If you've ever signed up for a gym membership, or a streaming service like Netflix, you're likely acquainted with recurring payments. These are charged at regular intervals and continue until the service is cancelled or fully paid.

Juniper Research estimates a recurring transaction value of $13.2 trillion in 2023. By 2027, they forecast the market will grow by 17% to $15.4 trillion. It’s an extremely popular payment method for subscription-based models, which explains its increasing adoption in streaming services, Software-as-a-Service, and digital media.

Here we take a look at different types of recurring transactions and establish the key differences between direct debit and variable recurring payments.

What Is Direct Debit?

Recurring payments are often processed through a direct debit. Customers arrange for their bank to authorise ongoing payments to a specific merchant. This can be set up online, via mail, or over the phone.

Direct debit is an easy, secure way for businesses to collect recurring payments directly from a customer's bank account with prior consent. Common direct debit examples include payments for utilities, subscriptions, and memberships. It minimises the risk of late or missed payments, offers a convenient experience for customers, and helps businesses maintain a steady cash flow.

Direct debits are managed through the Bankers' Automated Clearing System (BACS), which typically settles transactions within three days. This is also a key disadvantage of direct debits - a slow settlement cycle.

What Is Variable Direct Debit?

Variable direct debit allows businesses to take different amounts of money from their bank accounts at different times via a direct debit. Unlike fixed direct debits, which withdraw the same amount each time, variable direct debits adjust based on what’s owed, like utility bills or credit card payments. These transactions are also processed through systems like BACS in the UK.

What Are Variable Recurring Payments (VRP)?

Variable Recurring Payments (VRP) enable customers to pay for transactions of different amounts at regular intervals. Unlike direct debits, VRPs are built on the open banking ecosystem, providing a more seamless user experience (UX).

In 2018, PSD2 regulation mandated European banks to share their data with licensed third-party providers (TPPs), like Noda. Banks share data via secure application programming interfaces (APIs), which act as a software bridge for systems to communicate.

By opting for an open banking VRP, a customer authorises a TPP to make multiple payments from their bank account at varying amounts and intervals. The customer must still verify each payment with strong customer authentication (SCA).

Types of VRP

VRP Sweeping

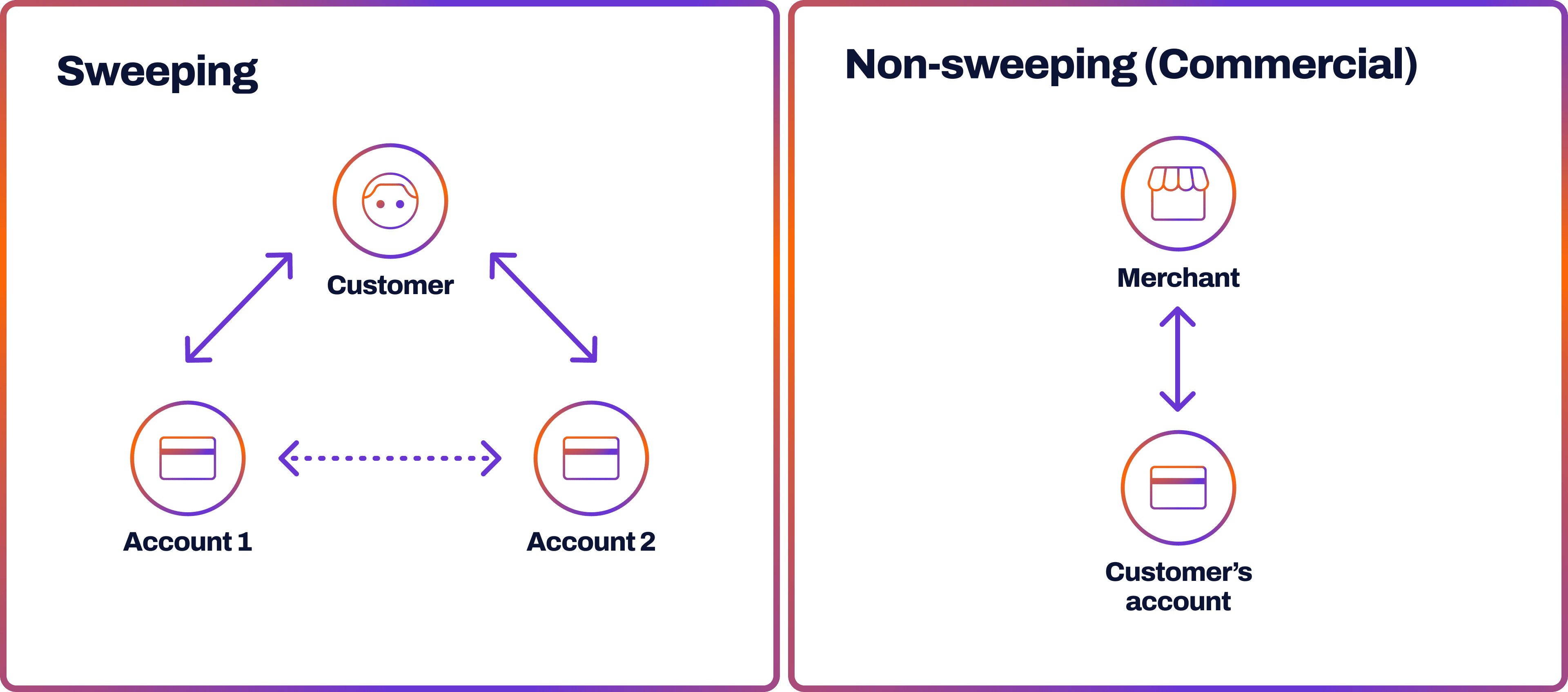

Sweeping involves transferring money between two accounts owned by the same customer.

