Card Fees with Noda

With open banking payments, you can eliminate credit and debit card processing fees entirely. Often called pay-by-bank, this method transfers money directly between accounts, bypassing costly card networks, including interchange and scheme fees. It’s a more cost-efficient option for merchants.

Lower fees are just the beginning. Open banking also eliminates chargebacks, boosts conversions by reducing shopping cart abandonment, and offers a smoother, faster user experience. Customers don’t need to enter long card details; they simply log in to their trusted bank’s secure interface, ensuring top-tier security and convenience.

Fully regulated under Europe’s PSD2, open banking is a safe and reliable payment solution. Data is shared securely between banks and payment providers via APIs, protecting both merchants and customers.

Switch to Open Banking with Noda

At Noda, we provide a smooth and reliable open banking solution. We are connected with over 2,000 banks in 28 countries, supporting multiple currencies to help you serve global clients. Get started quickly with our plugins for popular e-commerce platforms or integrate seamlessly using Open Banking APIs.

Our flexible pricing adapts to your business needs, and we go beyond pay-by-bank with a secure card payment gateway, no-code payment solutions, actionable data insights, authorisation tools, and more.

Whether you’re launching or scaling, Noda simplifies transactions, saves time, and reduces costs — so you can focus on growing your business.

Negotiate with Your Provider

The set-up of your payment processing is something you should regularly revisit. A pricing model that worked for your business initially might become too expensive as your transaction volumes grow.

That’s why it’s essential to review your agreements regularly and find a pricing structure that fits your needs. Many processors now offer options beyond flat-rate and tiered pricing, helping high-volume businesses lower their costs.

There are four main pricing models for payment processing: interchange-plus, tiered pricing, flat-rate, and subscription pricing. With interchange-plus, fees are split into interchange, scheme fees, and a markup. This model provides transparency, showing exactly how much goes to banks and credit card networks versus the processor’s markup. The markup is often negotiable.

High-volume businesses can also explore bulk discounts. Providers are usually willing to lower rates for merchants with significant monthly transactions. Alternatively, working with multiple providers can increase your negotiating power.

FAQs

Why are credit card processing fees so high?

Credit card fees are high because they include fixed interchange fees and scheme fees set up by card networks. These costs cover fraud prevention and payment infrastructure. Open banking payments avoid debit and credit card transaction fees and are therefore cheaper.

Is there a processing fee for debit cards?

Yes, debit cards also have processing fees. These fees are typically lower than credit card fees for businesses, especially for domestic transactions.

Who pays credit card transaction fees?

Merchants pay credit card transaction fees. These fees are usually deducted from the transaction amount before funds are deposited into the merchant’s account.

Why do processing fees matter to small businesses?

Processing fees directly impact small businesses' profit margins. High fees can add up quickly, reducing overall revenue and affecting their ability to stay competitive.

Is there any way to reduce credit card processing fees for merchants?

Yes, merchants can switch to cost-efficient payment methods like open banking or negotiate lower markup fees with their payment processor. They can also explore bulk discounts or use multiple providers for better rates.

How do mobile payments lower merchant transaction fees?

Mobile payments can reduce fees by using methods like open banking, which bypass traditional card networks. This eliminates interchange and scheme fees.

What are credit card transaction fees?

Credit card transaction fees are charges merchants pay for processing a credit card payment. These include interchange fees (paid to the cardholder’s bank), scheme fees (paid to the card network), and the payment processor’s markup. Interchange and scheme fees are fixed and set by card networks. Markup fees can be negotiated with the provider.

What is the best way to avoid credit card fees?

You can’t get rid of credit card processing fees entirely when the payment is via a card. Open banking payments, however, avoid debit and credit card transaction fees and are therefore more cost-efficient for merchants.

Latest from Noda

Payment Methods in Ireland in 2026: Everything You Need to Know

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know