Digital payments have grown to over $10 trillion in transaction value in 2023, according to Statista - the number that is expected to reach $16 trillion in 2028. As online payments gain the momentum and cash is in decline, third-party payment processors have become more important than ever.

Therefore, it’s key for merchants to understand how third-party online payment processing works. Choosing the right payment processor can enhance customer experience, make operations smoother, and open up new markets. Here's everything you need to know about third-party payments and how to select the best processor for your business.

What Is a Third-Party Payment Processor?

Third-party payment services allow businesses to accept different online payment methods without needing to establish and manage their own merchant account in a bank.

A traditional third-party merchant account is a special bank account that allows businesses to receive payments. Third-party payment processors combine all their clients' transactions into one merchant account. This allows businesses to use the features of a merchant account without the lengthy process of setting up an individual one.

This is especially valuable for small businesses and start-ups. Using a third-party payment network provides a faster and easier way to start accepting online payments.

As of 2025, the landscape of third-party payment processing has continued to evolve with greater focus on speed, compliance, and multi-channel support. The introduction of real-time payment rails in many regions, such as FedNow in the United States and the expansion of SEPA Instant in Europe, means that many third-party payment providers now offer near-instant settlement times. This is particularly helpful for small businesses managing tight cash flow. Additionally, stricter regulatory frameworks like PSD3 in the EU and expanded KYC/AML protocols globally have pushed third-party processors to improve onboarding and security while still maintaining simplicity. Today’s providers, such as Noda, also typically support a mix of traditional card payments, open banking-powered account-to-account transfers, digital wallets, and alternative payment methods, making them an increasingly comprehensive and scalable choice for merchants worldwide.

Third-Party Payment Processing – How Does It Work?

Third-party payment processing is an important part of the digital economy. It lets businesses accept different types of payments without having to deal with the technical setup or follow complex rules themselves. Instead of creating their own payment systems, companies use external providers who handle the safe and smooth transfer of money.

These processors act as intermediaries between the customer, the merchant, and the banking institutions involved, streamlining the third-party merchant processing behind the scenes. Below, we highlight the most important functions of third-party payment processing.

Online Payment Processing

The core function of a payment processor is self-explanatory – it’s the payment processing itself.