In late 2022, six major UK banks introduced VRPs for sweeping. This resulted in a doubling of VRP transactions within a month, according to Open Banking UK. There are numerous use cases for sweeping VRPs:

- Investing

Customers can use sweeping payments to automate their investments. For instance, they can schedule monthly transfers from their current account to their investment account. This simplifies the investment process, making it more convenient.

- Savings

Similarly, sweeping VRPs allows clients to automatically move surplus funds from their checking to savings accounts when certain conditions are met. For example, they might choose to transfer a specific percentage of their monthly income into a higher-interest savings account.

- Overdrafts

Consumer credit often has high interest rates and overdraft fees, which are generally considered bad debt. By using sweeping VRPs, customers can avoid these costs and set up automated transfers to ensure timely payments. This helps them avoid fees and build a strong credit score through consistent, on-time payments.

- Debt

Similarly to consumer credit, sweeping allows customers to automate the use of excess funds in their accounts to pay off loans. This helps in repaying debts faster and eliminates the need for manual fund transfers.

Non-sweeping (Commercial)

Non-sweeping VRPs involve transactions between a customer’s account and a merchant and are currently less common. In the UK, for instance, only sweeping VRPs are mandated for banks.

Some banks are exploring the commercial use of this open-banking technology. In 2022, NatWest collaborated with TPPs to offer VRPs as a new payment option for businesses and consumers.

Commercial use of non-sweeping VRPs may bring a wide range of opportunities such as more efficient bill payments, subscriptions, and B2B invoicing. They can streamline subscriptions making them faster and more efficient.

Direct Debit vs Variable Recurring Payments

| Direct Debit | VRPs | |

| Mechanism | Processed through BACs | Relies on open banking APIs |

| Settlement Time | Typically three days | Almost instant |

| Set-up | Requires setting up an instruction with a merchant | Set-up through open banking APIs |

| Transaction Type | Sweeping/Non-sweeping | Currently sweeping only |

| Adoption | Widely adopted | Emerging technology |

Although VRPs and direct debits may seem similar to customers, the underlying mechanisms are quite different. VRPs use open banking APIs, offering flexibility, immediate settlement, and an enhanced UX. In contrast, direct debits are processed through the BACs, which typically have a three-day settlement cycle.

Regarding security, VRP is using SCA, which ensures multi-layered verification to authorise payments. To initiate a direct debit, on the other hand, customers set up an instruction by paper or electronically. Merchants store these instructions for each customer, which can be subject to data breaches.

Online Payments & Open Banking with Noda

Noda is a global open banking provider that assists online merchants with end-user KYC, payment processing, LTV forecasting and UX optimisation. We partner with 2,000 banks across 28 countries, spanning over 30,000 bank branches. Noda supports a wide range of currencies for globally-minded clients. We offer scalable plans to fuel your business growth and e-commerce plugins for easy integration.

With Noda's advanced Open Banking API, online businesses can easily integrate direct bank payments, offering their customers a seamless and secure payment experience with lower fees. Whether you're looking to enhance customer verification processes, optimise payment systems, forecast long-term value, or refine the user experience, Noda is your partner in growth.

FAQs

What does recurrent transaction mean?

A recurrent transaction is a payment automatically charged at regular intervals, such as monthly or annually. These payments continue until the service is either cancelled or completely paid off. Common examples include subscriptions to services like gym memberships or streaming platforms like Netflix.

What are the different types of VRPs?

VRPs come in two main types: sweeping and non-sweeping. Sweeping VRPs involve transferring funds between accounts owned by the same customer, like moving money from a checking account to a savings account. Non-sweeping VRPs, on the other hand, involve payments from a customer’s account to a merchant, facilitating transactions for services or goods.

How do I cancel a recurring payment?

To cancel a recurring payment, you need to contact your bank or the service provider directly. This can usually be done online through your bank’s website or app, by phone, or in writing. It’s important to follow the specific instructions provided by your bank or service provider to ensure the cancellation is processed correctly.

What is the best way to set up recurring payments?

VRPs offer more flexibility and immediate settlement by using open banking APIs. Direct debits are best suited for fixed, regular payments and typically have a three-day settlement cycle. Yet VRPs are currently only available for sweeping transactions.

What are the benefits of VRP?

Some of the VRP benefits include flexibility and immediate settlement of transactions. They provide a superior user experience by allowing payments of varying amounts at different intervals. Additionally, VRPs enhance security through SCA.

Latest from Noda

Top Payment Methods in Austria: How to Accept Payments Efficiently in 2026

GoCardless Review 2026: What Merchants Need to Know

AIS vs PIS in Open Banking: What’s the Difference & When to Use Each