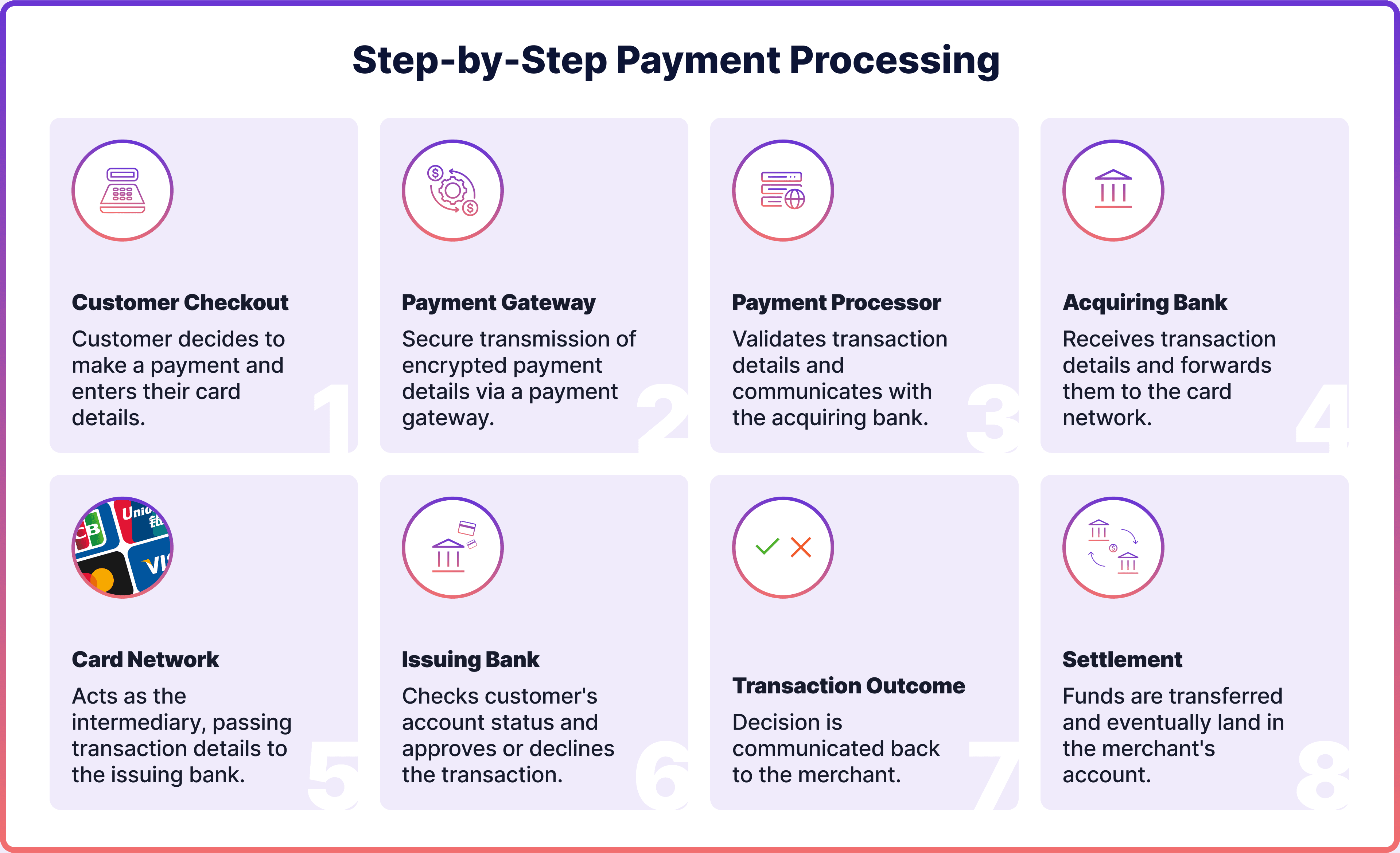

When a customer inputs their payment details, the information is securely sent to a third-party payment gateway. The payment processor then collects the transaction data from the gateway, checks and confirms the details, and then communicates with the acquiring bank linked to the merchant's account.

Next, the acquiring bank sends the transaction details to a card network like Visa or Mastercard, which then contacts the issuing bank. The issuing bank verifies the account status and balance.

It's important to note that card networks do not participate in open banking payments, often referred to as Pay-by-Bank or Account-to-Account (A2A), as these transactions happen directly between the accounts involved.

Once the issuing bank reviews the transaction, it either approves or declines it. Approved transactions are compiled by the merchant at the end of the day and sent to the payment processor for settlement.

Fraud Prevention

Payment processors would typically also offer fraud-prevention services such as anti-fraud transaction monitoring.

There are typically two main methods for this: rules-based logic and machine learning. Rules-based fraud detection follows a straightforward "If x happens, then do y" approach, which is constantly overseen by fraud analysts. The downside of this method is that it might miss hidden patterns or fail to adapt to evolving fraud tactics, as it only examines data within set parameters.

In contrast, machine learning-based fraud management uses transaction data to train adaptive algorithms. Some models mimic the actions of human reviewers, while others are trained on millions of data points. These models learn to identify the difference between legitimate and potentially fraudulent transactions.

Improving Payment Conversions

Another extra service that a third-payment processor may offer is improving your payment conversions. That’s essentially the percentage of payments that were completed successfully.

There are number of factors that may cause lower conversions. For example, shopping cart abandonment is fairly common in e-commerce. According to Baymard Institute, 70.19% of online shopping baskets are typically left uncompleted. This could happen due to complicated checkout forms and poor user experience.

Therefore, its key to choose a third-party processor that can offer smooth payment experience and a variety of payment options. The most popular payment methods worldwide include digital wallets like PayPal, Apple Pay, GooglePay, credit and debit cards, open banking-led A2A payments and Buy Now Pay Later (BNLP). Keep in mind that customers from various regions and demographics might favor different payment methods.

Payment success also depends on network acceptance, where the issuing bank processes and approves the payment. This decision is influenced by factors like the customer’s balance, transaction details, and system availability.

To reduce issues at this stage, gather extra verification data during checkout, such as CVC, billing address, or postcode. However, avoid making the checkout process overly complex, as it can frustrate users. Your third-party payment provider may be able to advise you on this.

Third-Party Payment Processor Examples

For anyone launching an online store or an app, third-party payment processors provide a fast and flexible way to accept payments without the need to build complex infrastructure or sign long-term contracts. These platforms handle everything from data security to transaction routing, fraud protection, and compliance, so you can focus on running your business. Here are some third-party payment processor examples:

Noda

Noda is one of the best third-party payment processors, operating in 28 countries in Europe, and a standout example for beginners, especially those looking to get started with minimal specialist knowledge. Built with simplicity in mind, Noda allows merchants to accept open banking payments with low fees and near-instant settlementd directly into your business bank account.

With our easy-to-install plugins for popular ecommerce platforms like WooCommerce, OpenCart, PrestaShop and Magento, setup takes just minutes. If you do not have a website, it’s not a problem. Noda offers branded, no-code payment pages and links you can send directly to customers via email, chat, or social media. This makes it perfect for freelancers, digital creators, and early-stage businesses looking to start selling immediately.

Open banking is particularly powerful as a payment method. It offers direct account-to-account payments, reducing dependency on costly card networks. Transactions settle quickly, there are no hidden fees, and the risk of fraud is significantly lower.

Noda also supports card payments, providing your customers with choice and flexibility, all through a single provider. Each Noda merchant is assigned a personal account manager to help guide them through setup and optimise payment performance over time.

Stripe

Stripe is another popular third-party payment processor, which is widely known for its developer-friendly APIs and global reach. Stripe supports credit cards, as well as wallets like Apple Pay, and local payment methods in multiple countries. It is ideal for businesses with more complex customisation needs or those looking to expand internationally.

PayPal

PayPal is a strong choice, especially for small businesses and independent sellers. It is easy to integrate and trusted by millions of consumers. It allows you to accept card payments, PayPal balances, and even Pay Later options. Customers do not need to enter card details every time, which can improve conversions; however, merchants should bear in mind the higher transaction costs.

Square

Square is particularly useful for brick-and-mortar businesses with an online presence. It provides both hardware for in-person transactions and software for online checkouts, along with a comprehensive dashboard for tracking sales and managing inventory. Its ecosystem is designed to help small businesses grow with minimal effort, but is only available in some European countries, like Ireland, the UK, France and Spain.

Adyen

Adyen is an enterprise-grade solution that caters to larger businesses needing custom solutions, advanced analytics, and global reach. It handles everything from payments to risk management, offering a unified commerce experience across in-store, online, and mobile channels.

The Risks and Benefits of Using A Third-Party Payment Processor

Using a third-party payment processor offers several advantages, particularly for small businesses, new ventures, and independent sellers who require a straightforward and efficient way to start accepting payments. The most important advantages of using Third-Party Payment Processing are:

- Easy to get started without complex bank applications or approval processes

- Quick setup through third-party services that let businesses begin trading almost immediately

- Ready-made tools like ecommerce plugins and reporting dashboards

- Built-in security features such as encryption, fraud checks and industry compliance

- Support for multiple payment types including cards, digital wallets and bank payments via open banking

Despite these advantages, third-party processors do carry certain risks that should not be overlooked. These are the following:

- Less control over payment handling since the merchant account is often shared with others.

- Providers may freeze or hold funds if they spot suspicious activity, often without warning. This can cause cash flow problems, especially for smaller businesses.

- Per-transaction fees are often higher than what businesses could get by negotiating directly with banks.

- Relying on one provider means there is a risk of downtime or technical issues disrupting payments.

- Changes in provider policies can also affect how payments are processed.

Businesses should regularly review their provider’s performance and be ready to adjust their setup as they grow.

Do I Need Third-Party Payment Processors? Is It Necessary?

In most cases, yes. If you want to start accepting payments quickly and securely without handling the complexity of financial regulations, data security, and bank integrations yourself, third-party payment processors are essential. They enable businesses of all sizes to leverage ready-made infrastructure, providing seamless checkout experiences to customers from the outset.

Third-party processors eliminate the technical and regulatory barriers associated with building your system. You gain access to fraud protection tools, reliable payment gateways, and multi-currency support, all without needing a team of engineers or compliance officers. With open banking services like Noda, you also benefit from low transaction fees, faster settlement, and flexible setup options that do not require a website or development skills.

Whether you are a freelancer sending invoices via payment links, an e-commerce seller looking for fast setup, or an established business wanting to expand your reach, third-party payment processors are not just convenient — they are often critical for growth.

How to Choose Third-Party Payment Processor

Define Your Business Needs

Begin by assessing your payment needs and those of your clients.

Some of the key questions to ask yourself: what channels are you planning to accept payments via? These could range from an online store to invoices with payment links or QR codes to mobile in-app purchases.

Are you offering subscriptions? Then a recurring payment feature is a must.

Another key question is how do your customers prefer to pay (payment methods) and in what currencies. It’s crucial to ensure that the chosen provider can meet these needs.

Define Your Budget

Then, it could be useful to determine how much you are willing to pay and how it fits into the pricing plan provided by a provider. For example, they may suggest commissions, flat rates, subscription-based pricing.

Consider a typical number and value of transactions your business is processing. For example, if it’s fairly large, a subscription model may be beneficial. On the other hand, if your transaction volume is lower, flat-rate pricing may prove more cost-effective.

Compare Providers

You can start by talking to sources and reading online reviews. After compiling a list of potential providers, look at their track record in supporting businesses like yours. Look out for the required third-party payment systems and features you identified in the very first step. Focus on those with a strong reputation in your industry.

Test

Now that you've narrowed down a list of providers that fit your business needs, reach out to test their solutions. Many payment companies offer a trial period without requiring a commitment. Pay attention to the UX, the quality of customer support, compliance and security.

Payments & Open Banking with Noda

Noda is a global open banking provider designed to make payment processing simple, fast and accessible, especially for new businesses. By connecting directly to over 2,000 banks across 28 countries through a secure open banking API, Noda enables merchants to accept payments straight from customers’ bank accounts. This eliminates the need for card networks, helping to reduce fees and speed up settlement, which in turn improves cash flow and overall efficiency.

Getting started with Noda is quick and straightforward. We offer ready-to-use plugins for popular e-commerce platforms, including WooCommerce and Magento, as well as no-code branded payment pages and shareable links that enable you to sell online without a website or technical setup. In addition to open banking, Noda supports card payments, giving your customers greater choice at checkout. With tools for KYC, LTV forecasting, UX optimisation and multi-currency support, plus a dedicated account manager for every merchant, Noda gives you everything you need to grow with confidence.

FAQs

What is a third-party payment processor?

A third-party payment processor is a service that allows businesses to accept various online payment methods without needing their own merchant account. It combines all client transactions into one merchant account.

Why use third-party payments?

Using third-party payment platforms provides a faster and easier way for businesses, especially small ones and start-ups, to start accepting online payments. It simplifies the process and avoids the lengthy setup required for individual merchant accounts.

What are third-party payment processing fees?

Third-party payment processing fees can include setup fees, monthly fees, and transaction fees. The exact fees depend on the provider's pricing plan, which may be based on commissions, flat rates, or subscriptions.

What are third-party payments examples?

Examples of third-party payments include Noda, PayPal, Stripe, Square and Ayden. Examples of third-party payments include Noda, PayPal, Stripe, and Square. These third-party credit card processing services allow businesses to accept payments online without needing their own merchant account. They offer various payment methods, including credit cards and digital wallets.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each